Crescita Therapeutics Inc. (TSX: CTX and OTC US:

CRRTF) (“Crescita” or the “Company”), a growth-oriented,

innovation-driven Canadian commercial dermatology company, today

reported its financial results for the fourth quarter and fiscal

year ended December 31, 2023 (“Q4-2023” and “F2023”). All amounts

presented are in thousands of Canadian dollars (“CAD”) unless

otherwise noted, and in accordance with International Financial

Reporting Standards (“IFRS”) as issued by the International

Accounting Standards Board.

Financial Highlights

Q4-2023 vs. Q4-2022

- Revenue was $4,725 compared to $6,030, down $1,305;

- Gross profit was $3,060 compared to $3,885, down $825;

- Operating expenses were $3,173 compared to $3,313, down

$140;

- Adjusted EBITDA1 was $245 compared to $997, down $752.

F2023 vs. F2022

- Revenue was $17,522 compared to $23,525, down $6,003;

- Gross profit was $10,364 compared to $13,182, down $2,818;

- Operating expenses were $12,320 compared to $12,653, down

$333;

- Adjusted EBITDA1 was $(368) compared to $2,221, down

$2,589;

- Ending cash of $9,385 compared to $8,238, up $1,147.

Commenting on the Company's results for the fourth quarter and

full year 2023, Crescita's President and Chief Executive Officer,

Serge Verreault, said:

“2023 was a challenging year for Crescita, marked by headwinds

in our manufacturing segment. We recorded a 26% decrease in total

revenue versus 2022, mainly due to a reduction in production

volumes for one key customer. We are in active discussions to

secure new manufacturing business and to diversify our customer

base. On the licensing front, we are seeking a new U.S. partner for

Pliaglis in this important market. We are also expecting existing

partners to launch Pliaglis in several European and Middle Eastern

countries in 2024.

Our skincare business grew 30% over 2022 and outperformed the

6%2 projected beauty industry growth rate. Twelve months

post-launch, ART FILLER is gaining traction in the Canadian

physician-dispensed market, as we open new accounts and observe

repeat orders.”

We are enthusiastic about our growing aesthetic market portfolio

and the overall prospects for our business segments. We have a

strong cash position, which allows us to continue investing

strategically in people, marketing and product innovation. M&A

continues to be a key part of our strategy as we pursue

opportunities in what we believe are conducive market

conditions.”

Operational and Corporate Developments

Termination of Agreement with Taro Pharmaceuticals

Inc.

- On October 25, 2023, Taro Pharmaceuticals Inc. (“Taro”)

delivered a notice to terminate the development and

commercialization license agreement for Pliaglis® in the U.S.

market. Our final entitlement to the annual guaranteed minimum

royalties in the amount of US$1.0 million was recognized in

Q4-2023, with payment expected in Q2-2024. We are in the process of

seeking a new partner to commercialize Pliaglis in the U.S.

market.

Update on Manufacturing Segment

- Certain manufacturing orders initially scheduled to be

delivered in the second half of fiscal 2023 were, in part, deferred

to 2024, and some cancelled, contributing to a material decrease in

our manufacturing segment revenue for Q4-2023 and fiscal 2023,

compared to the same periods of 2022. While our customer is

reassessing commercial options for their products in key markets,

we continue to have discussions regarding manufacturing

opportunities to support their growth plans going forward.

Normal Course Issuer Bid

- In Q3-2023, the Toronto Stock Exchange (the “TSX”) approved the

Company’s proposed normal course issuer bid (“NCIB”) to purchase up

to a maximum of 1,821,616 common shares (“Common Shares”) for

cancellation. The NCIB commenced on August 31, 2023 and is expected

to terminate on August 30, 2024 or such earlier date as the Company

completes its purchases pursuant to the NCIB or provides notice of

termination. The Company has also entered into an automatic

securities purchase plan in connection with its NCIB. During fiscal

2023, 719,203 Common Shares were repurchased for cancellation, at

an average price of $0.55 per share for total cash consideration of

$393.

