Crescita Therapeutics Inc. (TSX: CTX and OTC US:

CRRTF) (“Crescita” or the “Company”), a growth-oriented,

innovation-driven Canadian commercial dermatology company, today

reported its financial results for the third quarter ended

September 30, 2024 (“Q3-2024”). All amounts presented in this press

release are in thousands of Canadian dollars (“CAD”) unless

otherwise noted and are in accordance with International Financial

Reporting Standards (“IFRS”) as issued by the International

Accounting Standards Board.

Financial Highlights

Q3-2024 vs. Q3-2023

- Revenue was $3,594 compared to $3,033, up $561;

- Gross profit was $1,967 compared to $1,499, up $468;

- Operating expenses were $3,139 compared to $2,880, up

$259;

- Net loss was $(1,036) compared to $(1,282), an improvement of

$246;

- Adjusted EBITDA1 was $(681) compared to $(988), an improvement

of $307;

- Ending cash was $8,438, down $574 for the quarter.

“Our year-over-year revenue growth of 18.5% in the third quarter

reflects organic and inorganic growth in our Skincare segment, and

higher Licensing revenue from supplying Pliaglis® in support of

international launches,” commented Serge Verreault, President and

Chief Executive Officer of Crescita. “We expect to see continued

improvement in our Manufacturing segment as we integrate new

manufacturing equipment into our plant and begin to fulfill the

recently announced new long-term manufacturing and supply

agreements.

“In addition to increasing sales and margins from our existing

business segments, we continue to prioritize securing a new partner

for Pliaglis in the U.S.,” concluded Mr. Verreault.

Operational and Corporate Developments

For the three and nine months ended September 30, 2024 and up to

the date of this press release:

Normal Course Issuer Bid (“NCIB”)

- On September 24, we announced that the Toronto Stock Exchange

(the “TSX”) approved the Company’s proposed normal course issuer

bid (the “NCIB”) to purchase up to a maximum of 1,478,854 common

shares (“Common Shares”) for cancellation. The NCIB commenced on

September 27, 2024 and will end on September 26, 2025, or such

earlier date as the Company completes its purchases pursuant to the

NCIB or provides notice of termination. Furthermore, Crescita

entered into an automatic securities purchase plan with a broker to

facilitate purchases of Common Shares under the NCIB.

Amendment to Contract Manufacturer Supply Agreement, Securing

US$10M over Four Years

- In July, we signed an amendment to our contract manufacturer

supply agreement (the “Amended Agreement”) with our largest

manufacturing segment client (the “Manufacturing Client”), a global

skincare company. The Amended Agreement expands our existing

partnership with the Manufacturing Client and is the result of

ongoing discussions since we announced the cancellation of certain

purchase orders by the Manufacturing Client. Under the terms of the

Amended Agreement, Crescita will manufacture selected products from

the Manufacturing Client’s largest product franchises (the “New

Products”), representing a minimum commitment of US$2.5 million per

year during a four-year term, starting in 2025. Manufacturing

volumes of the New Products will, in part, make up for previously

cancelled purchase orders. In connection with the cancelled

purchase orders, the Manufacturing Client reimbursed Crescita

US$1.2 million subsequent to September 30, 2024, mainly for the

cost of unused inventory. To meet the New Products’ specifications

and scale up our operations, we are investing in specialized

equipment, now expected to total approximately $1.0 million,

revised from the $0.8 million previously disclosed.

Exclusive Manufacturing and Supply Agreement with Leading

Canadian Healthcare Services Provider

- In July, we signed an exclusive Manufacturing and Supply

Agreement (the “Agreement”) with a leading Canadian diversified

healthcare services provider (the “Client”) to supply sanitary

products, including hand sanitizer, hand soap, and hand lotion

(together the “Products”), for onward distribution to a network of

publicly funded healthcare organizations, represented by a buying

group (the “Buying Group” and the “Buying Group Members”). The

Agreement is for an initial term of five years with a three-year

renewal option exercisable by the Buying Group. Based on the

volumes forecasted by the Buying Group, annual revenue under the

Agreement may reach up to $6.0 million by the end of the initial

term. Crescita’s manufacturing revenue will be contingent on the

Client’s ability to convert Buying Group Members from their

existing solutions to its new sanitizer dispensing solution. As its

exclusive manufacturing partner, Crescita will support the Client

in developing the public sector healthcare market for the Products

through competitive bidding processes with other buying groups in

Canada.

