Lithium Americas Corp. (TSX: LAC) (NYSE: LAC)

(“

Lithium Americas” or the

“

Company”) has reported financial and operating

results for the quarter ended June 30, 2023 (“

Q2

2023”).

HIGHLIGHTS

Argentina

Caucharí-Olaroz

- In June 2023,

Caucharí-Olaroz achieved first lithium production as the project

advances commissioning and ramp up to Stage 1 capacity of 40,000

tonnes per annum (“tpa”) of battery-quality

lithium carbonate

(”Li2CO3”),

which is scheduled to be completed in mid-2024.

- Since startup,

production quality has exceeded expectations with critical

equipment required to achieve battery-quality lithium carbonate in

the process of testing and commissioning.

- Caucharí-Olaroz

is expected to produce approximately 5,000 tonnes of lithium

carbonate in 2023.

- First lithium

product from Caucharí-Olaroz has left the site and is being

prepared for shipment at the port.

- As of June 30,

2023, $895 million of the $979 million total expected capex has

been spent (on a 100% basis). As of June 30, 2023, the Company

expects its remaining funding requirement to be less than $25

million for capital costs, value added taxes and working capital to

reach positive cash flow.

- Preparation for

Caucharí-Olaroz Stage 2 expansion targeting additional production

capacity of at least 20,000 tpa is underway.

Pastos Grandes

Basin

- On June 26,

2023, the Company announced the SEDAR filing of a National

Instrument 43-101 (“NI 43-101”) Technical Report

and resource update for the Pastos Grandes Project titled, “NI

43-101 Technical Report, Lithium Resources Update, Pastos Grandes

Project, Salta Province, Argentina,” with an effective date of

April 30, 2023.

- The Company

continues to advance Pastos Grandes’ $30 million development plan,

including engineering and evaluation work, which is expected to be

completed by the end of the year. Simultaneously, the Company is

working to complete a project review and an updated feasibility

study.

- A geophysics

program to map the basin and brine geological units has been

completed and drilling has commenced. This will allow the Company

to deepen its understanding of the brine reserves and provide key

inputs to design the brine production system.

- On April 20, 2023, the Company

completed its acquisition of Arena Minerals and its 65% ownership

interest in the Sal de la Puna project, adjacent to the Pastos

Grandes project in Salta, Argentina.

United

States

Thacker

Pass

- In mid-June

2023, major earthworks construction commenced at Thacker Pass to

support the target of initial production in the second half of

2026.

- Deposits on

long-lead items are expected to start in Q3 2023 and will continue

through Q4 2024.

- The Company

continues to work closely with the U.S. Department of Energy

(“DOE”) Loans Program Office to advance

confirmatory due diligence and term sheet negotiations for the

Advanced Technology Vehicles Manufacturing Loan Program

(“ATVM Loan Program”), following the receipt of a

Letter of Substantial Completion on February 22, 2023.

- The Company

expects the DOE ATVM Loan Program conditional approval process to

be completed in 2023 and if approved, to fund up to 75% of capital

costs for construction of Phase 1. Development costs incurred by

the project may qualify as eligible costs under the ATVM Loan

Program as of January 31, 2023.

- The Company has

approved a 2023 construction budget of $125 million with $48

million cash spent in Q2 2023 for construction of water pipelines

and ponds, infrastructure improvements and the start of major

earthworks.

- On February 6, 2023, the US

District Court, District of Nevada ruled favorably for the Company

in the appeal filed against the Bureau of Land Management by

declining to vacate the Record of Decision. The U.S. Court of

Appeals for the Ninth Circuit affirmed the District Court’s

decision on July 17, 2023.

Corporate

- As at June 30,

2023, the Company had $502.0 million in cash and cash equivalents

and short-term bank deposits, with an additional $75 million in

available credit.

- On July 31,

2023, at the annual, general and special meeting of Lithium

Americas shareholders, 98.85% of the votes cast by shareholders

present in person or by proxy at the meeting voted in favor of the

separation of the Company into Lithium Americas (Argentina) Corp.

(“Lithium Argentina”) and a new Lithium Americas

Corp. (“Lithium Americas (NewCo)”), pursuant to a

statutory plan of arrangement (the “Separation”).

The Separation is targeted to become effective in early October

2023.

- Additionally, in

connection with the second tranche of the previously announced $650

million investment by General Motors Holdings LLC

(“GM”), the Company’s shareholders passed two

resolutions approving: (a) the ownership by GM and its affiliates

of more than 20% of the issued and outstanding shares of the

Company (or following the Separation, Lithium Americas (NewCo));

and (b) $27.74 per share (as adjusted for the Separation) as the

maximum subscription price at which Tranche 2 of GM’s investment

would be made.

- On August 4,

2023, the Company obtained a final order from the Supreme Court of

British Columbia approving the plan of arrangement to effect the

Separation.

