Supremex Announces Normal Course Issuer Bid

29 August 2023 - 10:00PM

Supremex Inc. (“Supremex” or the “Company”) (TSX: SXP), a leading

North American manufacturer and marketer of envelopes and a growing

provider of paper-based packaging solutions, today announced that

it has received approval from the Toronto Stock Exchange (the

“TSX”) to purchase by way of a normal course issuer bid (“NCIB”),

for cancellation, up to 1,294,058 of its common shares,

representing approximately 5.0% of its 25,881,169 issued and

outstanding common shares as of August 18, 2023.

Purchases under the NCIB will be made through

the facilities of the TSX and/or alternative trading systems in

Canada, if eligible, in accordance with applicable securities laws

and regulations, over a maximum period of 12 months beginning on

August 31, 2023 and ending on August 30, 2024. The price to be paid

by Supremex for any common share will be the market price at the

time of acquisition. All common shares purchased pursuant to the

NCIB will be cancelled.

The average daily trading volume of Supremex’

common shares over the six completed calendar months prior to the

date hereof, as calculated in accordance with TSX rules, is 39,228

common shares. Accordingly, under TSX rules, Supremex is entitled

to purchase, on any trading day, up to 9,807 common shares,

representing 25% of such average daily trading volume.

In connection with the NCIB, the Company entered

into an automatic share purchase plan. Under the automatic share

purchase plan, the Company’s broker may repurchase common shares

which it would ordinarily not be permitted to due to regulatory

restrictions or self-imposed blackout periods. Purchases will be

made by the Company’s broker based upon the parameters prescribed

by the TSX and applicable Canadian securities laws and the terms of

the parties’ written agreement. The automatic share purchase plan

has been pre-cleared by the TSX and will be implemented effective

as of August 31, 2023.

Supremex believes that, from time to time, the

purchase of its common shares under the NCIB is an appropriate and

desirable use of available cash to increase shareholder value.

From August 31, 2022 to August 18, 2023,

Supremex repurchased 131,700 of its outstanding common shares

through the facilities of the TSX and/or alternative trading

systems in Canada under a normal course issuer bid, at a weighted

average price per share of $4.9346. The TSX had approved the

purchase of 1,301,713 common shares under a normal course issuer

bid over that period.

About Supremex

Supremex is a leading North American

manufacturer and marketer of envelopes and a growing provider of

paper-based packaging solutions. Supremex operates eleven

manufacturing facilities across four provinces in Canada and six

manufacturing facilities in four states in the United States

employing over 1,000 people. Supremex’ growing footprint allows it

to efficiently manufacture and distribute envelope and packaging

solutions designed to the specifications of major national and

multinational corporations, direct mailers, resellers, government

entities, SMEs and solutions providers.

For more information, please visit

www.supremex.com.

|

Contact: |

|

| François Bolduc |

Martin Goulet, M.Sc., CFA |

| Chief Financial Officer and Corporate Secretary |

MBC Capital Markets Advisors |

| investors@supremex.com |

mgoulet@maisonbrison.com |

| 514 595-0555, extension 2316 |

514 731-0000, extension 229 |

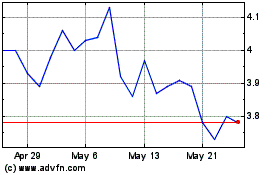

Supremex (TSX:SXP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Supremex (TSX:SXP)

Historical Stock Chart

From Dec 2023 to Dec 2024