Northland Power Inc. (

“Northland” or the

“Company”) (TSX:

NPI) today

announces that the maturity date of its $500 million short-term

corporate credit facility related to its equity contribution in Hai

Long has been extended from November 27, 2023 to December 31, 2023.

The facility is expected to be repaid upon receipt of the proceeds

from the Gentari Sell-Down (as defined in the Company’s

Management’s Discussion and Analysis for the third quarter of

2023), which management is targeting to close in the fourth quarter

of 2023, upon certain closing conditions being met, which also

include meeting requirements under the existing multi-party project

finance agreements. In the event that the Gentari Sell-Down is

delayed due to satisfying closing conditions taking more time than

planned, the facility may need to be further extended or

re-financed.

ABOUT NORTHLAND POWER

Northland Power is a global power producer

dedicated to helping the clean energy transition by producing

electricity from clean renewable resources. Founded in 1987,

Northland has a long history of developing, building, owning and

operating clean and green power infrastructure assets and is a

global leader in offshore wind. In addition, Northland owns and

manages a diversified generation mix including onshore renewables,

efficient natural gas energy, as well as supplying energy through a

regulated utility.

Headquartered in Toronto, Canada, with global

offices in eight countries, Northland owns or has an economic

interest in approximately 3.4GW (net 2.9GW) of operating capacity.

The Company also has a significant inventory of projects in

construction and in various stages of development encompassing

approximately 15GW of potential capacity.

Publicly traded since 1997, Northland's common

shares, Series 1 and Series 2 preferred shares trade on the Toronto

Stock Exchange under the symbols NPI, NPI.PR.A and NPI.PR.B,

respectively.

FORWARD-LOOKING STATEMENTS

This press release contains statements that

constitute forward-looking information within the meaning of

applicable securities laws (“forward-looking statements”) that are

provided for the purpose of presenting information about

management’s current expectations and plans. Readers are cautioned

that such statements may not be appropriate for other purposes.

Northland’s actual results could differ materially from those

expressed in, or implied by, these forward-looking statements and,

accordingly, the events anticipated by the forward-looking

statements may or may not transpire or occur. Forward-looking

statements include statements that are not historical facts and are

predictive in nature, depend upon or refer to future events or

conditions, or include words such as “expects,” “anticipates,”

“plans,” “predicts,” “believes,” “estimates,” “intends,” “targets,”

“projects,” “forecasts” or negative versions thereof and other

similar expressions or future or conditional verbs such as “may,”

“will,” “should,” “would” and “could.” These statements may

include, without limitation, statements regarding the completion of

construction, acquisitions, dispositions, investments or financings

and the timing thereof, including the timing and final terms of the

pending Gentari Sell-Down, the timing for repayment of credit

facilities, and the future operations, business, financial

condition, financial results, priorities, ongoing objectives,

strategies and the outlook of Northland, its subsidiaries and joint

ventures. There is a risk that delays in closing financings, assets

sales or sell-downs, failure to obtain the anticipated level of

finance commitments and failure to close or extend one or more

financings, credit facilities or sell-downs could affect

construction schedules and/or Northland’s cash or credit position

and capital funding needs. These statements are based upon certain

material factors or assumptions that were applied in developing the

forward-looking statements, including the design specifications of

development projects, the provisions of contracts to which

Northland or a subsidiary is a party, management’s current plans

and its perception of historical trends, current conditions and

expected future developments, the ability to obtain necessary

approvals, satisfy any closing conditions, satisfy any project

finance lender conditions to closing sell-downs or obtain adequate

financing regarding contemplated construction, acquisitions,

dispositions, investments or financings, as well as other factors,

estimates and assumptions that are believed to be appropriate in

the circumstances. Although these forward-looking statements are

based upon management’s current reasonable expectations and

assumptions, they are subject to numerous risks and uncertainties.

Some of the factors include, but are not limited to, risks

associated with sales contracts, the emergence of widespread health

emergencies or pandemics, counterparty and joint venture risks,

natural gas and power market risks, Northland’s ability to resolve

issues/delays with the relevant regulatory and/or government

authorities, permitting, construction risks, project development

risks, acquisition risks, procurement and supply chain risks,

financing risks, disposition and joint-venture risks, competition

risks, interest rate and refinancing risks, liquidity risk,

inflation risks, impacts of regional or global conflicts, credit

rating risk, currency fluctuation risk, variability of cash flow

and potential impact on dividends, taxation, natural events,

environmental risks, climate change, health and worker safety

risks, market compliance risk, government regulations and policy

risks, utility rate regulation risks, international activities,

cybersecurity, data protection and reliance on information

technology, labour relations, reputational risk, insurance risk,

risks relating to co-ownership, bribery and corruption risk,

terrorism and security, legal contingencies, and the other factors

described in the “Risks Factors” section of Northland’s

Management’s Discussion and Analysis and Annual Information Form

for the year ended December 31, 2022, which can be found at

www.sedarplus.ca under Northland’s profile and on Northland’s

website at northlandpower.com. Northland has attempted to identify

important factors that could cause actual results to materially

differ from current expectations, however, there may be other

factors that cause actual results to differ materially from such

expectations. Northland’s actual results could differ materially

from those expressed in, or implied by, these forward-looking

statements and, accordingly, no assurances can be given that any of

the events anticipated by the forward-looking statements will

transpire or occur, and Northland cautions you not to place undue

reliance upon any such forward-looking statements.

The forward-looking statements contained in this

release are, unless otherwise indicated, stated as of the date

hereof and are based on assumptions that were considered reasonable

as of the date hereof. Other than as specifically required by law,

Northland undertakes no obligation to update any forward-looking

statements to reflect events or circumstances after such date or to

reflect the occurrence of unanticipated events, whether as a result

of new information, future events or results, or otherwise.

For further information, please

contact:

Dario Neimarlija, Vice President

Adam Beaumont, Vice President

647-288-1019

investorrelations@northlandpower.com

northlandpower.com

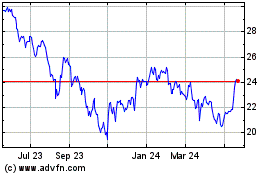

Northland Power (TSX:NPI)

Historical Stock Chart

From Dec 2024 to Jan 2025

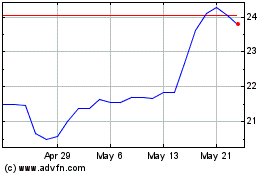

Northland Power (TSX:NPI)

Historical Stock Chart

From Jan 2024 to Jan 2025