Stantec (TSX, NYSE:STN), a global leader in sustainable design and

engineering, today reported its results for the three months ended

June 30, 2024.

Stantec delivered strong second quarter earnings driven by its

diversified business model and solid project execution.

Stantec generated record net revenue of $1.5 billion on the

strength of 7.1% organic and 8.8% acquisition growth1. Stantec's

Water business delivered double digit organic growth of 13.8%, as

did Buildings with 13.6%. The Company's US region delivered 8.7%

organic growth driven primarily by double digit growth in Water and

Infrastructure, and high single digit growth in Buildings. Stantec

also delivered 5% organic growth in Canada and 5.5% organic growth

in the Global region. Adjusted EBITDA for the second quarter 2024

increased 14.5% or $31.3 million, while Adjusted EBITDA margin

decreased by 30 basis points to 16.6%, primarily due to claim

provision estimates which increased to historically normal levels

compared to the second quarter of 2023. Stantec delivered diluted

earnings per share (EPS) of $0.74 and adjusted diluted EPS of

$1.12.

“Our solid second quarter results reflect continued strong

operational performance,” said Gord Johnston, President and CEO.

"We were also extremely busy throughout the second quarter

advancing the integration of the ZETCON, Morrison Hershfield and

Hydrock acquisitions, supporting our 2,700 new colleagues as they

transition onto Stantec's systems and processes."

____________________________1 Adjusted diluted EPS, adjusted net

income, adjusted EBITDA, and adjusted EBITDA margin are non-IFRS

measures, and organic growth, acquisition growth and DSO are other

financial measures (discussed in the Definitions section of the Q2

2024 MD&A).

2024 Outlook

"Our outlook for the full year remains very positive and we are

well positioned to deliver strong results for the year as we

continue to execute our three-year strategic plan," said Mr.

Johnston.

Stantec is revising and narrowing certain targets contained

within its 2024 guidance:

|

|

Previously Published 2024 Annual Range |

Revised 2024 Annual Range |

|

Targets |

|

|

| Net revenue growth |

11% to 15% |

12% to 15% |

| Adjusted EBITDA as % of net

revenue (note) |

16.2% to 17.2% |

16.5% to 16.9% |

| Adjusted net income as % of

net revenue (note) |

above 8% |

above 8% |

| Adjusted diluted EPS growth

(note) |

12% to 16% |

12% to 16% |

|

Adjusted ROIC (note) |

above 11% |

above 11% |

Stantec's targets and guidance assumed the average value for the

US dollar to be $1.35, GBP to be $1.70, and AU dollar $0.90. For

all other underlying assumptions, see the Assumptions section of

the Q2 2024 MD&A. These targets do not include the impact of

revaluing Stantec's share-based compensation, which fluctuates

primarily due to share price movements subsequent to December 31,

2023, as further described below.

note: Adjusted EBITDA, adjusted net income, adjusted diluted

EPS, and adjusted ROIC are non-IFRS measures discussed in

the Definitions section of this MD&A.

Stantec's outlook for net revenue growth remains robust. The

Company now expects net revenue growth to be in the range of 12% to

15%, raising the lower end of the range from 11%. Stantec reaffirms

expectations for organic net revenue growth in the mid to

high-single digits. The Company continues to expect the US and

Global regions to deliver organic growth in the mid to high-single

digits and Canada to be in the mid-single digits. This has been

complemented by increased expectations from acquisition net revenue

growth, revised to high-single digit growth from mid to high-single

digit growth.

The Company is narrowing its target range for adjusted EBITDA

margin to 16.5% to 16.9% (previously 16.2% to 17.2%). This reflects

the continuing confidence in solid project execution and

operational performance, while recognizing that opportunities for

margin and earnings enhancement from recent acquisitions will be

muted during this initial period of transition and integration. As

such, Stantec continues to expect adjusted net income to achieve a

margin above 8.0%, adjusted diluted EPS growth to be in the range

of 12% to 16%, and adjusted ROIC to be above 11%.

