THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED

STATES, AUSTRALIA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH IT WOULD BE UNLAWFUL TO DO SO. PLEASE SEE THE

IMPORTANT NOTICES SECTION WITHIN THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT IS FOR INFORMATION

PURPOSES ONLY, AND DOES NOT CONSTITUTE OR FORM PART OF ANY OFFER OR

INVITATION TO SELL OR ISSUE, OR ANY SOLICITATION OF AN OFFER TO

PURCHASE OR SUBSCRIBE FOR, ANY SECURITIES OF AMAROQ MINERALS

LTD.

THIS ANNOUNCEMENT CONTAINS INSIDE

INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION NO

596/2014, WHICH IS PART OF ICELANDIC LAW BY VIRTUE OF THE ACT NO

60/2021 ON MEASURES AGAINST MARKET ABUSE AND ASSIMILATED REGULATION

NO 596/ 2014 AS IT FORMS PART OF THE LAW OF THE UNITED KINGDOM BY

VIRTUE OF THE EUROPEAN (WITHDRAWAL) ACT 2018, AS AMENDED. ON

PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION

SERVICE, THIS INFORMATION IS CONSIDERED TO BE IN THE PUBLIC

DOMAIN.

Amaroq Minerals Ltd.

(“Amaroq” or the “Company”)

Closing of Fundraising and

Admission

TORONTO, ONTARIO – 17 December 2024

– Amaroq Minerals Ltd. (AIM, TSX-V, NASDAQ Iceland: AMRQ),

an independent mining company with a substantial land package of

gold and strategic mineral assets in Southern Greenland, today

announces further to its announcements on 3 and 4 December 2024,

the closing of its fundraising pursuant to which it raised gross

proceeds of approximately £27.5 million (C$49.0 million, ISK 4.8

billion) through a placing of 9,150,927 common shares of the

Company pursuant to the UK Placing, 20,100,648 common shares of the

Company pursuant to the Icelandic Placing, and 2,783,089 common

shares of the Company pursuant to the Canadian Subscription, which

have been issued and will be admitted to trading on AIM, Nasdaq

Iceland’s main market, and the TSX-V. A total of 32,034,664 new

common shares have been placed as part of the Fundraising.

Following admission, Amaroq’s total issued share

capital will consist of 397,694,407 common shares of no par value.

Given the Company does not hold any common shares in Treasury, this

figure may be used by shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in interest in, the share

capital of the Company under the Disclosure Guidance and

Transparency Rules and the Icelandic Act No 20/2021 on Disclosure

Obligations of Issuers and Notifications on Major Holdings.

The Fundraising Shares will be subject to

statutory resale (hold) restrictions for a period of four months

and one day in Canada under the applicable Canadian securities

laws, which will expire on 18 April 2025. Such restrictions shall

not apply to any Fundraising Shares acquired outside of Canada.

Net proceeds from the Fundraising will be used

to strengthen the Company’s working capital position whilst Nalunaq

is in commissioning phase and accelerate growth opportunities

within the Company’s portfolio of assets in Greenland in Greenland.

More specifically, the net proceeds from the Fundraising will be to

fund further resource drilling at Nalunaq to expand resource and

provide mining flexibility, further exploration drilling at Nanoq

to define resource potential and the development opportunity,

investments in mining equipment, other facilities and green energy

production to further optimise operations in Nalunaq, and

advancement of the Company’s strategic portfolio, alongside JV

partners with further target exploration, and to provide additional

working capital.

Amaroq director, Eldur Olafsson, has

participated in the Canadian Subscription, acquiring a total of

582,690 new common shares representing gross proceeds of

approximately £0.50 million (C$0.89 million, ISK 88.2 million) via

Vatnar hf.. Following Admission, Eldur Olafsson will be interested

in a total of 10,084,863 common shares in the capital of the

Company, representing approximately 2.5 per cent. of the Company’s

enlarged issued share capital.

Amaroq director, Sigurbjorn Thorkelsson, has

also participated in the Canadian Subscription, acquiring a total

of 1,165,382 new common shares representing gross proceeds of

approximately £1.00 million (C$1.78 million, ISK 176.4 million) via

Klettar fjarfestingar ehf.. Following Admission, Sigurbjorn

Thorkelsson will be interested in a total of 12,037,640 common

shares in the capital of the Company, representing approximately

3.0 per cent. of the Company’s enlarged issued share capital.