Exclusive Distribution Agreement with NanoPass Technologies

Ltd.

- In July, we signed an exclusive distribution agreement with

NanoPass Technologies Ltd., a pioneer in the development and

commercialization of an advanced intradermal delivery device, to

launch and distribute MicronJet™600 (“MicronJet”) in the Canadian

medical aesthetics market. MicronJet is an innovative intradermal

injection device, leveraging the proven Micro Electro Mechanical

Systems (“MEMS”) technology, that offers a highly effective,

consistent and virtually pain-free delivery of aesthetic products

and therapeutic substances. With three 0.6mm, silicon crystal-made

delivery pyramids, MicronJet can be attached to standard syringes

and will provide aesthetic clinicians with the least invasive and

most precise intradermal delivery on the market today, allowing

administration to delicate and sensitive areas such as around the

eyes, neck and décolleté area, as well as to the full face, for

optimal patient outcomes. Crescita has recently obtained regulatory

approval for MicronJet from Health Canada and expects to launch the

product early in 2025.

Acquisition of Strategic Assets of Occy Laboratoire

Inc.

- On June 26, we completed the acquisition of all of the non-real

estate business assets of Occy Laboratoire Inc. (“Occy”), a

Laval-based manufacturer and distributor of high-quality

dermocosmetic products (the “Transaction”). The Transaction,

conducted pursuant to the voluntary proceedings initiated by Occy

under the Bankruptcy and Insolvency Act, received an Approval and

Vesting Order rendered by the Québec Superior Court on June 19,

2024, and is expected to enhance our position in the skincare

market. As a precursor step leading to the Transaction, Crescita

entered into a subrogation agreement with Occy’s former banker to

purchase its outstanding loan to Occy at a price significantly less

than the principal amount of the then outstanding debt and assumed

the first-ranking secured creditor rights. The assets, acquired for

total cash consideration of $0.9 million, include manufacturing

equipment, inventory, customer network and intellectual property

and have an estimated fair value of $1.7 million. Occy’s revenue

for fiscal 2023, its most recently completed year-end, was

approximately $1.5 million.

Update on Licensing Agreement for Pliaglis® in China

- In April, the National Medical Products Administration (the

“NMPA”, formerly the China Food and Drug Administration or “CFDA”)

confirmed the need for a local clinical trial to support the

registration of Pliaglis in China. Our licensing partner, Juyou

Bio-Technology Co. Ltd. (“Juyou”) is finalizing the protocol for

the clinical trial and the manufacture of required clinical study

test articles. Juyou is assessing the timeline for the clinical

trial, subsequent registration stages, and the projected launch

date. Under the commercialization and development license

agreement, Juyou is contractually responsible for all expenses

related to obtaining regulatory approval in China and conducting

the required clinical trials. Crescita will supply Pliaglis at a

pre-determined transfer price and is eligible for potential

regulatory and sales milestones that could exceed US$2.2 million,

as well as for tiered double-digit royalties should the product’s

retail price surpass specified thresholds.

Q3-2024 Summary Financial Results

Note: Select financial information is outlined below and

should be read in conjunction with Crescita's Condensed

Consolidated Interim Financial Statements and Management's

Discussion and Analysis (“MD&A”) for the three and nine months

ended September 30, 2024, which are available on Crescita’s profile

on SEDAR+ at www.sedarplus.ca and on Crescita’s website at

www.crescitatherapeutics.com.

In thousands of CAD, except per share data

and number of shares

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

$

$

$

$

Commercial Skincare

2,703

2,412

8,210

7,589

Licensing and Royalties

457

163

948

483

Manufacturing and Services

434

458

3,520

4,725

Revenues

3,594

3,033

12,678

12,797

Cost of goods sold

1,627

1,534

6,065

5,493

Gross profit

1,967

1,499

6,613

7,304

Gross margin (%)

54.7%

49.4%

52.2%

57.1%

Research and development (“R&D”)

157

143

490

481

Selling, general and administrative

(“SG&A)

2,670

2,360

8,069

7,539

Depreciation and amortization

312

377

1,001

1,127

Total operating expenses

3,139

2,880

9,560

9,147

Operating loss

(1,172)

(1,381)

(2,947)

(1,843)

Interest income, net

(96)

(92)

(312)

(285)

Foreign exchange (gain) loss

(36)

2

(50)

