Legrand recorded a quarterly sales

increase of +2.4% (excluding exchange rates and Russia)

driven by acquisitions and datacenters

Performance at end of September 9M sales

trends: +0.3% excluding exchange rates and Russia Adjusted

operating margin: 20.5% Net profit attributable to the Group: 13.4%

of sales

7 acquisitions announced since the beginning

of the year, including 4 in datacenters Around €350

million additional revenue on an annual basis

2024 full-year targets specified

2030 ambitions: 2030 sales of between €12bn

and €15bn, buoyed by offers linked to the energy and digital

transition

Regulatory News:

Legrand (Paris:LR):

Benoît Coquart, Legrand’s Chief Executive Officer,

commented:

“For the first nine months of the year, sales (excluding

currency effects and our exit from Russia) were stable, in a

building market that remains in decline in most of our geographies.

In the third quarter alone, sales growth (+2.4% excluding currency

effects and Russia) was driven in particular by sustained growth in

datacenters in the United States.

Our financial indicators remain solid, in terms of both margins

and free cash flow.

Our external growth has been very dynamic this year, with 7

acquisitions announced, including 4 in the buoyant datacenter

sector, demonstrating Legrand's ongoing ability to strengthen its

leadership positions through value-creating operations.

Fully confident in our strategy, we are specifying our annual

targets as communicated at the beginning of February, and are

resolutely pursuing the implementation of our 2030 roadmap, as

presented at our Capital Markets Day on September 24. This roadmap

is supported in particular by the buoyant field of energy and

digital transition, which already represented 46% of sales in

2023.”

2024 full-year targets specified1

In 2024, the Group is pursuing the profitable and responsible

development laid out in its strategic roadmap.

Taking into account the achievements on the first nine months of

the year as well as the world’s current macroeconomic outlook, and

with confidence in its model for creating integrated value, Legrand

has specified its full-year targets for 2024:

- low single-digit sales growth (organic and through

acquisitions2 - unchanged);

- an adjusted operating margin after acquisitions of between

20.0% and 20.4% (vs. between 20.0% and 20.8% before acquisitions

previously);

- at least 100% CSR achievement rate for the third year of the

2022-2024 roadmap (unchanged).

_________________________ 1 For more information, see Legrand

press releases dated February 15, May 3, and July 31, 2024 2

Excluding exchange-rate effect and impacts linked to the Group’s

disengagement from Russia

Financial performance at September 30,

2024

Key figures

Consolidated data

(€ millions)(1)

9 months 2023

9 months 2024

Change

Sales

6,307.3

6,229.0

-1.2%

Adjusted operating profit

1,363.5

1,276.1

-6.4%

As % of sales

21.6%

20.5%

20.6% before acquisitions (2)

Operating profit

1,273.8

1,189.7

-6.6%

As % of sales

20.2%

19.1%

Net profit attributable to the Group

937.2

833.7

-11.0%

As % of sales

14.9%

13.4%

Normalized free cash flow

1,112.9

1,046.5

-6.0%

As % of sales

17.6%

16.8%

Free cash flow

1,214.1

749.2

-38.3 %

As % of sales

19.2%

12.0%

Net financial debt at September 30

2,153.7

3,204.8

+48.8%

(1) See appendices to this press

release for definitions and indicator reconciliation tables

(2) At 2023 scope of

consolidation

Consolidated sales

In the first nine months of 2024, sales were down a total of

-1.2% from the same period of 2023, at €6,229.0 million.

In a building market which remains depressed in many

geographies, the organic decline in sales was -0.8% over the

period, including -0.1% in mature countries and -2.8% in new

economies.

The impact of a broader scope of consolidation was +0.3%,

including +1.1% linked to acquisitions and ‑0.8% due to the impact

of the Group’s disengagement from Russia. Based on acquisitions

made and their likely dates of consolidation, their overall impact

should be close to +2% full year, of which nearly +2.5% linked to

acquisitions and -0.6% to the impact of disengagement from Russia

as of October 4, 2023.

The exchange-rate effect on sales in the first nine months of

2024 was -0.7%. Based on average exchange rates in October 2024

alone, the full-year effect should be around -1% in 2024.

