Sabre Gold Mines Corp. (TSX: SGLD, OTCQB: SGLDF)

(“

Sabre Gold” or the “

Company”)

announced today the appointment of Mr. Andrew Elinesky as Chief

Executive Officer/President and Director of Sabre Gold. Mr.

Elinesky succeeds Giulio Bonifacio, who has retired from his role

as Chief Executive Officer/President and Director effective October

23, 2022 to dedicate more time to his family and pursue other

business interests. The Company has made several coordinated moves

to significantly enhance its overall ability to attract

construction funding to return its fully-permitted Copperstone gold

project towards production.

Significant highlights include:

- Appointment of

Andrew Elinesky, CPA, as President, CEO and Director effective

immediately

- Retirement of

4.5% Gross Production Royalty on Copperstone

- Retirement of

outstanding long-term debt in the amount of US$3.65 million

dollars

- Extension of

remaining outstanding debt by one year to December 31, 2024

- Sale of the

Company’s 1% NSR on the Kerr-Addison Mine claims owned by Gold

Candle Ltd. for total consideration of US$7.4 million (providing

for the royalty retirement and the debt reduction)

- Private Sale of

14,500,000 shares of C2C Gold Corp. for net proceeds of

CDN$800,000

- Implementation

of the 1:10 share consolidation previously approved by shareholders

on December 17, 2021.

The steps outlined above will provide the

Company with working capital as well as significantly reduce its

debt and extend the payment terms of the remaining debt. These

steps have been taken to pave the way for advancing continuing

discussions with potential financial partners to return the

fully-permitted Copperstone Gold Mine in southwestern Arizona to

production.

Andrew Elinesky, CEO

Mr. Andrew Elinesky brings over 20 years of

experience as a CFO and senior leader for publicly traded companies

in both Canada, the U.S. and the United Kingdom. With a focus on

corporate financings, M&A and integration experience, he was

previously the CFO for Skylight Health Group Inc. and Reklaim

Inc. Prior to that, Andrew was with McEwen Mining Inc.

for 11 years in increasing roles of responsibility having spent his

last 5 years there as Senior Vice-President and CFO where he

managed equity and debt financings of over $150M, multiple

acquisitions, operational development, and, government and ESG

relations.

Andrew Elinesky stated “I look forward to taking

on the role of Chief Executive Officer at Sabre Gold and thank the

Board of Directors for this opportunity. Sabre Gold is one of the

very few gold companies that has a fully licensed and permitted

quality asset in a safe jurisdiction that, with final construction

and operational capital, becomes a revenue source for the Company

adding significant value for the shareholders. I see the key

advantages of Copperstone’s Arizona location, a long established

pro-mining jurisdiction, minimal capital needs, the removal of the

4.5% royalty and the increased health of our balance sheet as

combining to make this asset a compelling financeable project. With

a strong team behind me, Sabre Gold has a bright future moving

Copperstone into the construction phase with the final step of

arranging project financing.”

“The Company is very pleased to have someone

with Andrew’s capabilities and strong background in finance and

mining choosing to lead our company. We have every confidence in

Andrew and given the Company’s moves announced today I think he is

in a good position to maneuver the Company’s prime asset,

Copperstone, through project financing and into production over the

coming quarters.” Said William M. Sheriff, Chairman of Sabre Gold

Inc.

The Company also wishes to thank Mr. Giulio T.

Bonifacio who will has stepped down in order to dedicate more time

to his family and other business interests.

William Sheriff, Chair of Sabre Gold added, “On

behalf of the Board of Directors, we welcome Andrew in his new role

as Chief Executive Officer. We also thank Giulio Bonificio, former

CEO, who over the past two years, integrated Golden Predator and

Arizona Gold to create Sabre Gold Mines Corp. The combined resource

of the Yukon project plus the fully permitted and licensed

Copperstone Mine in southwestern Arizona provide sound brownfield

projects with established resources for Sabre Gold to advance

towards production. His work in establishing relationships and

opening the doors to likely financiers while managing the merger of

the two entities and the sale of the royalty has brought us to this

position where we are ready to take on project financings in order

to return Copperstone to production.”