Effect of Long-term Incentive PlanConsistent with guidance

previously provided, the targets do not include the impact of

revaluing Stantec's share-based compensation, which fluctuates

primarily due to share price movements subsequent to December 31,

2023. Year to date, the revaluation resulted in a $6.4 million

expense (pre-tax), the equivalent of 20 basis points as a

percentage of net revenue and $0.04 EPS. If the LTIP metrics

existing at Q2 remain constant to the end of the year, the impact

of higher share-based compensation expense to the remaining two

quarters would be approximately $0.6 million (pre- tax) or less

than $0.01 EPS, and the full year impact would be approximately

$7.0 million (pre-tax) or $0.05 EPS.

The above targets do not include any assumptions for additional

acquisitions given the unpredictable nature of the size and timing

of such acquisitions, or the impact from share price movements

subsequent to December 31, 2023 and the relative total shareholder

return components on our share-based compensation programs.

Q2 2024 compared to Q2 2023

- Net revenue increased 16.8% or $214.6 million, to $1.5 billion,

primarily driven by 8.8% acquisition and 7.1% organic net revenue

growth. The Company achieved organic growth in all regional and

business operating units with the exception of Energy &

Resources. Double-digit organic growth was achieved in the Water

and Buildings businesses.

- Project margin increased 17.0% or $117.7 million, to

$811.7 million. As a percentage of net revenue, project margin

increased by 10 basis points to 54.4% reflecting solid project

execution, particularly in the Water and Buildings businesses.

- Adjusted EBITDA increased 14.5% or $31.3 million, to $247.3

million. Adjusted EBITDA margin was 16.6%, in line with

expectations. Compared to Q2 2023, adjusted EBITDA margin decreased

by 30 basis points and by 90 basis points when normalizing for the

Q2 2023 increase in long-term incentive plan (LTIP) expense that

resulted from strong price appreciation. The quarter-over-quarter

change in margin primarily reflects claim provision estimates

increasing to historically normal levels compared to 2023.

- Net income decreased 3.9% or $3.4 million, to $84.6 million,

and diluted EPS decreased 6.3% or $0.05, to $0.74, mainly due to a

non-cash impairment charge of $16.5 million from the Company's real

estate optimization strategy and higher administrative and

marketing expenses as a percentage of net revenue.

- Adjusted net income grew 16.3% or $17.8 million, to $127.2

million, achieving 8.5% of net revenue—a decrease of 10 basis

points. Adjusted diluted EPS increased 13.1% or $0.13, to $1.12.

The LTIP revaluation had a minimal impact on adjusted diluted EPS

in Q2 2024 and a downward impact of $0.05 in Q2 2023.

- Contract backlog increased to $7.2 billion at June 30,

2024, reflecting 8.2% acquisition growth and 3.0% organic growth

from December 31, 2023. Organic backlog growth was achieved in

all regional operating units, and double-digit organic backlog

growth was achieved in the Environmental Services and Energy &

Resources businesses. Contract backlog represents approximately 12

months of work.

- Operating cash flows increased $49.3 million, with cash inflows

of $80.3 million, reflecting strong operational performance and

collection efforts.

- DSO was 77 days, remaining below Stantec's target of 80

days.

- Net debt to adjusted EBITDA (on a trailing twelve-month basis)

at June 30, 2024 was 1.7x, reflecting the funding of recent

acquisitions, and remaining within the Company's internal target

range of 1.0x to 2.0x.

- Consistent with Stantec's growth strategy, on April 30, 2024,

the Company completed the acquisition of Hydrock Holdings Limited

(Hydrock), a 950-person integrated engineering design firm

headquartered in Bristol, England. Hydrock bolsters the Company's

offering in the energy, buildings, and infrastructure markets.

- On August 7, 2024, the Company's Board of Directors

declared a dividend of $0.21 per share, payable on October 15,

2024, to shareholders of record on September 27, 2024.

Year-to-date Q2 2024 compared to year-to-date Q2

2023

- Net revenue increased 14.2% or $356.2 million, to

$2.9 billion, primarily driven by 7.2% acquisition and 6.8%

organic net revenue growth. Stantec achieved organic growth in all

of its regional and business operating units with the exception of

Energy & Resources. Double-digit organic growth was achieved in

the Water and Buildings businesses.

- Project margin increased $200.2 million or 14.8%, to

$1,554.2 million. As a percentage of net revenue, project

margin increased by 30 basis points to 54.3% due to solid project

execution, particularly in the Water and Buildings businesses.

