This news release contains "forward-looking information and

statements" within the meaning of applicable securities laws. For a

full disclosure of the forward-looking information and statements

and the risks to which they are subject, see the "Cautionary

Statement Regarding Forward-Looking Information and Statements"

later in this news release.

Precision Drilling Corporation (“Precision” or

the “Company”) (TSX:PD; NYSE:PDS) is pleased to announce that it

has successfully extended its Senior Credit Facility and with

strong cash flow generation during the first half of the year, it

is well on track to meet its 2024 debt reduction and share

repurchase targets.

Senior Credit Facility Extension

On June 28, 2024, Precision extended its Senior

Credit Facility’s maturity date, revised the available borrowing

capacity, and amended certain terms. The maturity date was extended

to June 28, 2027, and the size was revised to US$375 million

(previously US$447 million), which includes an accordion feature to

increase the facility to US$750 million.

2024 Debt Repayment and Share Repurchase

Progress

Since the beginning of the year, Precision has

reduced debt by $103 million, marking significant progress toward

its 2024 debt reduction target of $150 million to $200 million.

Second quarter debt repayments included the redemption of US$56

million of 2026 unsecured senior notes and the repayment of $25

million of real estate credit facilities that were due in 2026 and

2028. As at June 30, 2024, Precision’s outstanding debt obligations

include:

- US$217 million – 7.125% unsecured

senior notes due January 15, 2026

- US$400 million – 6.875% unsecured

senior notes due January 15, 2029

- US$8 million real estate credit

facility due in 2025

With strong cash flow generation during the

second quarter, Precision also returned $24 million to shareholders

through share repurchases under its Normal Course Issuer Bid. For

the first six months of the year, Precision has repurchased 369,309

common shares for $34 million, representing 3% of its outstanding

common shares.

CFO Quote

Carey Ford, Precision’s CFO, commented, “Today’s

announcement marks another step in strengthening our balance sheet

and returning capital to shareholders. Our organization has

been intensely focused on cost management, capital discipline, and

cash flow generation and our results are a testament to the efforts

of all Precision employees. For 2024 we are committed to

repaying $150 million to $200 million in debt and returning 25% to

35% of free cash flow before debt repayments to shareholders

through share repurchases. Precision’s longer-term balance

sheet goal is to reduce debt by $600 million between 2022 and 2026

and achieve a Net Debt to Adjusted EBITDA ratio(1) of below 1.0

times by the end of 2025. Since the beginning of 2022, we have

reduced debt by approximately $360 million and expect to be well

over $400 million by the end of this year.”

(1) Net Debt to Adjusted EBITDA ratio is a

Non-GAAP measure. Please refer to Precision’s 2023 Annual Report

for more information.

About Precision

Precision is a leading provider of safe and

environmentally responsible High Performance, High Value services

to the energy industry, offering customers access to an extensive

fleet of Super Series drilling rigs. Precision has commercialized

an industry-leading digital technology portfolio known as AlphaTM

that utilizes advanced automation software and analytics to

generate efficient, predictable, and repeatable results for energy

customers. Our drilling services are enhanced by our EverGreenTM

suite of environmental solutions, which bolsters our commitment to

reducing the environmental impact of our operations. Additionally,

Precision offers well service rigs, camps and rental equipment all

backed by a comprehensive mix of technical support services and

skilled, experienced personnel.

Precision is headquartered in Calgary, Alberta,

Canada and is listed on the Toronto Stock Exchange under the

trading symbol “PD” and on the New York Stock Exchange under the

trading symbol “PDS”.

Cautionary Statement Regarding Forward-Looking

Information and Statements

Certain statements contained in this report,

including statements that contain words such as "could", "should",

"can", "anticipate", "estimate", "intend", "plan", "expect",

"believe", "will", "may", "continue", "project", "potential" and

similar expressions and statements relating to matters that are not

historical facts constitute "forward-looking information" within

the meaning of applicable Canadian securities legislation and

"forward-looking statements" within the meaning of the "safe

harbor" provisions of the United States Private Securities

Litigation Reform Act of 1995 (collectively, "forward-looking

information and statements").

In particular, forward-looking information and

statements include, but are not limited to, the following:

- anticipated Net

Debt to Adjusted EBITDA ratio;

- 2024 debt

reduction and share repurchase targets; and

-

our future debt reduction and shareholder capital return

plans.

