Canadian Large Cap Leaders Split Corp. Completes Preferred Share Private Placement

05 February 2025 - 3:07AM

(TSX: NPS, NPS.PR.A) – Canadian Large Cap Leaders

Split Corp. (the “Company”) is pleased to announce that it has

completed the previously announced private placement of its

preferred shares for aggregate gross proceeds of approximately $2.5

million (the “Private Placement”). Pursuant to the Private

Placement, 235,000 preferred shares were offered to investors at a

price of $10.65 per preferred share.

The Company’s previously announced split of its

Class A shares (the “Share Split”) will be effected at the close of

business today. Following the Share Split, there will be

approximately 1,795,547 Class A shares and 1,796,353 preferred

shares outstanding. DBRS has confirmed that the rating of the

preferred shares will continue to be Pfd-3 (high) following the

completion of the Share Split.

The Company invests, on an approximately

equally-weighted basis, in a portfolio comprised primarily of

equity securities of Canadian Dividend Growth Companies (as defined

below), selected by the portfolio manager, that at the time of

investment and immediately following each periodic reconstitution

and rebalancing: (i) are listed on a Canadian exchange; (ii) pay a

dividend; (iii) generally have a market capitalization of at least

$10 billion; (iv) have options in respect of its equity securities

that, in the opinion of the portfolio manager, are sufficiently

liquid to permit the portfolio manager to write options in respect

of such securities; and (v) have a history of dividend growth or,

in the portfolio manager’s view have high potential for future

dividend growth (“Canadian Dividend Growth Companies”).

About Ninepoint

Partners LP

Ninepoint Partners LP is the Manager, Portfolio

Manager and Promoter of the Company and provides all administrative

services required by the Company. Based in Toronto, Ninepoint

Partners LP is one of Canada’s leading alternative investment

management firms overseeing approximately $7 billion in assets

under management and institutional contracts. Committed to helping

investors explore innovative investment solutions that have the

potential to enhance returns and manage portfolio risk, Ninepoint

offers a diverse set of alternative strategies spanning Equities,

Fixed Income, Alternative Income, Real Assets, F/X and Digital

Assets.

For more information on Ninepoint Partners LP,

please visit www.ninepoint.com or please contact us at

416.362.7172 or 1.888.362.7172 or invest@ninepoint.com.

You will usually pay brokerage fees to your

dealer if you purchase or sell shares of investment funds on the

TSX or another alternative Canadian trading system (an “exchange”).

If shares are purchased or sold on an exchange, investors may pay

more than the current net asset value when buying shares of the

investment fund and may receive less than the current net asset

value when selling them.

There are ongoing fees and expenses associated

with owning shares of an investment fund. An investment fund must

prepare disclosure documents that contain key information about the

fund. You can find more detailed information about the Company in

the public filings available at www.sedarplus.ca. Investment funds

are not guaranteed, their values change frequently and past

performance may not be repeated.

Certain statements contained in this document

constitute forward-looking information within the meaning of

Canadian securities laws. Forward-looking information may relate to

matters disclosed in this document and to other matters identified

in public filings relating to the Company, to the future outlook of

the Company and anticipated events or results and may include

statements regarding the future financial performance of the

Company. In some cases, forward-looking information can be

identified by terms such as “may”, “will”, “should”, “expect”,

“plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”,

“potential”, “continue” or other similar expressions concerning

matters that are not historical facts. Actual results may vary from

such forward-looking information. Investors should not place undue

reliance on forward-looking statements. These forward-looking

statements are made as of the date hereof and we assume no

obligation to update or revise them to reflect new events or

circumstances.

The securities have not been registered under

the U.S. Securities Act of 1933, as amended, and may not be offered

or sold in the United States absent registration or any applicable

exemption from the registration requirements. This news release

does not constitute an offer to sell or the solicitation of an

offer to buy securities nor will there be any sale of such

securities in any state in which such offer, solicitation or sale

would be unlawful.

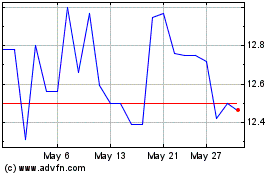

Canadian Large Cap Leade... (TSX:NPS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Canadian Large Cap Leade... (TSX:NPS)

Historical Stock Chart

From Feb 2024 to Feb 2025