- Adjusted EBITDA increased $64.1 million or 16.2%, to $459.2

million. Adjusted EBITDA margin increased by 20 basis points over

the prior period to 16.0%, and decreased by 10 basis points after

normalizing for the LTIP revaluation. Consistent adjusted EBITDA

margin was driven by strong net revenue growth and increased

project margins, offset by higher administrative and marketing

expenses as a percentage of net revenue primarily reflecting claim

provision estimates increasing to historically normal levels

compared to 2023.

- Net income increased 7.3% or $11.1 million, to $164.0

million, and diluted EPS increased 4.3% or $0.06, to $1.44, mainly

due to strong net revenue growth and solid project execution,

partly offset by a non-cash impairment charge of $16.9 million from

Stantec's real estate optimization strategy and higher

administrative and marketing expenses as a percentage of net

revenue.

- Adjusted net income grew 21.0% or $39.9 million, to $230.2

million, achieving 8.0% of net revenue—an increase of 40 basis

points and adjusted diluted EPS increased 17.4%, or $0.30 to $2.02.

The LTIP revaluation had an impact of $0.04 on the 2024

year-to-date adjusted diluted EPS and an impact of $0.10 in the

comparative period.

- Operating cash flows increased $69.5 million or 102.7%,

with cash inflows of $137.2 million, reflecting strong

operational performance and collection efforts.