23

Share of (profit) loss of an associate

(4)

(9)

3

(26)

Net loss on convertible note measured at

fair value through profit or loss

-

-

-

22

Loss before income taxes

(1,036)

(1,282)

(2,588)

(1,577)

Deferred income tax expense

-

-

-

259

Net loss

(1,036)

(1,282)

(2,588)

(1,836)

Adjusted EBITDA1

(681)

(988)

(1,692)

(613)

Loss per share

Basic and diluted

$

(0.05)

$

(0.06)

$

(0.13)

$

(0.09)

Weighted average number of common

shares outstanding

Basic and diluted

19,272,495

20,367,631

19,435,144

20,345,435

Selected Balance Sheet

Information

Cash and cash equivalents, end of

period

8,438

10,021

Selected Cash Flow Information

Cash provided by operating activities

424

125

1,349

2,337

Cash used in investing activities

(754)

(28)

(1,666)

(28)

Cash used in financing activities

(227)

(324)

(621)

(524)

Revenue We have three reportable segments: 1) Commercial

Skincare (“Skincare”), which generates revenue from the

commercialization of our branded non-prescription skincare

products, manufactured in-house, in Canada and in certain

international markets, as well as other brands under exclusive

distribution agreements; 2) Licensing and Royalties (“Licensing”),

which currently derives revenue from licensing our intellectual

property related to Pliaglis®; and 3) Manufacturing and Services

(“Manufacturing”), which generates revenue from contract

manufacturing and, to a lesser extent, product development

services.

For the three months ended September 30, 2024, total revenue was

$3,594 compared to $3,033 for the three months ended September 30,

2023. The net increase of $561 was mainly driven by higher Skincare

segment revenue, primarily from incremental sales of Aquafolia,

acquired in June 2024, and growth in domestic sales from our core

brands across all channels, as well as the increase in Licensing

revenue from supplying Pliaglis under licensing agreements in

connection with international launches by our partners.

For the nine months ended September 30, 2024, total revenue was

$12,678 compared to $12,797 for the nine months ended September 30,

2023. The net decrease of $119 was mainly driven by lower

Manufacturing revenue from the cancellation of certain purchase

orders by our largest Manufacturing client, partly offset by the

growth in our Skincare and Licensing segments, mainly due to the

same factors as for the quarter.

Gross Profit and Gross Margin For the three months ended

September 30, 2024, gross profit was $1,967, representing a gross

margin of 54.7%, compared to $1,499 and 49.4%, respectively, for

the three months ended September 30, 2023. The net increases in

gross profit of $468 and in gross margin of 5.3% were mainly due to

higher overall revenue, as explained above, favorable product and

channel mix, as well as lower obsolescence charges in our Skincare

segment year-over-year, partly offset by the impact of lower margin

Pliaglis product sales in our Licensing segment.

For the nine months ended September 30, 2024, gross profit was

$6,613, representing a gross margin of 52.2%, compared to $7,304

and 57.1%, respectively, for the nine months ended September 30,

2023. The net decreases in gross profit of $691 and in gross margin

of 4.9% were mainly due to overall lower Manufacturing segment

volumes year-over-year, driven in part, by the fulfilment in the

prior year of higher-margin purchase orders which did not repeat,

and the impact of pricing concessions relating to a purchase order

from our largest Manufacturing client that was deferred from 2023

into Q1-2024.

Operating Expenses For the three and nine months ended

September 30, 2024, total operating expenses were $3,139 and

$9,560, respectively, compared to $2,880 and $9,147 for the

comparable periods of 2023. The increases of $259 and $413 for the

quarter and year-to-date periods were mainly due to higher

consulting fees and commercial partnership fees to support our

digital strategy, as well as acquisition-related and integration

costs incurred in connection with the acquisition of Occy’s

assets.

Cash and Cash Equivalents Cash and cash equivalents were

$8,438 at September 30, 2024, reflecting a net decrease of $574 in

the quarter, mainly as a result of investments in specialized

equipment, totaling $0.8 million during the quarter.

Non-IFRS Financial Measures We report our financial

results in accordance with IFRS. However, we use certain non-IFRS

financial measures to assess our Company’s performance. We believe

these to be useful to management, investors, and other financial

stakeholders in assessing Crescita’s performance. The non-IFRS

measures used in this press release do not have any standardized

meaning prescribed by IFRS and are therefore not comparable to

similar measures presented by other issuers. These measures should

be considered as supplemental in nature and not as a substitute for

the related financial information prepared in accordance with IFRS.