Re-Launch of Alyria® as a Direct-to-Consumer Brand

- In Q1-2023, following rebranding and various product

reformulations, we relaunched Alyria as a direct-to-consumer

medical-grade dermocosmetic brand in the Canadian skincare market.

Alyria is primarily targeted at millennials and marketed and sold

online in Canada through Amazon.ca and alyriaskincare.com. In

Q2-2023, Alyria was also launched in retail outlets of Familiprix,

a Québec based chain of independently owned pharmacies. The

relaunch of Alyria strengthens our omnichannel expansion and

provides the opportunity to engage with a new consumer group.

Launch of ART FILLER®

- In Q1-2023, we launched ART FILLER, an exclusive collection of

hyaluronic acid-based dermal fillers in the Canadian medical

aesthetic market through our new dedicated sales force. ART FILLER

is designed to smooth and fill in wrinkles and create or restore

the volumes and contours of the face. Crescita is the exclusive

Canadian distributor of ART FILLER and NCTF® Boost 135 HA (“NCTF”)

under its distribution and promotion agreement with Laboratoires

FILLMED.

Q4-2023 and F2023 Summary Financial Results

Note: Select financial information is outlined below and

should be read in conjunction with Crescita's Consolidated Audited

Financial Statements and related Management's Discussion and

Analysis (“MD&A”) for the fiscal year ended December 31, 2023,

which are available on SEDAR+ at www.sedarplus.ca and on Crescita’s

website at www.crescitatherapeutics.com.

In thousands of CAD, except per share data

and number of shares

Quarter ended December

31,

Year ended December

31,

2023

2022

2023

2022

$

$

$

$

Commercial Skincare

2,851

2,422

10,440

8,022

Licensing and Royalties

1,547

1,481

2,030

1,800

Manufacturing and Services

327

2,127

5,052

13,703

Revenues

4,725

6,030

17,522

23,525

Cost of goods sold

1,665

2,145

7,158

10,343

Gross profit

3,060

3,885

10,364

13,182

Gross margin (%)

64.8

%

64.4

%

59.1

%

56.0

%

Research and development (“R&D”)

218

160

699

609

Selling, general and administrative

(“SG&A”)

2,576

2,776

10,115

10,573

Depreciation and amortization

379

377

1,506

1,471

Total operating expenses

3,173

3,313

12,320

12,653

Operating profit (loss)

(113

)

572

(1,956

)

529

Interest income, net

(137

)

(68

)

(422

)

(102

)

Foreign exchange (gain) loss

(33

)

(131

)

(10

)

51

Share of (profit) loss of an associate

10

27

(16

)

57

Net loss on convertible note measured

at

fair value through profit or loss

-

24

22

119

Income (loss) before income

taxes

47

720

(1,530

)

404

Deferred income tax (recovery) expense

197

(458

)

456

(458

)

Net income (loss)

(150

)

1,178

(1,986

)

862

Adjusted EBITDA1

245

997

(368

)

2,221

Weighted average number of common

shares outstanding

Basic

19,987,774

20,392,231

20,255,285

20,690,875

Diluted

19,987,774

20,643,129

20,255,285

21,000,182

Earnings (loss) per share

Basic

$

(0.01

)

$

0.06

$

(0.10

)

$

0.04

Diluted

$

(0.01

)

$

0.06

$

(0.10

)

$

0.04

Selected Balance Sheet

Information

Cash and cash equivalents, end of

period

9,385

8,238

Selected Cash Flow Information

Cash provided by (used in) operating

activities

(261

)

(2,215

)

2,076

(1,020

)

Cash used in investing activities

(105

)

(74

)

(133

)

(290

)

Cash used in financing activities

(258

)

(221

)

(782

)

(1,846

)

Revenue

We have three reportable segments: 1) Commercial Skincare

(“Skincare”), which manufactures our branded non-prescription

skincare products for sale in Canada and certain international

markets, and also commercializes Pliaglis®, NCTF®, ART FILLER®, and

Obagi® Medical in Canada; 2) Licensing and Royalties (“Licensing”),

which primarily derives revenue from licensing our intellectual

property related to Pliaglis, or to a lesser extent, our

transdermal delivery technologies; and 3) Manufacturing and

Services (“Manufacturing”), which generates revenue from contract

manufacturing and product development services.

