PERSEUS PROGRESSES NYANZAGA GOLD PROJECT

Perth, Western Australia/May 31,

2024/Perseus Mining Limited (“Perseus” or the “Company”)

(ASX/TSX:PRU) is pleased to provide an update on its recently

acquired Nyanzaga Gold Project in Tanzania.

HIGHLIGHTS

- The compulsory

acquisition process of the remaining OreCorp shares completed on

May 20, 2024 and Perseus now owns 100% of the shares in OreCorp

Limited.

- Perseus is

implementing three concurrent work streams, namely implementation

of the Resettlement Action Plan (RAP), additional drilling of the

Nyanzaga mineralisation, and Front-End Engineering and Design

(FEED).

- Perseus is

commencing Feasibility level mining studies on the Nyanzaga Gold

Project with the intention of releasing Perseus’s first Mineral

Resources and Ore Reserves estimates during the December quarter of

2024.

- Drilling to

increase Perseus’s understanding of the Nyanzaga Mineral Resources

will commence as soon as possible, taking into account Tanzanian

local procurement regulations.

- FEED studies

across the project are underway in order to optimise engineering

and capital cost estimates for the project.

- A Final

Investment Decision (FID) for the Nyanzaga Gold Project is expected

by year end, enabling project development to commence in the new

year with the aim of first gold production during the first quarter

of 2027.

Perseus’s Chairman and CEO Jeff

Quartermaine said:

“Perseus is pleased to have completed the

acquisition of the Nyanzaga Gold Project through the takeover of

OreCorp Limited. The Nyanzaga Project represents an exciting growth

opportunity for Perseus that aligns with our strategy of upgrading

the size, quality and geographic distribution of our asset

portfolio. We have hit the ground running with the various work

streams and are working diligently towards the target of taking a

final investment decision for the project by the end of the

year.

Perseus now has three operating mines currently

producing gold at a rate of more than 500,000 ounces per year and

two high-quality development projects that when brought on stream,

should ensure that Perseus can maintain or exceed its targeted

production level well into the next decade.

With the objective of operating at least four

mines simultaneously, Perseus is well advanced towards confirming

its place as a highly profitable, well managed, pan-African gold

company that consistently creates benefits for all

stakeholders.”

OVERVIEW OF WORK PROGRAMS

Perseus has commenced its review of the geology,

mining engineering and mineral processing studies of the Nyanzaga

Gold Project. A comprehensive review of all aspects of the project

is planned to produce Perseus’s Mineral Resource estimate and Ore

Reserve estimate for Nyanzaga prior the end of December this year.

Geotechnical and Mineral Processing testwork and analysis is also

under review to ensure optimal value is extracted during

development of the project by Perseus.

Drilling is planned to commence as soon as

possible for the purposes of resource definition, exploration

drilling and sterilisation for key infrastructure.

The FEED work program is focussed on right

sizing the process plant throughput to align with the resource

technical interpretation from the Perseus feasibility work,

incorporating the Perseus lessons learnt from our existing

operations and detailed project execution planning.

Perseus is also continuing work under the RAP in

the impacted villages. The RAP provides a comprehensive and widely

consulted framework and strategy for the resettlement of people and

households affected by Project land acquisition. The resettlement

planning has been finalised, including the development of a

valuation report and compensation schedules, in compliance with

Tanzanian legislation and approved by the Chief Valuer.

Compensation agreements have been signed with about 93% of

project-affected persons so far. Critical next steps include

finalising building permits, commencing construction of replacement

housing, finalising the planning for the relocation of a cemetery,

layout and design of a school and health dispensary as well as the

continuation of livelihood restoration training activities.

NYANZAGA GOLD PROJECT

- The

Nyanzaga Gold Project is located in north-western Tanzania, south

of Lake Victoria within the Sengerema District of the Mwanza

Region, approximately 60 kilometres southwest of Mwanza (Tanzania’s

second largest city).

- The

Project is located on the north-eastern flank of the Sukumaland

Archaean Greenstone Belt of the Lake Victoria Goldfield,

approximately 60 km east of the Geita Gold Mine and 35 km northeast

of the Bulyanhulu Gold Mine. The Project area covers Nyanzian

greenstone volcanic rocks and sediments typical of the greenstone

belts of the central craton.

The Nyanzaga Gold Project’s Mineral Resource

Estimates1 consist of a Measured and Indicated resource of 24.2Mt

grading 3.64g/t Au for 2.8Moz Au and an Inferred Resource of 5.8Mt

grading 2.4g/t Au for 0.5Moz Au. It has a Probable Ore Reserve

Estimate1 of 40.1Mt grading 2.01g/t Au for 2.6Moz Au.

