Fancamp Announces Closing of the Transaction with Lode Gold Resources to Advance New Brunswick and Yukon Mineral Properties

10 October 2024 - 3:30AM

Fancamp Exploration Ltd. (“

Fancamp” or the

“

Company”) (TSX Venture Exchange:

FNC) is pleased to announce that it has closed the

transaction with Lode Gold Resources Inc. (“

Lode

Gold”) (TSX Venture Exchange:

LOD) and

1475039 B.C. Ltd. (“

Gold Orogen”), a subsidiary of

Lode Gold, as previously announced on August 27, 2024, to advance

the exploration and development of certain mineral properties

located in the Yukon and New Brunswick (the

“

Transaction”). The Transaction represents the

opportunity for the joint advancement of significantly sized and

under-explored land packages, in highly prospective regions for

gold and polymetallic mineral discovery, with the potential to

create district scale projects on orogenic belts where other major

developers are established and host certain world-class deposits.

In connection with the closing of the

Transaction:

- Lode Gold

transferred all of its interests in its McIntyre Brook mineral

property located in New Brunswick (the “McIntyre Brook

Property”) and Fancamp transferred all of its interests in

the Riley Brook mineral property located in New Brunswick (the

“Riley Brook Property”) to a newly incorporated

joint-venture entity by the name of Acadian Gold Corp.

(“Acadian”) of which Fancamp and Gold Orogen each

own 50% of the outstanding shares (the “Acadian

Shares”), and for which Fancamp acts as the initial

operator of the mineral exploration work to be conducted by

Acadian;

- Acadian

granted Fancamp a 2% net smelter returns royalty on the Riley Brook

Property, which shall be proportionally reduced in the event that

Gold Orogen secures reduced net smelter returns royalties and

buy-back terms on all, but not less than all, of the mineral claims

comprising the McIntyre Brook Property;

- Fancamp

and Gold Orogen entered into a Shareholders’ Agreement to govern

Acadian, pursuant to which, among other terms, the initial

strategic budget for Acadian to cover work to be completed by May

31, 2025 will total approximately $1.8 million;

- Lode Gold

transferred to Gold Orogen both its Golden Culvert mineral property

located in Selwyn Basin, Tombstone Belt, southeastern Yukon, and

its nearby Win mineral property located in the Tombstone Belt,

southeastern Yukon;

- Fancamp

invested $2,500,000 into Gold Orogen (the “Fancamp

Investment”) in exchange for such number of common shares

of Gold Orogen (“Gold Orogen Shares”) as is equal

to 19.9% of the outstanding Gold Orogen Shares on an undiluted

basis. A portion of the Fancamp Investment was completed through an

indirect flow through offering by Gold Orogen which resulted in

Gold Orogen receiving approximately $3,000,000 in proceeds under

the Fancamp Investment; and

- Fancamp invested $500,000 into Lode

Gold on a private placement basis in exchange for 14,285,714

special warrants of Lode Gold (“Lode Gold Special

Warrants”) at an issue price of $0.035 per Lode Gold

Special Warrant, with each Lode Gold Special Warrant automatically

convertible on the earlier of the completion of the Spin Out (as

defined below) and March 31, 2025 (the “Outside

Date”), into one common share of Lode Gold (each, a

“Lode Gold Share”) and one common share purchase

warrant of Lode Gold (each, a “Lode Gold

Warrant”). Each Lode Gold Warrant shall be exercisable for

one Lode Gold Share at a price of $0.05 for a period of five years

from the date of issue.

The Transaction has received the conditional

approval of the TSX Venture Exchange (the

“TSX-V”), however remains subject to the final

approval of the TSX-V.

Pursuant to the terms of the investment

agreement dated August 26, 2024, entered into among Fancamp, Lode

Gold and Gold Orogen:

- Prior to

the completion of the Spin Out, Gold Orogen will raise an aggregate

of $1,500,000, in addition to the Fancamp Investment (the

“Gold Orogen Private Placement”)

by the later of 30 days after the Outside Date, failing which Gold

Orogen shall transfer to Fancamp between 7.5% and 15% of the issued

and outstanding Acadian Shares, with the actual number of Acadian

Shares transferred to be determined based on the amount of funds

actually raised by Gold Orogen under the Gold Orogen Private

Placement;

- In the

event that (i) Gold Orogen raises in excess of $1,500,000 pursuant

to the Gold Orogen Private Placement; or (ii) any future financings

are undertaken by Gold Orogen (or the resulting issuer of any

reverse-takeover transaction consummated by Gold Orogen) (each, a

“Gold Orogen Additional Financing”), Fancamp, for

so long as it holds at least 10% of the issued and outstanding Gold

Orogen Shares, will have the right (but not the obligation) to

participate in the Gold Orogen Additional Financing to maintain its

pro rata interest in Gold Orogen;

- Lode Gold

will commence a spin-out transaction of Gold Orogen (the

“Spin Out”) to be completed on or before the

Outside Date pursuant to which:

- each

shareholder of Lode Gold on the effective date of the Spin Out will

receive Gold Orogen Shares for each Lode Gold Share held; and

-

immediately after completion of the Spin Out, Fancamp will hold

19.9% of the issued and outstanding Gold Orogen Shares on an

undiluted basis.

