Canadian Apartment Properties Real Estate Investment Trust

("CAPREIT") (TSX: CAR.UN) announced today strong operating and

financial results for the three and nine months ended September 30,

2023. Management will host a conference call to discuss the

financial results on Thursday, November 9, 2023 at 9:00 a.m. ET.

HIGHLIGHTS

|

As at |

September 30, 2023 |

December 31, 2022 |

September 30, 2022 |

|

Total Portfolio Performance and Other

Measures |

|

|

|

|

Number of suites and sites |

|

64,461 |

|

|

66,586 |

|

|

66,583 |

|

|

Investment properties fair value(1) (000s) |

$ |

16,482,890 |

|

$ |

17,153,709 |

|

$ |

16,894,551 |

|

|

Occupied AMR(2) |

|

|

|

|

Canadian Residential Portfolio(3) |

$ |

1,490 |

|

$ |

1,401 |

|

$ |

1,387 |

|

|

The Netherlands Portfolio |

€ |

1,053 |

|

€ |

992 |

|

€ |

983 |

|

|

Occupancy |

|

|

|

|

Canadian Residential Portfolio(3) |

|

98.9 |

% |

|

98.9 |

% |

|

98.8 |

% |

|

The Netherlands Portfolio |

|

98.7 |

% |

|

98.4 |

% |

|

97.8 |

% |

|

Total Portfolio(4) |

|

98.4 |

% |

|

98.3 |

% |

|

98.1 |

% |

|

(1) |

Investment properties exclude assets held for sale, as

applicable. |

|

(2) |

Occupied average monthly rent ("Occupied AMR") is defined as actual

residential rents divided by the total number of occupied suites or

sites in the property, and does not include revenues from parking,

laundry or other sources. |

|

(3) |

Excludes MHC sites. |

|

(4) |

Includes MHC sites. |

| |

Three Months Ended |

Nine Months Ended |

| |

September 30, |

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Financial Performance |

|

|

|

|

|

Operating revenues (000s) |

$ |

268,377 |

|

$ |

252,032 |

|

$ |

793,122 |

|

$ |

750,353 |

|

|

Net operating income ("NOI") (000s) |

$ |

178,432 |

|

$ |

166,644 |

|

$ |

516,075 |

|

$ |

485,909 |

|

|

NOI margin |

|

66.5 |

% |

|

66.1 |

% |

|

65.1 |

% |

|

64.8 |

% |

|

Same property NOI (000s) |

$ |

170,070 |

|

$ |

157,823 |

|

$ |

493,686 |

|

$ |

460,774 |

|

|

Same property NOI margin |

|

66.5 |

% |

|

66.5 |

% |

|

65.4 |

% |

|

65.1 |

% |

|

Net income (loss) (000s) |

$ |

(357,542 |

) |

$ |

63,159 |

|

$ |

(420,786 |

) |

$ |

(141,886 |

) |

|

FFO per unit – diluted (formerly known as "NFFO per unit –

diluted")(1) |

$ |

0.638 |

|

$ |

0.610 |

|

$ |

1.795 |

|

$ |

1.748 |

|

|

Distributions per unit |

$ |

0.362 |

|

$ |

0.362 |

|

$ |

1.087 |

|

$ |

1.087 |

|

|

FFO payout ratio (formerly known as "NFFO payout ratio")(1) |

|

56.8 |

% |

|

59.1 |

% |

|

60.5 |

% |

|

62.0 |

% |

|

(1) |

These measures are not defined by International Financial Reporting

Standards ("IFRS"), do not have standard meanings and may not be

comparable with other industries or companies. Please refer to the

cautionary statements under the heading "Non-IFRS Measures" and the

reconciliations provided in this press release. |

|

As at |

September 30, 2023 |

December 31, 2022 |

September 30, 2022 |

|

Financing Metrics and Liquidity |

|

|

|

|

Total debt to gross book value(1) |

|

41.4 |

% |

|

39.4 |

% |

|

39.4 |

% |

|

Weighted average mortgage effective interest rate(2) |

|

2.73 |

% |

|

2.61 |

% |

|

2.59 |

% |

|

Weighted average mortgage term (years)(2) |

|

5.0 |

|

|

5.4 |

|

|

5.6 |

|

|

Debt service coverage (times)(1)(3) |

1.8x |

1.9x |

1.9x |

|

Interest coverage (times)(1)(3) |

3.5x |

3.7x |

3.8x |

|

Cash and cash equivalents (000s) |

$ |

48,266 |

|

$ |

47,303 |

|

$ |

101,295 |

|

|

Available liquidity – Acquisition and Operating Facility

(000s) |

$ |

257,875 |

|

$ |

333,416 |

|

$ |

312,578 |

|

|

Capital |

|

|

|

|

Unitholders' equity (000s) |

$ |

9,304,029 |

|

$ |

10,003,695 |

|

$ |

9,832,599 |

|

|

Net asset value(1) (000s) |

$ |

9,228,233 |

|

$ |

9,954,566 |

|

$ |

9,730,535 |

|

|

Total number of units – diluted (000s) |

|

169,777 |

|

|

171,599 |

|

|

172,393 |

|

|

Net asset value per unit – diluted(1) |

$ |

54.36 |

|

$ |

58.01 |

|

$ |

56.44 |

|

|

(1) |

These measures are not defined by IFRS, do not have standard

meanings and may not be comparable with other industries or

companies. Please refer to the cautionary statements under the

heading "Non-IFRS Measures" and the reconciliations provided in

this press release. |

|

(2) |

Excludes liabilities related to assets held for sale, as

applicable. |

|

(3) |

Based on the trailing four quarters. |

"We're proud to have achieved another quarter of

robust operational and financial performance," commented Mark

Kenney, President and Chief Executive Officer. "Occupancies

remained stable at our highest levels, with nearly 99% of our

suites occupied at current period end, reflecting the ongoing

tightening we continue to see across all of our Canadian rental

markets. We're simultaneously making steady progress on our

