Imperial Metals Corporation (the “Company”)

(TSX:III) reports financial results for its fiscal year ended

December 31, 2022.

| Select Annual

Financial Information |

|

Years Ended December 31 |

|

|

expressed in thousands, except share and per share amounts |

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

Operations: |

|

|

|

|

Total revenues |

$172,797 |

|

$133,591 |

|

$148,097 |

|

|

Net loss |

$(75,975 |

) |

$(26,070 |

) |

$(4,892 |

) |

|

Net loss per share |

$(0.51 |

) |

$(0.19 |

) |

$(0.04 |

) |

|

Diluted loss per share |

$(0.51 |

) |

$(0.19 |

) |

$(0.04 |

) |

|

Adjusted net loss (1) |

$(95,598 |

) |

$(23,181 |

) |

$(5,421 |

) |

|

Adjusted net loss per share (1) |

$(0.64 |

) |

$(0.17 |

) |

$(0.04 |

) |

|

Adjusted EBITDA(1) |

$(63,131 |

) |

$11,553 |

|

$36,034 |

|

|

Cash earnings (1)(2) |

$(52,873 |

) |

$11,034 |

|

$36,909 |

|

|

Cash earnings per share (1)(2) |

$(0.36 |

) |

$0.08 |

|

$0.29 |

|

|

Working capital (deficiency) deficiency |

$(65,091 |

) |

$(19,060 |

) |

$9,292 |

|

|

Total assets |

$1,299,702 |

|

$1,186,341 |

|

$1,091,321 |

|

|

Total debt (including current portion) (3) |

$197,788 |

|

$34,975 |

|

$2,422 |

|

|

(1) Refer to table in section Non-IFRS Financial Measures of the

December 31, 2022 Management’s Discussion & Analysis for

further details. |

|

(2) Cash earnings is defined as the cash flow from operations

before the net change in non-cash working capital balances, income

and mining taxes, and interest paid. Cash earnings per share is

defined as cash earnings divided by the weighted average number of

common shares outstanding during the year. |

|

(3) Total debt consists of banker’s acceptances, debentures, and

equipment leases. |

| Select Items Affecting

Net Loss (presented on an after-tax basis) |

Years Ended December 31 |

|

|

expressed in thousands |

|

2022 |

|

|

2021 |

|

|

2020 |

|

| Net loss before undernoted

items |

$(67,063 |

) |

$(24,337 |

) |

$(3,559 |

) |

|

Interest expense |

|

(8,921 |

) |

|

(1,497 |

) |

|

(1,358 |

) |

|

Foreign exchange gain (loss) on debt |

|

9 |

|

|

(236 |

) |

|

25 |

|

| Net Loss |

$(75,975 |

) |

$(26,070 |

) |

$(4,892 |

) |

Total revenue increased to $172.8 million in

2022 compared to $133.6 million in 2021, an increase of $39.2

million or 29%.

Revenue from the Red Chris mine in 2022 was

$129.5 million compared to $132.6 million in 2021, a decrease of

$3.1 million. In 2022, the Red Chris mine (100% basis) had 14.6

concentrate shipments (2021-14.5 concentrate shipments).

Revenue from the Mount Polley mine in 2022 was

$42.7 million compared to $nil million in 2021, an increase of

$42.7 million. In 2022, the Mount Polley mine had 1.0 concentrate

shipments (2021-nil concentrate shipments).

Variations in revenue are impacted by the timing

and quantity of concentrate shipments, metal prices and exchange

rates, and period end revaluations of revenue attributed to

concentrate shipments where copper and gold prices will settle at a

future date.

The London Metals Exchange cash settlement

copper price per pound averaged US$4.00 in 2022 compared to US$4.23

in 2021. London Bullion Market Association, London gold price per

troy ounce averaged US$1,801 in 2022 compared to US$1,800 in 2021.

The average US/CDN dollar exchange rate in 2022 was 1.302 compared

to an average of 1.254 in 2021. In CDN dollar terms, the average

copper price in 2022 was CDN$5.21 per pound compared to CDN$5.30

per pound in 2021, and the average gold price in 2022 was CDN$2,345

per ounce compared to CDN$2,256 per ounce in 2021.