The above-mentioned estimates were released by

OreCorp in ASX releases dated 12 September 2017 titled “MRE Update

for the Nyanzaga Project Increasing Category and Grade”, 5 May 2022

titled “DFS Completion and Kilimani Mineral Resource Estimate

update within the Nyanzaga Special Mining Licence – Tanzania”, and

22 August 2022 titled “Nyanzaga DFS Delivers Robust Results”,

available on https://perseusmining.com/. Perseus is conducting an

independent review of these estimates and the Nyanzaga Gold Project

as a whole. Perseus’s estimates will be completed in the December

2024 quarter.

This announcement was approved for

release by the Jeff Quartermaine, Chairman and CEO of Perseus

Mining Limited.

-

CAUTION REGARDING FORWARD LOOKING

INFORMATION:

- This report

contains forward-looking information which is based on the

assumptions, estimates, analysis and opinions of management made in

light of its experience and its perception of trends, current

conditions and expected developments, as well as other factors that

management of the Company believes to be relevant and reasonable in

the circumstances at the date that such statements are made, but

which may prove to be incorrect. Assumptions have been made by the

Company regarding, among other things: the price of gold,

continuing commercial production at the Yaouré Gold Mine, the

Edikan Gold Mine and the Sissingué Gold Mine without any major

disruption, the receipt of required governmental approvals, the

accuracy of capital and operating cost estimates, the ability of

the Company to operate in a safe, efficient and effective manner

and the ability of the Company to obtain financing as and when

required and on reasonable terms. Readers are cautioned that the

foregoing list is not exhaustive of all factors and assumptions

which may have been used by the Company. Although management

believes that the assumptions made by the Company and the

expectations represented by such information are reasonable, there

can be no assurance that the forward-looking information will prove

to be accurate. Forward-looking information involves known and

unknown risks, uncertainties, and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any anticipated future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others,

the actual market price of gold, the actual results of current

exploration, the actual results of future exploration, changes in

project parameters as plans continue to be evaluated, as well as

those factors disclosed in the Company's publicly filed documents.

The Company believes that the assumptions and expectations

reflected in the forward-looking information are reasonable.

Assumptions have been made regarding, among other things, the

Company’s ability to carry on its exploration and development

activities, the timely receipt of required approvals, the price of

gold, the ability of the Company to operate in a safe, efficient

and effective manner and the ability of the Company to obtain

financing as and when required and on reasonable terms. Readers

should not place undue reliance on forward-looking information.

Perseus does not undertake to update forward-looking information,

except in accordance with applicable securities laws.

-

ASX/TSX CODE: PRU

-

REGISTERED OFFICE:

- Level 2

- 437 Roberts Road

- Subiaco WA

6008

- Telephone: +61 8

6144 1700

-

ABN: 27 106 808 986

-

WWW.PERSEUSMINING.COM

|

-

CONTACTS:

- Jeff

Quartermaine

- Executive Chairman & CEO

-

jeff.quartermaine@perseusmining.com

- Stephen FormanInvestor Relations

-

stephen.forman@perseusmining.com

-

Nathan Ryan

- Media Relations

-

nathan.ryan@nwrcommunications.com.au

|

Competent Person Statement ASX Listing

Rules

All information on the Nyanzaga Mineral Resource

and Ore Reserve estimates has been extracted from the OreCorp ASX

announcements dated 12 September 2017 titled “MRE Update for the

Nyanzaga Project Increasing Category and Grade”, 5 May 2022 titled

“DFS Completion and Kilimani Mineral Resource Estimate update

within the Nyanzaga Special Mining Licence – Tanzania”, and 22

August 2022 titled “Nyanzaga DFS Delivers Robust Results” available

on www.perseusmining.com. Perseus confirms that it is not aware of

any new information or data that materially affect the information

included in the original ASX announcements and that all material

assumptions and technical parameters underpinning the estimates in

the ASX announcements continue to apply and have not materially

changed. Perseus confirms that the form and context in which the

Competent Person’s findings are presented have not been materially

modified from the original ASX announcements.

