BlueRush Pleased to Announce Signing of Master Services Agreements with Two Global Insurance Companies

12 May 2023 - 7:00AM

BlueRush Inc. ("

BlueRush" or the

"

Company") (TSXV:BTV; OTCQB:BTVRF), a

pioneering personalized video Software as a Service

("

SaaS") company, today announced the signing of

master service agreements (MSA) with two global insurance companies

after successful pilot projects.

“The Insurance vertical continues to be a growth

area for BlueRush and our IndiVideo platform. We are pleased to be

adding new customers in this vertical and have proven that we can

grow these relationships significantly beyond the initial

subscription value,” said Steve Taylor, CEO of BlueRush.

The combined value of these initial subscription

contracts is $75,000. The average growth rate of BlueRush’s top

enterprise accounts in the financial services vertical is

approximately 700% from the opening ARR value to current ARR

achieved in an average of 3.2 years. “While past and average

results are not necessarily indicative of future results, our

customer success and service delivery teams do an excellent job

working with our customers to ensure that their business objectives

are met and exceeded which lays the foundation for this kind of

growth in key accounts,” continued Taylor. “We recently reported

that one of our insurance customers has achieved a 500% sales lift

year over year after introducing IndiVideo to help upsell Term Life

clients to a Whole Life product. This type of result is what

continues to drive our success and is testimony to the power of

IndiVideo.”

To maintain an effective incentive equity

program focussed on retention and attraction, the board of

directors of BlueRush has approved amending the exercise price of

existing stock options held by certain employees and consultants of

the Company (the “Existing Options”), exercisable

for up to an aggregate of 825,000 common shares of the Company, to

$0.08. The Existing Options were originally issued between June

2019 and May 2022, have exercise prices ranging from $0.25 to $0.80

and expire between June 2024 and May 2027. None of the Existing

Options are held by Insiders (as such term is defined by the TSX

Venture Exchange (the “Exchange”)). The amendments

remain subject to Exchange approval pursuant to Exchange Policy

4.4.

In addition, the board of directors of the

Company have granted stock options to officers, directors and

employees of the Company exercisable for up to an aggregate of

2,695,000 common shares of the Company at $0.08 per share for

five years. All options will vest over three years with the

initial vesting after 12 months. Options granted to officers and

directors are subject to an Exchange four-month hold.

About BlueRush

BlueRush develops and markets IndiVideo™, a

disruptive, award-winning interactive personalized video platform

that drives return on investment throughout the customer lifecycle,

from increased conversions to more engaging statements and

customer care. IndiVideo enables BlueRush clients to capture

knowledge and data from their customers' video interaction,

creating new and compelling data driven customer insights. For

more information visit https://www.bluerush.com.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For further information please contact:

Steve TaylorChief Executive OfficerBlueRush

Inc.Tel: 416-457-9391Email: steve.taylor@bluerush.com

Kendra BorutskiDirector of MarketingBlueRush

Inc.Email: kendra.borutski@bluerush.com

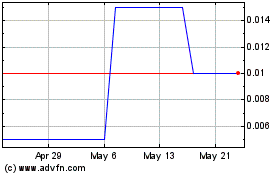

BlueRush (TSXV:BTV)

Historical Stock Chart

From Nov 2024 to Dec 2024

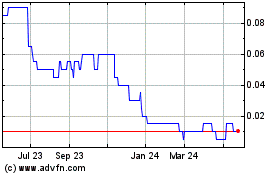

BlueRush (TSXV:BTV)

Historical Stock Chart

From Dec 2023 to Dec 2024