Revenue in 2022 decreased by a $6.7 million

negative revenue revaluation compared to a positive revenue

revaluation of $1.6 million in 2021. Revenue revaluations are the

result of the metal price on the settlement date and/or the current

period balance sheet date being higher or lower than when the

revenue was initially recorded or the metal price at the last

balance sheet date and finalization of contained metal as a result

of final assays.

Net loss in 2022 was $75.9 million ($0.51 per

share) compared to net loss of $26.1 million ($0.19 per share) in

2021. The majority of the increase in net loss of $49.8 million was

primarily due to the following factors:

- Income from mine operations went

from $10.4 million in 2021 to loss of $28.7 million in 2022, an

increase in net loss of $39.1 million.

- Mine restart costs went from $11.4

in 2021 to $64.9 million in 2022, an increase in net loss of $53.5

million, which was offset by the decrease of $18.4 million in idle

mine cost from $24.9 million in 2021 to $6.5 million in 2022.

- Net gain on disposal of mineral

properties, including the reversal of impairment on exploration

costs of $3.6 million in 2021 increased by $13.3 million to $16.9

million in 2022.

- Interest expense of 1.5 million in

2021 increased to $8.9 million in 2022, an increase of $7.4

million, as a result of additional financing required to support

working capital and capital expenditures in 2022.

Capital expenditures including finance leases

were $150.0 million in 2022, up from $108.6 million in 2021.

Expenditures in 2022 included $41.4 million in exploration, an

increase of $6.3 million in comparison to 2021 of $35.1 million;

$36.7 million for tailings dam construction, an increase of $14.0

million in comparison to 2021 of $22.7 million; $23.8 million on

stripping costs, an increase of $8.0 million in comparison to 2021

of $15.8 million and investment in other plant and equipment of

$48.1 million, an increase of $13.1 million in comparison to 2021

of $35.0 million.

At December 31, 2022, the Company had $27.5

million in cash compared to $33.3 million at December 31, 2021.

NON-IFRS FINANCIAL MEASURES

The Company reports four non-IFRS financial

measures: adjusted net loss, adjusted EBITDA, cash earnings and

cash cost per pound of copper produced which are described in

detail below. The Company believes these measures are useful to

investors because they are included in the measures that are used

by management in assessing the financial performance of the

Company.

Adjusted net loss, adjusted EBITDA, cash

earnings and cash cost per pound of copper are not standardized

financial measures under IFRS and might not be comparable to

similar financial measures disclosed by other issuers.

Adjusted Net Loss and Adjusted Net Loss

Per Share

Adjusted net loss is derived from operating net

loss by removing the gains or loss, resulting from acquisition and

disposal of property, mark to market revaluation of derivative

instruments not related to the current period, net of tax,

unrealized foreign exchange gains or losses on non-current debt,

net of tax and other non-recurring items. Adjusted net loss in 2022

was $95.6 million ($0.64 per share) compared to an adjusted net

loss of $23.2 million ($0.17 per share) in 2021. We believe that

the presentation of Adjusted Net Loss helps investors better

understand the results of our normal operating activities and the

ongoing cash generating potential of our business.

Adjusted EBITDA

Adjusted EBITDA in 2022 was $(63.1) million

compared to $11.6 million in 2021. We define Adjusted EBITDA as net

loss before interest expense, taxes, depletion, and depreciation,

and as adjusted for certain other items.

Cash Earnings and Cash Earnings Per

Share

Cash earnings in 2022 was $(52.9) million

compared to $11.0 million in 2021. Cash earnings per share were

$(0.36) in 2022 compared to $0.08 in 2021. Cash earnings and cash

earnings per share are measures used by the Company to evaluate its

performance; however, they are not terms recognized under IFRS. We

believe that the presentation of cash earnings and cash earnings

per share is appropriate to provide additional information to

investors about how well the Company can earn cash to pay its debts

and manage its operating expenses and investment. Cash earnings is

defined as cash flow from operations before the net change in

non-cash working capital balances, income and mining taxes paid,

and interest paid. Cash earnings per share is the same measure

divided by the weighted average number of common shares outstanding

during the year.