Historical Estimates – clarifying

statements as required by Canadian National Instrument

43-101

The information in this section relating to the

Nyanzaga Gold Project is extracted from the OreCorp ASX

announcements dated 12 September 2017 titled “MRE Update for the

Nyanzaga Project Increasing Category and Grade”, 5 May 2022 titled

“DFS Completion and Kilimani Mineral Resource Estimate update

within the Nyanzaga Special Mining Licence – Tanzania”, and 22

August 2022 titled “Nyanzaga DFS Delivers Robust Results” available

on www.perseusmining.com. A Qualified Person has not done

sufficient work to classify the Historical Estimates as current. As

such, any Mineral Resource and Mineral Reserve estimates included

in this section are Historical Estimates as defined in Canadian

National Instrument 43-101 and are not reported as current Perseus

estimates. The OreCorp Feasibility Study includes key assumptions

for commodity prices, gold mining and processing costs, and there

have been no material changes in assumptions. The OreCorp

Feasibility Study in its current form is considered to be a

comprehensive compilation of all available data applicable to the

estimation of Mineral Resources and Mineral Reserves.

Table 1: Nyanzaga Project Measured and

Indicated Mineral Resources 6,7

|

DEPOSIT |

DEPOSIT TYPE |

MEASURED RESOURCES |

INDICATED RESOURCES |

MEASURED & INDICATED RESOURCES |

|

QUANTITY |

GRADE |

GOLD |

QUANTITY |

GRADE |

GOLD |

QUANTITY |

GRADE |

GOLD |

|

Mt |

g/t gold |

‘000 oz |

Mt |

g/t gold |

‘000 oz |

Mt |

g/t gold |

‘000 oz |

|

Nyanzaga1,3 |

Open Pit/Underground |

4.6 |

4.96 |

738 |

16.2 |

3.80 |

1,977 |

20.8 |

4.06 |

2,715 |

|

Kilimani2,4,5 |

Open Pit |

- |

- |

- |

3.4 |

1.09 |

119 |

3.4 |

1.09 |

119 |

|

TOTAL |

|

4.6 |

4.96 |

738 |

19.6 |

3.33 |

2,096 |

24.2 |

3.64 |

2,834 |

Table 2: Nyanzaga Project Inferred

Mineral Resource 6,7

|

DEPOSIT |

DEPOSIT TYPE |

INFERRED RESOURCES |

|

QUANTITY |

GRADE |

GOLD |

|

Mt |

g/t gold |

‘000 oz |

|

Nyanzaga1,3 |

Open Pit/Underground |

2.9 |

3.8 |

358 |

|

Kilimani2,4,5 |

Open Pit |

2.9 |

1.0 |

94 |

|

Total |

|

5.8 |

2.4 |

452 |

Notes for Table 1 and Table

2:1) Based on September 2017 Mineral

Resource estimate by CSA Global Pty Ltd.2) Based

on May 2022 Mineral Resource estimate by CSA Global UK

Ltd.3) Reported at a 1.5 g/t Au

cut-off.4) Reported at a 0.4 g/t Au

cut-off.5) Open pit resources constrained to

US$1,500/oz pit shell.6) Rounding of numbers to

appropriate precision may result in summary

inconsistencies.7) Mineral Resources are reported

inclusive of Mineral Reserves.

Table 3: Nyanzaga Proven and Probable

Mineral

Reserves1,5,6

|

DEPOSIT |

DEPOSIT TYPE |

PROVEN |

PROBABLE |

PROVEN + PROBABLE |

|

QUANTITY |

GRADE |

GOLD |

QUANTITY |

GRADE |

GOLD |

QUANTITY |

GRADE |

GOLD |

|

Mt |

g/t gold |

‘000 oz |

Mt |

g/t gold |

‘000 oz |

Mt |

g/t gold |

‘000 oz |

|

Nyanzaga2,3 |

Open Pit |

- |

- |

- |

25.7 |

1.35 |

1,110 |

25.7 |

1.35 |

1,110 |

|

Kilimani3 |

Open Pit |

- |

- |

- |

2.04 |

1.05 |

70 |

2.04 |

1.05 |

70 |

|

Sub-Total |

|

- |

- |

- |

27.7 |

1.32 |

1,180 |

27.7 |

1.32 |

1,180 |

|

Nyanzaga4 |

Underground |

- |

- |

- |

12.4 |

3.57 |

1,420 |

12.4 |

3.57 |

1,420 |

|

TOTAL |

|

- |

- |

- |

40.1 |

2.01 |

2,600 |

40.1 |

2.01 |

2,600 |

Notes for Table

3:1) Based on Mineral Reserve Statement

22 August 2022. 2) Variable gold grade cut-offs

depending on rock type, ranging from 0.44 g/t to 0.52

g/t.3) Pit designs are based on US$1,500/oz gold

metal price.4) Based upon cut-off of 0.5 g/t Au

for development and 2.0 g/t Au for

stoping.5) Mineral Reserves were prepared in

accordance with the JORC Code (2012 edition). See item d)

below.6) Rounding of numbers to appropriate

precisions may have resulted in apparent inconsistencies.