strategy, with a focus on our portfolio modernization program which

has completed the acquisition of over $200 million of newly

constructed buildings located in strong-performing, high-growth

geographies, funded through the disposition of our non-core

Canadian properties. In optimizing our portfolio through downsizing

on suite count and upsizing on quality, we're also having to

optimize our organizational structure to adapt and ensure alignment

with our re-envisioned CAPREIT 2.0 strategy for success now, and in

the future."

"Our same property NOI margin held strong at

66.5% for the quarter, inclusive of higher operating expenses from

inflation, foreign exchange and repair and maintenance costs,"

added Stephen Co, Chief Financial Officer. "On the latter, we're

strategically scaling back on our discretionary value-enhancing

expenditure, and are instead intentionally reallocating that

capital into R&M projects, in response to the tight rental

market in which we're currently operating. That said, we continue

to prioritize our environmental and energy initiatives, alongside

our active management of debt financing and leverage in order to

maintain our solid and conservative balance sheet position. We have

ongoing opportunity for accretive use of funds across our various

avenues for capital redeployment, and we will continue to actively

exercise these levers in tandem to ultimately maximize value for

our Unitholders."

SUMMARY OF Q3 - 2023 RESULTS OF

OPERATIONS

Strategic Initiatives

Update

- CAPREIT continues to invest in

strategic opportunities that are accretive. For the nine months

ended September 30, 2023, CAPREIT acquired five properties for a

total acquisition cost of $208.3 million.

- CAPREIT disposed of 388 suites

which comprised of five non-core properties and three single

residential suites located in Canada and the Netherlands,

respectively, for the three months ended September 30, 2023 for

$60.8 million (excluding transaction costs and other adjustments).

For the nine months ended September 30, 2023, CAPREIT disposed of

$354.5 million (excluding transaction costs and other adjustments)

worth of non-core property dispositions.

- CAPREIT did not purchase any Trust

Units for cancellation during the three months ended September 30,

2023. During the nine months ended September 30, 2023, CAPREIT

purchased and cancelled approximately 2.2 million Trust Units

under the normal course issuer bid ("NCIB") program, at a weighted

average purchase price of $46.53 per Trust Unit, for a total cost

of $100.9 million.

- Pursuant to CAPREIT's strategy of

upgrading and diversifying its property portfolio through

accretive, on-strategy acquisitions and selected non-core or

opportunistic dispositions, CAPREIT is currently targeting the

disposition of approximately $400 million to $500 million of

Canadian properties in 2023.

Operating Results

- Same property Occupied AMR for the

Canadian residential portfolio as at September 30, 2023 increased

by 5.8% compared to September 30, 2022, while same property

occupancy for the Canadian residential portfolio remained

relatively stable at 98.9%.

- NOI increased by 7.8% and 7.1%,

respectively, for the same property portfolio for the three and

nine months ended September 30, 2023, compared to the same periods

last year. Additionally, same property NOI margin remained

consistent at 66.5%, for the three months ended September 30, 2023

and increased to 65.4%, up 0.3%, for the nine months ended

September 30, 2023, compared to the same periods last year.

- Diluted FFO per unit (formerly

known as "diluted NFFO per unit") increased by 4.6% and 2.7% for

the three and nine months ended September 30, 2023, respectively,

compared to the same periods last year primarily due to same

property operational growth and supplemented by accretive NCIB

purchases.

Balance Sheet Highlights

- CAPREIT's financial position

remains strong with $257.9 million of available capacity on its

Canadian Acquisition and Operating Facility.

- Based on the current property

portfolio and execution of strategic initiatives, management

expects to raise between $600 million and $650 million in mortgages

for the Canadian portfolio for 2023.

- To date, CAPREIT completed or

committed consolidated mortgage financings of $605.8 million. The

mortgages refinanced have a weighted average term to maturity of

6.9 years and a weighted average interest rate of 4.40%.

- For the three and nine months ended

September 30, 2023, CAPREIT recorded a fair value loss on

investment properties of $507.0 million and $803.2 million,

respectively, primarily driven by capitalization rate ("cap rate")

expansion in the Greater Toronto Area within the Canadian portfolio

and in the Netherlands portfolio as a reflection of the market

conditions. The overall carrying value of investment properties

(excluding assets held for sale) as at September 30, 2023 was $16.5

billion compared to $17.0 billion as at June 30, 2023 and $17.2

billion as at December 31, 2022.