Royalty Purchase

The Company has entered into a letter of intent

(the “LOI”) with Trans Oceanic Minerals Company

Ltd. (“TOMCL”), a company owned by Fahad Al

Tamimi, a director of the Company and Braydon Capital Corporation

(“Braydon” and together with TOMCL, the

“Purchasers”), a Company owned by Claudio

Ciavarella, a director of the Company, setting forth the terms on

which the Purchasers are prepared to acquire from the Company the

1% net smelter returns royalty (the “GC Royalty”)

granted to the Company by Candle Gold Ltd. (“Gold

Candle”) pursuant to the Net Smelter Royalty

Agreement between the parties dated February 11, 2015 (the

“CG Royalty Agreement”)(the

“Transaction”). The proposed purchase price for

the CG Royalty is US$7,400,000 to be satisfied by the Purchasers as

follows:

- US$1,800,00

credit applied by TOMCL against payment in the amount of

US$1,800,000 to be made by the Company to TOMCL as repayment of

some of the outstanding debt owed by the Company to TOMCL pursuant

to certain promissory notes;

- US$1,850,000

credit applied by Braydon against payment in the amount of

$US1,850,000 to be made by the Company to Braydon as repayment of

some of the outstanding debt owed by the Company to Braydon

pursuant to certain promissory notes; and

- US$3,750,000 to

be satisfied by the transfer by TOMCL of all of its right and

interest in 4.5% Gross Production Royalty on the Copperstone Gold

Mine (the “Copperstone Royalty”) to the

Company.

Under the terms of the CG Royalty Agreement, the

Company must provide the grantor of the GC Royalty, Gold Candle ,

the right to acquire the GC Royalty on the same terms as provided

in the LOI. In the event that Gold Candle exercises it right to

acquire the GC Royalty, on payment of the purchase price by Gold

Candle, a break fee of US$500,000 is payable by the Company to the

Purchasers.

In connection with the Transaction, the LOI also

provides that TOMCL and Braydon will extend the maturity date on

their respective promissory notes to December 31, 2024 upon

completion of the Transaction.

The Company has granted TOCML and Braydon

exclusivity for the Transaction until the earlier of (a) execution

of the definitive agreement in respect of the Transaction (the

“Definitive Agreement”), and (b) November 30,

2022.

The completion of the Transaction is subject to

the parties entering into a Definitive Agreement and customary

terms and conditions to be included in the Definitive

Agreement.

Sale of CTOC shares

The LOI also provides for the sale by the

Company to TOCML 14,500,000 shares in the capital of C2C Gold Corp.

that are currently held by the Company for an aggregate

consideration of CDN$800,000. The purchase will be completed

subject to customary representations and warranties to be provided

by the Company to TOCML. (the “CTOC Share

Sale”)

The Board of Directors of the Company has

established an ad hoc committee of independent directors (the

“Independent Committee”) which supervised the

negotiation of the LOI. The Independent Committee is in the process

of negotiating the Definitive Agreements in respect of the

Transaction and the CTOC Share Sale, and there can be no assurance

that the Transaction and the CTOC Share Sale will be completed. The

Transaction, the CTOC Share Sale and the extension of the

promissory notes will be subject to the requirements of

Multilateral Instrument 61-101 – Protection of Minority

Securityholders in Special Transactions.

Share Consolidation

Pursuant to shareholder approval received on

December 17, 20201 the Company will consolidate all of its Common

Shares on the basis of one new post consolidation Common Share for

every ten existing pre-consolidation Common Shares (the

“Consolidation”). The Board of Directors of the

Company has approved the Consolidation ratio, and expects the

Consolidation to be completed during the week of November 7, 2022.

The Consolidation reduces the number of issued and outstanding

Common Shares from 632,916,250 to approximately 63,291,625.

