Immunotec Files a Preliminary Short Form Prospectus

04 July 2014 - 7:52AM

Marketwired Canada

Immunotec Inc. (TSX VENTURE:IMM), a Canadian-based company and a leader in the

wellness industry (the "Company" or "Immunotec"), is pleased to announce that it

has filed a preliminary short form prospectus with the securities regulatory

authorities in each of the provinces of Canada in connection with a treasury

offering of common shares ("Common Shares") in the capital of the Company (the

"Primary Shares") and a secondary offering of Common Shares (the "Secondary

Shares" and collectively with the Primary Shares, the "Offered Securities") by

two selling shareholders of the Company (the "Selling Shareholders") for gross

proceeds of $7 million to $15 million (the "Offering").

The net proceeds from the sale of Primary Shares pursuant to the Offering will

be used by the Company primarily (i) to finance future growth opportunities,

such as expanding its direct selling network in new markets in Central and South

America, (ii) to establish "pick and pack" facilities in Mexico, (iii) to

purchase new manufacturing equipment for its existing manufacturing facility

located in Blainville, Quebec, Canada, (iv) to improve its information

technology and systems infrastructure and (v) for working capital and general

corporate purposes.

Canaccord Genuity Corp. will act as lead underwriter (the "Lead Underwriter")

and Euro Pacific Canada Inc. and Industrial Alliance Securities Inc. will act as

co-managers (collectively with the Lead Underwriter, the "Underwriters") in

connection with the Offering. An underwriting agreement for the Offering will be

entered into by the Company, the Selling Shareholders and the Underwriters, at

the time of filing of the final short form prospectus.

The Company and the Selling Shareholders expect to grant to the Underwriters a

30-day option to purchase up to an additional 15 percent of the number of

Offered Securities sold pursuant to the Offering to cover over-allotments, if

any, and for market stabilization purposes.

Final pricing and determination of the number of Primary Shares and Secondary

Shares to be sold pursuant to the Offering will occur immediately prior to the

filing of the final short form prospectus in respect of the Offering. The

Offering is subject to market conditions, and there can be no assurance as to

whether or when the Offering may be completed, or as to the actual size or terms

of the Offering. The Offering is subject to customary conditions and regulatory

approval, including that of the TSX Venture Exchange.

If completed, the closing of the Offering shall take place within 30 days of the

date of receipt for the final short form prospectus in respect of the Offering,

or on such other date agreed upon by Company and the Lead Underwriter. The

Offered Securities have not been and will not be registered under the United

States Securities Act of 1933, as amended (the "1933 Act"), or any state

securities laws of the United States. Accordingly, the Offered Securities will

not be offered or sold to persons within the United States unless an exemption

from the registration requirements of the 1933 Act and applicable state

securities laws is available.

This news release does not constitute an offer to sell or a solicitation of an

offer to buy any of the securities described herein.

Copies of the preliminary short form prospectus will be available once a receipt

has been obtained therefor at www.sedar.com and a written copy may be obtained

upon request by contacting Canaccord Genuity Corp., Attention: Ron Sedran,

Managing Director, Equity Capital Markets, P.O. Box 516, 161 Bay Street, Suite

3000, Toronto, Ontario M5J 2S1.

About Immunotec Inc.

Immunotec is dedicated to improving people's lives every day by offering

research-driven nutritional products through its network of Independent

Consultants worldwide. Immunotec's strength comes from its culture that

emphasizes teamwork and entrepreneurial leadership by employees, consultants and

research collaborators.

Headquartered with manufacturing facilities near Montreal, Canada, Immunotec

Consultants generated nearly $55.0 million in annual revenues for the

Corporation during fiscal year 2013. Immunotec reported for the first half of

fiscal 2014 an overall revenue growth of 42%. Revenues from the United States

grew 36% and revenues from Mexico grew 81% over the same period. Please visit us

at www.immunotec.com for additional information.

The Company files its continuous disclosure documents on the SEDAR database at

www.sedar.com and on the Company's website at www.immunotec.com. The common

shares of the Company are listed on the TSX Venture Exchange under the ticker

symbol IMM. Neither TSX Venture Exchange nor its Regulation Services Provider

(as that term is defined in policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS: Certain statements contained in

this news release are forward looking and are subject to numerous risks and

uncertainties, known and unknown. For information identifying known risks and

uncertainties and other important factors that could cause actual results to

differ materially from those anticipated in the forward-looking statements,

please refer to the heading Risks and Uncertainties in Immunotec's most recent

Management's Discussion and Analysis, Annual Information Form and Preliminary

Short Form Prospectus, which can be found at www.sedar.com. Consequently, actual

results may differ materially from the anticipated results expressed in these

forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Patrick Montpetit CPA, CA, CF

Vice-President and Chief Financial Officer

Immunotec Inc.

(450) 510-4527

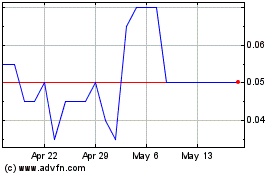

International Metals Min... (TSXV:IMM)

Historical Stock Chart

From Apr 2024 to May 2024

International Metals Min... (TSXV:IMM)

Historical Stock Chart

From May 2023 to May 2024