Amaroq director, David Neuhauser, has also

participated in the Canadian Subscription, acquiring a total of

116,538 new common shares representing gross proceeds of

approximately £0.10 million (C$0.18 million, ISK 17.6 million) via

Livermore Strategic Opportunities LP. Following Admission, David

Neuhauser will be interested in a total of 14,738,462 common shares

in the capital of the Company, representing approximately 3.7 per

cent. of the Company’s enlarged issued share capital.

As such, the Canadian Subscriptions will

constitute a "related party transaction" within the meaning of

Multilateral Instrument 61-101 – Protection of Minority Security

Holders in Special Transactions ("MI 61-101") and within the

meaning of Policy 5.9 of the TSX-V rules.

Related party transactions require the Company

to obtain a formal valuation and minority shareholder approval

unless exemptions from these requirements are available under

applicable Canadian securities laws. With respect to the Canadian

Subscription, the Company is relying on the exemption from the

formal valuation requirements and minority approval requirements in

sections 5.5(a) and 5.7(1)(a), respectively, of MI 61-101, as the

fair market value of the securities distributed to, and the

consideration received from, interested parties does not exceed 25%

of the Company's market capitalization. The Company did not file a

material change report at least 21 days prior to the closing of the

Canadian Subscription as participation of the insiders had not been

confirmed at that time and the Company wishes to close on an

expedited basis for business reasons.

Panmure Liberum acted as nominated adviser,

joint bookrunner and joint broker, alongside Canaccord, who also

acted as joint bookrunner and joint broker on the UK Placing.

Landsbankinn, Acro and Fossar acted as joint bookrunners on the

Icelandic Placing and Landsbankinn acted as underwriter. In

consideration for their services, Panmure Liberum, Canaccord,

Landsbankinn, Acro and Fossar received a cash commission equal to

C$1,857,555.23, consisting of (i) a total of C$274,003.23

(£154,098.88) to Panmure Liberum and Canaccord representing a 4.0%

base commission, 1.0% discretionary commission and a 0.25%

settlement commission for the UK placing, including a corporate

finance fee of C$124,467.00 (£70,000.00) payable to Panmure Liberum

and (ii) a total of C$1,049,841.00 to Landsbankinn, Acro and

Fossar, representing a total of 3.4% commission for the Icelandic

Placing, in addition to a C$533,711.00 underwriting fee payable to

Landsbankinn.

The Fundraising is subject to final acceptance

of the TSX-V.

Capitalised terms not otherwise defined in the

text of this announcement have the meanings given in the Company’s

Fundraising announcement dated 3 December 2024.

Enquiries:

Amaroq Minerals

Ltd. Eldur

Olafsson, Executive Director and CEOeo@amaroqminerals.com

Eddie Wyvill, Corporate Development+44

(0)7713 126727ew@amaroqminerals.com

Panmure Liberum Limited (Nominated Adviser, Joint

Bookrunner and Corporate Broker)Scott MathiesonNikhil

VargheseKieron HodgsonJosh Moss+44 (0) 20 7886 2500

Canaccord Genuity Limited (Joint Bookrunner and

Corporate Broker)James AsensioHarry ReesGeorge Grainger+44

(0) 20 7523 8000

Landsbankinn hf. (Joint Bookrunner and

Underwriter)Björn HákonarsonSigurður Kári Tryggvason+354

410 4000

Acro verðbréf hf. (Joint Bookrunner)Hannes

ÁrdalÞorbjörn Atli Sveinsson+354 532 8000

Fossar Investment Bank hf. (Joint

Bookrunner)Steingrímur Arnar FinnssonKristín Alexandra

Gísladóttir+354 522 4000

Camarco (Financial PR)Billy CleggElfie

KentFergus Young+44 (0) 20 3757 4980

IMPORTANT NOTICES

This Announcement does not constitute, or form

part of, a prospectus relating to the Company, nor does it

constitute or contain an invitation or offer to any person, or any

public offer, to subscribe for, purchase or otherwise acquire any

shares in the Company or advise persons to do so in any

jurisdiction, nor shall it, or any part of it form the basis of or

be relied on in connection with any contract or as an inducement to

enter into any contract or commitment with the Company.

This Announcement is not for publication or

distribution, directly or indirectly, in or into the United States

of America, Australia, The Republic of South Africa (“South

Africa”), Japan or any other jurisdiction in which such release,

publication or distribution would be unlawful. This Announcement is

for information purposes only and does not constitute an offer to

sell or issue, or a solicitation of an offer to buy, subscribe for

or otherwise acquire any securities in the United States (including

its territories and possessions, any state of the United States and

the District of Columbia (collectively, the “United States”)),

Iceland, Australia, Canada, South Africa, Japan or any other

jurisdiction in which such offer or solicitation would be unlawful

or to any person to whom it is unlawful to make such offer or

solicitation.