Q2 2024 Financial Highlights

| |

For the quarter endedJune

30, |

For the two quarters endedJune

30, |

| |

2024 |

2023 |

2024 |

2023 |

|

(In millions of Canadian dollars,except per share amounts and

percentages) |

$ |

% of NetRevenue |

|

$ |

|

% of NetRevenue |

|

$ |

|

% of NetRevenue |

|

$ |

|

% of NetRevenue |

|

|

Gross revenue |

1,889.7 |

126.5 |

% |

1,638.2 |

|

128.1 |

% |

3,611.1 |

|

126.1 |

% |

3,177.4 |

|

126.7 |

% |

| Net

revenue |

1,493.3 |

100.0 |

% |

1,278.7 |

|

100.0 |

% |

2,863.4 |

|

100.0 |

% |

2,507.2 |

|

100.0 |

% |

| Direct

payroll costs |

681.6 |

45.6 |

% |

584.7 |

|

45.7 |

% |

1,309.2 |

|

45.7 |

% |

1,153.2 |

|

46.0 |

% |

|

Project margin |

811.7 |

54.4 |

% |

694.0 |

|

54.3 |

% |

1,554.2 |

|

54.3 |

% |

1,354.0 |

|

54.0 |

% |

|

Administrative and marketing expenses |

576.6 |

38.6 |

% |

487.3 |

|

38.1 |

% |

1,119.5 |

|

39.1 |

% |

975.6 |

|

38.9 |

% |

| Depreciation of property and

equipment |

17.2 |

1.2 |

% |

14.7 |

|

1.1 |

% |

33.0 |

|

1.2 |

% |

30.2 |

|

1.2 |

% |

| Depreciation of lease

assets |

32.0 |

2.1 |

% |

30.2 |

|

2.4 |

% |

63.5 |

|

2.2 |

% |

61.1 |

|

2.4 |

% |

| Net impairment (reversal) of

lease assets |

16.5 |

1.1 |

% |

0.4 |

|

0.0 |

% |

16.9 |

|

0.6 |

% |

(2.1 |

) |

(0.1 |

%) |

| Amortization of intangible

assets |

31.8 |

2.1 |

% |

26.4 |

|

2.1 |

% |

62.8 |

|

2.2 |

% |

52.7 |

|

2.1 |

% |

| Net interest expense and other

net finance expense |

27.4 |

1.8 |

% |

22.9 |

|

1.8 |

% |

51.6 |

|

1.8 |

% |

44.5 |

|

1.8 |

% |

| Other expense (income) |

0.9 |

0.1 |

% |

(1.4 |

) |

(0.1 |

%) |

(4.8 |

) |

(0.2 |

%) |

(5.3 |

) |

(0.2 |

%) |

| Income

taxes |

24.7 |

1.7 |

% |

25.5 |

|

2.0 |

% |

47.7 |

|

1.7 |

% |

44.4 |

|

1.8 |

% |

|

Net income |

84.6 |

5.7 |

% |

88.0 |

|

6.9 |

% |

164.0 |

|

5.7 |

% |

152.9 |

|

6.1 |

% |

| Basic and diluted earnings per

share (EPS) |

0.74 |

n/m |

|

0.79 |

|

n/m |

|

1.44 |

|

n/m |

|

1.38 |

|

n/m |

|

|

Adjusted EBITDA (note) |

247.3 |

16.6 |

% |

216.0 |

|

16.9 |

% |

459.2 |

|

16.0 |

% |

395.1 |

|

15.8 |

% |

| Adjusted net income

(note) |

127.2 |

8.5 |

% |

109.4 |

|

8.6 |

% |

230.2 |

|

8.0 |

% |

190.3 |

|

7.6 |

% |

| Adjusted diluted EPS

(note) |

1.12 |

n/m |

|

0.99 |

|

n/m |

|

2.02 |

|

n/m |

|

1.72 |

|

n/m |

|

|

Dividends declared per common share |

0.210 |

n/m |

|

0.195 |

|

n/m |

|

0.420 |

|

n/m |

|

0.390 |

|

n/m |

|

note: Adjusted EBITDA, adjusted net income, and adjusted diluted

EPS are non-IFRS measures (discussed in the Definitions of Non-IFRS

and Other Financial Measures section of the Q2 2024 MD&A).

n/m = not meaningful

Net Revenue by Reportable Segment

|

(In millions of Canadian dollars, except

percentages) |

Q2 2024 |

Q2 2023 |

Total Change |

|

Change Due to Acquisitions |

|

Change Due to Foreign Exchange |

|

Change Due to Organic Growth |

|

% of Organic Growth |

|

|

Canada |

370.7 |

320.3 |

50.4 |

|

34.4 |

|

n/a |

|

16.0 |

|

5.0 |

% |

| United States |

775.6 |

667.2 |

108.4 |

|

37.7 |

|

12.6 |

|

58.1 |

|

8.7 |

% |

|

Global |

347.0 |

291.2 |

55.8 |

|

40.4 |

|

(0.7 |

) |

16.1 |

|

5.5 |

% |

|

Total |

1,493.3 |

1,278.7 |

214.6 |

|

112.5 |

|

11.9 |

|

90.2 |

|

|

|

Percentage Growth |

|

|

16.8 |

% |

8.8 |

% |

0.9 |

% |

7.1 |

% |

|

Backlog

|

(In millions of Canadian dollars, except percentages) |

Jun 30, 2024 |

Dec 31, 2023 |

Total Change |

|

Change Due to Acquisitions |

|

Change Due to Foreign Exchange |

|

Change Due to Organic Growth |

|

% of Organic Growth |

|

|

Canada |

1,650.5 |

1,342.6 |

307.9 |

|

183.8 |

|

n/a |

|

124.1 |

|

9.2 |

% |

| United States |

4,174.2 |

3,950.8 |

223.4 |

|

54.3 |

|

129.1 |

|

40.0 |

|

1.0 |

% |

|

Global |

1,327.9 |

1,012.5 |

315.4 |

|

279.3 |

|

9.8 |

|

26.3 |

|

2.6 |

% |

|

Total |

7,152.6 |

6,305.9 |

846.7 |

|

517.4 |

|

138.9 |

|

190.4 |

|

|

|

Percentage Growth |

|

|

13.4 |

% |

8.2 |

% |

2.2 |

% |

3.0 |

% |

|

Webcast & Conference Call

Stantec will host a live webcast and conference call on

Thursday, August 8, 2024, at 7:00 AM Mountain Time (9:00 AM

Eastern Time) to discuss the Company’s second quarter

performance.

To listen to the webcast and view the slide presentation, please

join here.

If you are an analyst and would like to participate in the

Q&A, please register here.

The conference call and slideshow presentation will be broadcast

live and archived in their entirety in the Investors section of

Stantec.com.

About Stantec

Stantec empowers clients, people, and communities to rise to the

world’s greatest challenges at a time when the world faces more

unprecedented concerns than ever before.

We are a global leader in sustainable architecture, engineering,

and environmental consulting.