- Diluted NAV per unit as at

September 30, 2023 decreased to $54.36 from $57.08 as at June 30,

2023 and $58.01 as at December 31, 2022, primarily due to fair

value losses recognized in investment properties, partially offset

by the effects of accretive purchases of Trust Units for

cancellation through the NCIB program.

OPERATIONAL AND FINANCIAL

RESULTS

Portfolio Occupied Average Monthly

Rents

| |

Total Portfolio |

Same Property Portfolio(1) |

|

As at September 30, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

Occupied AMR |

Occ. % |

Occupied AMR |

Occ. % |

Occupied AMR |

Occ. % |

Occupied AMR |

Occ. % |

|

Average Canadian residential suites |

$ |

1,490 |

98.9 |

$ |

1,387 |

98.8 |

$ |

1,485 |

98.9 |

$ |

1,403 |

98.8 |

|

Average MHC sites |

$ |

437 |

96.0 |

$ |

425 |

95.6 |

$ |

437 |

96.0 |

$ |

425 |

95.5 |

|

Average Netherlands portfolio |

€ |

1,053 |

98.7 |

€ |

983 |

97.8 |

€ |

1,053 |

98.7 |

€ |

983 |

97.8 |

|

(1) |

Same property Occupied AMR and occupancy include all properties

held as at September 30, 2022, but exclude properties disposed of

or held for sale as at September 30, 2023. |

The rate of growth in total portfolio Occupied

AMR has been primarily driven by (i) new acquisitions completed

over the past 12 months and (ii) same property operational growth.

The rate of growth in same property Occupied AMR has been primarily

due to (i) rental increases on turnover in the rental markets of

most provinces across the Canadian portfolio and (ii) rental

increases on renewals.

The weighted average gross rent per square foot

for total Canadian residential suites was approximately $1.80 as at

September 30, 2023, increased from $1.70 as at September 30,

2022.

Net Operating Income

Same properties for the three and nine months

ended September 30, 2023 are defined as all properties owned by

CAPREIT continuously since December 31, 2021, and therefore do not

take into account the impact on performance of acquisitions or

dispositions completed during 2023 and 2022, or properties that are

classified as held for sale as at September 30, 2023.