The securities referred to herein have not been

and will not be registered under the U.S. Securities Act of 1933,

as amended (the “Securities Act”), and may not be offered or sold

in the United States, except pursuant to an applicable exemption

from the registration requirements of the Securities Act and in

compliance with any applicable securities laws of any state or

other jurisdiction of the United States, or under the securities

laws of Iceland, Australia, Canada, South Africa, Japan, or any

state, province or territory thereof or any other jurisdiction

outside the United Kingdom, except pursuant to an applicable

exemption from the registration requirements and in compliance with

any applicable securities laws of any state, province or other

jurisdiction of Iceland, Australia, Canada, South Africa or Japan

(as the case may be). No public offering of securities is being

made in the United States, Iceland, Australia, Canada, South

Africa, Japan or elsewhere.

No action has been taken by the Company, Panmure

Liberum, Canaccord, Landsbankinn, Acro, Fossar or any of their

respective affiliates, or any of its or their respective directors,

officers, partners, employees, consultants, advisers and/or agents

(collectively, “Representatives”) that would permit an offer of the

Fundraising Shares or possession or distribution of this

Announcement or any other publicity material relating to such

Fundraising Shares in any jurisdiction where action for that

purpose is required. Persons receiving this Announcement are

required to inform themselves about and to observe any restrictions

contained in this Announcement. Persons (including, without

limitation, nominees and trustees) who have a contractual or other

legal obligation to forward a copy of this Announcement should seek

appropriate advice before taking any action. Persons distributing

any part of this Announcement must satisfy themselves that it is

lawful to do so.

This Announcement, as it relates to the UK

Placing, is directed at and is only being distributed to: (a) if in

a member state of the EEA, persons who are qualified investors

(“EEA Qualified Investors”), being persons falling within the

meaning of Article 2(e) of Regulation (EU) 2017/1129 (the “EU

Prospectus Regulation”); or (b) if in the United Kingdom, persons

who are qualified investors (“UK Qualified Investors”), being

persons falling within the meaning of Article 2(e) of assimilated

Regulation (EU) 2017/1129 as it forms part of the law of the United

Kingdom by virtue of the European Union (Withdrawal) Act 2018, as

amended (the “UK Prospectus Regulation”), and who are (i) persons

falling within the definition of “investment professional” in

Article 19(5) of the Financial Services And Markets Act 2000

(Financial Promotion) Order 2005, as amended (the “Order”) or (ii)

persons who fall within Article 49(2)(a) to (d) (high net worth

companies, unincorporated associations, etc.) of the Order, or (c)

persons to whom it may otherwise be lawfully communicated (all such

persons referred to in (a), (b) and (c) together being referred to

as “Relevant Persons”).

The Fundraising Shares have not been qualified

for distribution by prospectus in Canada and may not be offered or

sold in Canada except in reliance on exemptions from the

requirements to provide the relevant purchaser with a prospectus

and, as a consequence of acquiring securities pursuant to this

exemption or exemptions, certain protections, rights and remedies

provided by the applicable Canadian securities laws will not be

available to the relevant purchaser. The Fundraising Shares will be

subject to statutory resale (hold) restrictions for a period of

four months and one day in Canada under the applicable Canadian

securities laws and any resale of the Common Shares must be made in

accordance with such resale restrictions or in reliance on an

available exemption therefore. Such restrictions shall not apply to

any Fundraising Shares acquired outside of Canada.

For the attention of residents of Australia:

This Announcement is not a prospectus or product disclosure

statement or otherwise a disclosure document for the purposes of

Chapter 6D or Part 7.9 of the Australian Corporations Act 2001

(Cth) (“Corporations Act”) and does not constitute an offer, or an

invitation to purchase or subscribe for the Fundraising Shares

offered by this Announcement except to the extent that such an

offer or invitation would be permitted under Chapter 6D or Part 7.9

of the Corporations Act without the need for a lodged prospectus or

product disclosure statement. In addition, for a period of 12

months from the date of issue of the Fundraising Shares, no

transfer of any interest in the Fundraising Shares may be made to

any person in Australia except to “sophisticated investors” or

“professional investors” within the meaning of sections 708(8) and

(11) of the Corporations Act or otherwise in accordance with

section 707(3) of the Corporations Act.