For the quarter ended December 31, 2023, total revenue was

$4,725 compared to $6,030 for the quarter ended December 31, 2022.

The year-over-year decrease of $1,305 was driven by the revenue

shortfall in our Manufacturing segment of $1,800, as a result of

the deferral by a large customer of purchase orders into fiscal

2024 and, to a lesser extent, by the difference in the level and

timing of orders year-over-year, partly offset by an increase of

$429 in our Skincare segment, mainly due to incremental sales of

ART FILLER launched in Q1-2023, and higher online sales from our

core brands.

For the year ended December 31, 2023, total revenue was $17,522,

compared to $23,525 for the year ended December 31, 2022,

representing a net decrease of $6,003. Manufacturing segment

revenue decreased by $8,651 mainly due to the deferral into 2024

and partial cancellation of purchase orders by a large customer, as

well as the difference in the timing and value of orders versus the

prior year. This decrease was partly offset by an increase of

$2,418 in our Skincare segment, mainly driven by higher product

sales from our core brands across all channels, as a result of

launches and promotions, including the launch of ART FILLER.

Gross Profit and Gross Margin

For the quarter ended December 31, 2023, gross profit was

$3,060, representing a gross margin of 64.8%, compared to $3,885

and 64.4%, respectively, for the quarter ended December 31, 2022.

The net decrease of $825 in gross profit was mainly due to lower

Manufacturing segment revenue.

For the year ended December 31, 2023, gross profit was $10,364,

representing a gross margin of 59.1%, compared to $13,182 and

56.0%, respectively, for the year ended December 31, 2022. The net

decrease in gross profit of $2,818 was mainly due to lower

Manufacturing segment revenue. The increase in gross margin of 3.1%

was mainly driven by favorable product and channel mix.

Operating Expenses

For the quarter and year ended December 31, 2023, total

operating expenses were $3,173 and $12,320, compared to $3,313 and

$12,653 for the quarter and year ended December 31, 2022. The net

decreases of $140 for the quarter and $333 for the year, were

driven by lower SG&A expenses, mainly reflecting lower

headcount-related and share-based compensation expenses, partly

offset by higher advertising and promotion and R&D spend.

Cash and Cash Equivalents

Cash and cash equivalents were $9,385 at December 31, 2023,

reflecting a net increase of $1,147, compared to $8,238 at December

31, 2022. Despite lower earnings year-over-year, the increase

mainly resulted from the favorable movement in non-cash working

capital items and the non-recurring $1,000 repayment of convertible

debentures in F2022.

Non-IFRS Financial Measures

We report our financial results in accordance with IFRS.

However, we use certain non-IFRS financial measures to assess our

Company’s performance. We believe these to be useful to management,

investors, and other financial stakeholders in assessing Crescita’s

performance. The non-IFRS measures used in this press release do

not have any standardized meaning prescribed by IFRS and are

therefore not comparable to similar measures presented by other

issuers. These measures should be considered as supplemental in

nature and not as a substitute for the related financial

information prepared in accordance with IFRS. The following are the

Company’s non-IFRS measures along with their respective

definitions:

- EBITDA is defined as earnings before interest, income taxes,

depreciation of property, plant and equipment, and amortization of

right-of-use asset and intangible assets.

- Adjusted EBITDA is defined as earnings before interest, income

taxes, depreciation of property, plant and equipment and

amortization of right-of-use asset and intangible assets, share of

(profit) losses of associates, fair value (gains) losses,

share-based compensation costs, goodwill and intangible asset

impairment, and foreign exchange (gains) losses, as

applicable.

Management believes that Adjusted EBITDA is an important measure

of operating performance and cash flow and provides useful

information to investors as it highlights trends in the underlying

business that may not otherwise be apparent when relying solely on

IFRS measures. Below is a reconciliation of EBITDA and Adjusted

EBITDA to their closest IFRS measures.