Our professionals deliver the expertise, technology, and

innovation communities need to manage aging infrastructure,

demographic and population changes, the energy transition, and

more.

Today’s communities transcend geographic borders. At Stantec,

community means everyone with an interest in the work that we

do—from our project teams and industry colleagues to our clients

and the people our work impacts. The diverse perspectives of our

partners and interested parties drive us to think beyond what’s

previously been done on critical issues like climate change,

digital transformation, and future-proofing our cities and

infrastructure.

We are engineers, designers, scientists, project managers, and

strategic advisors. We innovate at the intersection of community,

creativity, and client relationships to advance communities

everywhere, so that together we can redefine what’s possible.

Stantec trades on the TSX and the NYSE under the symbol STN.

Cautionary Statements

Non-IFRS and Other Financial Measures

Stantec reports its financial results in accordance with IFRS.

This news release also reports the following non-IFRS and other

financial measures used by the Company: adjusted EBITDA, adjusted

net income, adjusted earnings per share (EPS), net debt to adjusted

EBITDA, days sales outstanding (DSO), margin (percentage of net

revenue), organic growth (retraction), acquisition growth, adjusted

return on invested capital (ROIC), and measures described as on a

constant currency basis and the impact of foreign exchange or

currency fluctuations, as well as measures and ratios calculated

using these non-IFRS or other financial measures. Additional

disclosure for these non-IFRS and other financial measures,

incorporated by reference, is included in the Definitions of

Non-IFRS and Other Financial Measures section of the Q2 2024

Management’s Discussion and Analysis, available on SEDAR+ at

sedarplus.ca, EDGAR at sec.gov, and the Company’s website at

Stantec.com and the reconciliation of Non-IFRS Financial Measures

appended hereto.

These non-IFRS and other financial measures do not have a

standardized meaning under IFRS and, therefore, may not be

comparable to similar measures presented by other issuers.

Management believes that, in addition to conventional measures

prepared in accordance with IFRS, these non-IFRS and other

financial measures and ratios provide useful information to

investors to assist them in understanding components of the

Company's financial results. These measures should not be

considered in isolation or viewed as a substitute for the related

financial information prepared in accordance with IFRS.

Forward-looking Statements

Certain statements contained in this news release constitute

forward-looking statements. These statements include, without

limitation, comments regarding the Company's ability to capture

future growth opportunities, adjusted diluted EPS and net revenue

growth, adjusted EBITDA margin, adjusted ROIC, and the 2024

outlook. Readers of this news release are cautioned not to place

undue reliance on forward-looking statements since a number of

factors could cause actual future results to differ materially from

the expectations expressed in these forward-looking statements.

These factors include, but are not limited to, the risk of economic

downturn, cash flow projections, project cancellations, access and

retention of skilled labor, decreased infrastructure spending

levels, decrease or end to stimulus programs, changing market

conditions for Stantec’s services, and the risk that Stantec fails

to capitalize on its strategic initiatives. Investors and the

public should carefully consider these factors, other

uncertainties, and potential events, as well as the inherent

uncertainty of forward-looking statements, when relying on these

statements to make decisions with respect to the Company.

Future outcomes relating to forward-looking statements may be

influenced by many factors and material risks. For the three and

six month periods ended June 30, 2024, there has been no

significant change in the risk factors from those described in

Stantec's 2023 Annual Report. This report is accessible online by

visiting EDGAR on the SEC website at sec.gov or by visiting the CSA

website at sedarplus.ca or Stantec’s website, Stantec.com. You may

obtain a hard copy of the 2023 annual report free of charge from

the investor contact noted below.

Investor Contact

Jess NieukerkStantec Investor RelationsPh:

403-569-5389jess.nieukerk@stantec.com

To subscribe to Stantec’s email news alerts, please fill out the

subscription form.

