Copper Fox Announces Second Quarter Results

19 June 2014 - 6:30AM

Marketwired Canada

Copper Fox Metals Inc. ('Copper Fox' or the 'Company') (TSX VENTURE:CUU) is

pleased to announce its second quarter operating and financial results as well

as a summary of activities completed during the quarter. Copper Fox had a net

loss for the quarter of $768,651 ($0.00 income per share). The Company also

incurred $795,304 in expenditures toward furthering the exploration of its Van

Dyke copper project in Arizona. Copies of the financial statements, notes and

related management discussion and analysis may be obtained on SEDAR at

www.sedar.com, the Company web site at www.copperfoxmetals.com or by contacting

the Company directly. The technical information provided in this news release

has been previously disclosed and are available on SEDAR. All amounts are in

Canadian dollars unless otherwise stated.

Highlights:

Schaft Creek Project

During the quarter, the results for the 2013 Schaft Creek Joint Venture

exploration and geotechnical program were released. The objectives of the

program were achieved in that mineralization was intersected approximately 300

metres ('m') east of the 2012 resource block model in the Paramount zone and

also to the west. Results of the geotechnical studies to provide updated data on

slope stability were positive.

The Schaft Creek Joint Venture approved a 2014 program consisting of a

comprehensive series of studies to review all aspects (including metallurgical,

pit slope design, geological modelling and environmental) of the Schaft Creek

project and to update and optimize various parameters with a goal to improving

the economics of the Schaft Creek deposit. In addition to the ongoing

optimization work; a field program of mapping and core re-logging is planned to

collect additional structural information for pit slope design purposes and to

update the geological model for the Schaft Creek deposit. The geological

modelling on Schaft Creek could have implications on the potential size of this

deposit as well as provide indicators that would aid future exploration on the

other targets identified within the Schaft Creek property. Environmental

monitoring studies will also continue through 2014. The 2014 Schaft Creek

program is estimated to cost approximately $2.5 million.

Van Dyke Copper Project

During the quarter, the diamond drilling program (6-8 holes approximately

5,000m) to verify the historical estimate completed by Occidental in the 1970's

commenced. Contracts were also executed with various contactors to review the

historical data and provide input on the geotechnical, metallurgical,

hydrogeological, environmental and resource aspects of the oxide portion of the

Van Dyke copper deposit.

Drilling Activities:

The first drill hole (DDH VD2014-01) of the verification drilling program was

completed to a depth of 639.3metres (2,097 feet) and intersected a 167m metre

thick zone with visible oxide copper minerals in the Pinal Schist and a lower

interval of sulphide mineralization (from 338.8m to end of hole at 639.3m)

consisting of vein and fracture controlled chalcopyrite-molybdenite

mineralization hosted in the Pinal Schist and a granodiorite/quartz monzonite

porphyry. This hole was terminated in weak chalcopyrite-molybdenite

mineralization. A second diamond drill has been added to the Van Dyke drilling

program to reduce the time required to complete the verification drilling

program and lower costs associated with the drilling.

Corporate Investments

In line with the Corporate strategy to acquire equity or working interest in

copper projects in North America, subsequent to the quarter, Copper Fox through

its wholly owned subsidiary Northern Fox Copper Inc. ('Northern Fox'), on May

29, 2014, closed a non-brokered private placement, for 20,000,000 units of

Carmax Mining Corp. ('Carmax') (TSX VENTURE:CXM) for an aggregate subscription

price of $1,000,000. Units (each a "Unit") were subscribed for a price of $0.05

per Unit and consist of one previously unissued common share of Carmax and one

common share purchase warrant ('Warrant'). Northern Fox owns approximately 38.9%

of the shares of Carmax. Each Warrant is exercisable until May 29, 2016 and

entitles Northern Fox, on exercise, to purchase one additional common share of

Carmax at a price of $0.075 per share.

In connection with the private placement, Carmax has granted Northern Fox

certain rights, including, but not limited to:

-- The right to nominate two members to the Board of Carmax at each annual

meeting of Carmax's shareholders;

-- The pre-emptive right to participate in any equity financing of Carmax,

so as to maintain its pro rata percentage shareholding in Carmax; and

-- The right to make top-up investments in Carmax, by way of future private

placements, so as to maintain its pro rata percentage shareholding in

Carmax.

The aforementioned rights are, however, subject to Copper Fox and its affiliates

maintaining ownership of 20% of Carmax's issued and outstanding common shares.