Cash Cost Per Pound of Copper Produced

Management uses this non-IFRS financial measure

to monitor operating costs and profitability. The Company is

primarily a copper producer and therefore calculates this non-IFRS

financial measure individually for its three copper mines, Red

Chris (30% share), Mount Polley and Huckleberry, and on a composite

basis for these mines.

Variations from period to period in the cash

cost per pound of copper produced are the result of many factors

including: grade, metal recoveries, amount of stripping charged to

operations, mine and mill operating conditions, labour and other

cost inputs, transportation and warehousing costs, treatment and

refining costs, the amount of by-product and other revenues, the

US$ to CDN$ exchange rate and the amount of copper produced.

Idle mine and mine restart costs during the

periods when the Huckleberry and Mount Polley mines were not in

operation have been excluded from the cash cost per pound of copper

produced.

|

Calculation of Cash Cost Per Pound of Copper Produced |

|

|

expressed in thousands of dollars, except cash cost per pound of

copper produced |

Years Ended December 31, 2022 |

|

|

|

Red Chris |

|

Mount Polley (1) |

|

Composite |

|

|

Cash cost of copper produced in US$ |

$52,128 |

|

$33,891 |

|

$86,019 |

|

|

Copper produced – pounds |

|

20,281 |

|

|

6,206 |

|

|

26,487 |

|

|

Cash cost per lb copper produced in US$ |

$2.57 |

|

$5.46 |

|

$3.25 |

|

|

|

|

|

expressed in thousands of dollars, except cash cost per pound of

copper produced |

Years Ended December 31, 2021 |

|

|

|

Red Chris |

|

Mount Polley (1) |

|

Composite |

|

|

Cash cost of copper produced in US$ |

$48,107 |

|

|

$ - |

|

$48,107 |

|

|

Copper produced – pounds |

|

19,717 |

|

|

- |

|

|

19,717 |

|

|

Cash cost per lb copper produced in US$ |

$2.44 |

|

|

$ - |

|

$2.44 |

|

| (1) Mount Polley

mine operations were suspended in May 2019, and the mine remained

on care and maintenance until the economics of mining improved. The

mine restarted operations in late June 2022. |

DEVELOPMENTS DURING 2022

Red Chris Mine

Red Chris metal production (100% basis) for 2022

was 67.6 million pounds copper and 63,658 ounces gold, an increase

of 3% and 6% respectively from the 65.4 million pounds copper and

60,160 ounces gold produced in 2021. The increase in 2022 metal

production was a result of higher copper and gold grades, and

slightly higher tonnes milled, partially offset by lower

recoveries.

Imperial’s 30% portion of Red Chris mine for

2022 was 20.3 million pounds copper and 19,097 ounces gold.

Newcrest has maintained its guidance for Red Chris mine production

(100%) for the period July 2022 to June 2023 at approximately 60

million pounds of copper and approximately 40,000 ounces of

gold.

Red Chris production (100%) for the 2022 fourth

quarter was 13.1 million pounds copper and 14,518 ounces gold

compared to 14.7 million pounds copper and 13,610 ounces gold in

the 2021 fourth quarter. Lower mining rates and unscheduled

maintenance on an overland conveyor belt resulted in reduced mill

throughput in the fourth quarter.

|

|

Three Months EndedDecember 31* |

|

Year Ended December 31* |

|

|

2022 |

2021 |

|

2022 |

2021 |

|

Ore milled - tonnes |

2,390,084 |

2,124,732 |

|

9,457,303 |

9,324,304 |

| Ore milled per calendar day -

tonnes |

25,979 |

23,095 |

|

25,910 |

25,546 |

| Grade % - copper |

0.339 |

0.387 |

|

0.421 |

0.403 |

| Grade g/t - gold |

0.386 |

0.334 |

|

0.382 |

0.358 |

| Recovery % - copper |

73.4 |

81.2 |

|

77.0 |

79.1 |

| Recovery % - gold |

49.0 |

59.6 |

|

54.8 |

56.0 |

| Copper - 000’s pounds |

13,107 |

14,723 |

|

67,604 |

65,426 |

| Gold -

ounces |

14,518 |

13,610 |

|

63,658 |

60,160 |

| * 100% Red Chris

mine production |

Imperial’s 30% share of exploration,

development, and capital expenditures was $118.2 million in 2022

compared to $99.5 million in the 2021 comparative year.

