Valeura Energy Announces C$10 Million Bought Deal Financing

01 February 2023 - 8:20AM

Valeura Energy Inc. (TSX:VLE) (“

Valeura” or the

“

Company”), the upstream oil and gas company with

assets in the offshore Gulf of Thailand and the Thrace Basin of

Turkey, is pleased to announce that it has entered into an

agreement for a bought deal basis, private placement of 3,937,000

common shares of the Company (the “

Common Shares”)

at a price of C$2.54 per Common Share for aggregate gross proceeds

to the Company of approximately C$10 million (the

“

Offering”). The Offering is being led by Research

Capital Corporation as the sole underwriter and sole bookrunner

(the “

Underwriter”).

The net proceeds from the Offering will be used

to fund the Company’s pre-production operations at the Wassana

field and its Wassana infill drilling programme and for general

corporate purposes.

The closing of the Offering is expected to occur

on or about February 9, 2023 or such later or earlier date as the

Underwriter may determine and is subject to the Company receiving

all necessary regulatory and TSX approvals.

The Offering will be conducted pursuant to the

amendments to National Instrument 45-106 – Prospectus Exemptions

(“NI 45-106”) set forth in Part 5A thereof (the

“Listed Issuer Financing Exemption”) to purchasers

resident in Canada, except Québec, and/or other qualifying

jurisdictions pursuant to the Listed Issuer Financing Exemption.

The Common Shares offered under the Listed Issuer Financing

Exemption will not be subject to resale restrictions pursuant to

applicable Canadian securities laws.

There is an offering document related to the

Listed Issuer Financing Exemption Offering that can be accessed

under the Company’s profile at www.sedar.com and on the Company’s

website at https://www.valeuraenergy.com/. Prospective investors

should read this offering document before making an investment

decision.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy nor shall there be any

sale of any of the securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful. The securities have

not been and will not be registered under the United States

Securities Act of 1933, as amended (the “1933

Act”) or any state securities laws and may not be offered

or sold within the United States or to, or for account or benefit

of, U.S. Persons (as defined in Regulation S under the 1933 Act)

except pursuant to an available exemption under the 1933 Act and

compliance with, or exemption from, applicable U.S. state

securities laws.

| For

further information, please contact: |

|

| |

|

| Valeura Energy Inc. (General Corporate

Enquiries) |

+1 403 237 7102 |

| Sean Guest, President and CEO |

|

| Heather Campbell, CFO |

|

| Contact@valeuraenergy.com |

|

| |

|

| Valeura Energy Inc. (Capital Markets / Investor

Enquiries) |

+1 403 975 6752 |

| Robin James Martin, Investor Relations Manager |

+44 7392 940495 |

| IR@valeuraenergy.com |

|

| |

|

| Research Capital Corporation (Sole Bookrunner and

Underwriter) |

+1 403 750 1280 |

| Kevin Shaw, Managing Director, Investment Banking, Head of

Energy Capital Markets |

|

| kshaw@researchcapital.com |

|

| |

|

| Auctus Advisors LLP (Corporate Broker to

Valeura) |

+44 (0) 7711 627 449 |

| Jonathan Wright |

|

| Valeura@auctusadvisors.co.uk |

|

| |

|

| CAMARCO (Public Relations, Media Adviser to

Valeura) |

+44 (0) 20 3757 4980 |

| Owen Roberts, Billy Clegg |

|

| Valeura@camarco.co.uk |

|

About the Company

Valeura Energy Inc. is a Canada-based public

company engaged in the exploration, development and production of

petroleum and natural gas in Thailand and in Turkey, and is

pursuing further inorganic growth in Southeast Asia.

Additional information relating to Valeura is

also available on SEDAR at www.sedar.com.