The following are the Company’s non-IFRS measures along with their

respective definitions:

- EBITDA is defined as earnings before interest, income taxes,

depreciation of property, plant and equipment and amortization of

right-of-use asset and intangible assets.

- Adjusted EBITDA is defined as earnings before interest, income

taxes, depreciation of property, plant and equipment and

amortization of right-of-use asset and intangible assets, foreign

exchange (gains) losses, share of (profit) loss of associates, fair

value (gains) losses, share-based compensation, restructuring,

acquisition-related and integration costs, and goodwill and

intangible asset impairment, as applicable.

Management believes that Adjusted EBITDA is an important measure

of operating performance and cash flow and provides useful

information to investors as it highlights trends in the underlying

business that may not otherwise be apparent when relying solely on

IFRS measures. Below is a reconciliation of EBITDA and Adjusted

EBITDA to their closest IFRS measures.

In thousands of CAD dollars

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

$

$

$

$

Net loss

(1,036)

(1,282)

(2,588)

(1,836)

Adjust for:

Depreciation and amortization

312

377

1,001

1,127

Interest income, net

(96)

(92)

(312)

(285)

Deferred income tax expense

-

-

-

259

EBITDA

(820)

(997)

(1,899)

(735)

Adjust for:

Acquisition-related and integration

costs

90

-

90

-

Share-based compensation

89

16

164

103

Foreign exchange (gain) loss

(36)

2

(50)

23

Share of (profit) loss of an associate

(4)

(9)

3

(26)

Net loss on convertible note measured at

fair value through profit or loss

-

-

-

22

Adjusted EBITDA

(681)

(988)

(1,692)

(613)

Caution Concerning Limitations of Summary Financial Results

Press Release This summary earnings press release contains

limited information meant to assist the reader in assessing

Crescita’s performance, but it is not a suitable source of

information for readers who are unfamiliar with Crescita and is not

in any way a substitute for the Company's Consolidated Audited

Financial Statements and notes thereto, MD&A and latest Annual

Information Form (“AIF”), all of which can be found on the

Company’s profile on SEDAR+ at www.sedarplus.ca.

About Crescita Therapeutics Inc. Crescita (TSX: CTX and

OTC US: CRRTF) is a growth-oriented, innovation-driven Canadian

commercial dermatology company with in-house R&D and

manufacturing capabilities. The Company offers a portfolio of

high-quality, science-based non-prescription skincare products and

a commercial stage prescription product. We also own multiple

proprietary transdermal delivery platforms that support the

development of patented formulations to facilitate the delivery of

active ingredients into or through the skin. For more information

visit, www.crescitatherapeutics.com.

Forward-looking Information Certain statements in this

press release constitute forward-looking statements and/or

forward-looking information (collectively “forward-looking

information”) within the meaning of applicable securities laws. All

information in this press release, other than statements of current

and historical fact, represents forward-looking information and is

qualified by this cautionary note.

Forward-looking information may relate to the Company’s future

financial outlook and anticipated events or results and may include

information regarding the Company’s financial position, business

strategy, growth strategies, addressable markets, budgets,

operations, financial results, taxes, dividend policy, plans,

objectives, and expectations. Such information is provided for the

purpose of presenting information about management’s current

expectations and plans relating to the future and allowing

investors and others to get a better understanding of the Company’s

anticipated financial position, results of operations and operating

environment. Readers are cautioned that such information may not be

appropriate for other purposes.

Often, but not always, forward-looking information can be

identified by the use of forward-looking terminology such as:

“outlook”, “objective”, “anticipate”, “intend”, “plan”, “goal”,

“seek”, “believe”, “aim”, “project”, “estimate”, “expect”,

“strategy”, “future”, “likely”, “may”, “should”, “will”, “growth

strategy”, “future”, “prospects”, “continue”, and similar

references to future periods or suggesting future outcomes or

events. In addition, any statements that refer to expectations,

intentions, projections or other characterizations of future events

or circumstances contain forward-looking information.

Examples of forward-looking information include, but are not

limited to, statements made in this press release under the heading

“Financial Highlights”, including statements regarding the

Company’s objectives, plans, goals, strategies, growth,

performance, operating results, financial condition, business

prospects, opportunities and industry trends, and similar

statements concerning anticipated future events, results,

circumstances, performance or expectations.