- In the

event that Lode Gold fails to complete the Spin Out before the

Outside Date, Lode Gold, at its election shall:

- cause

Gold Orogen to transfer to Fancamp such number of Acadian Shares as

is equal to 15% of the issued and outstanding Acadian Shares;

or

- pay a

penalty to Fancamp (the “Penalty Payment”), equal

to an annual rate of 6% of $3,000,000 calculated on a pro rata

basis, for such number of days as the Spin Out has been delayed up

to a maximum of 60 days from the Outside Date (the

“Extension Period”), which Penalty Payment shall

be paid on the date that is the earlier of (i) the completion date

of the Spin Out, and (ii) the last day of the Extension Period. In

the event Lode Gold fails to complete the Spin Out before the

expiry of the Extension Period, Gold Orogen shall transfer to

Fancamp such number of Acadian Shares as is equal to 15% of the

issued and outstanding Acadian Shares.

About Fancamp Exploration Ltd. (TSX-V:

FNC)

Fancamp is a growing Canadian mineral

exploration company focused on creating value through medium term

growth and monetization opportunities with its strategic interests

in high potential mineral projects, royalty portfolio and mineral

properties. The Company is focused on an advanced asset play poised

for growth and selective monetization with a portfolio of mineral

claims across Ontario, Québec and New Brunswick, Canada; including

copper, gold, zinc, titanium, chromium, strategic rare-earth metals

and others. The Company continues to identify near term cash-flow

generating opportunities and in parallel aims to advance its

investments in strategic mineral properties. Fancamp has

investments in an existing iron ore operation in the

Quebec-Labrador Trough, a rare earth elements company, NeoTerrex

Minerals Inc., a copper–gold exploration company, Platinex Inc., an

opportunity to develop an emerging gold-copper exploration play

with Lode Gold Resources, in addition to an investment in a near

term cash flow generating zinc mine, EDM Resources Inc. in Nova

Scotia. The Company has future monetization opportunities from its

Koper Lake transaction in the highly sought-after Ring of Fire in

Northern Ontario. Fancamp is developing an energy reduction and

titanium waste recycling technology with its advanced titanium

extraction strategy. The Company is managed by a focused leadership

team with decades of mining, exploration and complementary

technology experience.

Further information on the Company can be found

at: www.fancamp.ca

Forward-Looking Statements

This news release contains certain

“forward-looking statements” or “forward-looking information”

(collectively referred to herein as “forward-looking

statements”) within the meaning of applicable securities

legislation. Such forward-looking statements include, without

limitation: the execution of all documents and completion of all

steps required subsequent to the closing of the Transaction,

including but not limited to the completion of the Spin Out and the

Gold Orogen Private Placement; the receipt of final TSX-V approval

in respect of the Transaction and any post-closing transactions

related thereto; and the Company’s forecasts, estimates,

expectations and objectives for future.

Such forward-looking statements are based on a

number of assumptions, which may prove to be incorrect. Assumptions

have been made regarding, among other things: conditions in general

economic and financial markets; accuracy of assay results;

geological interpretations from drilling results, timing and amount

of capital expenditures; performance of available laboratory and

other related services; future operating costs; and the historical

basis for current estimates of potential quantities and grades of

target zones. The actual results could differ materially from those

anticipated in these forward-looking statements as a result of risk

factors, including the timing and content of work programs; results

of exploration activities and development of mineral properties;

the interpretation and uncertainties of drilling results and other

geological data; receipt, maintenance and security of permits and

mineral property titles; environmental and other regulatory risks;

project costs overruns or unanticipated costs and expenses;

availability of funds; failure to delineate potential quantities

and grades of the target zones based on historical data; and

general market and industry conditions.

Forward-looking statements are based on the

expectations and opinions of the Company’s management on the date

the statements are made. The assumptions used in the preparation of

such statements, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date the statements were

made. The Company undertakes no obligation to update or revise any

forward-looking statements included in this news release if these

beliefs, estimates and opinions or other circumstances should

change, except as otherwise required by applicable law.

For Further Information

|

Rajesh Sharma, President

& CEO+1 (604) 434 8829info@fancamp.ca |

Debra Chapman, CFO+1 (604) 434

8829info@fancamp.ca |

|

|

|

|

Tara Asfour, Director of Investor

Relations+1 (604) 434 8829tasfour@fancamp.ca |

|

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this news

release.

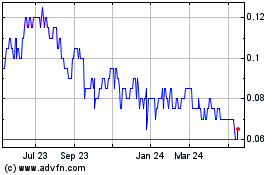

Fancamp Exploration (TSXV:FNC)

Historical Stock Chart

From Dec 2024 to Jan 2025

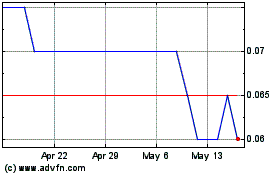

Fancamp Exploration (TSXV:FNC)

Historical Stock Chart

From Jan 2024 to Jan 2025