Logica Ventures Corp. (the

“

Company”), a capital pool company trading on the

TSX Venture Exchange Inc. (the “

TSXV”) is pleased

to announce that it has entered into a letter of intent dated June

14, 2022 (the “

LOI”) with Alpha Gold North Inc.

(“

AGN”), which outlines the general terms and

conditions pursuant to which the Company and AGN intend to complete

a transaction that will result in the Company acquiring all of the

issued and outstanding securities of AGN (the “

Proposed

Transaction”). The Proposed Transaction will constitute

the Company’s qualifying transaction under the policies of the

TSXV.

Alpha Gold North Inc.

AGN is an arm’s length, private, mineral

exploration company incorporated under the laws of the Province of

Ontario on October 2, 2020. AGN is not a reporting issuer. AGN does

not currently have any shareholders that would qualify as a

“Control Person”, as such term is defined in TSXV Policy 1.1. AGN

owns the Mine Brook Property (the “Mine Brook

Property”) located in the Province of Newfoundland and

Labrador. The Mine Brook Property comprises 20 claims covering a

total area of 500 ha.

Transaction Structure

The Proposed Transaction is expected to be

completed by way of a three-cornered amalgamation or other

similarly structured transaction which will result in AGN becoming

a wholly-owned subsidiary of the Company. Upon completion of the

Proposed Transaction, it is expected that the resulting entity (the

“Resulting Issuer”) will carry on the business

previously carried on by AGN.

Pursuant to the Proposed Transaction, the

Company will acquire 100% of the issued and outstanding shares of

AGN on a share exchange ratio of one Company common share (each, a

“Company Share”) for one AGN common share (each,

an “AGN Share”).

Completion of the Proposed Transaction will be

subject to a number of conditions precedent set forth in the LOI,

including, but not limited to: (i) the negotiation and execution of

a definitive agreement (the “Definitive

Agreement”) on or before September 30, 2022; (ii) AGN’s

completion of certain share buy-back transactions; (iii) approval

of the shareholders of AGN and, if applicable, of the Company; (iv)

AGN’s completion of a concurrent financing; and (v) receipt of all

requisite regulatory and third party approvals, including

conditional approval by the TSXV of the Proposed Transaction. There

can be no assurance that the Proposed Transaction will be completed

on the terms proposed in the LOI or at all.

There can be no assurances that the common

shares of the Resulting Issuer will begin trading either on the

TSXV, or at all, and neither the Company nor AGN makes any

representations that the Proposed Transaction will be completed as

contemplated or that trading on any stock exchange of the

securities of the Company or AGN will occur.

When a Definitive Agreement between the Company

and AGN is executed, the Company will issue a subsequent press

release containing the details of the Definitive Agreement and

additional terms of the Proposed Transaction.

Summary of Proposed Directors and Officers of

the Resulting Issuer

The board and management of the Resulting Issuer

will be comprised of AGN nominees, and is expected to include

Trumbull Fisher (chief executive officer and director), Alan

Rootenberg (chief financial officer and director), Bob Metcalfe

(independent director) and Clayton Fisher (independent

director).

The following are brief descriptions of the

currently proposed directors and officers of the Resulting

Issuer:

Trumbull Fisher – Chief Executive Officer and

Director

Mr. Fisher has approximately 15 years of capital

markets expertise in various capacities. In the past, he served as

a co-founder of Casimir Capital’s, a former IIROC dealer’s,

Canadian Sales and Trading operation. Upon leaving Casimir, he

cofounded Sui Generis, an offshore hedge fund that was eventually

sold to a Canadian asset manager, where he acted as head of

trading. Trumbull previously served as president of New Wave

Holdings Corp. (previously New Wave Esports Corp.), an Esports

investment company. Trumbull has extensive experience in raising

capital, advising businesses and managing successful teams in the

capital markets industry.

Alan Rootenberg – Chief Financial Officer and

Director

Mr. Rootenberg is a chartered professional

accountant who has served as the chief financial officer of a

number of publicly traded companies listed on the Toronto Stock

Exchange, TSXV, OTCBB and Canadian Securities Exchange. These

companies include mineral exploration, mining, technology and

cannabis companies. Mr. Rootenberg has a Bachelor of Commerce

degree from the University of the Witwatersrand in Johannesburg,

South Africa and received his CPA designation in Ontario,

Canada.