Proportionate adjustments will be made to the Company's outstanding

stock options, warrants, restricted share units, deferred share

units and convertible notes. No fractional Common Shares will be

issued pursuant to the Consolidation and any fractional Common

Shares that would have otherwise been issued will be rounded down

to the nearest whole Common Share. A letter of transmittal with

respect to the Consolidation will be mailed to the Company's

registered shareholders. All registered shareholders will be

required to send their certificate(s) representing

pre-Consolidation Common Shares, along with a properly executed

letter of transmittal, to the Company's registrar and transfer

agent, TSX Trust Company, in accordance with the instructions

provided in the letter of transmittal. Shareholders who hold their

Common Shares through a broker, investment dealer, bank or trust

company should contact that nominee or intermediary for their

post-Consolidation positions. A copy of the letter of transmittal

will be posted on the Company's issuer profile on SEDAR. The

Company's ticker symbols are expected to remain unchanged. The

Consolidation remains subject to the approval of the TSX. The

Company will issue a further press release to advise shareholders

of the date the Common Shares will commence trading on a

consolidated basis.

About Sabre Gold Mines

Corp.

Sabre Gold is a diversified, multi-asset

near-term gold producer in North America which holds 100-per-cent

ownership of both the fully licensed and permitted Copperstone gold

mine located in Arizona, United States, and the Brewery Creek gold

mine located in Yukon, Canada, both of which are former producers.

Management intends to restart production at Copperstone followed by

Brewery Creek in the near term. Sabre Gold also holds other

investments and projects at varying stages of development.

Sabre Gold’s two advanced projects have

approximately 1.5 million ounces of gold in the Measured and

Indicated categories, and approximately 1.2 million ounces of gold

in the Inferred category. Additionally, both Copperstone and

Brewery Creek have considerable exploration upside with a combined

land package of over 230 square kilometers that will be further

drill tested with high-priority targets currently identified. Sabre

Gold is led by an experienced team of mining professionals with

backgrounds in exploration, mine building and operations.

For further information please send query to

info@sabre.gold or visit the Sabre Gold Mines Corp. website

(www.sabre.gold).

Cautionary Note Regarding Forward Looking

Statements

This news release contains forward-looking

information under Canadian securities legislation including

statements regarding drill results, potential mineralization,

potential expansion and upgrade of mineral resources and current

expectations on future exploration and development plans. These

forward-looking statements entail various risks and uncertainties

that could cause actual results to differ materially from those

reflected in these forward-looking statements. Such statements are

based on current expectations, are subject to a number of

uncertainties and risks, and actual results may differ materially

from those contained in such statements. These uncertainties and

risks include, but are not limited to: the strength of the Canadian

economy; the price of gold; operational, funding, and

liquidity risks; reliance on third parties, exploration risk,

failure to upgrade resources, the degree to which mineral

resource and reserve estimates are reflective of actual

mineral resources and reserves; the degree to which factors which

would make a mineral deposit commercially viable are present, and

the risks and hazards associated with underground operations and

other risks involved in the mineral exploration and development

industry. Risks and uncertainties about Sabre Gold’s business are

more fully discussed in the Company’s disclosure materials,

including its annual information form and MD&A, filed with the

securities regulatory authorities in Canada and available at

www.sedar.com and readers are urged to read these materials. Sabre

Gold assumes no obligation to update any forward-looking statement

or to update the reasons why actual results could differ from such

statements unless required by law.

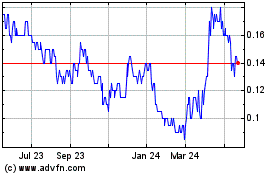

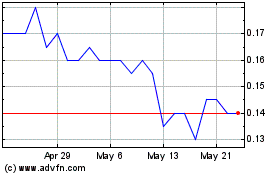

Sabre Gold Mines (TSX:SGLD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sabre Gold Mines (TSX:SGLD)

Historical Stock Chart

From Feb 2024 to Feb 2025