Changes in sales by destination at constant scope of

consolidation and exchange rates broke down as follows by

region:

9 months 2024 / 9 months

2023

3rd quarter 2024 / 3rd quarter

2023

Europe

-3.4%

-4.1%

North and Central America

+2.0%

+6.0%

Rest of the world

-0.9%

+3.9%

Total

-0.8%

+1.7%

These changes are analyzed below by geographical region:

- Europe (40.1% of Group revenue): in a building market

that remains difficult in most countries, sales at constant scope

of consolidation and exchange rates fell by -3.4% over the first

nine months of 2024, and by -4.1% over the third quarter alone.

These trends reflect a particularly deteriorated context in mature

countries during the quarter, and do not point to a recovery in the

construction market in the very short term.

Sales in Europe's mature economies (35.0% of Group sales) fell

organically by -3.7% over the first nine months of 2024, of which

-5.3% in the third quarter alone. Italy and the UK held up well

over the first nine months, but failed to offset a decline in sales

in France, Spain, Germany and the Netherlands in particular.

Sales in Europe’s new economies were down -1.3% over the first

nine months of the year. In the third quarter alone, sales rose by

a healthy +4.7%, with a growth in Eastern European sales.

- North and Central America (40.1% of Group revenue):

sales were up +2.0% from the first nine months of 2023 at constant

scope of consolidation and exchange rates.

In the United States alone (36.8% of Group revenue), sales rose

+3.1% in the first nine months of the year, including a steep +7.2%

rise in the third quarter alone. The 9-month performance was mostly

driven by offers dedicated to the datacenter segment.

Over the first nine months, sales declined in Canada and

Mexico.

- Rest of the world (19.8% of Group revenue): sales

marked an organic decline of -0.9% in the first nine months of

2024.

In Asia-Pacific (12.2% of Group revenue), sales declined by

-3.8% over the 9-month period and by -3.2% in the third quarter

alone. Over the first nine months, growth in India was unable to

offset the sharp fall in China, where the construction market

continues experiencing a marked decrease.

In Africa and the Middle East (3.6% of Group revenue), sales

were up +4.4% in the first nine months of the year and +25.7% in

the third quarter alone. Over nine months, sales trends were

sustained in the Middle East and showed a slight decline in Africa,

which saw a strong recovery in the third quarter alone.

In South America (4.0% of Group revenue), sales were up +3.8 %

in the nine first months, with marked growth in Brazil, and

advanced a strong +7.6% in the third quarter alone.

Adjusted operating profit and margin

Adjusted operating profit for the first nine months of 2024

stood at €1,276.1 million, down -6.4% from the first nine months of

2023. This corresponds to an adjusted operating margin equal to

20.5% of sales for the period.

Before acquisitions, adjusted operating margin for the first

nine months of 2024 stood at 20.6% of sales, down -1.0 point from

the first nine months of 2023.

Over this period, Group profitability confirmed Legrand’s

ability to maintain high margins despite a decrease in sales.

Value creation and solid balance sheet

Net profit attributable to the Group came to €833.7 million,

down -11.0% from the first nine months of 2023 and equal to 13.4%

of sales. This trend was due primarily to a decline in operating

profit, the negative impact of financial results and exchange-rate

effects, and a corporate income tax rate of 27.0% for the first

nine months of 2024.

Free cash flow came to 12.0% of sales over the period, to total

€749.2 million.

The ratio of net debt to EBITDA1 stood at 1.7 on September 30,

2024, a level that reflects the pace of acquisitions since the

beginning of the year as well as a solid free cash flow

generation.

In addition, as previously announced2, Legrand will have to pay

an amount of €43 million following the decision by the French

Competition Authority regarding the application of derogated prices

on the French market between 2012 and 2015. Legrand categorically

rejects the allegation made against it and reserves the right to

appeal this decision.

Strong acquisition

momentum

This year, Legrand pursued external acquisitions at a robust

pace. The 7 operations announced in 2024 represent acquired annual

sales of almost €350 million and include:

- in the buoyant datacenters segment, the acquisition of

Netrack (Indian specialist in racks), Davenham (Irish

specialist in low-voltage power distribution systems), Vass

(Australian leader in busbars) and UPSistemas (Colombian

specialist in the integration, commissioning, maintenance and

monitoring of technical infrastructures);

- in the assisted living and connected health segment:

Enovation, the Dutch leader in connected health

software;

- lastly, in the essential infrastructures segment: MSS in

New Zealand and APP in Australia.