TECHNICAL

INFORMATION

The Technical

Information in this news release has been reviewed and approved by

Rene LeBlanc, PhD, SME, Chief Technical Officer of Lithium

Americas, and a Qualified Person as defined by National Instrument

43-101.

FINANCIAL

RESULTS

Selected consolidated

financial information is presented as follows:

|

(in US$ million except per share information) |

Quarters ended June 30, |

|

|

2023 |

|

|

2022 |

|

|

|

|

$ |

|

|

|

$ |

|

|

Expenses |

|

(17.1 |

) |

|

|

(90.3 |

) |

|

Net income/(loss) |

|

25.8 |

|

|

|

(16.6 |

) |

|

Income/(loss) per share – basic |

|

0.16 |

|

|

|

(0.12 |

) |

|

Income/(loss) per share – diluted |

|

0.16 |

|

|

|

(0.12 |

) |

|

(in US$ million) |

As at June 30, 2023 |

|

|

As at December 31, 2022 |

|

|

|

|

$ |

|

|

|

$ |

|

| Cash, cash equivalents and

short-term bank deposits |

|

502.0 |

|

|

|

352.1 |

|

| Total assets |

|

1,501.9 |

|

|

|

1,016.5 |

|

| Total

long-term liabilities |

|

(203.5 |

) |

|

|

(212.9 |

) |

Net income in Q2 2023

versus loss in Q2 2022 is primarily due to lower share of loss of

Caucharí-Olaroz project partially offset by lower gain on change in

fair value of the GM agreements derivative liability and

convertible note derivative liability.

In H1 2023, total

assets increased primarily due to acquisition of Arena Minerals and

cash proceeds from the first tranche investment by GM of $320

million.

This news release

should be read in conjunction with Lithium Americas’ condensed

consolidated interim financial statements and management's

discussion and analysis for the quarter ended June 30, 2023, which

are available on SEDAR. All amounts are in U.S. dollars unless

otherwise indicated.

ABOUT LITHIUM

AMERICAS

Lithium Americas is advancing a separation of

its U.S. and Argentine business units into two public independent

companies. Lithium Argentina will retain Caucharí-Olaroz

(44.8%-interest), focused on advancing toward full production

capacity, and regional growth opportunities in the Pastos Grandes

basin with Pastos Grandes and Sal de la Puna projects (100%-owned

and 65%-interest, respectively). Lithium Americas (NewCo) will

retain the 100%-owned Thacker Pass, focused on advancing

construction with the target to commence production in the second

half of 2026. The Company currently trades on the TSX and on the

NYSE, under the ticker symbol “LAC.”

For further information contact:Investor

RelationsTelephone: 778-656-5820Email:

ir@lithiumamericas.comWebsite: www.lithiumamericas.com

FORWARD-LOOKING INFORMATION

This news release

contains “forward-looking information” within the meaning of

applicable Canadian securities legislation and “forward-looking

statements” within the meaning of the United States Private

Securities Litigation Reform Act of 1995 (collectively referred to

herein as “forward-looking information”). These statements relate

to future events or the Company’s future performance. All

statements, other than statements of historical fact, may be

forward-looking information. Information concerning Mineral

Resource and Mineral Reserve estimates also may be deemed to be

forward-looking information in that it reflects a prediction of

mineralization that would be encountered if a mineral deposit were

developed and mined. Forward-looking information generally can be

identified by the use of words such as “seek,” “anticipate,”

“plan,” “continue,” “estimate,” “expect,” “may,” “will,” “project,”

“predict,” “propose,” “potential,” “targeting,” “intend,” “could,”

“might,” “should,” “believe” and similar expressions. These

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

information.

In particular, this

news release contains forward-looking information, including,

without limitation, with respect to the following matters or the

Company’s expectations relating to such matters: goals of the

Company; development of the Caucharí-Olaroz project and the Thacker

Pass project, including timing, progress, approach, continuity or

change in plans, construction, commissioning, milestones,

anticipated production and results thereof and expansion plans;

plans at the Caucharí-Olaroz project to prioritize commissioning;

expected remaining funding commitments at the Caucharí-Olaroz

project; expected timing of full capacity production at the

Caucharí-Olaroz project and plans for additional production

capacity; expectations regarding accessing funding from the ATVM

Loan Program, including the expected amount, timing and outcome of

the loan application; expectation that ATVM Loan Program, if

approved, will fund 75% of capital costs for construction of Phase

1 at the Thacker Pass project; that development costs at the

Thacker Pass project may qualify as eligible costs under the ATVM

Loan Program; anticipated timing to resolve, and the expected

outcome of, any complaints or claims made or that could be made

concerning the environmental permitting process in the United

States for the Thacker Pass project, including current lawsuits

involving the Record of Decision for the project; capital

expenditures and programs; the Company’s ability to raise capital

and the sufficiency of currently available funding; expected

expenditures to be made by the Company on its properties;