In thousands of CAD dollars

Quarter ended

December 31,

Year ended

December 31,

2023

2022

2023

2022

$

$

$

$

Net income (loss)

(150

)

1,178

(1,986

)

862

Adjust for:

Depreciation and amortization

379

377

1,506

1,471

Interest income, net

(137

)

(68

)

(422

)

(102

)

Deferred income tax (recovery) expense

197

(458

)

456

(458

)

EBITDA

289

1,029

(446

)

1,773

Adjust for:

Share-based compensation

(21

)

48

82

221

Foreign exchange (gain) loss

(33

)

(131

)

(10

)

51

Share of (profit) loss of an associate

10

27

(16

)

57

Net loss on convertible note measured at

fair value through profit or loss

-

24

22

119

Adjusted EBITDA

245

997

(368

)

2,221

Caution Concerning Limitations of Summary Financial Results

Press Release

This summary earnings press release contains limited information

meant to assist the reader in assessing Crescita’s performance, but

it is not a suitable source of information for readers who are

unfamiliar with Crescita and is not in any way a substitute for the

Company's Consolidated Audited Financial Statements and notes

thereto, MD&A and latest Annual Information Form (“AIF”), all

of which can be found on the Company’s profile on SEDAR+ at

www.sedarplus.ca.

About Crescita Therapeutics Inc.

Crescita (TSX: CTX and OTC US: CRRTF) is a growth-oriented,

innovation-driven Canadian commercial dermatology company with

in-house R&D and manufacturing capabilities. The Company offers

a portfolio of high-quality, science-based non-prescription

skincare products and early to commercial stage prescription

products. We also own multiple proprietary transdermal delivery

platforms that support the development of patented formulations to

facilitate the delivery of active ingredients into or through the

skin. For more information visit, www.crescitatherapeutics.com.

Forward-looking Information

Certain statements in this press release constitute

forward-looking statements and/or forward-looking information

(collectively “forward-looking statements”) within the meaning of

applicable securities laws. All information in this press release,

other than statements of current and historical fact, represents

forward-looking information and is qualified by this cautionary

note.

Forward-looking statements may relate to the Company’s future

financial outlook and anticipated events or results and may include

information regarding the Company’s financial position, business

strategy, growth strategies, addressable markets, budgets,

operations, financial results, taxes, dividend policy, plans,

objectives, and expectations. Such statements are provided for the

purpose of presenting information about management’s current

expectations and plans relating to the future and allowing

investors and others to get a better understanding of the Company’s

anticipated financial position, results of operations and operating

environment. Readers are cautioned that such information may not be

appropriate for other purposes.

Often, but not always, forward-looking statements can be

identified by the use of forward-looking terminology such as:

“outlook”, “objective”, “anticipate”, “intend”, “plan”, “goal”,

“seek”, “believe”, “aim”, “project”, “estimate”, “expect”,

“strategy”, “future”, “likely”, “may”, “should”, “will”, “growth

strategy”, “future”, “prospects”, “continue”, and similar

references to future periods or suggesting future outcomes or

events. In addition, any statements that refer to expectations,

intentions, projections or other characterizations of future events

or circumstances contain forward-looking statements.

Examples of forward-looking information include, but are not

limited to, statements made in this press release under the heading

“Financial Highlights”, including statements regarding the

Company’s objectives, plans, goals, strategies, growth,

performance, operating results, financial condition, business

prospects, opportunities and industry trends, and similar

statements concerning anticipated future events, results,

circumstances, performance or expectations.

Forward-looking statements are neither historical fact nor

assurances of future performance. Instead, they reflect

management’s current beliefs, expectations and assumptions and are

based only on information currently available to us.

Forward-looking statements are necessarily based on a number of

estimates and assumptions that, while considered reasonable by

management of the Company as of the date of this press release, are

inherently subject to significant business, economic, and

competitive uncertainties and contingencies that are difficult to

predict and many of which are outside of our control.