|

($ Thousands) |

Total NOI |

Same Property NOI |

|

For the Three Months Ended September 30, |

|

2023 |

|

|

2022 |

|

%(1) |

|

2023 |

|

|

2022 |

|

%(1) |

|

Total operating revenues |

$ |

268,377 |

|

$ |

252,032 |

|

6.5 |

$ |

255,868 |

|

$ |

237,154 |

|

7.9 |

|

Operating expenses |

|

|

|

|

|

|

|

Realty taxes |

|

(24,391 |

) |

|

(23,262 |

) |

4.9 |

|

(23,155 |

) |

|

(21,707 |

) |

6.7 |

|

Utilities |

|

(15,704 |

) |

|

(15,226 |

) |

3.1 |

|

(15,296 |

) |

|

(14,546 |

) |

5.2 |

|

Other(2) |

|

(49,850 |

) |

|

(46,900 |

) |

6.3 |

|

(47,347 |

) |

|

(43,078 |

) |

9.9 |

|

Total operating expenses(3) |

$ |

(89,945 |

) |

$ |

(85,388 |

) |

5.3 |

$ |

(85,798 |

) |

$ |

(79,331 |

) |

8.2 |

|

NOI |

$ |

178,432 |

|

$ |

166,644 |

|

7.1 |

$ |

170,070 |

|

$ |

157,823 |

|

7.8 |

|

NOI margin |

|

66.5 |

% |

|

66.1 |

% |

|

|

66.5 |

% |

|

66.5 |

% |

|

|

(1) |

Represents the year-over-year percentage change. |

|

(2) |

Comprises repairs and maintenance ("R&M"), wages, insurance,

advertising, legal costs and expected credit losses. |

|

(3) |

Total operating expenses, on a constant currency basis, increased

by approximately 4.6% and 7.3%, respectively, for the total and

same property portfolio compared to the same periods last

year. |

|

($ Thousands) |

Total NOI |

Same Property NOI |

|

For the Nine Months Ended September 30, |

|

2023 |

|

|

2022 |

|

%(1) |

|

2023 |

|

|

2022 |

|

%(1) |

|

Total operating revenues |

$ |

793,122 |

|

$ |

750,353 |

|

5.7 |

$ |

754,347 |

|

$ |

707,503 |

|

6.6 |

|

Operating expenses |

|

|

|

|

|

|

|

Realty taxes |

|

(72,475 |

) |

|

(70,515 |

) |

2.8 |

|

(68,503 |

) |

|

(66,240 |

) |

3.4 |

|

Utilities |

|

(57,796 |

) |

|

(57,210 |

) |

1.0 |

|

(55,584 |

) |

|

(53,645 |

) |

3.6 |

|

Other(2) |

|

(146,776 |

) |

|

(136,719 |

) |

7.4 |

|

(136,574 |

) |

|

(126,844 |

) |

7.7 |

|

Total operating expenses(3) |

$ |

(277,047 |

) |

$ |

(264,444 |

) |

4.8 |

$ |

(260,661 |

) |

$ |

(246,729 |

) |

5.6 |

|

NOI |

$ |

516,075 |

|

$ |

485,909 |

|

6.2 |

$ |

493,686 |

|

$ |

460,774 |

|

7.1 |

|

NOI margin |

|

65.1 |

% |

|

64.8 |

% |

|

|

65.4 |

% |

|

65.1 |

% |

|

|

(1) |

Represents the year-over-year percentage change. |

|

(2) |

Comprises repairs and maintenance ("R&M"), wages, insurance,

advertising, legal costs and expected credit losses. |

|

(3) |

Total operating expenses, on a constant currency basis, increased

by approximately 4.2% and 5.1%, respectively, for the total and

same property portfolio compared to the same periods last

year. |

Operating

Revenues

For the three months ended September 30, 2023,

same property operating revenues increased by $18.7 million

primarily driven by increases in monthly rents on turnovers and

renewals. Total operating revenues increased by $16.3 million

during the same period, due to $18.8 million of operational growth

on the same property operating portfolio and assets held for sale

as at September 30, 2023 and $3.5 million increase from

acquisitions, partially offset by $6.0 million lower revenues due

to dispositions.

For the nine months ended September 30, 2023,

same property operating revenues increased by $46.8 million

primarily driven by increases in monthly rents on turnovers and

renewals. Total operating revenues increased by $42.8 million

during the same period, due to $47.1 million of operational growth

on the same property operating portfolio and assets held for sale

as at September 30, 2023 and $13.2 million increase from

acquisitions, partially offset by $17.5 million lower revenues due

to dispositions.

Operating Expenses

For the three and nine months ended September

30, 2023 operating costs increased for the same property portfolio

compared to the same periods last year primarily due to increase in

other operating expenses. Other operating expenses increased

primarily due to higher R&M costs. The higher R&M costs in

both periods are due to general inflationary pressures, as well as

higher maintenance costs that correspond with a reduction in

discretionary capital expenditures, reflecting CAPREIT's strategic

reallocation of capital in response to the tight rental market in

Canada.

For the three and nine months ended September

30, 2023, other operating expenses for the total portfolio

increased for the same reasons as described above and due to

certain required maintenance costs for the operation of CAPREIT's

septic systems at primarily two MHC properties, one of which was

disposed of on March 1, 2023 while the other was disposed of on

June 30, 2023.

ADDITIONAL INFORMATION

More detailed information and analysis is

included in CAPREIT's unaudited condensed consolidated interim

financial statements and MD&A for the three and nine months

ended September 30, 2023, which have been filed on SEDAR+ and can

be viewed at www.sedarplus.ca under CAPREIT's profile or on

CAPREIT's website on the investor relations page at

www.capreit.ca.

Conference Call

A conference call hosted by Mark Kenney,

President and Chief Executive Officer, Stephen Co, Chief Financial

Officer, and Julian Schonfeldt, Chief Investment Officer, will be

held on Thursday, November 9, 2023 at 9:00 am ET. The telephone

numbers for the conference call are: Canadian Toll Free: (833)

950-0062, International: +1 (929) 526-1599. The conference call

access code is 078065.

The call will also be webcast live and

accessible through the CAPREIT website at www.capreit.ca –

click on "For Investors" and follow the link at the top of the

page. A replay of the webcast will be available for one year after

the webcast at the same link.

The slide presentation to accompany management's

comments during the conference call will be available on the

CAPREIT website an hour and a half prior to the conference

call.

About CAPREIT

CAPREIT is Canada's largest publicly traded

provider of quality rental housing. As at September 30, 2023,

CAPREIT owns approximately 64,500 residential apartment suites,

townhomes and manufactured home community sites that are

well-located across Canada and the Netherlands, with approximately

$16.5 billion of investment properties in Canada and Europe. For

more information about CAPREIT, its business and its investment

highlights, please visit our website at www.capreit.ca and our

public disclosures which can be found under our profile at

www.sedarplus.ca.

Non-IFRS Measures

CAPREIT prepares and releases unaudited

condensed consolidated interim financial statements and audited

consolidated annual financial statements in accordance with IFRS.

In this and other earnings releases and investor conference calls,

as a complement to results provided in accordance with IFRS,

CAPREIT discloses measures not recognized under IFRS which do not

have standard meanings prescribed by IFRS. These include Funds From

Operations ("FFO"), Net Asset Value ("NAV"), Total Debt, Gross Book

Value, and Adjusted Earnings Before Interest, Tax, Depreciation,

Amortization and Fair Value ("Adjusted EBITDAFV") (the "Non-IFRS

Financial Measures"), as well as diluted FFO per unit, Ratio of

Total Debt to Gross Book Value, Debt Service Coverage Ratio and

Interest Coverage Ratio (the "Non-IFRS Ratios" and together with

the Non-IFRS Financial Measures, the "Non-IFRS Measures"). These

Non-IFRS Measures are further defined and discussed in the MD&A

released on November 8, 2023, which should be read in conjunction

with this press release. Since these measures and related per unit

amounts are not recognized under IFRS, they may not be comparable

to similar measures reported by other issuers. CAPREIT presents the

Non-IFRS Measures because management believes Non-IFRS Measures are

relevant measures of the ability of CAPREIT to earn revenue and to

evaluate its performance, financial condition and cash flows. These

Non-IFRS Measures have been assessed for compliance with the new

National Instrument 52-112 and a reconciliation of these Non-IFRS

Measures is included in this press release below. The Non-IFRS

Measures should not be construed as alternatives to net income

(loss) or cash flows from operating activities determined in

accordance with IFRS as indicators of CAPREIT's performance or the

sustainability of our distributions.