Legrand intends to continue strengthening its leadership

positions with value-creating acquisitions.

2030 ambitions and growth

pillars

Legrand hosted a Capital Markets Day in London on September 24,

2024.

This event was an opportunity for the Group to present its

strategy both for essential infrastructures products (54% of its

2023 revenue) and for solutions that support the energy and digital

transition (46% of its 2023 revenue, including products for

datacenters, energy transition, and digital lifestyles).

Legrand detailed its 2030 ambitions, with:

- Sales in 2030 in a range of €12 to 15 billion, including sales

growth excluding the impact of exchange rates of between +6% to

+10% in CAGR. This includes +3% to +5% organic CAGR and +3% to +5%

CAGR related to acquisitions,

- Average adjusted operating margin of around 20% of revenue,

including +30 to +50 basis points of annual organic improvement and

-30 to -50 basis points of annual dilution from acquisitions,

- Free cash flow generation of nearly €10 billion from 2025 to

2030, with average free cash flow ranging between 13% and 15% of

sales, an average Capex to sales ratio of 3% to 3.5%, and an

average working capital requirement ratio of 10% of sales or

less,

- A capital allocation policy prioritizing acquisitions (at least

50% of average free cash flow) and an attractive dividend payment

(with a distribution ratio of around 50%). Over the period, a total

of around €5 billion will thus be dedicated to acquiring companies

to round out the Group's products and geographical range,

- 80% of total sales qualifying as eco-responsible sales, and

reducing Scope 1, 2 and 3 emissions in line with Legrand’s Net Zero

2050 commitment.

The presentation and webcast can be found on Legrand’s website

at www.legrandgroup.com through the following link: Capital Markets

Day 2024 - Legrand (legrandgroup.com)

----------------

_________________________ 1 Based on EBITDA for the past 12

months 2 For more information, see Legrand’s press release dated

October 30, 2024

Consolidated financial statements for the first nine months of

2024, a presentation, and the related teleconference (live and

replay) are available at www.legrandgroup.com.

Key financial dates

- 2024 annual results : February 13, 2025 “Quiet period1” starts

: January 14, 2025

- 2025 first-quarter results : May 7, 2025 “Quiet period1” starts

: April 7, 2025

- General Meeting of Shareholders : May 27, 2025

About Legrand

Legrand is the global specialist in electrical and digital

building infrastructures. Its comprehensive offering of solutions

for residential, commercial, and datacenter markets makes it a

benchmark for customers worldwide.

The Group harnesses technological and societal trends with

lasting impacts on buildings with the purpose of improving life by

transforming the spaces where people live, work and meet with

electrical, digital infrastructures and connected solutions that

are simple, innovative and sustainable.

Drawing on an approach that involves all teams and stakeholders,

Legrand is pursuing a strategy of profitable and responsible growth

driven by acquisitions and innovation, with a steady flow of new

offerings that include products with enhanced value in use (energy

and digital transition solutions: datacenters, digital lifestyles

and energy transition offerings).

Legrand reported sales of €8.4 billion in 2023. The company is

listed on Euronext Paris and is a component stock of the CAC 40,

CAC 40 ESG and CAC SBT 1.5 indexes. (code ISIN FR0010307819).

https://www.legrandgroup.com

_________________________ 1 Period of time when all

communication is suspended in the run-up to publication of

results

Appendices

Glossary

Adjusted operating profit: Adjusted operating profit is

defined as operating profit adjusted for: i/ amortization and

depreciation of revaluation of assets at the time of acquisitions

and for other P&L impacts relating to acquisitions, ii/ impacts

related to disengagement from Russia (impairment of assets and

effective disposal) and, iii/ where applicable, impairment of

goodwill.

Busways: electric power distribution systems based on

metal busbars.

Cash flow from operations: Cash flow from operations is

defined as net cash from operating activities excluding changes in

working capital requirement.

CSR: Corporate Social Responsibility.