Drilling continues at East Ridge with two

underground and two surface drill rigs operating. A further 25

diamond drill holes at minimum are planned to test and close out

the target mineralization. This program is expected to be completed

by the second quarter of 2023. East Ridge is outside of Newcrest’s

initial Mineral Resource estimate, however, work will be undertaken

to deliver an updated Red Chris Mineral Resource estimate including

the East Ridge in 2023.

Block Cave development continues with the

exploration decline at 2,731 metres as of February 8, 2023, and the

first ventilation raise bore was completed in February 2023.

The Block Cave Feasibility Study is now expected

to be completed in the second half of 2023 to allow optimization

opportunities to be evaluated and further defined, with no impact

to the project development timeline expected. Inflation and global

supply chain interruptions continue to be assessed as part of the

Feasibility Study and value engineering is underway with the

objective to offset inflationary cost pressures.

Mount Polley Mine

During the fourth quarter 1,084,016 tonnes ore

were treated, producing 3.8 million pounds copper and 6,995 ounces

gold. Operations in the 2022 fourth quarter were negatively

impacted by a period of very cold weather in December 2022.

|

|

Three Months EndedDecember 31 |

|

Year Ended December 31 |

|

|

|

2022 |

|

|

2022 |

|

Ore milled - tonnes |

|

1,084,016 |

|

|

2,068,830 |

| Ore milled per calendar day -

tonnes |

|

11,783 |

|

|

11,244 |

| Grade % - copper |

|

0.230 |

|

|

0.214 |

| Grade g/t - gold |

|

0.325 |

|

|

0.306 |

| Recovery % - copper |

|

68.9 |

|

|

63.5 |

| Recovery % - gold |

|

61.8 |

|

|

59.4 |

| Copper - 000’s pounds |

|

3,786 |

|

|

6,206 |

| Gold -

ounces |

|

6,995 |

|

|

12,078 |

Exploration, development, and capital

expenditures in 2022 were $28.5 million compared to $4.0 million in

the 2021 comparative year.

During January 2023, 510,935 tonnes were

processed. Metal production was 2.3 million pounds of copper and

3,326 ounces of gold. Copper recovery averaged 81% and gold

recovery was 68% from grades averaging 0.257% copper and 0.294 g/t

gold.

The 2023 production target for Mount Polley is

30-33 million pounds copper and 35-40 thousand ounces gold.

Huckleberry Mine

Huckleberry operations ceased in August 2016 and

the mine remains on care and maintenance status.

Site personnel continue to focus on maintaining

site access, water management (treatment and release of mine

contact water into Tahtsa Reach), maintenance of site

infrastructure and equipment, mine permit compliance, environmental

compliance monitoring and monitoring tailings management

facilities.

In 2022 Huckleberry incurred idle mine costs

comprised of $5.6 million in operating costs and $0.8 million in

depreciation expense, which is a slight increase from $5.2 million

in operating costs and $0.7 million in depreciation in comparison

to 2021.

Exploration, development, and capital

expenditures in 2022 were $2.8 million compared to $2.1 million in

2021.

Greenfield Projects

In 2022, exploration was conducted on 10

properties:

Sustut: In the fall of 2021,

the Company acquired the Freeport McMoRan claims adjacent to the

Sustut deposit and contracted Geotech Ltd. to fly an airborne ZTEM

geophysical survey over the entire claim block. The survey was only

partially completed due to inclement weather. In 2022 the Geotech

ZTEM geophysical survey was completed over an area of 83 km².

Porcher Island Gold: In 2022, a

soil and rock geochemical survey was carried out over features

highlighted from the 2021 LiDAR and Orthographic Survey. The

objective for the soil and rock geochemical survey was to be a

first pass of field exploration and test highlighted features and

inferred faults for gold mineralization. The soil and rock

geochemical survey was successful at producing anomalous values

over some of the highlighted features.

Huckleberry Mine (including Whiting

Creek): In 2022, a property wide geophysical review using

decades of data was completed and produced numerous exploration

targets across the property. Also carried out in 2022 was a

regional geological mapping and geochemical sampling program

completed over Huckleberry, Whiting Creek and select targets. A

LiDAR and Orthographic survey were also completed over 139 km² and

covered the western half of the Huckleberry property.