CAPREIT undertook a comprehensive review of

MD&A disclosures and, starting with the first quarter of 2023,

streamlined disclosures to focus on measures and metrics that

management believes are the most relevant. Accordingly, CAPREIT is

no longer disclosing Ratio of Total Debt to Gross Historical Cost

and Ratio of Total Debt to Total Capitalization, amongst others. In

this press release, CAPREIT relabeled Normalized Funds from

Operations ("NFFO") to FFO (formerly known as "NFFO") and as such,

introduced a modified definition of FFO which is identical to the

prior definition of NFFO. As a result, CAPREIT will no longer refer

to NFFO throughout the press release.

Cautionary Statements Regarding

Forward-Looking Statements

Certain statements contained, or contained in

documents incorporated by reference, in this press release

constitute forward-looking information within the meaning of

securities laws. Forward-looking information may relate to

CAPREIT's future outlook and anticipated events or results and may

include statements regarding the future financial position,

business strategy, growth strategy, budgets, litigation, occupancy

rates, rental rates, productivity, projected costs, acquisitions,

dispositions, capital investments, development and development

opportunities, financial results, taxes, plans and objectives of,

or involving, CAPREIT. Particularly, statements regarding CAPREIT's

future results, performance, achievements, prospects, costs,

opportunities and financial outlook, including those relating to

acquisitions, dispositions and capital investment strategies and

the real estate industry generally, are forward-looking statements.

In some cases, forward-looking information can be identified by

terms such as "may", "will", "would", "should", "could", "likely",

"expect", "plan", "anticipate", "believe", "intend", "estimate",

"forecast", "predict", "potential", "project", "budget", "continue"

or the negative thereof, or other similar expressions concerning

matters that are not historical facts. Forward-looking statements

are based on certain factors and assumptions regarding expected

growth, results of operations, performance, and business prospects

and opportunities. In addition, certain specific assumptions were

made in preparing forward-looking information, including: that the

Canadian and Dutch economies will generally experience growth,

which, however, may be adversely impacted by the global economy,

inflation and increasing interest rates, potential health crises

and their direct or indirect impacts on the business of CAPREIT;

that Canada Mortgage and Housing Corporation ("CMHC") mortgage

insurance will continue to be available and that a sufficient

number of lenders will participate in the CMHC-insured mortgage

program to ensure competitive rates; that the Canadian capital

markets will continue to provide CAPREIT with access to equity

and/or debt at reasonable rates; that vacancy rates for CAPREIT

properties will be consistent with historical norms; that rental

rates on renewals will grow; that rental rates on turnovers will

grow; that the difference between in-place and market-based rents

will be reduced upon such turnovers and renewals; that the markets

in which CAPREIT currently operates remain stable, with no material

increase in supply of directly-competitive residential real estate;