Sombrero Butte Copper Project

During the quarter, an archeological survey was completed and approval was

received from regulatory agencies to complete a geophysical survey over a

portion of the project. The proposed survey would cover that areas of the

project that host multiple mineralized breccia pipes as well as altered,

mineralized intrusive rocks (see news release dated March 19, 2014).

In addition to the above work, efforts commenced to acquire the historical

exploration data collected by various exploration/production companies that may

have explored this area for porphyry copper style mineralization in the late

1960's and early 1970's.

Selected Financial Results

-----------------------------------------------------------------------------

Net

(loss)/income

per share -

basic and

Net Loss diluted

-----------------------------------------------------------------------------

2014

---------------------------------------------

Second Quarter $ (768,651) $ 0.00

First Quarter $ (182,095) $ 0.00

2013

---------------------------------------------

Fourth Quarter $ (636,715) $ 0.00

Third Quarter $ 3,117,445 $ 0.01

Second Quarter $ (697,664) $ 0.00

First Quarter $ (525,595) $ 0.00

2012

---------------------------------------------

Fourth Quarter $ (812,324) $ 0.00

Third Quarter $ (1,328,328) $ 0.00

-----------------------------------------------------------------------------

Liquidity and Capital Resources

At April 30, 2014, the Company had working capital of $10,428,020 and a deficit

of $16,916,533 and had a net loss and comprehensive loss of $948,089 for the six

months ended April 30, 2014.

About Copper Fox

Copper Fox is a Canadian based resource company listed on the TSX-Venture

Exchange (TSX VENTURE:CUU) with offices in Calgary, Alberta and Miami, Arizona.

Copper Fox holds a 25% interest in a joint venture (the 'Schaft Creek Joint

Venture') with Teck Resources Limited ('Teck') on the Schaft Creek

copper/gold/molybdenum/silver project located in northwestern British Columbia.

On January 23, 2013, a National Instrument 43-101 Technical Report was prepared

by Tetra Tech under the direction of Copper Fox comprising a feasibility study

of a 130,000 tonne per day-open pit mine with a Proven and Probable Reserve of

940.8 million tonnes grading 0.27% copper, 0.19 g/t gold, 0,018% molybdenum and

1.72 g/t silver; (recoverable CuEq 0.40 over a 21 year mine life with contained

metal of 5,611.7 million pounds of copper, 5.8 million ounces of gold, 363.5

million pounds of molybdenum and 51.7 million ounces of silver.

The Schaft Creek deposit host a Measured and Indicated Resource of 1,228.6

tonnes grading 0.26% copper, 0.017% molybdenum, 0.19 g/t gold and 1.69 g/t

silver and a 597.2 million tonne Inferred Resource grading 0.22% copper, 0.016%

molybdenum, 0.17 g/t gold and 1.65 g/t silver. The above stated Proven and

Probable Reserves for the Schaft Creek project are included within the stated

Measured, Indicated and Inferred Resources for this project.

In addition to Copper Fox's 25% interest in the Schaft Creek Joint Venture,

Copper Fox holds through Desert Fox Copper Inc. (a wholly owned subsidiary of

Copper Fox) and its wholly-owned subsidiaries, 100% interest in the Sombrero

Butte copper project in the Bunker Hill Mining District, Arizona and the Van

Dyke oxide copper project in the Globe-Miami Mining District, Arizona. Desert

Fox Copper Inc. has opened an operations office in Miami, Arizona to complete

the work required with the objective of completing a Preliminary Economic

Assessment on the Van Dyke copper project. Copper Fox holds through Northern

Copper (a wholly owned subsidiary of Copper Fox) a 40% equity interest in Carmax

Mining Corp. who in turn, owns 100% of the Eaglehead copper/gold/molybdenum

project located in northwestern British Columbia. For further information on

these projects, please refer to the Company's website at

www.copperfoxmetals.com.