No other person should act on or rely on this

Announcement as it relates to the UK Placing and persons

distributing this Announcement must satisfy themselves that it is

lawful to do so. By accepting the terms of this Announcement, you

represent and agree that you are a Relevant Person. This

Announcement must not be acted on or relied on by persons who are

not Relevant Persons. Any investment or investment activity to

which this Announcement or the Fundraising relates is available

only to Relevant Persons and will be engaged in only with Relevant

Persons.

No offering document or prospectus will be made

available in any jurisdiction in connection with the matters

contained or referred to in this Announcement or the UK Placing or

the Fundraising, unless applicable in relation to admission to

trading in Iceland and no such prospectus is required (in

accordance with either the EU Prospectus Regulation for the purpose

of the offer or sale of the Common Shares, the UK Prospectus

Regulation or Canadian securities laws) to be published. The

offering as it relates to the Icelandic Placing is subject to the

exemptions from the obligation to publish a prospectus provided for

in Articles 1(4)(a) and 1(4)(b) of the EU Prospectus

Regulation.

Panmure Liberum, which is authorised and

regulated by the Financial Conduct Authority in the United Kingdom

is acting exclusively for the Company and for no one else in

connection with the UK Placing and will not regard any other person

(whether or not a recipient of this Announcement) as a client in

relation to the UK Placing and will not be responsible to anyone

other than the Company in connection with the UK Placing or for

providing the protections afforded to their clients or for giving

advice in relation to the UK Placing, the Fundraising or any other

matter referred to in this Announcement. The responsibilities of

Panmure Liberum, as nominated adviser, are owed solely to the

London Stock Exchange and are not owed to the Company or to any

director or any other person and accordingly no duty of care is

accepted in relation to them. No representation or warranty,

express or implied, is made by Panmure Liberum as to, and no

liability whatsoever is accepted by Panmure Liberum in respect of,

any of the contents of this Announcement (without limiting the

statutory rights of any person to whom this Announcement is

issued).

Canaccord, which is authorised and regulated by

the Financial Conduct Authority in the United Kingdom is acting

exclusively for the Company and for no one else in connection with

the UK Placing and will not regard any other person (whether or not

a recipient of this Announcement) as a client in relation to the UK

Placing and will not be responsible to anyone other than the

Company in connection with the UK Placing or for providing the

protections afforded to their clients or for giving advice in

relation to the UK Placing, the Fundraising or any other matter

referred to in this Announcement.

Acro, which is authorised and regulated by the

Financial Supervisory Authority of the Central Bank of Iceland, is

acting exclusively for the Company and for no one else in

connection with the Icelandic Placing and will not regard any other

person (whether or not a recipient of this Announcement) as a

client in relation to the Icelandic Placing and will not be

responsible to anyone other than the Company in connection with the

Icelandic Placing or for providing the protections afforded to

their clients or for giving advice in relation to the Icelandic

Placing, the Fundraising or any other matter referred to in this

Announcement. Some Icelandic Placees may however be customers of

Acro.

Fossar, which is authorised and regulated by the

Financial Supervisory Authority of the Central Bank of Iceland, is

acting exclusively for the Company and for no one else in

connection with the Icelandic Placing and will not regard any other

person (whether or not a recipient of this Announcement) as a

client in relation to the Icelandic Placing and will not be

responsible to anyone other than the Company in connection with the

Icelandic Placing or for providing the protections afforded to

their clients or for giving advice in relation to the Icelandic

Placing, the Fundraising or any other matter referred to in this

Announcement. Some Icelandic Placees may however be customers of

Fossar.

Landsbankinn, which is authorised and regulated

by the Financial Supervisory Authority of the Central Bank of

Iceland, is acting exclusively for the Company and for no one else

in connection with the Icelandic Placing and will not regard any

other person (whether or not a recipient of this Announcement) as a

client in relation to the Icelandic Placing and will not be

responsible to anyone other than the Company in connection with the

Icelandic Placing or for providing the protections afforded to

their clients or for giving advice in relation to the Icelandic

Placing, the Fundraising or any other matter referred to in this

Announcement. Some Icelandic Placees may however be customers of

Landsbankinn.