EBITDA: EBITDA is defined as operating profit plus

depreciation and impairment of tangible and right of use assets,

amortization and impairment of intangible assets (including

capitalized development costs), reversal of inventory step-up and

impairment of goodwill.

ESG: Environmental, Societal and Governance.

Free cash flow: Free cash flow is defined as the sum of

net cash from operating activities and net proceeds from sales of

fixed and financial assets, less capital expenditure and

capitalized development costs.

KVM: Keyboard, Video and Mouse.

Net financial debt: Net financial debt is defined as the

sum of short-term borrowings and long-term borrowings, less cash

and cash equivalents and marketable securities.

Normalized free cash flow: Normalized free cash flow is

defined as the sum of net cash from operating activities—based on a

normalized working capital requirement representing 10% of the last

12 months’ sales and whose change at constant scope of

consolidation and exchange rates is adjusted for the period

considered—and net proceeds of sales from fixed and financial

assets, less capital expenditure and capitalized development

costs.

Organic growth: Organic growth is defined as the change

in sales at constant structure (scope of consolidation) and

exchange rates.

Payout: Payout is defined as the ratio between the

proposed dividend per share for a given year, divided by the net

profit attributable to the Group per share of the same year,

calculated on the basis of the average number of ordinary shares at

December 31 of that year, excluding shares held in treasury.

PDU: Power Distribution Units.

UPS: Uninterruptible Power Supply.

Working capital requirement: Working capital requirement

is defined as the sum of trade receivables, inventories, other

current assets, income tax receivables and short-term deferred tax

assets, less the sum of trade payables, other current liabilities,

income tax payables, short-term provisions and short-term deferred

tax liabilities.

Calculation of working capital requirement

In € millions

9M 2023

9M 2024

Trade receivables

1,015.2

1,059.9

Inventories

1,305.1

1,360.8

Other current assets

291.1

274.0

Income tax receivables

152.7

223.2

Short-term deferred taxes

assets/(liabilities)

109.1

104.2

Trade payables

(885.2)

(923.7)

Other current liabilities

(846.0)

(873.7)

Income tax payables

(79.1)

(70.1)

Short-term provisions

(147.0)

(160.7)

Working capital

required

915.9

993.9

Calculation of net financial debt

In € millions

9M 2023

9M 2024

Short-term borrowings

1,187.1

412.3

Long-term borrowings

4,138.8

4,627.1

Cash and cash equivalents

(3,172.2)

(1,834.6)

Net financial debt

2,153.7

3,204.8

Reconciliation of adjusted operating profit with profit for

the period

In € millions

9M 2023

9M 2024

Profit for the period

937.5

833.9

Share of profits (losses) of

equity-accounted entities

0.0

0.0

Income tax expense

329.8

307.8

Exchange (gains) / losses

(0.4)

16.4

Financial income

(59.1)

(79.0)

Financial expense

66.0

110.6

Operating profit

1,273.8

1,189.7

i) Amortization &

depreciation of revaluation of assets at the time of acquisitions,

other P&L impacts relating to acquisitions and ii) impacts

related to disengagement from Russia (impairment of assets and

effective disposal)

89.7

86.4

Impairment of goodwill

0.0

0.0

Adjusted operating

profit

1,363.5

1,276.1

Reconciliation of EBITDA with profit for the period

In € millions

9M 2023

9M 2024

Profit for the period

937.5

833.9

Share of profits (losses) of

equity-accounted entities

0.0

0.0

Income tax expense

329.8

307.8

Exchange (gains) / losses

(0.4)

16.4

Financial income

(59.1)

(79.0)

Financial expense

66.0

110.6

Operating profit

1,273.8

1,189.7

Depreciation and impairment of

tangible assets (including right-of-use assets)

148.3

161.9

Amortization and impairment of

intangible assets (including capitalized development costs)

109.2

100.5

Impairment of goodwill

0.0

0.0

EBITDA

1,531.3

1,452.1

Reconciliation of cash flow from operations, free cash flow

and normalized free cash flow with profit for the period

In € millions

9M 2023

9M 2024

Profit for the period

937.5

833.9

Adjustments for non-cash movements in

assets and liabilities:

Depreciation, amortization and

impairment

260.3

266.3

Changes in other non-current assets and

liabilities and long-term deferred Taxes

51.6

56.9

Unrealized exchange (gains)/losses

16.3

(6.7)

(Gains)/losses on sales of assets, net

1.4

0.9

Other adjustments

0.2

12.2

Cash flow from operations

1,267.3

1,163.5

Decrease (Increase) in working capital

requirement

79.5

(292.2)

Net cash provided from operating

activities

1,346.8

871.3

Capital expenditure (including capitalized

development costs)

(133.7)

(127.3)

Net proceeds from sales of fixed and

financial assets

1.0

5.2

Free cash flow

1,214.1

749.2

Increase (Decrease) in working capital

requirement

(79.5)

292.2

(Increase) Decrease in normalized working

capital requirement

(21.7)

5.1

Normalized free cash flow

1,112.9

1,046.5

Scope of consolidation

2023

Q1

H1

9M

Full-year

Full consolidation

method

Geiger

3 months

6 months

9 months

12 months

Emos

3 months

6 months

9 months

12 months

Usystems

3 months

6 months

9 months

12 months

Voltadis

Balance sheet only

6 months

9 months

12 months

A. & H. Meyer

Balance sheet only

6 months

9 months

12 months

Power Control

Balance sheet only

Balance sheet only

9 months

12 months

Encelium

Balance sheet only

6 months

9 months

12 months

Clamper

Balance sheet only

Balance sheet only

Balance sheet only

11 months

Teknica

Balance sheet only

4 months

MSS

Balance sheet only

2024

Q1

H1

9M

Full-year

Full consolidation

method

Voltadis

3 months

6 months

9 months

12 months

A. & H. Meyer

3 months

6 months

9 months

12 months

Power Control

3 months

6 months

9 months

12 months

Encelium

3 months

6 months

9 months

12 months

Clamper

3 months

6 months

9 months

12 months

Teknica

3 months

6 months

9 months

12 months

MSS

Balance sheet only

6 months

9 months

12 months

ZPE Systems

Balance sheet only

Balance sheet only

Balance sheet only

To be determined

Enovation

Balance sheet only

Balance sheet only

To be determined

Netrack

Balance sheet only

Balance sheet only

To be determined

Davenham

Balance sheet only

Balance sheet only

To be determined

Vass

Balance sheet only

Balance sheet only

To be determined

UPSistemas

Balance sheet only

To be determined

Disclaimer

This press release may contain forward-looking statements which

are not historical data. Although Legrand considers these

statements to be based on reasonable assumptions at the time of

publication of this release, they are subject to various risks and

uncertainties that could cause actual results to differ from those

expressed or implied herein.

Details on risks are provided in the most recent version of

Legrand Universal Registration Document filed with the Autorité des

marchés financiers (Financial Markets Authority, AMF), which is

available on-line on the websites of both AMF (www.amf-france.org)

and Legrand (www.legrandgroup.com).

Investors and holders of Legrand securities are reminded that no

forward-looking statement contained in this press release is or

should be construed as a promise or a guarantee of actual results,

which are liable to differ significantly. Therefore, such

statements should be used with caution, taking into account their

inherent uncertainty.

Subject to applicable regulations, Legrand does not undertake to

update these statements to reflect events or circumstances

occurring after the date of publication of this release.

This press release does not constitute an offer to sell, or a

solicitation of an offer to buy Legrand securities in any

jurisdiction.

Readers are invited to verify the authenticity of Legrand press

releases with the CertiDox app. Learn more at www.certidox.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106925509/en/

Investor relations & financial communication Ronan

MARC (Legrand) +33 1 49 72 53 53. ronan.marc@legrand.com

Press relations Lucie DAUDIGNY (TBWA) +33 6 77 20 71 11.

lucie.daudigny@tbwa-corporate.com

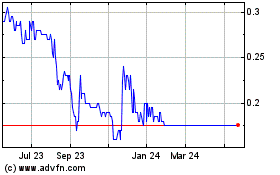

Luminex Resources (TSXV:LR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Luminex Resources (TSXV:LR)

Historical Stock Chart

From Feb 2024 to Feb 2025