Platinex Inc. Closes First Tranche of Private Placement

11 March 2023 - 1:00AM

Platinex Inc. ("

Platinex" or the

"

Company")

(CSE:PTX) is pleased

to announce that it has completed a first tranche of its previously

announced private placement raising proceeds of $1.25 million. The

financing was announced on February 6, 2023, part of a binding

heads of agreement with Fancamp Exploration Ltd.

("

Fancamp") (TSXV: FNC) with respect to advancing

the exploration and development of certain gold mineral properties

owned by the parties located in the Timmins, Ontario mining camp

(the "

Transaction") (see press release dated

February 6, 2023, for further details).

As part of Transaction, Fancamp will subscribe

for 9.5% of the issued and outstanding shares of Platinex. The

balance of the financing will occur in tranches including proceeds

from Fancamp’s subscription and from additional investors raising

approximately $2.5 million. The Transaction including the financing

is expected to close on or about March 13, 2023.

The TSX Venture Exchange has provided its

conditional acceptance of the Transaction in respect of Fancamp's

participation. The FT Offering and Non-FT Offering are subject to

receipt of all necessary regulatory approvals including the

Canadian Securities Exchange.

Platinex Financings

To date, Platinex has raised $720,500 of units

("Units") at a price of $0.04 per Unit by issuing

18,012,500 Units (the "Non-FT Offering"). The

Company also raised $530,550 of flow-through units (the "FT

Units") at a price of $0.045 per FT Unit (the "FT

Offering") by issuing 11,790,000 FT Units. The Company has

increased its Non-FT Unit Offering from $1.5 million to $2.0

million.

Each Unit is comprised of one common share of

the Company and one half of one common share purchase warrant, with

each whole warrant exercisable into one common share of the Company

at a price of $0.055 at any time on or before the date which is 60

months from the closing of the Non- FT Offering.

Each FT Unit is comprised of one common share of

the Company to be issued as a "flow-through share" within the

meaning of the Income Tax Act (Canada) (each, a "FT

Share") and one half of one common share purchase warrant

(each whole such warrant, a "Warrant"). Each

Warrant shall be exercisable into one non-flow-through common share

of the Company at a price of $0.055 per share at any time on or

before the date which is 60 months after the closing date of the FT

Offering. The Warrants will be subject to an acceleration clause

requiring the exercise of the Warrants if the Platinex share price

closes on the Canadian Securities Exchange at $0.15 or greater for

20 consecutive trading days.

The gross proceeds of the FT Offering will be

used by Platinex to incur eligible "Canadian exploration expenses"

that will qualify as "flow-through mining expenditures" as such

terms are defined in the Income Tax Act (Canada) (the

"Qualifying Expenditures") related to the gold

projects including the Shining Tree Properties and Swayze

Properties on or before December 31, 2024. All Qualifying

Expenditures will be renounced in favour of the subscribers

effective December 31, 2023.

These shares and warrants comprising the FT

Units, and the Non-FT Units are subject to a hold period of four

months and one day until July 3, 2023, in accordance with

applicable securities laws.

The Company may pay finders fees on

subscriptions.

About Platinex Inc.

Platinex Inc. creates shareholder value through

the opportunistic acquisition and advancement of high-quality

projects in prolific Ontario mining camps. The Company is at the

exploration and evaluation stage and is engaged in the acquisition,

exploration and development of properties for the mining of

precious and base metals. Current assets include a 100% ownership

interest in the W2 Copper-Nickel-PGE Project and a 100% interest in

the 225 sq. km Shining Tree Gold Project in the Abitibi region of

Ontario, a world-renowned gold district. Both projects are district

scale. The W2 Project controls one of the major Oxford Stull Dome

complexes including the Lansdowne House Igneous Complex. The

Shining Tree Project covers over 21 km of the Ridout-Tyrrell

deformation zone that trends as far west as Newmont's Borden Mine,

through the area of IAMGOLD's Cote Gold deposit, and across Aris

Gold's Juby Project. The Company is also developing a net smelter

return royalty portfolio and current holds royalties on gold, PGE,

and base metal properties in Ontario.

For additional information on Platinex and other

corporate information, please visit the Company's website at

https://platinex.com/.

For further information, please contact:

Greg Ferron, President, and Chief Executive Officer

Phone: 416-270-5042

Email: gferron@platinex.com

Forward-Looking Information

This news release contains forward-looking

information which is not comprised of historical facts.

Forward-looking information is characterized by words such as

"plan", "expect", "project", "intend", "believe", "anticipate",

"estimate" and other similar words, or statements that certain

events or conditions "may" or "will" occur. Forward-looking

information involves risks, uncertainties and other factors that

could cause actual events, results, and opportunities to differ

materially from those expressed or implied by such forward-looking

information. All statements regarding the completion of the

Transaction with Fancamp (see press release dated February 6,

2023), including the transfer of properties to South Timmins Mining

Inc. ("Goldco"), the cash payment by Fancamp to Goldco, the

entering into the Shareholders' Agreement, the completion of the FT

Offering and the Non-FT Offering, and future expectations regarding

the advancement and development of the mining properties by Goldco

are examples of forward-looking information. Factors that could

cause actual results to differ materially from such forward-looking

information include, but are not limited to, changes in the state

of equity and debt markets, fluctuations in commodity prices,

delays in obtaining required regulatory or governmental approvals,

and includes those risks set out in the Company's management's

discussion and analysis as filed under the Company's profile at

www.sedar.com. Forward-looking information in this news release is

based on the opinions and assumptions of management considered

reasonable as of the date hereof, including that all necessary

governmental and regulatory approvals will be received as and when

expected. Although the Company believes that the assumptions and

factors used in preparing the forward-looking information in this

news release are reasonable, undue reliance should not be placed on

such information. The Company disclaims any intention or obligation

to update or revise any forward-looking information, other than as

required by applicable securities laws.

Neither the CSE nor its Regulation Services

Provider (as that term is defined in the policies of the CSE)

accepts responsibility for the adequacy or accuracy of this

release.

Neither the CSE nor its Regulation Services

provider approves or disapproves the contents of this news

release.

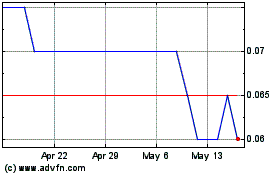

Fancamp Exploration (TSXV:FNC)

Historical Stock Chart

From Oct 2024 to Nov 2024

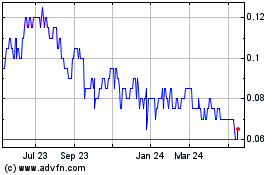

Fancamp Exploration (TSXV:FNC)

Historical Stock Chart

From Nov 2023 to Nov 2024