This Announcement is being issued by and is the

sole responsibility of the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by or on

behalf of Panmure Liberum, Canaccord, Landsbankinn, Acro and/or

Fossar (apart from in the case of Panmure Liberum and Canaccord the

responsibilities or liabilities that may be imposed by the

Financial Services and Markets Act 2000, as amended (“FSMA”) or the

regulatory regime established thereunder) and/or by any of their

respective affiliates and/or any of their respective

Representatives as to, or in relation to, the accuracy, adequacy,

fairness or completeness of this Announcement or any other written

or oral information made available to or publicly available to any

interested party or their respective advisers or any other

statement made or purported to be made by or on behalf of Panmure

Liberum, Canaccord, Landsbankinn, Acro and/or Fossar and/or any of

their respective affiliates and/or by any of their respective

Representatives in connection with the Company, the UK Placing

Shares, the UK Placing, the Common Shares or any part of the

Fundraising and any responsibility and liability whether arising in

tort, contract or otherwise therefor is expressly disclaimed. No

representation or warranty, express or implied, is made by Panmure

Liberum, Canaccord, Landsbankinn, Acro and/or Fossar and/or any of

their respective affiliates and/or any of their respective

Representatives as to the accuracy, fairness, verification,

completeness or sufficiency of the information or opinions

contained in this Announcement or any other written or oral

information made available to or publicly available to any

interested party or their respective advisers, and any liability

therefor is expressly disclaimed.

The information in this Announcement may not be

forwarded or distributed to any other person and may not be

reproduced in any manner whatsoever. Any forwarding, distribution,

reproduction or disclosure of this Announcement, in whole or in

part, is not authorised. Failure to comply with this directive may

result in a violation of the Securities Act or the applicable laws

of other jurisdictions.

This Announcement does not constitute a

recommendation concerning any investor’s options with respect to

the UK Placing or any part of the Fundraising. Recipients of this

Announcement should conduct their own investigation, evaluation and

analysis of the business, data and other information described in

this Announcement. This Announcement does not identify or suggest,

or purport to identify or suggest, the risks (direct or indirect)

that may be associated with an investment in the UK Placing Shares

or the Common Shares. The price and value of securities can go down

as well as up and investors may not get back the full amount

invested upon the disposal of the shares. Past performance is not a

guide to future performance. The contents of this Announcement are

not to be construed as legal, business, financial or tax advice.

Each investor or prospective investor should consult his or her or

its own legal adviser, business adviser, financial adviser or tax

adviser for legal, business, financial or tax advice.

Any indication in this Announcement of the price

at which the Company’s shares have been bought or sold in the past

cannot be relied upon as a guide to future performance. Persons

needing advice should consult an independent financial adviser. No

statement in this Announcement is intended to be a profit forecast

or profit estimate for any period and no statement in this

Announcement should be interpreted to mean that earnings, earnings

per share or income, cash flow from operations or free cash flow

for the Company for the current or future financial periods would

necessarily match or exceed the historical published earnings,

earnings per share or income, cash flow from operations or free

cash flow for the Company.

All offers of the Fundraising Shares will be

made pursuant to an exemption under the EU Prospectus Regulation

and the UK Prospectus Regulation from the requirement to produce a

prospectus. This Announcement is being distributed and communicated

to persons in the United Kingdom only in circumstances in which

section 21(1) of FSMA does not apply.

The Fundraising Shares to be issued pursuant to

the Fundraising will not be admitted to trading on any stock

exchange other than AIM, the TSX-V and the Icelandic Exchange.

Neither the TSX-V nor its Regulation Services

Provider (as that term is defined in the policies of the TSX-V)

accepts responsibility for the adequacy or accuracy of this

release.

Forward-Looking Information

This Announcement includes statements that are,

or may be deemed to be, “forward-looking statements”. In some

cases, these forward-looking statements can be identified by the

use of forward-looking terminology, including the terms “aims”,

“anticipates”, “believes”, “could”, “envisages”, “estimates”,

“expects”, “intends”, “may”, “plans”, “projects”, “should”,

“targets” or “will” or, in each case, their negative or other

variations or comparable terminology. By their nature,

forward-looking statements involve risks and uncertainties because

they relate to events and depend on circumstances that may or may

not occur in the future and factors which are beyond the Company’s

control. The actual results, performance or achievements of the

Company or developments in the industry in which the Company

operates may differ materially from the future results, performance

or achievements or industry developments expressed or implied by

the forward-looking statements contained in this Announcement. The

forward-looking statements contained in this Announcement speak

only as at the date of this Announcement. The Company undertakes no

obligation to update or revise publicly the forward-looking

statements contained in this Announcement, except as required in

order to comply with its legal and regulatory obligations.

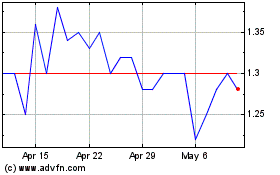

Amaroq Minerals (TSXV:AMRQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Amaroq Minerals (TSXV:AMRQ)

Historical Stock Chart

From Dec 2023 to Dec 2024