On behalf of the Board of Directors

Elmer B. Stewart, President and Chief Executive Officer

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking statements" and "forward-looking

information" (collectively, "forward-looking information") within the meaning of

applicable securities laws. Forward-looking information is generally

identifiable by use of the words "believes," "may," "plans," "will,"

"anticipates," "intends," "budgets", "could", "estimates", "expects",

"forecasts", "projects" and similar expressions, and the negative of such

expressions. Forward-looking information in this MD&A includes statements about

Desert Fox's future exploration/development activities as well as any equity or

working interest acquired in other significant copper projects in North America;

the utilization of unallocated cash to advance Arizona copper assets (with the

majority of effort on the Van Dyke oxide copper deposit); historical data on the

Van Dyke deposit; the efficacy of in-situ recovery method (with respect to the

environment, lower capital costs and low operating costs); Desert Fox's

objective (including timing) to complete the work required to prepare a

Preliminary Economic Assessment technical report on the Van Dyke project to

estimate a preliminary valuation; timing of the finalization of the 2014 plans

for the Schaft Creek project; the recommendation of a program of optimization

studies as well as a field program to update the geological model and better

define certain parameters of the Schaft Creek project; the program to verify the

historical results from the Van Dyke oxide copper deposit and the completion of

a NI 43-101 compliant resource estimation for the Van Dyke copper deposit;

collection of hydro geological, metallurgical and geotechnical data required for

a Preliminary Economic Assessment on the Van Dyke project; a follow-up 25 hole

drilling program for the Van Dyke deposit; timing of the expected drilling

program on the Van Dyke project; the upgrade of the Van Dyke historical estimate

as a current mineral resource; objective on the Sombrero Butte project to assess

its potential to host a large porphyry copper-molybdenum deposit; plans for a

deep penetrating geophysical survey (Induced Polarization) to identify

chargeability/resistivity anomalies indicative of porphyry copper systems at the

Sombrero Butte project; expected capital requirements to continue planned

activities; expected capital requirements to continue planned activities;

expected sources and the adequacy of required capital resources; geological

interpretations and potential mineral recovery processes.

In connection with the forward-looking information contained in this News

Release, Copper Fox has made numerous assumptions, regarding, among other

things: the geological, metallurgical, engineering, financial and economic

advice that Copper Fox has received is reliable, and is based upon practices and

methodologies which are consistent with industry standards; and the continued

financing of Copper Fox and Desert Fox's operations. While Copper Fox considers

these assumptions to be reasonable, these assumptions are inherently subject to

significant uncertainties and contingencies. Additionally, there are known and

unknown risk factors which could cause Copper Fox's actual results, performance

or achievements to be materially different from any future results, performance

or achievements expressed or implied by the forward-looking information

contained herein. Known risk factors include: the Schaft Creek Joint Venture may

not result in a Production Decision being made, or the construction of a mine;

further exploration and development of the Schaft Creek property may not occur

as expected; cash payments to Copper Fox may not be paid by Teck in the quantum

or timing expected, or at all; financing commitments may not be sufficient to

advance the Schaft Creek project as expected, or at all; proven and probable

reserves at Schaft Creek may not be in the quantum as currently expected, or

result in economic mining thereof; the possibility that future obligations with

respect to the Sombrero Butte property may not be met on a timely basis, or at

all; planned activities for the Van Dyke and Sombrero Butte properties many not

commence as currently planned, or at all; a current (43-101 compliant) resource

estimate, and a Preliminary Economic Assessment may never be obtained by the

Company for the Van Dyke property; fluctuations in metal prices and currency

exchange rates; conditions in the financial markets and overall economy may

continue to deteriorate; uncertainties relating to interpretation of drill

results and the geology, continuity and grade of mineral deposits; uncertainty

of the metallurgical testwork; the uncertainty of the estimates of capital and

operating costs, recovery rates, and estimated economic return; the need to

obtain additional financing and uncertainty as to the availability and terms of

future financing; the possibility of delay in exploration or development

programs; and uncertainty of meeting anticipated program milestones.

A more complete discussion of the risks and uncertainties facing Copper Fox is

disclosed in Copper Fox's continuous disclosure filings with Canadian securities

regulatory authorities at www.sedar.com. All forward-looking information herein

is qualified in its entirety by this cautionary statement, and Copper Fox

disclaims any obligation to revise or update any such forward-looking

information or to publicly announce the result of any revisions to any of the

forward-looking information contained herein to reflect future results, events

or developments, except as required by law.

FOR FURTHER INFORMATION PLEASE CONTACT:

Copper Fox Metals Inc.

Investor line

1-844-464-2820

www.copperfoxmetals.com

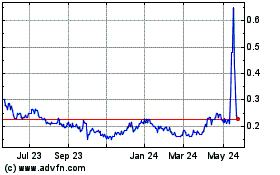

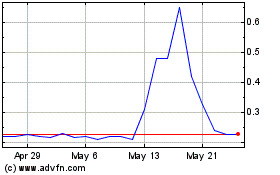

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From Apr 2024 to May 2024

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From May 2023 to May 2024