Advisory and Caution Regarding Forward-Looking

Information

Certain information included in this new release

constitutes forward-looking information under applicable securities

legislation. Such forward-looking information is for the purpose of

explaining management’s current expectations and plans relating to

the future. Readers are cautioned that reliance on such information

may not be appropriate for other purposes, such as making

investment decisions. Forward-looking information typically

contains statements with words such as “anticipate”, “believe”,

“expect”, “plan”, “intend”, “estimate”, “propose”, “project”,

“target” or similar words suggesting future outcomes or statements

regarding an outlook. Forward-looking information in this new

release includes, but is not limited to: the closing of the

Offering and the timing thereof; the expected use of the net

proceeds from the Offering; and the Company’s business

objectives.

Forward-looking information is based on

management’s current expectations and assumptions regarding, among

other things: regulatory approval for the Offering; the completion

of the Offering; the ability to successfully re-start production

from the Wassana field; the ability to close the acquisition of

Busrakham Oil and Gas Ltd., a subsidiary of Mubadala Energy,

pursuant to the Company’s press release dated December 6, 2022; the

continuation of operations following the COVID-19 pandemic;

political stability of the areas in which the Company is operating;

continued safety of operations and ability to proceed in a timely

manner; continued operations of and approvals forthcoming from

governments and regulators in a manner consistent with past

conduct; future drilling activity on the required/expected

timelines; the prospectivity of the Company’s lands; the continued

favourable pricing and operating netbacks across its business;

future production rates and associated operating netbacks and cash

flow; decline rates; future sources of funding; future economic

conditions; the impact of inflation of future costs; future

currency exchange rates; the ability to meet drilling deadlines and

fulfil commitments under licences and leases and the Company’s

continued ability to obtain and retain qualified staff and

equipment in a timely and cost efficient manner. In addition, the

Company’s work programmes and budgets are in part based upon

expected agreement among joint venture partners and associated

exploration, development and marketing plans and anticipated costs

and sales prices, which are subject to change based on, among other

things, the actual results of drilling and related activity,

availability of drilling, offshore storage and offloading

facilities and other specialised oilfield equipment and service

providers, changes in partners’ plans and unexpected delays and

changes in market conditions. Although the Company believes the

expectations and assumptions reflected in such forward-looking

information are reasonable, they may prove to be incorrect.

Forward-looking information involves significant

known and unknown risks and uncertainties. Exploration, appraisal,

and development of oil and natural gas reserves and resources are

speculative activities and involve a degree of risk. A number of

factors could cause actual results to differ materially from those

anticipated by the Company including, but not limited to: the

ability of management to execute its business plan or realise

anticipated benefits from the Mubadala Acquisition; the risk of

further disruptions from the COVID-19 pandemic; competition for

specialised equipment and human resources; the Company’s ability to

manage growth; the Company’s ability to manage the costs related to

inflation; disruption in supply chains; the risk of currency

fluctuations; changes in interest rates, oil and gas prices and

netbacks; potential changes in joint venture partner strategies and

participation in work programmes; uncertainty regarding the

contemplated timelines and costs for work programme execution; the

risks of disruption to operations and access to worksites;

potential changes in laws and regulations, the uncertainty

regarding government and other approvals; counterparty risk; the

risk that financing may not be available; risks associated with

weather delays and natural disasters; and the risk associated with

international activity. The forward-looking information included in

this new release is expressly qualified in its entirety by this

cautionary statement. See the Company’s most recent AIF and

MD&A for a detailed discussion of the risk factors.

The forward-looking information contained in

this new release is made as of the date hereof and the Company

undertakes no obligation to update publicly or revise any

forward-looking information, whether as a result of new

information, future events or otherwise, unless required by

applicable securities laws. The forward-looking information

contained in this new release is expressly qualified by this

cautionary statement.

Additional information relating to Valeura is

also available on SEDAR at www.sedar.com.

Neither the Toronto Stock Exchange nor

its Regulation Services Provider (as that term is defined in the

policies of the Toronto Stock Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

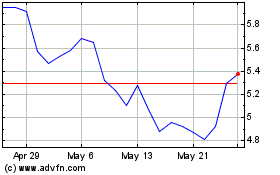

Valeura Energy (TSX:VLE)

Historical Stock Chart

From Dec 2024 to Jan 2025

Valeura Energy (TSX:VLE)

Historical Stock Chart

From Jan 2024 to Jan 2025