a) The

information provided in relation to these Historical Estimates is

extracted from the OreCorp Feasibility Study which was prepared in

accordance with the JORC Code (2012 edition) and announced on 22

August 2022.

b) The OreCorp

Feasibility Study includes key assumptions for commodity prices,

gold mining and processing costs, and there has been no material

changes in assumptions. The OreCorp Feasibility Study in its

current form is considered to be a comprehensive compilation of all

available data applicable to the estimation of Mineral Resources

and Mineral Reserves. A summary of key assumptions and methods used

to prepare the Historical Estimate include:

- Resource

Estimation calculated using Ordinary Kriging and Localised Uniform

Conditioning methods.

- Economic

assumptions include (i) a US$1,500/oz gold price, (ii) US$896/oz

gold average total cash cost, (iii) US$954/oz gold average all in

sustaining cost, (iv) 88% metallurgical recoveries, and (v) a 7.3%

government royalty including inspection fee and service levy.

- The estimates

are based on 269,116 metres of RC and core drilling in 2,027 drill

holes across both the Nyanzaga and Kilimani projects.

c) As at the

date of this announcement, the Historical Estimates reported by

OreCorp and referenced by Perseus herein have not been superseded

by any later estimates and Perseus is not in possession of any new

information.

d) Perseus

believes the resource classification categories reported in line

with the JORC Code (2012 edition) are similar to categories for CIM

compliant Mineral Resource and Mineral Reserve estimates to be

reported under NI 43-101. Perseus considers the Historical

Estimates to be material to Perseus, given its intention, through

the acquisition of OreCorp, to contribute funding to continued

exploration activity and advancement of the asset through

additional drilling, future mineral resource estimation updates and

economic studies.

e) Perseus

also believes that the Historical Estimates are relevant to Perseus

shareholders as they provide an indication of the current

mineralisation and the potential of the Nyanzaga Gold Project at

this date.

f) Based on

the information received by Perseus to date in relation to the

Nyanzaga Gold Project, physical inspection of the project sites,

discussions with OreCorp’s technical and administrative personnel

and assessment of the key criteria, the reliability of the

Historical Estimates has been addressed in the due diligence

completed by Perseus. Perseus therefore believes that the

Historical Estimates are sufficiently reliable with estimation

methodologies and data compilation work acceptable for

methodologies used at the time of their estimation to provide the

basis for a decision to assess the property to have merit for

further exploration expenditure.

g) It is

Perseus’s intention to undertake an evaluation of the data and

initiate further exploration work planned for the Nyanzaga Gold

Project to underpin a Mineral Resource estimate and Mineral Reserve

estimate in accordance with NI 43-101 that will include selective

infill drilling to increase confidence in Mineral Resources. Future

Mineral Reserve estimates will include an updated mine plan

(optimisation, design and scheduling).

h) It is

Perseus’s intention to undertake a review of the capital and

operating costs to be consistent with latest market conditions,

complete additional geotechnical, hydrological and comminution

studies to further optimise infrastructure and mine design, review

water supply and power options, including the use of renewable

solar energy, complete further tailings storage facilities studies

to optimise design and maximise water recovery, optimise grind size

and CIL recovery methods, complete further sterilisation drilling

in the areas of infrastructure as part of a FEED Study to reduce

risk and/or improve technical and financial outcomes.

i) The Mineral

Resource and Mineral Reserve work in items g) and h) will take

approximately 6 months to complete. The Mineral Resource work can

be completed simultaneously with the FEED study leading to a FID

expected in the December Quarter of 2024.

1 NI43-101 disclosure: The Historical Estimates

have been prepared in accordance with JORC (2012 edition) and have

not been reported in accordance with NI43-101. A Qualified Person

has not done sufficient work to classify the resource estimate as

current in accordance with NI43-101. Please refer to further

disclosure required by NI43-101 together with a more detailed

resource table at the conclusion of this announcement. OreCorp

Mineral Reserve and Mineral Resource estimates are stated on 100%

basis.

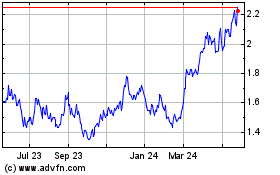

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Dec 2024 to Jan 2025

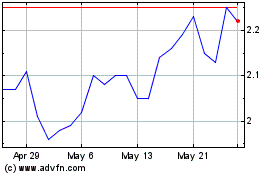

Perseus Mining (TSX:PRU)

Historical Stock Chart

From Jan 2024 to Jan 2025