Rainmaker Announces Proposed Conversion to a Growth-Oriented Corporation

19 June 2008 - 10:19AM

Marketwired Canada

Rainmaker Income Fund (the "Fund") (TSX:RNK.UN) announces its intention to

convert from an income trust into a growth-oriented corporation, to be called

"Rainmaker Entertainment Inc." ("Rainmaker"). The conversion will be undertaken

pursuant to a statutory plan of arrangement under the Business Corporations Act

(British Columbia) (the "Reorganization").

Over the past year, management and the Board of Trustees completed a review of

strategic alternatives, the distribution policy and the appropriateness of the

income trust structure. The conclusion of the review was to focus on the growth

opportunities in the production of computer generated animated programs. The

Fund suspended distributions in May 2007 in order to reinvest the cash flow in

infrastructure to support the animation group. In January 2008 the Fund sold

certain non-core assets relating to its post and visual effects businesses. The

proceeds of this sale were used to retire debt and provide further working

capital. Following the Reorganization Rainmaker will continue to invest cash to

grow the animation business.

The Reorganization is expected to provide a number of strategic benefits to the

Fund and holders of securities of the Fund, including:

- Rainmaker will be repositioned as a growth oriented company.

- Rainmaker will have the flexibility to reinvest substantively all of its cash

flow to grow its business.

- It is anticipated that the reorganized structure of the Fund as a growth

oriented company will attract new investors, provide flexibility in raising new

capital, and provide, in the aggregate, a more active and attractive market for

the common shares of Rainmaker than currently exists for the trust units of the

Fund.

- Rainmaker will have simpler corporate structure than the Fund.

- Completion of the Reorganization will eliminate the risks and uncertainty

facing the Fund as a result of the federal government's proposal to change the

tax treatment of income trusts.

- Rainmaker will be managed by the same experienced management team.

- New directors of Rainmaker are expected to include Stephen G. Arnold and

Gordon Radley, both of whom have substantial experience in the animation or

entertainment business. Mr. Arnold is a partner at and co-founded Polaris

Venture Partners, following 10 years in executive positions in software

companies and the digital media industry. Mr. Radley has 35 years experience in

the entertainment industry and recently retired from Lucasfilm Ltd., where he

had been President since 1992.

Mechanics of the Reorganization

Under the Reorganization the holders of trust units of the Fund will exchange

their trust units for common shares of Rainmaker, on a one-for-one basis.

Holders of Class B limited partnership units of RNK Capital Limited Partnership

will exchange their Class B units for common shares of Rainmaker on a

one-for-one basis. The corresponding special voting units of the Fund held by

the holders of the Class B units will be redeemed for $0.001 per unit and

cancelled. Upon completion of the Reorganization it is expected that Rainmaker

will have approximately 17,480,175 common shares issued and outstanding.

The Fund has applied for Rainmaker to be listed on the Toronto Stock exchange

and upon completion of the Reorganization the trust units will be delisted.

The Fund expects that a special meeting of the Fund at which the Reorganization

will be considered will be held on July 24, 2008 and that an information

circular and proxy statement will be mailed to unitholders next week. The

Reorganization is subject to the receipt of all required court and regulatory

approvals and the approval of the votes of at least two-thirds of the votes cast

by holders of trust units and special voting units (voting together as a single

class) at the special meeting.

The Fund's trustees, directors and officers, and their associates, as a group,

who own in the aggregate approximately 40.6% of the outstanding trust units have

indicated that they intend to vote in favour of the Reorganization.

Recommendation of the Board

The Board has unanimously concluded that the Reorganization is in the best

interest of the Fund and the holders of trust units and special voting units of

the Fund and Class B limited partnership units of RNK Capital Limited

Partnership (collectively the "Securityholders") and has unanimously resolved to

recommend that Securityholders vote their trust units and special voting units

in favour of the Reorganization.

The trustees, directors and officers of Rainmaker and their associates, as a

group, beneficially own, directly or indirectly, or exercise control or

direction over, an aggregate of approximately 7,097,440 units of the Fund,

representing approximately 40.6% of the voting units of the Fund. Each of the

trustees, directors and officers of and their associates have indicated they

intend to vote in favour of the Reorganization.

Fairness Opinion

The Board has retained PricewaterhouseCoopers LLP to address the fairness, from

a financial point of view, of the consideration to be received by

Securityholders under the Reorganization. In connection with this mandate,

PricewaterhouseCoopers LLP has provided the Board with its opinion that, on the

basis of the particular assumptions and considerations summarized therein, that

the consideration under the Reorganization is fair, from a financial point of

view, to such Securityholders.

Draft Legislation

On Friday June 13, 2008, the Minister of Finance announced that it plans to

announce draft legislation governing the conversion of income trusts to

corporations within 30 days. If the draft legislation is announced prior to the

closing of the Arrangement, the Fund will review the rules to determine if the

rules will provide an opportunity to amend the terms of the Arrangement to be

more favourable to Securityholders or to Rainmaker. It is not expected that the

draft legislation will provide any additional benefits to Securityholders.

New Chairman of the Board of Trustees

The fund is pleased to announce the appointment of Mr. Tim McElvaine as Chairman

of the Board of Trustees, effective immediately. Mr. McElvaine has been a

trustee of the Fund since January 2007, and is President of McElvaine Investment

Management Ltd. Mr. McElvaine replaces Mr. Bruce Hodge, who has been a trustee

of the Fund since April 2003 and Chairman of the Board of Trustees since

December 2005. Mr. Hodge will continue to serve as a trustee.

Other

Additional information and other publicly filed documents relating to the Fund,

including the information circular and proxy statement for the special meeting,

annual audited consolidated financial statements and related management

discussion and analysis plus the Annual Information Form are or will be

available through the internet on the Canadian Securities Administrators' System

for Electronic Document Analysis and Retrieval ("SEDAR"), which can be accessed

at www.sedar.com.

The Fund is an unincorporated open-ended limited purpose trust located in

Vancouver, British Columbia. The Fund indirectly owns 100% of Rainmaker

Entertainment Inc. ("REI"), EP Canada Limited Partnership ("EP") and Canada Film

Capital Limited Partnership ("CFC"). REI is an award-winning company producing

computer generated animated feature films, television, direct to DVD films,

games and commercials. EP is a leading provider of payroll services for the film

and television industry across Canada. CFC provides tax credit administration

services and financing of tax credits through factoring for film and television

productions across Canada.

This press release and any related attachments may contain forward-looking

statements that involve a number of risks and uncertainty. Among the important

factors that could cause actual results to differ materially from those

indicated by such forward-looking statements are market and general economic

conditions and the risk factors detailed from time to time in the periodic

reports and documents filed by the Fund with The Toronto Stock Exchange and

other regulatory authorities. Forward-looking statements are based on the

estimates and opinions of management on the date the statements are made, and

the Fund undertakes no obligation to update the forward-looking statements

should there be a change in conditions, or in management's estimates or

opinions.

Empire Metals (TSXV:EP)

Historical Stock Chart

From Apr 2024 to May 2024

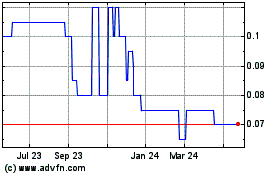

Empire Metals (TSXV:EP)

Historical Stock Chart

From May 2023 to May 2024