Euro Manganese Inc. (TSX-V and ASX: EMN; OTCQB: EUMNF; Frankfurt:

E06) (the "

Company" or "

EMN")

announces that, effective November 12, 2024 Vancouver time, Martina

Blahova, the Company’s current Chief Financial Officer, has been

appointed as Interim Chief Executive Officer. Ms Blahova will

replace Dr. Matthew James who has resigned as Chief Executive

Officer and director of the Company. Euro Manganese's Board will

conduct a search for a new Chief Executive Officer.

Ms. Blahova joined Euro Manganese in 2018 as

Corporate Controller and has served as Chief Financial Officer

since January 2020. Prior to joining the Company, Ms. Blahova was

Manager of Financial Reporting at SSR Mining Inc., a global

precious metals producer. She also worked in accounting consultancy

and was Manager of Financial Planning and Analysis for the Czech

subsidiary of Rheinmetall Group AG, a global supplier to the

automotive and defence industries. Ms. Blahova was previously at

PricewaterhouseCoopers in increasingly senior roles, having worked

at the firm’s Prague (CZ) and Reading (UK) offices. She received

her ACCA (UK) qualification while working at the Prague office of

Ernst & Young. Ms. Blahova is a Fellow Certified Chartered

Accountant in the UK and a Chartered Professional Accountant (CGA)

in Canada. She has a Master of Economics degree, specializing in

international trade, from the University of Economics in Prague,

and a Master of International Business from the Université

d'Orléans, France.

Euro Manganese also announces that Dean Larocque

has been appointed as the Company’s new Chief Financial Officer

effective November 12, 2024, replacing Ms. Blahova who is stepping

into the Interim CEO role. Mr. Larocque is a seasoned finance

professional and a Chartered Professional Accountant (CPA) in

Canada and a Certified Professional Accountant (CPA) in the United

States (Oregon, Nevada, Alaska). He has over 30 years of

experience, including an 18-year tenure as a Senior Assurance

Partner at PwC. Mr. Larocque has substantial experience in initial

public offerings, mergers and acquisitions, due diligence, all

forms of financing, dual listings, and mining and public

company-specific accounting, regulatory and controls issues. In

addition to his CPA certifications, Mr. Larocque recently obtained

his Independent Corporate Director (ICD.D) designation. He is a

graduate of the Institute of Corporate Directors at the Rotman

School of Management and Beedie School of Business, is a designated

Certified Financial Planner (CFP), and holds a joint Bachelor of

Business Administration (BBA) and Bachelor of Arts in Economics

(BA) from Simon Fraser University.

Mr. John Webster, Chairman of the Board of

Directors, commented:

“Over the past six years, Martina has been an

integral part of the growth of our business and a driving force

behind many of our key strategic milestones at Euro Manganese. The

Board is confident that, as Interim Chief Executive Officer, she

has the breadth of experience and knowledge to navigate current

market conditions, and we look forward to her continued guidance

and leadership as we undertake our search for a replacement. We are

also delighted to welcome Dean as our new Chief Financial Officer.

A seasoned financial and accounting executive with a long history

of working with companies like Euro Manganese, we are confident

that he will be an invaluable addition to the team. We extend our

sincere thanks to Matt for his significant contributions to Euro

Manganese and his efforts in progressing the Chvaletice Manganese

Project. We wish him well in his future endeavours.”

A summary of the material terms of Ms. Blahova’s

employment for compliance with ASX Listing Rule 3.16.4 is attached

to this announcement.

About Euro Manganese

Euro Manganese is a battery materials company

focused on becoming a leading, competitive, and environmentally

superior producer of high-purity manganese for the electric vehicle

industry and other high-technology applications. The Company is

advancing development of the Chvaletice Manganese Project in the

Czech Republic, which is a unique waste-to-value recycling and

remediation opportunity involving refining old tailings from a

decommissioned mine. The Chvaletice project is the only sizable

resource of manganese in Europe, strategically positioning the

Company to provide battery supply chains with critical raw

materials to support the global shift to a circular, low-carbon

economy.

Authorized for release by the Chairman of the

Board of Euro Manganese Inc.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) or the ASX accepts responsibility for the

adequacy or accuracy of this release.

Enquiries

Martina BlahovaInterim Chief

Executive Officer+1 (604) 681-1010martina@mn25.ca

LodeRock AdvisorsNeil

WeberInvestor and Media Relations – North America+1 (647)

222-0574neil.weber@loderockadvisors.com

Jane Morgan ManagementJane

MorganInvestor and Media Relations - Australia+61 (0) 405 555

618jm@janemorganmanagement.com.au

Company Address: #709 -700 West

Pender St., Vancouver, British Columbia, Canada, V6C 1G8

Website: www.mn25.ca

Forward-Looking Statements

Certain statements in this news release

constitute “forward-looking statements” or “forward-looking

information” within the meaning of applicable securities laws. Such

statements and information involve known and unknown risks,

uncertainties and other factors that may cause the actual results,

performance, or achievements of the Company, its Chvaletice

Project, or industry results, to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements or information. Such statements can

be identified by the use of words such as “may”, “would”, “could”,

“will”, “intend”, “expect”, “believe”, “plan”, “anticipate”,

“estimate”, “scheduled”, “forecast”, “predict” and other similar

terminology, or state that certain actions, events or results

“may”, “could”, “would”, “might” or “will” be taken, occur or be

achieved.

Readers are cautioned not to place undue

reliance on forward-looking information or statements.