that CAPREIT will effectively manage price pressures relating to

its energy usage; and, with respect to CAPREIT's financial outlook

regarding capital investments, assumptions respecting projected

costs of construction and materials, availability of trades, the

cost and availability of financing, CAPREIT's investment

priorities, the properties in which investments will be made, the

composition of the property portfolio and the projected return on

investment in respect of specific capital investments. Management's

estimates, beliefs and assumptions are inherently subject to

significant business, economic, competitive and other uncertainties

and contingencies regarding future events and, as such, are subject

to change. Although the forward-looking statements contained in

this press release are based on assumptions and information that is

currently available to management, including current market

conditions and management's assessment of acquisition, disposition

and other opportunities that are or may become available to

CAPREIT, which are subject to change, management believes these

statements have been prepared on a reasonable basis, reflecting

CAPREIT's best estimates and judgments. However, there can be no

assurance actual results, terms or timing will be consistent with

these forward-looking statements, and they may prove to be

incorrect. Forward-looking statements necessarily involve known and

unknown risks and uncertainties, many of which are beyond CAPREIT's

control, that may cause CAPREIT's or the industry's actual results,

performance, achievements, prospects and opportunities in future

periods to differ materially from those expressed or implied by

such forward-looking statements. These risks and uncertainties

include, among other things, risks related to: rent control and

residential tenancy regulations, general economic conditions,

privacy, cyber security and data governance risks, talent

management and human resources shortages, taxation-related risks,

energy costs, public health crises, environmental matters, vendor

management and third-party service providers, operating risk,

valuation risk, climate change, other regulatory compliance risks,

availability of debt, risks related to acquisitions, dispositions

and property development, catastrophic events, litigation risk,

liquidity and price volatility of Trust Units, CAPREIT's investment

in ERES, potential conflicts of interest, investment restrictions,

lack of diversification of investment assets, geographic

concentration, illiquidity of real property, capital investments,

leasing risk, competition for real property investments, dependence

on key personnel, adequacy of insurance and captive insurance,

competition for residents, controls over financial reporting, the

nature of CAPREIT Trust Units, Unitholder liability, dilution,

distributions, participation in CAPREIT's distribution reinvestment

plan ("DRIP") and foreign operation and currency risks. There can

be no assurance that the expectations of CAPREIT's management will

prove to be correct. These risks and uncertainties are more fully

described in regulatory filings, including CAPREIT's Annual

Information Form, which can be obtained on SEDAR+ at

www.sedarplus.ca, under CAPREIT's profile, as well as under the

"Risks and Uncertainties" section of the MD&A released on

November 8, 2023. The information in this press release is based on

information available to management as of November 8, 2023. Subject

to applicable law, CAPREIT does not undertake any obligation to

publicly update or revise any forward-looking information.

SOURCE: Canadian Apartment Properties Real

Estate Investment Trust

|

CAPREITMr. Mark KenneyPresident & Chief Executive Officer(416)

861-9404 |

CAPREITMr. Stephen CoChief Financial Officer(416) 306-3009 |

CAPREITMr. Julian SchonfeldtChief Investment Officer(647)

535-2544 |

SELECTED NON-IFRS MEASURES

A reconciliation of net

income (loss) to FFO (formerly known as

"NFFO") is as follows:

|

($ Thousands, except per unit amounts) |

Three Months Ended |

Nine Months Ended |

| |

September 30, |

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net income (loss) |

$ |

(357,542 |

) |

$ |

63,159 |

|

$ |

(420,786 |

) |

$ |

(141,886 |

) |

|

Adjustments: |

|

|

|

|

|

Fair value adjustments of investment properties |

|

507,003 |

|

|

95,680 |

|

|

803,204 |

|

|

542,788 |

|

|

Fair value adjustments of investments |

|

3,272 |

|

|

19,799 |

|

|

24,989 |

|

|

98,000 |

|

|

Fair value adjustments of derivative financial instruments |

|

(7,350 |

) |

|

(25,248 |

) |

|

2,677 |

|

|

(93,670 |

) |

|

Unit-based compensation remeasurement gain |

|

(3,318 |

) |

|

(1,468 |

) |

|

(954 |

) |

|

(10,654 |

) |

|

Fair value adjustments of Exchangeable LP Units |

|

(9,519 |

) |

|

(4,568 |

) |

|

4,167 |

|

|

(29,991 |

) |

|

Interest expense on Exchangeable LP Units |

|

597 |

|

|

609 |

|

|

1,785 |

|

|

1,826 |

|

|

Gain on non-controlling interest |

|

(29,542 |

) |

|

(46,232 |

) |

|

(36,250 |

) |

|

(113,804 |

) |

|

Net FFO impact attributable to ERES units held by non-controlling

unitholders(1) |

|

(4,833 |

) |

|

(4,637 |

) |

|

(14,303 |

) |

|

(13,567 |

) |

|

Deferred income tax expense (recovery) |

|

(7,084 |

) |

|

1,612 |

|

|

(70,100 |

) |

|

17,187 |

|

|

Loss (gain) on foreign currency translation |

|

7,533 |

|

|

3,800 |

|

|

(1,816 |

) |

|

20,952 |

|

|

Loss on transactions and other activities(2) |

|

4,031 |

|

|

3,177 |

|

|

10,102 |

|

|

23,302 |

|

|

Lease principal repayments |

|

(298 |

) |

|

(275 |

) |

|

(882 |

) |

|

(721 |

) |

|

Former FFO |

$ |

102,950 |

|

$ |

105,408 |

|

$ |

301,833 |

|

$ |

299,762 |

|

|

Reorganization, senior management termination, and retirement

costs(3) |

|

4,836 |

|

|

— |

|

|

6,860 |

|

|

6,250 |

|

|

Amortization of losses from accumulated other comprehensive loss to

interest and other financing costs |

|

— |

|

|

121 |

|

|

68 |

|

|

1,294 |

|

|

Net loss (gain) on derecognition of debt |

|

439 |

|

|

997 |

|

|

(3,307 |

) |

|

(1,766 |

) |

|

Mortgage prepayment cost |

|

55 |

|

|

12 |

|

|

55 |

|

|

1,354 |

|

|

Costs relating to transactions that were not completed |

|

— |

|

|

24 |

|

|

— |

|

|

161 |

|

|

FFO (formerly known as "NFFO") |

$ |

108,280 |

|

$ |

106,562 |

|

$ |

305,509 |

|

$ |

307,055 |

|

|

Weighted average number of units (000s) ‑ diluted |

|

169,727 |

|

|

174,588 |

|

|

170,213 |

|

|

175,629 |

|

|

FFO per unit – diluted (formerly known as "NFFO per unit –

diluted") |

$ |

0.638 |

|

$ |

0.610 |

|

$ |

1.795 |

|

$ |

1.748 |

|

| |

|

|

|

|

|

Total distributions declared |

$ |

61,536 |

|

$ |

63,005 |

|

$ |

184,862 |

|

$ |

190,446 |

|

|

FFO payout ratio (formerly known as "NFFO payout ratio")(4) |

|

56.8 |

% |

|

59.1 |

% |

|

60.5 |

% |

|

62.0 |

% |

|

(1) |

The adjustment is based on applying the 35% weighted average

ownership held by ERES non-controlling unitholders (September 30,

2022 – 34%). |

|

(2) |

Includes amortization of property, plant, and equipment and

right-of-use asset and impairment of goodwill. |

|

(3) |

For the three and nine months ended September 30, 2023, includes

$679 and $765, respectively, of accelerated vesting of previously

granted unit-based compensation (three and nine months ended

September 30, 2022 – $nil and $976, respectively). |

|

(4) |

The payout ratio compares distributions declared to FFO (formerly

known as "NFFO"). |

Reconciliation of Unitholders' Equity to

NAV:

|

($ Thousands, except per unit amounts) |

|

|

As at |

September 30, 2023 |

December 31, 2022 |

September 30, 2022 |

|

Unitholders' equity |

$ |

9,304,029 |

|

$ |

10,003,695 |

|

$ |

9,832,599 |

|

|

Adjustments: |

|

|

|

|

Exchangeable LP Units |

|

74,257 |

|

|

71,668 |

|

|

70,694 |

|

|

Unit-based compensation financial liabilities excluding ERES's unit

options plan |

|

20,165 |

|

|

17,455 |

|

|

16,488 |

|

|

Deferred income tax liability |

|

58,124 |

|

|

120,524 |

|

|

141,179 |

|

|

Deferred income tax asset |

|

(13,686 |

) |

|

(6,173 |

) |

|

(3,812 |

) |

|

Derivative assets – non-current |

|

(55,018 |

) |

|

(62,599 |

) |

|

(84,073 |

) |

|

Derivative assets – current |

|

(7,691 |

) |

|

— |

|

|

(26,568 |

) |

|

Derivative liabilities – current |

|

7,154 |

|

|

10,625 |

|

|

— |

|

|

Adjustment to ERES non-controlling interest(1) |

|

(159,101 |

) |

|

(200,629 |

) |

|

(215,972 |

) |

|

NAV |

$ |

9,228,233 |

|

$ |

9,954,566 |

|

$ |

9,730,535 |

|

|

Diluted number of units |

|

169,777 |

|

|

171,599 |

|

|

172,393 |

|

|

NAV per unit – diluted |

$ |

54.36 |

|

$ |

58.01 |

|

$ |

56.44 |

|

|

(1) |

CAPREIT accounts for the non-controlling interest in ERES as a

liability, measured at the trading value of ERES's units not owned

by CAPREIT. The adjustment is made so that the non-controlling

interest in ERES is measured at ERES's disclosed NAV, rather than

ERES's trading value. The table below summarizes the calculation of

adjustment to ERES non-controlling interest as at September 30,

2023, December 31, 2022 and September 30, 2022: |

|

($ Thousands) |

|

|

As at |

September 30, 2023 |

December 31, 2022 |

September 30, 2022 |

|

ERES's NAV |

€ |

711,062

|

|

€ |

899,166 |

|

€ |

987,803 |

|

|

Ownership by ERES non-controlling interest |

|

35 |

% |

|

34 |

% |

|

34 |

% |

|

Closing foreign exchange rate |

|

1.4360 |

|

|

1.4498 |

|

|

1.3463 |

|

|

Impact to NAV due to ERES's non-controlling unitholders |

$ |

357,385 |

|

$ |

443,228 |

|

$ |

452,159 |

|

|

Less: ERES units held by non-controlling unitholders |

$ |

198,284 |

|

$ |

242,599 |

|

$ |

236,187 |

|

|

Adjustment to ERES non-controlling interest |

$ |

159,101 |

|

$ |

200,629 |

|

$ |

215,972 |

|

Reconciliation for Total Debt and Total

Debt Ratios:

|

($ Thousands) |

|

|

As at |

September 30, 2023 |

December 31, 2022 |

September 30, 2022 |

|

Mortgages payable – non-current |

$ |

5,797,931 |

|

$ |

5,963,820 |

|

$ |

5,874,897 |

|

|

Mortgages payable – current |

|

741,706 |

|

|

613,277 |

|

|

623,385 |

|

|

Liabilities related to assets held for sale |

|

— |

|

|

38,116 |

|

|

— |

|

|

Mortgage debt |

|

6,539,637 |

|

|

6,615,213 |

|

|

6,498,282 |

|

|

Bank Indebtedness – non-current |

|

489,024 |

|

|

388,975 |

|

|

402,112 |

|

|

Total Debt |

$ |

7,028,661 |

|

$ |

7,004,188 |

|

$ |

6,900,394 |

|

|

|

|

|

|

|

Total Assets |

$ |

16,946,089 |

|

$ |

17,741,888 |

|

$ |

17,456,012 |

|

|

Add: Total accumulated amortization and depreciation |

|

43,865 |

|

|

42,100 |

|

|

40,468 |

|

|

Gross Book Value(1) |

$ |

16,989,954 |

|

$ |

17,783,988 |

|

$ |

17,496,480 |

|

|

Ratio of Total Debt to Gross Book Value |

|

41.4 |

% |

|

39.4 |

% |

|

39.4 |

% |

|

Ratio of Mortgage debt to Gross Book Value |

|

38.5 |

% |

|

37.2 |

% |

|

37.1 |

% |

|

(1) |

Gross Book Value ("GBV") is defined by CAPREIT's Declaration of

Trust. |

Reconciliation of Net

Income (Loss) to Adjusted EBITDAFV:

|

($ Thousands) |

|

|

|

|

For the Trailing 12 Months Ended |

September 30, 2023 |

December 31, 2022 |

September 30, 2022 |

|

Net income (loss) |

$ |

(265,263 |

) |

$ |

13,637 |

|

$ |

503,073 |

|

|

Adjustments: |

|

|

|

|

Interest and other financing costs |

|

201,950 |

|

|

180,434 |

|

|

177,600 |

|

|

Interest on Exchangeable LP Units |

|

2,394 |

|

|

2,435 |

|

|

2,434 |

|

|

Current and deferred income tax expense (recovery) |

|

(95,053 |

) |

|

(10,034 |

) |

|

57,629 |

|

|

Amortization of property, plant and equipment and right-of-use

asset |

|

6,448 |

|

|

7,462 |

|

|

7,819 |

|

|

Unit-based compensation amortization expense |

|

7,943 |

|

|

7,256 |

|

|

7,301 |

|

|

EUPP unit-based compensation expense |

|

(545 |

) |

|

(514 |

) |

|

(511 |

) |

|

Fair value adjustments of investment properties |

|

728,743 |

|

|

468,327 |

|

|

(25,492 |

) |

|

Fair value adjustments of financial instruments |

|

75,313 |

|

|

7,440 |

|

|

(55,202 |

) |

|

Net gain on derecognition of debt |

|

(3,307 |

) |

|

(1,766 |

) |

|

(1,766 |

) |

|

Gain on non-controlling interest |

|

(27,268 |

) |

|

(104,822 |

) |

|

(102,919 |

) |

|

Loss (gain) on foreign currency translation |

|

(2,539 |

) |

|

21,000 |

|

|

21,917 |

|

|

Loss on dispositions and other |

|

5,318 |

|

|

3,318 |

|

|

3,624 |

|

|

Adjusted EBITDAFV adjustment for income from investment in

associate(1) |

|

— |

|

|

— |

|

|

(7,060 |

) |

|

Goodwill impairment loss |

|

— |

|

|

14,278 |

|

|

14,278 |

|

|

Adjusted EBITDAFV |

$ |

634,134 |

|

$ |

608,451 |

|

$ |

602,725 |

|

|

(1) |

Relates to CAPREIT's share of Irish Residential Properties REIT plc

investment property fair value gain. |

Debt Service Coverage Ratio

|

($ Thousands) |

|

|

For the Trailing 12 Months Ended |

September 30, 2023 |

December 31, 2022 |

September 30, 2022 |

|

Interest on mortgages payable and liabilities related to assets

held for sale |

$ |

161,855 |

|

$ |

154,467 |

|

$ |

151,588 |

|

|

Interest on bank indebtedness |

|

21,808 |

|

|

8,292 |

|

|

8,278 |

|

|

Mortgage principal repayments |

|

161,102 |

|

|

162,048 |

|

|

160,438 |

|

|

Debt service payments |

$ |

344,765 |

|

$ |

324,807 |

|

$ |

320,304 |

|

|

Adjusted EBITDAFV |

$ |

634,134 |

|

$ |

608,451 |

|

$ |

602,725 |

|

|

Debt Service Coverage Ratio (times) |

1.8x |

1.9x |

1.9x |

Interest Coverage Ratio

|

($ Thousands) |

|

|

For the Trailing 12 Months Ended |

September 30, 2023 |

December 31, 2022 |

September 30, 2022 |

|

Interest on mortgages payable and liabilities related to assets

held for sale |

$ |

161,855 |

|

$ |

154,467 |

|

$ |

151,588 |

|

|

Interest on bank indebtedness |

|

21,808 |

|

|

8,292 |

|

|

8,278 |

|

|

Interest Expense |

$ |

183,663 |

|

$ |

162,759 |

|

$ |

159,866 |

|

|

Adjusted EBITDAFV |

$ |

634,134 |

|

$ |

608,451 |

|

$ |

602,725 |

|

|

Interest coverage ratio (times) |

3.5x |

3.7x |

3.8x |

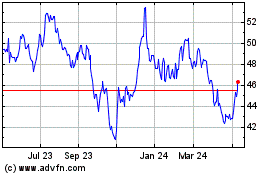

Canadian Apartment Prope... (TSX:CAR.UN)

Historical Stock Chart

From Mar 2024 to Apr 2024

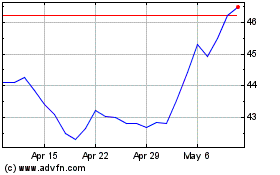

Canadian Apartment Prope... (TSX:CAR.UN)

Historical Stock Chart

From Apr 2023 to Apr 2024