S Split Corp. Announces Semi-Annual Results

24 August 2021 - 6:01AM

(TSX: SBN; SBN.PR.A) S Split Corp. announces

results of operations for the six months ended June 30, 2021.

Increase in net assets attributable to holders of Class A shares

amounted to $1.90 million or $2.32 per Class A share. Net assets

attributable to holders of Class A shares as at June 30, 2021 were

$5.70 million or $6.94 per Class A share. Cash distributions of

$0.10 per Class A share and $0.26 per Preferred Share were paid

during the period.

The investment objectives for the Preferred Shares are: (i) to

provide holders of Preferred Shares with fixed cumulative

preferential monthly cash distributions in the amount of $0.04375

per Preferred Share ($0.525 per year) representing a yield on the

issue price of the Preferred Shares of 5.25% per annum; and (ii) to

return the issue price of $10.00 per Preferred Share to holders of

Preferred Shares upon termination of the Fund.

The investment objectives for the Class A Shares are: (i) to

provide holders of Class A Shares with regular monthly cash

distributions in an amount targeted to be 6.00% per annum on the

net asset value (“NAV”) of the Class A Shares; and (ii) to provide

holders of Class A Shares with the opportunity for leveraged growth

in NAV and distributions per Class A Share.

The Fund invests in the common shares of the Bank of Nova Scotia

(“BNS”) and employs a proprietary investment strategy, Strathbridge

Selective Overwriting (“SSO”), to enhance the income generated by

the BNS shares and to reduce volatility. In addition,

the Fund may write cash covered put options in respect of

securities in which it is permitted to invest.

The Fund’s investment portfolio is managed by its investment

manager, Strathbridge Asset Management Inc. The Fund’s Class A and

Preferred shares are listed on Toronto Stock Exchange under the

symbols SBN and SBN.PR.A respectively.

|

Selected Financial Information : ($ Millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Statement of Comprehensive Income |

|

|

|

|

|

|

For the six months ended June 30, 2021 |

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (including Net Gain on Investments) |

$ |

2.38 |

|

|

|

|

Expenses |

|

(0.26 |

) |

|

|

|

Operating Profit |

|

2.12 |

|

|

|

|

Preferred Share Distributions |

|

(0.22 |

) |

|

|

|

|

|

|

|

|

|

|

Increase in Net Assets Attributable |

|

|

|

|

|

|

to Holders of Class A Shares |

$ |

1.90 |

|

|

|

For further information, please contact Investor Relations at

416.681.3966, toll free at 1.800.725.7172 or visit

www.strathbridge.com.

|

John Germain, Senior Vice-President & CFO |

Strathbridge Asset Management Inc. |

| |

121 King

Street West |

| |

Suite

2600 |

| |

Toronto,

Ontario, M5H 3T9 |

| |

416.681.3966; 1.800.725.7172 |

| |

www.mulvihill.com |

|

|

info@mulvihill.com |

Commissions, trailing commissions, management fees and expenses

all may be associated with investment funds. Please read the

prospectus before investing. Investment funds are not guaranteed,

their values change frequently and past performance may not be

repeated.

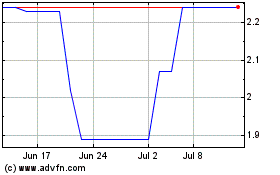

S Split (TSX:SBN)

Historical Stock Chart

From Oct 2024 to Nov 2024

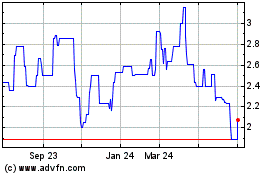

S Split (TSX:SBN)

Historical Stock Chart

From Nov 2023 to Nov 2024