Catface Copper: A soil

geochemistry survey was carried out in 2022 over an area with known

anomalous chargeability and small zones of mapped favorable host

intrusive at surface. The survey was a continuation of a survey

from 2021 and expanded the survey area to the south towards an area

named Hecate Bay.

Bear: In 2022, Geotech Ltd. was

contracted to conduct an airborne geophysical survey over 64 km² of

the Bear property and collect ZTEM and magnetic data. The survey

was designed to maximize survey coverage of areas with the highest

mineral potential. The goals of the survey were to identify a

geophysical footprint of the known mineralization at the Bear

property at surface and depth, collect a consistent property wide

geophysical data set, and identify areas at surface and at depth

with promising Cu-Mo mineralizing potential.

Bronson: In 2022, an airborne

geophysical Versatile Time Domain Electromagnetic (VTEM) survey

undertaken by Geotech Ltd. In addition to the VTEM survey Eagle

Mapping Ltd. was contracted to complete a LIDAR and Orthographic

survey over an area of 12 km².

Pelican: In 2022, a rock

sampling and prospecting program was undertaken with a focus to

check the continuity of anomalous gold (7.26g/t) sample taken in

2019 by Imperial Metals and to inspect interesting surface features

detected by the Light Detection and Ranging (LiDAR) survey carried

out by Eagle Mapping Ltd. over an area of 5 km².

LJ: In 2022, a rock

sampling/prospecting program was undertaken, and a LiDAR survey was

carried out on the LJ property covering 41 km². The focus of the

program was to investigate areas to the south and west of the main

massive sulphide horizon in search of an extension of

mineralization and to inspect interesting surface features which

were also detected by the LiDAR survey.

Wasi Creek: In 2022, access to

old core was gained after clearing and brushing out an old

exploration road. Then a relog of old core was carried out with a

focus of forming strong structural relationships that can be

related to the property and regional geology. Additionally, a

ground MAG survey consisting of 3 lines of 1.5 km was performed at

the property.

Mount Polley Mine (including all

surrounding claims): In 2022, a ground magnetic survey was

carried out over an area of 0.7 km² northwest of the mine that was

highlighted from a 2019-2020 Geophysics 3DIP survey.

Jim Miller-Tait, P.Geo. Vice President

Exploration with Imperial Metals, is the designated Qualified

Person as defined by National Instrument 43-101 for Red Chris,

Mount Polley and Huckleberry mines exploration programs and

Greenfield Projects.

FOURTH QUARTER RESULTS FROM

OPERATIONS

Revenue in the fourth quarter of 2022 was $61.6

million compared to $29.3 million in 2021. Sales revenue is

recorded when title for concentrate is transferred on ship loading.

Variations in revenue are impacted by the timing and quantity of

concentrate shipments, metal prices and exchange rates, and period

end revaluations of revenue attributed to concentrate shipments

where copper and gold prices will settle at a future date along

with finalization of contained metals as a result of final

assays.

The Company recorded a net loss of $11.8 million ($0.08 per

share) in the fourth quarter of 2022 compared to net loss of $14.7

million ($0.10 per share) in the prior year quarter.

Expenditures for exploration and ongoing capital

projects at Mount Polley, Red Chris and Huckleberry totaled $37.5

million during the three months ended December 31, 2022, compared

to $34.2 million in the 2021 comparative quarter.

OUTLOOK

Corporate and Operations

At December 31, 2022, the Company had not hedged

any copper, gold, or US$/CDN$ exchange. Quarterly revenues will

fluctuate depending on copper and gold prices, the US$/CDN$

exchange rate, and the timing of concentrate sales, which is

dependent on concentrate production and the availability and

scheduling of transportation.

Newcrest provided metals production guidance

(100%) for Red Chris mine, for the period July 1, 2022, to June 30,

2023 (period conforms to Newcrest June 30 annual year end), at

approximately 60 million pounds copper and approximately 40,000

ounces gold.

The Company will need to conclude further

financing arrangements to fund its share of cost of the ongoing

development of a block cave mine at Red Chris.