These forward-looking information and statements

are based on certain assumptions and analysis made by Precision in

light of our experience and our perception of historical trends,

current conditions, expected future developments and other factors

we believe are appropriate under the circumstances. These include,

among other things:

- the fluctuation

in oil prices may pressure customers into reducing or limiting

their drilling budgets;

-

the status of current negotiations with our customers and

vendors;

-

customer focus on safety performance;

-

existing term contracts are neither renewed nor terminated

prematurely;

-

continued market demand for Super Spec rigs;

-

our ability to deliver rigs to customers on a timely basis;

-

the general stability of the economic and political environments in

the jurisdictions where we operate; and

-

the impact of an increase/decrease in capital spending.

Undue reliance should not be placed on

forward-looking information and statements. Whether actual results,

performance or achievements will conform to our expectations and

predictions is subject to a number of known and unknown risks and

uncertainties which could cause actual results to differ materially

from our expectations. Such risks and uncertainties include, but

are not limited to:

- the business, operational and/or

financial performance or achievements of Precision may be

materially different from that currently anticipated;

-

volatility in the price and demand for oil and natural gas;

-

fluctuations in the level of oil and natural gas exploration and

development activities;

-

fluctuations in the demand for contract drilling, well servicing

and ancillary oilfield services;

-

our customers’ inability to obtain adequate credit or financing to

support their drilling and production activity;

-

changes in drilling and well servicing technology, which could

reduce demand for certain rigs or put us at a competitive

advantage;

-

shortages, delays and interruptions in the delivery of equipment

supplies and other key inputs;

-

liquidity of the capital markets to fund customer drilling

programs;

-

availability of cash flow, debt and equity sources to fund our

capital and operating requirements, as needed;

-

the impact of weather and seasonal conditions on operations and

facilities;

-

competitive operating risks inherent in contract drilling, well

servicing and ancillary oilfield services;

-

ability to improve our rig technology to improve drilling

efficiency;

-

general economic, market or business conditions;

-

the availability of qualified personnel and management;

-

a decline in our safety performance which could result in lower

demand for our services;

-

changes in laws or regulations, including changes in environmental

laws and regulations such as increased regulation of hydraulic

fracturing or restrictions on the burning of fossil fuels and GHG

emissions, which could have an adverse impact on the demand for oil

and natural gas;

-

terrorism, social, civil and political unrest in the foreign

jurisdictions where we operate;

-

fluctuations in foreign exchange, interest rates and tax rates;

and

-

other unforeseen conditions which could impact the use of services

supplied by Precision and Precision’s ability to respond to such

conditions.

Readers are cautioned that the forgoing list of

risk factors is not exhaustive. Additional information on these and

other factors that could affect our business, operations or

financial results are included in reports on file with applicable

securities regulatory authorities, including but not limited to

Precision’s Annual Information Form for the year ended December 31,

2023, which may be accessed on Precision’s SEDAR+ profile at

www.sedarplus.ca or under Precision’s EDGAR profile

at www.sec.gov. The forward-looking information and statements

contained in this news release are made as of the date hereof and

Precision undertakes no obligation to update publicly or revise any

forward-looking statements or information, whether as a result of

new information, future events or otherwise, except as required by

law.

Additional Information

For further information, about Precision, please

visit our website at www.precisiondrilling.com or contact:

Lavonne Zdunich, CPA, CAVice President, Investor

Relations403.716.4500

Precision Drilling Corporation800, 525 - 8th

Avenue S.W.Calgary, Alberta, Canada T2P 1G1Website:

www.precisiondrilling.com

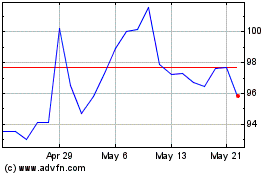

Precision Drilling (TSX:PD)

Historical Stock Chart

From Nov 2024 to Dec 2024

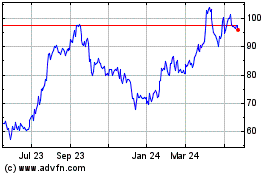

Precision Drilling (TSX:PD)

Historical Stock Chart

From Dec 2023 to Dec 2024