Forward-looking statements are subject to a number of risks and

uncertainties that may cause the actual results of the Company to

differ materially from those discussed in the forward-looking

statements and, even if such actual results are realized or

substantially realized, there can be no assurance that they will

have the expected consequences to, or effects on, the Company.

Forward looking statements include statements

about undertaking a search for a new CEO and any expected outcome,

and ability to navigate current market conditions. All

forward-looking statements are made based on the Company's current

beliefs including various assumptions made by the Company,

including that the Chvaletice Project will be developed and operate

as planned, that the demonstration plant will continue to operate

successfully, that the Company will obtain sufficient financing,

and that the Company will be able to meet the conditions of its

secured financing. Factors that could cause actual results or

events to differ materially from current expectations include,

among other things: inability to find a suitable permanent CEO;

insufficient working capital; inability to meet the conditions of

its secured financing, risks due to granting security, lack of

availability of financing for developing and advancing the

Chvaletice Project; the potential for unknown or unexpected events

to cause contractual conditions to not be satisfied; developments

in EV (Electric Vehicles) battery markets and chemistries; risks

related to fluctuations in currency exchange rates; and regulation

and changes in laws by various governmental agencies. For a further

discussion of risks relevant to the Company, see “Risk Factors” in

the Company's annual information form for the year ended September

30, 2023, available on the Company's SEDAR+ profile at

www.sedarplus.ca.

Although the forward-looking statements

contained in this news release are based upon what management of

the Company believes are reasonable assumptions, the Company cannot

assure investors that actual results will be consistent with these

forward-looking statements. These forward-looking statements are

made as of the date of this news release and are expressly

qualified in their entirety by this cautionary statement. Subject

to applicable securities laws, the Company does not assume any

obligation to update or revise the forward-looking statements

contained herein to reflect events or circumstances occurring after

the date of this news release.

Appendix

Summary of Material Contract Terms for Incoming Interim

Chief Executive Officer

In accordance with ASX Listing Rule 3.16.4, the

following are the material terms of the employment agreement with

Ms. Martina Blahova for the role of Interim Chief Executive Officer

of Euro Manganese Inc. ("EMN"), which was entered

into effective November 12, 2024.

The key remuneration and contract terms related

to Ms. Blahova’s new employment agreement are set out below:

|

Effective Date: |

12 November 2024 |

| Term: |

Interim CEO |

| Fixed Annual Remuneration

(FAR): |

FAR of CAD$450,000

per annum, to be taken as cash. |

| |

|

| Incentives: |

|

| Short Term Incentive Plan

(STIP): |

Ms. Blahova is

eligible for a short term incentive plan of up to 75% of her FAR

based on the achievement of certain corporate and individual

performance targets, payable as a cash bonus. The minimum award is

nil, which would occur if the threshold level of performance is

missed on each STIP measure, if individual performance does not

warrant an award, or if the Board determines that no award be

made.Annual awards under STIP are subject Ms. Blahova’s individual

performance (achievements and conduct) and EMN and Ms. Blahova

achieving Board-approved targets. |

|

Long Term Incentive Plan (LTIP): |

The form of Ms. Blahova’s participation in EMN’s LTIP is by way of

Stock Option Plan and Board approval. Stock options granted to Ms.

Blahova can range from 0% - 100% of the target

LTIP opportunity, based upon the achievement of corporate and

individual performance targets. Ms. Blahova’s annual performance is

measured against corporate and individual performance objectives,

the weighting of each being dependent upon her role in the

organization and relative influence over corporate performance

objectives. Any future stock option grants to Ms. Blahova are

expected to have an expiry of 10 years, and the vesting schedule

will be: (A) 50% of the stock option grant will vest 1/3 (or 16.66%

of the total grant) on the first anniversary of the date of the

grant, 1/3 (or 16.67% of the total grant) on the second anniversary

of the date of the grant, and 1/3 (or 16.67% of the total grant) on

the third anniversary of the date of the grant, all subject to the

Board’s discretion; and (B) 50% of the stock option grant will vest

on corporate goals/hurdles to be set at the time of the grant, all

subject to the Board’s discretion. |

|

| |

|

| |

|

|

|

Termination Provisions: |

|

|

| Resignation by Ms. Blahova |

Ms. Blahova may terminate her

employment at any time by giving EMN not less than six weeks’

written notice. EMN may waive or reduce this notice

requirement. |

|

| Termination by EMN with

Notice |

The Company may terminate Ms.

Blahova’s employment at any time by giving three months’ notice,

which can be waived by either party. Additionally, upon a

termination without cause, all unvested stock options shall

vest. |

|

| Termination by EMN Without

Notice |

Upon the Company’s termination of

Ms. Blahova's employment for cause, Ms. Blahova shall not be

entitled to reasonable written notice of termination or pay in lieu

of notice of termination, or any other compensation or damages for

severance. |

|

| Restraint |

Ms. Blahova has a limited

12-month post-employment restraint. |

|

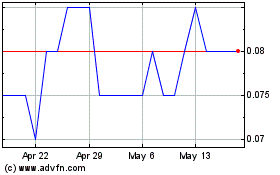

Euro Manganese (TSXV:EMN)

Historical Stock Chart

From Nov 2024 to Dec 2024

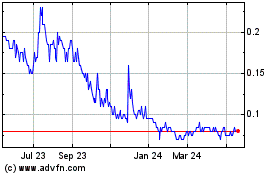

Euro Manganese (TSXV:EMN)

Historical Stock Chart

From Dec 2023 to Dec 2024