Exploration

Imperial maintains a large portfolio of

greenfield exploration properties in British Columbia. These

properties have defined areas of mineralization and exploration

potential. Management continues to evaluate various opportunities

to advance many of these properties.

Exploration for 2023 will be focused on Red

Chris, with 50,000 metres of drilling planned and continuing

development of the exploration decline to provide access for

underground exploration planned at Red Chris.

Diamond drilling began in February at Mount

Polley on targets located between the Cariboo and Springer pits.

Currently five holes are planned, drilling to an approximate depth

of 500m. In conjunction with the diamond drilling, a trenching

program was completed 2.4 km southeast of the mill, on copper

mineralization that was uncovered during a geotechnical

investigation.

At Huckleberry, in 2022 ground truthing was

conducted on the high priority targets generated by the property

wide airborne ZTEM and Aeromagnetic survey that was completed in

2021. Diamond drilling priority targets is planned for the 2023

field season.

Acquisitions

Management continues to evaluate potential

acquisitions.

For additional information, refer to Imperial’s

2022 Management Discussion and Analysis Report available on

imperialmetals.com and sedar.com.

About Imperial

Imperial is a Vancouver based exploration, mine

development and operating company with holdings that include the

Mount Polley mine (100%), the Huckleberry mine (100%) and the Red

Chris mine (30%). Imperial also holds a portfolio of 23 greenfield

exploration properties in British Columbia.

Company Contacts

Brian Kynoch | President |

604.669.8959Darb S. Dhillon | Chief Financial

Officer | 604.488.2658

Cautionary Note Regarding

Forward-Looking Statements

Certain information contained in this news

release are not statements of historical fact and are

“forward-looking” statements. Forward-looking statements relate to

future events or future performance and reflect Company

management’s expectations or beliefs regarding future events and

include, but are not limited to, statements regarding the Company’s

expectations with respect to its business and operations; metal

pricing and its impact on revaluations of revenue; fluctuations of

quarterly revenues; future foreign exchange currency rates;

potential development plans and mining methods at Red Chris; timing

of release of an initial mineral resource estimate; expectations

and timing regarding the Block Cave Feasibility Study and project

development; progression of the exploration decline at Red Chris;

expectations regarding financing arrangements to fund the Company’s

share of cost of ongoing development at Red Chris and the restart

of Mount Polley; metal production guidance and estimates; metal

grades; expectations and timing regarding current and future

exploration and drilling programs; expectations regarding data

interpretation and location of new drill targets at Huckleberry;

and the usefulness and comparability of non-IFRS financial measures

including adjusted net loss, adjusted EBITDA, cash earnings, cash

earnings per share and cash cost per pound of copper produced.

In certain cases, forward-looking statements can

be identified by the use of words such as "plans", "expects" or

"does not expect", "is expected", "outlook", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates" or "does not

anticipate", or "believes", or variations of such words and phrases

or statements that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved" or the negative of these terms or comparable terminology.

By their very nature forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements.

In making the forward-looking statements in this

release, the Company has applied certain factors and assumptions

that are based on information currently available to the Company as

well as the Company’s current beliefs and assumptions. These

factors and assumptions and beliefs and assumptions include, the

risk factors detailed from time to time in the Company’s interim

and annual financial statements and management’s discussion and

analysis of those statements, all of which are filed and available

for review on SEDAR at www.sedar.com. Although the Company has

attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors

that cause actions, events or results not to be as anticipated,

estimated or intended, many of which are beyond the Company’s

ability to control or predict. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements and all

forward-looking statements in this news release are qualified by

these cautionary statements.

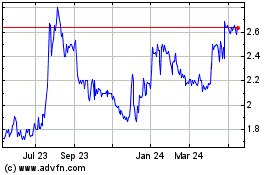

Imperial Metals (TSX:III)

Historical Stock Chart

From Nov 2024 to Dec 2024

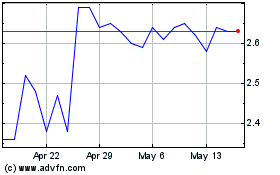

Imperial Metals (TSX:III)

Historical Stock Chart

From Dec 2023 to Dec 2024