Reconciliation of Non-IFRS Financial

Measures

| |

For the quarter endedJune

30, |

For the two quarters endedJune

30, |

|

(In millions of Canadian dollars, except per share amounts) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Net income |

84.6 |

|

88.0 |

|

164.0 |

|

152.9 |

|

| Add back

(deduct): |

|

|

|

|

|

Income taxes |

24.7 |

|

25.5 |

|

47.7 |

|

44.4 |

|

|

Net interest expense |

27.3 |

|

22.3 |

|

51.3 |

|

43.0 |

|

|

Net impairment (reversal) of lease assets (note 1) |

18.4 |

|

0.9 |

|

18.9 |

|

(2.0 |

) |

|

Depreciation and amortization |

81.0 |

|

71.3 |

|

159.3 |

|

144.0 |

|

|

Unrealized gain on equity securities |

(1.8 |

) |

(3.3 |

) |

(3.7 |

) |

(7.2 |

) |

|

Acquisition, integration, and restructuring costs (note 4) |

13.1 |

|

11.3 |

|

21.7 |

|

20.0 |

|

|

|

|

|

|

|

|

Adjusted EBITDA |

247.3 |

|

216.0 |

|

459.2 |

|

395.1 |

|

| |

For the quarter endedJune

30, |

For the two quarters endedJune

30, |

|

(In millions of Canadian dollars, except per share amounts) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Net income |

84.6 |

|

88.0 |

|

164.0 |

|

152.9 |

|

| Add back (deduct)

after tax: |

|

|

|

|

|

Net impairment (reversal) of lease assets (note 1) |

14.4 |

|

0.6 |

|

14.7 |

|

(1.6 |

) |

|

Amortization of intangible assets related to acquisitions (note

2) |

18.9 |

|

14.6 |

|

37.0 |

|

29.1 |

|

|

Unrealized gain on equity securities (note 3) |

(1.4 |

) |

(2.6 |

) |

(2.9 |

) |

(5.6 |

) |

|

Acquisition, integration, and restructuring costs (note 4) |

10.7 |

|

8.8 |

|

17.4 |

|

15.5 |

|

|

|

|

|

|

|

|

Adjusted net income |

127.2 |

|

109.4 |

|

230.2 |

|

190.3 |

|

|

Weighted average number of shares outstanding - diluted |

114,066,995 |

|

111,015,228 |

|

114,066,995 |

|

110,953,350 |

|

| |

|

|

|

|

|

Adjusted earnings per share - diluted |

1.12 |

|

0.99 |

|

2.02 |

|

1.72 |

|

See the Definitions section of the Q2 2024 MD&A for the

discussion of non-IFRS and other financial measures used and

additional reconciliations of non-IFRS financial measures.

note 1: The net impairment (reversal) of lease assets and

property and equipment includes onerous contracts associated with

the impairment for the quarter ended June 30, 2024 of $1.9 (2023 -

$0.5) and for the two quarters ended June 30, 2024 of $2.0

(2023 - $0.1). For the quarter ended June 30, 2024, this amount is

net of tax of $4.0 (2023 - $0.3). For the two quarters ended

June 30, 2024, this amount is net of tax of $4.2 (2023 -

$(0.4)).

note 2: The add back of intangible amortization relates only to

the amortization from intangible assets acquired through

acquisitions and excludes the amortization of software purchased by

Stantec. For the quarter ended June 30, 2024, this amount is net of

tax of $5.4 (2023 - $4.2). For the two quarters ended June 30,

2024 this amount is net of tax of $10.7 (2023 - $8.4).

note 3: For the quarter ended June 30, 2024, this amount is net

of tax of $(0.4) (2023 - $(0.7)). For the two quarters ended

June 30, 2024 this amount is net of tax of $(0.8) (2023-

$(1.6)).

note 4: The add back of certain administrative and marketing

costs and depreciation primarily related to acquisition and

integration expenses associated with our acquisitions and

restructuring costs. For the quarter ended June 30, 2024, this

amount is net of tax of $3.2 (2023 - $2.5). For the two quarters

ended June 30, 2024, this amount is net of tax of $5.1 (2023-

$4.5).

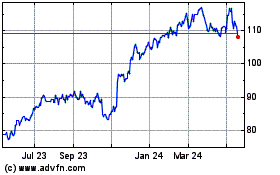

Stantec (TSX:STN)

Historical Stock Chart

From Feb 2025 to Mar 2025

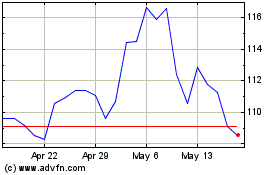

Stantec (TSX:STN)

Historical Stock Chart

From Mar 2024 to Mar 2025