Bob Metcalfe – Independent Director

Mr. Metcalfe was a senior partner with the law

firm Lang Michener LLP for 20 years. He is the former president and

chief executive officer of Armadale Properties and counsel to all

of the Armadale Group of Companies, with significant holdings

across numerous industries including finance, construction of

office buildings, airport ownership, management and refurbishing,

land development, automotive dealerships as well as newspaper

publishing, radio and television stations. Mr. Metcalfe has served

as president, chief executive officer, lead director, chairman and

committee member on numerous publicly listed natural resource and

industry company corporate boards globally, including Medoro

Resources Ltd. from August 2009 to June 2011 (chairman); Petro

Magdalena Energy Corp. from July 2009 to April 2012; as well as the

former chairman of the board of Alberta Oilsands Inc. from 2012 to

2015. As director and shareholder, Mr. Metcalfe has been engaged in

numerous acquisitions, divestitures, corporate reorganizations,

financings and corporate improvements, as well as serving on

numerous special committees across many sectors.

Clayton Fisher – Independent Director

Mr. Fisher has 15 years of experience in the

financial services and capital markets sectors. During his time as

an Investment Advisor with Raymond James Ltd, Mr. Fisher

evaluated and financed numerous mineral exploration companies.

Mr. Fisher has previously held chief executive officer, director,

and advisory roles for private and public corporations.

He holds a degree in Economics and Finance from the

University of Victoria.

ON BEHALF OF THE BOARD

“Munaf Ali”

Munaf AliDirectorT: 416-831-3598E:

ir@logicaventures.com

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Completion of the Proposed Transaction is

subject to a number of conditions, including but not limited to,

TSXV acceptance and if applicable pursuant to TSXV Requirements,

majority of the minority shareholder approval. Where applicable,

the Proposed Transaction cannot close until the required

shareholder approval is obtained. There can be no assurance that

the Transaction will be completed as proposed or at all.

Investors are cautioned that, except as

disclosed in the management information circular or filing

statement to be prepared in connection with the Proposed

Transaction, any information released or received with respect to

the Proposed Transaction may not be accurate or complete and should

not be relied upon. Trading in the securities of a capital pool

company should be considered highly speculative.

The TSXV has in no way passed upon the merits of

the Proposed Transaction and has neither approved nor disapproved

the contents of this press release.

All information contained in this news release

with respect to the Company, AGN and the Resulting Issuer was

supplied by the parties, respectively, for inclusion herein.

This news release does not constitute an offer

to sell or a solicitation of an offer to sell any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”) or any state

securities laws and may not be offered or sold within the United

States or to U.S. Persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

Notice Regarding Forward Looking

Statements

The information in this news release includes

certain information and statements about management’s view of

future events, expectations, plans and prospects that constitute

forward looking statements, including statements relating to the

completion of the Proposed Transaction and the proposed business of

the Resulting Issuer. These statements are based upon assumptions

that are subject to significant risks and uncertainties. Because of

these risks and uncertainties and as a result of a variety of

factors, the actual results, expectations, achievements or

performance may differ materially from those anticipated and

indicated by these forward looking statements. Any number of

factors could cause actual results to differ materially from these

forward-looking statements as well as future results. Although the

Company believes that the expectations reflected in forward looking

statements are reasonable, it can give no assurances that the

expectations of any forward looking statements will prove to be

correct. Except as required by law, the Company disclaims any

intention and assumes no obligation to update or revise any forward

looking statements to reflect actual results, whether as a result

of new information, future events, changes in assumptions, changes

in factors affecting such forward looking statements or

otherwise.

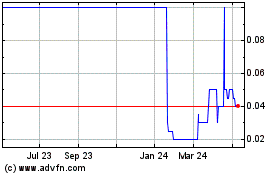

Logica Ventures (TSXV:LOG.P)

Historical Stock Chart

From Jan 2025 to Feb 2025

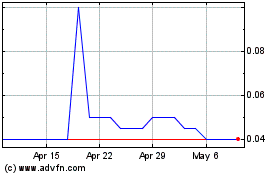

Logica Ventures (TSXV:LOG.P)

Historical Stock Chart

From Feb 2024 to Feb 2025