95% of the Corporations’ Mortgages are at Floating Rates Structured to Capture the Benefit of Rising Interest Rates

14 April 2022 - 6:30AM

Firm Capital Mortgage Investment Corporation (the

"

Corporation") (TSX: FC) is issuing this press

release in response to the rising interest rate environment and how

it is impacting returns for the Corporation and, ultimately,

shareholders.

In summary, the Corporation has for years

protected shareholders in the event of rising interest rates by

requiring the vast majority of mortgage investments to be floating

at the greater of (i) Bank Prime Rate (“Prime”)

plus a spread and, (ii) a Fixed Floor Rate (collectively the

“Floating Rate Investment Feature”). Therefore, as

Prime rises, so does the overall interest rate charged to

borrowers.

As at March 31, 2022, Approximately 95% of the

Corporations mortgage investments have the Floating Rate Investment

Feature.

As of December 31, 2021, the weighted average

face interest rate of the Corporation’s mortgage investment

portfolio stood at 7.91%. As of March 31, 2022, the weighted

average face interest rate of the Corporation’s mortgage investment

portfolio stands at 8.05%, for a 14 basis point increase since the

beginning of 2022. This is correlated to the 25 basis

point increase in Prime that occurred in March of 2022 when Prime

went from 2.45% to 2.7%.

With the preservation of Shareholder’s Capital

at the forefront of our investment strategy, any opportunity cost

lost looking for the right investment in an uncertain market has

been offset by the rise in bank prime.

The Floating Rate Investment Feature has been a

long-term operating strategy of the Corporation as a specialist in

bridge financing.

ABOUT THE CORPORATION

Where Mortgage Deals Get

Done®

The Corporation, through its mortgage banker,

Firm Capital Corporation, is a non-bank lender providing

residential and commercial short-term bridge and conventional real

estate financing, including construction, mezzanine and equity

investments. The Corporation's investment objective is the

preservation of shareholders' equity, while providing shareholders

with a stable stream of monthly dividends from investments. The

Corporation achieves its investment objectives through investments

in selected niche markets that are under-serviced by large lending

institutions. Lending activities to date continue to develop a

diversified mortgage portfolio, producing a stable return to

shareholders. The Corporation is a Mortgage Investment Corporation

(MIC) as defined in the Income Tax Act (Canada). Accordingly, the

Corporation is not taxed on income provided that its taxable income

is paid to its shareholders in the form of dividends within 90 days

after December 31 each year. Such dividends are generally treated

by shareholders as interest income, so that each shareholder is in

the same position as if the mortgage investments made by the

Corporation had been made directly by the shareholder. Full reports

of the financial results of the Corporation for the year are

outlined in the audited financial statements and the related

management discussion and analysis of the Corporation, available on

the SEDAR website at www.sedar.com. In addition, supplemental

information is available on the Corporation’s website at

www.firmcapital.com.

FORWARD-LOOKING STATEMENTSThis

news release contains forward-looking statements within the meaning

of applicable securities laws including, among others, statements

concerning our objectives, our strategies to achieve those

objectives, our performance, our mortgage portfolio and our

dividends, as well as statements with respect to management’s

beliefs, estimates, and intentions, and similar statements

concerning anticipated future events, results, circumstances,

performance or expectations that are not historical facts.

Forward-looking statements generally can be identified by the use

of forward-looking terminology such as “outlook”, “objective”,

“may”, “will”, “expect”, “intent”, “estimate”, “anticipate”,

“believe”, “should”, “plans” or “continue” or similar expressions

suggesting future outcomes or events. Such forward-looking

statements reflect management’s current beliefs and are based on

information currently available to management.

These statements are not guarantees of future

performance and are based on our estimates and assumptions that are

subject to risks and uncertainties, including those described in

our most recent Annual Information Form under “Risk Factors” (a

copy of which can be obtained at www.sedar.com), which could cause

our actual results and performance to differ materially from the

forward-looking statements contained in this circular. Those risks

and uncertainties include, among others, risks associated with

mortgage lending, dependence on the Corporation’s MIC manager and

mortgage banker, competition for mortgage lending, real estate

values, interest rate fluctuations, environmental matters,

Shareholder liability and the introduction of new tax rules.

Material factors or assumptions that were applied in drawing a

conclusion or making an estimate set out in the forward-looking

information include, among others, that the Corporation is able to

invest in mortgages at rates consistent with rates historically

achieved; adequate mortgage investment opportunities are presented

to the Corporation; and adequate bank indebtedness and bank loans

are available to the Corporation. Although the forward-looking

information continued in this new release is based upon what

management believes are reasonable assumptions, there can be no

assurance that actual results and performance will be consistent

with these forward-looking statements.

All forward-looking statements in this news

release are qualified by these cautionary statements. Except as

required by applicable law, the Corporation undertakes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

| For further

information, please contact: |

|

| |

|

| Eli Dadouch |

Ryan Lim |

| President & Chief Executive Officer |

Chief Financial Officer |

| (416) 635-0221 |

(416) 635-0221 |

| |

|

| For Investor Relations information, please contact: |

|

| |

|

| Victoria Moayedi |

|

| Director, Investor Relations |

|

| (416) 635-0221 |

|

Boutique Mortgage Lenders®

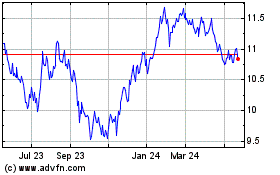

Firm Capital Mortgage In... (TSX:FC)

Historical Stock Chart

From Jan 2025 to Feb 2025

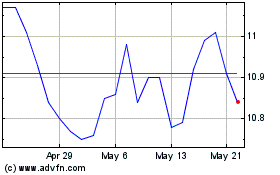

Firm Capital Mortgage In... (TSX:FC)

Historical Stock Chart

From Feb 2024 to Feb 2025