Forward-looking information is neither historical fact nor

assurance of future performance. Instead, it reflects management’s

current beliefs, expectations and assumptions and is based only on

information currently available to us. Forward-looking information

is necessarily based on a number of estimates and assumptions that,

while considered reasonable by management of the Company as of the

date of this press release, are inherently subject to significant

business, economic, and competitive uncertainties and contingencies

that are difficult to predict and many of which are outside of our

control.

The Company’s estimates, beliefs and assumptions, which may

prove to be incorrect, include various assumptions regarding, among

other things: the Company’s future growth potential, results of

operations, future prospects and opportunities; the Company’s

ability to retain and recruit, as applicable, customers, members of

management and key personnel; industry trends; legislative or

regulatory matters, including expected changes to laws and

regulations and the effects of such changes; future levels of

indebtedness; availability of capital; the Company’s ability to

secure additional capital and source and complete acquisitions; the

Company’s ability to maintain and expand its market presence and

geographic scope; current economic conditions; the impact of

currency exchange and interest rates; the Company’s ability to

maintain existing financing and insurance on acceptable terms; the

Company’s ability to execute on, and the impact of, its

environmental, social and governance initiatives; the impact of

competition; and the Company’s ability to respond to changes to its

industry and the global economy.

Forward-looking information involves risks and uncertainties

that could cause Crescita’s actual results and financial condition

to differ materially from those contemplated by such

forward-looking information. Important factors that could cause

such differences include, among others:

- economic and market conditions, including factors impacting

global supply chains such as pandemics and geopolitical conflicts

and tensions;

- the impact of inflation and fluctuating interest rates;

- the Company’s ability to execute its growth strategies;

- the degree or lack of market acceptance of the Company’s

products;

- reliance on third parties for marketing, distribution and

commercialization, and clinical trials;

- the impact of variations in the values of the Canadian dollar

in relation to the U.S. dollar and Euro;

- the impact of the volatility in financial markets;

- the Company’s ability to retain members of its management team

and key personnel;

- the impact of changing conditions in the regulatory environment

and product development processes;

- manufacturing and supply risks;

- increasing competition in the industries in which the Company

operates;

- the Company’s ability to meet its contractual obligations;

- the impact of product liability matters;

- the impact of litigation involving the Company and/or its

products;

- the impact of changes in relationships with customers and

suppliers;

- the degree of intellectual property protection of the Company’s

products;

- developments and changes in applicable laws and regulations,

and;

- other risk factors described from time to time in the reports

and disclosure documents filed by Crescita with Canadian securities

regulatory agencies and commissions, including the sections

entitled “Risk Factors” in the Company’s most recent annual

MD&A and AIF.

If any risks or uncertainties with respect to the above

materialize, or if the opinions, estimates or assumptions

underlying the forward-looking information prove incorrect, actual

results or future events might vary materially from those

anticipated in the forward-looking information. This list is not

exhaustive of the factors that may impact the Company’s

forward-looking information. Although management has attempted to

identify important risk factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other risk factors not presently known or

that management believes are not material that could also cause

actual results or future events to differ materially from those

expressed in such forward-looking information. There can be no

assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such information. Accordingly, investors should not

place undue reliance on forward-looking information, which speaks

only as of the date provided, and is subject to change after such

date. Except as required by applicable securities laws, the Company

undertakes no obligation to publicly update any forward-looking

information, whether written or oral, that may be provided from

time to time, whether as a result of new information, future

developments or otherwise.

1Please refer to the Non-IFRS Financial Measures section of this

press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106205026/en/

FOR MORE INFORMATION, PLEASE CONTACT: Linda Kisa, CPA, CA

Vice-President, Reporting and Corporate Affairs Email:

lkisa@crescitatx.com

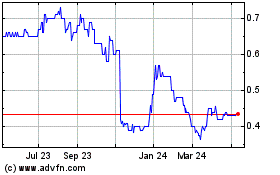

Crescita Therapeutics (TSX:CTX)

Historical Stock Chart

From Dec 2024 to Jan 2025

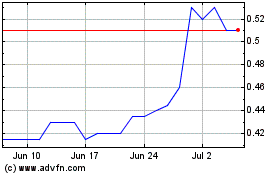

Crescita Therapeutics (TSX:CTX)

Historical Stock Chart

From Jan 2024 to Jan 2025