successful operation of the Caucharí-Olaroz project under its

co-ownership structure; ability to produce battery grade lithium

products; timing of deposits on long-lead items at the Thacker Pass

project; capital costs, operating costs, sustaining capital

requirements, after tax net present value and internal rate of

return, payback period, sensitivity analyses, and net cash flows of

the Caucharí-Olaroz project and the Thacker Pass project; expecting

timing to complete project review, feasibility studies, development

planning, evaluating opportunities for synergy, and reach a

construction decision for the Pastos Grandes and Sal de la Puna

projects; the ability of the Company to complete Tranche 2 of GM’s

investment on the terms and timeline anticipated, or at all; the

receipt of required stock exchange and regulatory approvals,

authorizations and court rulings; the expected timetable for

completing the Separation; the ability of the Company to complete

the Separation on the terms and timeline anticipated, or at all;

the receipt of required third party, stock exchange and regulatory

approvals required for the Separation; the expected holdings and

assets of the entities resulting from the Separation; the expected

benefits of the Separation for each business and to the Company’s

shareholders and other stakeholders; the strategic advantages,

future opportunities and focus of each business resulting from the

Separation; and the successful integration and expected benefits of

the acquisition of Arena Minerals, including opportunities for

regional growth and development of the Pastos Grandes basin

expected from the acquisition.

Forward-looking

information does not take into account the effect of transactions

or other items announced or occurring after the statements are

made. Forward-looking information is based upon a number of

expectations and assumptions and is subject to a number of risks

and uncertainties, many of which are beyond the Company’s control,

that could cause actual results to differ materially from those

that are disclosed in or implied by such forward-looking

information. With respect to forward-looking information listed

above, the Company has made assumptions regarding, among other

things: current technological trends; a cordial business

relationship between the Company and third party strategic and

contractual partners, including the co-owners of the

Caucharí-Olaroz project; ability of the Company to fund, advance

and develop the Caucharí-Olaroz project and the Thacker Pass

project, and the respective impacts of the projects when production

commences; ability of the Company to advance and develop the Pastos

Grandes and Sal de la Puna projects; the Company’s ability to

operate in a safe and effective manner; uncertainties relating to

receiving and maintaining mining, exploration, environmental and

other permits or approvals in Nevada and Argentina; demand for

lithium, including that such demand is supported by growth in the

electric vehicle market; the impact of increasing competition in

the lithium business, and the Company’s competitive position in the

industry; general economic conditions; the stable and supportive

legislative, regulatory and community environment in the

jurisdictions where the Company operates; stability and inflation

of the Argentine peso, including any foreign exchange or capital

controls which may be enacted in respect thereof, and the effect of

current or any additional regulations on the Company’s operations;

the impact of unknown financial contingencies, including litigation

costs, on the Company’s operations; gains or losses, in each case,

if any, from short-term investments in Argentine bonds and

equities; estimates of and unpredictable changes to the market

prices for lithium products; development and construction costs for

the Caucharí-Olaroz project and the Thacker Pass project, and costs

for any additional exploration work at the projects; estimates of

Mineral Resources and Mineral Reserves, including whether Mineral

Resources not included in Mineral Reserves will be further

developed into Mineral Reserves; reliability of technical data;

anticipated timing and results of exploration, development and

construction activities, including the impact of COVID-19 on such

timing; timely responses from governmental agencies responsible for

reviewing and considering the Company’s permitting activities at

the Thacker Pass project; the Company’s ability to obtain

additional financing on satisfactory terms or at all; the ability

to develop and achieve production at any of the Company’s mineral

exploration and development properties; the impact of inflationary

and other conditions flowing from COVID-19, or otherwise, on the

Company’s business and global mark; and accuracy of development

budget and construction estimates.

Although the Company

believes that the assumptions and expectations reflected in such

forward-looking information are reasonable, the Company can give no

assurance that these assumptions and expectations will prove to be

correct. Since forward-looking information inherently involves

risks and uncertainties, undue reliance should not be placed on

such information. The Company’s actual results could differ

materially from those anticipated in any forward-looking

information as a result of the risk factors set out herein and in

the Company’s latest annual information form

(“AIF”) available on SEDAR.

All forward-looking

information contained in this news release is expressly qualified

by the risk factors set out in the Company’s latest AIF, management

information circular and management discussion & analysis. Such

risk factors are not exhaustive. The Company does not undertake any

obligation to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise,

except as required by law. All forward-looking information

contained in this news release is expressly qualified in its

entirety by this cautionary statement. Additional information about

the above-noted assumptions, risks and uncertainties is contained

in the Company’s filings with securities regulators, including our

latest AIF and management information circular, which are available

on SEDAR at www.sedar.com.

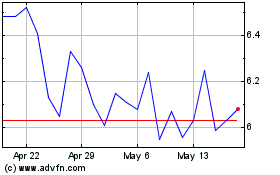

Lithium Americas (TSX:LAC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Lithium Americas (TSX:LAC)

Historical Stock Chart

From Dec 2023 to Dec 2024