The Company’s estimates, beliefs and assumptions, which may

prove to be incorrect, include various assumptions regarding, among

other things: the Company’s future growth potential, results of

operations, future prospects and opportunities; the Company’s

ability to retain and recruit, as applicable, customers, members of

management and key personnel; industry trends; legislative or

regulatory matters, including expected changes to laws and

regulations and the effects of such changes; future levels of

indebtedness; availability of capital; the Company’s ability to

secure additional capital and source and complete acquisitions; the

Company’s ability to maintain and expand its market presence and

geographic scope; current economic conditions; the impact of

currency exchange and interest rates; the Company’s ability to

maintain existing financing and insurance on acceptable terms; the

Company’s ability to execute on, and the impact of, its

environmental, social and governance initiatives; the impact of

competition; and the Company’s ability to respond to changes to its

industry and the global economy.

Forward-looking statements involve risks and uncertainties that

could cause Crescita’s actual results and financial condition to

differ materially from those contemplated by such forward-looking

statements. Important factors that could cause such differences

include, among others:

- economic and market conditions, including factors impacting

global supply chains such as pandemics and geopolitical conflicts

and tensions, including the uncertainty created by the war in

Ukraine and the Israel-Hamas war;

- the impact of inflation and rising interest rates together with

the threats of stagflation or recession;

- the Company’s ability to execute its growth strategies;

- the degree or lack of market acceptance of the Company’s

products;

- reliance on third parties for marketing, distribution and

commercialization, and clinical trials;

- the impact of variations in the values of the Canadian dollar

in relation to the U.S. dollar and Euro;

- the impact of the volatility in financial markets;

- the Company’s ability to retain members of its management team

and key personnel;

- the impact of changing conditions in the regulatory environment

and product development processes;

- manufacturing and supply risks;

- increasing competition in the industries in which the Company

operates;

- the Company’s ability to meet its contractual obligations;

- the impact of product liability matters;

- the impact of litigation involving the Company and/or its

products;

- the impact of changes in relationships with customers and

suppliers;

- the degree of intellectual property protection of the Company’s

products;

- developments and changes in applicable laws and regulations,

and;

- other risk factors described from time to time in the reports

and disclosure documents filed by Crescita with Canadian securities

regulatory agencies and commissions, including the sections

entitled “Risk Factors” in the Company’s most recent annual

MD&A and AIF.

If any risks or uncertainties with respect to the above

materialize, or if the opinions, estimates or assumptions

underlying the forward-looking statements prove incorrect, actual

results or future events might vary materially from those

anticipated in the forward-looking statements. This list is not

exhaustive of the factors that may impact the Company’s

forward-looking statements. Although management has attempted to

identify important risk factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other risk factors not presently known or

that management believes are not material that could also cause

actual results or future events to differ materially from those

expressed in such forward-looking statements. There can be no

assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such information. Accordingly, investors should not

place undue reliance on forward-looking statements, which speak

only as of the date made, and are subject to change after such

date. Except as required by applicable securities laws, the Company

undertakes no obligation to publicly update any forward-looking

information, whether written or oral, that may be provided from

time to time, whether as a result of new information, future

developments or otherwise.

1Please refer to the Non-IFRS Financial Measures section of this

press release. 2McKinsey & Company, The beauty market in 2023:

A special State of Fashion report

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240313349473/en/

FOR MORE INFORMATION, PLEASE CONTACT: Linda Kisa, CPA, CA

Vice-President, Reporting and Corporate Affairs Email:

lkisa@crescitatx.com

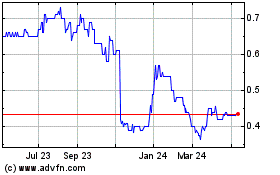

Crescita Therapeutics (TSX:CTX)

Historical Stock Chart

From Dec 2024 to Jan 2025

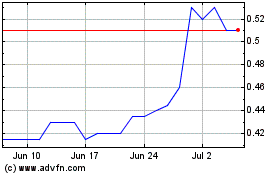

Crescita Therapeutics (TSX:CTX)

Historical Stock Chart

From Jan 2024 to Jan 2025