Midlands Minerals Releases Drilling Results and Plan for Next Phases at Kaniago

29 May 2012 - 1:46AM

Marketwired Canada

Midlands Minerals Corp. ("Midlands" or the "Company") (TSX

VENTURE:MEX)(OTCQX:MDLXF) is pleased to announce the results of a 1,995 meter

diamond drilling program completed on March 8 at the Kaniago West and Mmooho

targets on its Kaniago gold project in Ghana.

Drilling at the Mmooho gold target aimed at expanding the target along strike

and down dip whilst also providing core samples for structural analysis and

investigating the presence of additional deeper parallel zones of

mineralization. Drill holes KNDD-12-001, KNDD-12-002 and KNDD-12-003A totaling

1,289 meters confirmed the presence at depth and on strike of gold

mineralization above 0.5 g/t gold with a best composite of 3.8 meters grading

4.86 g/t gold at a depth of 95.6 meters in KNDD-12-002. The drilling provided

the expected structural control but did not enhance grades or thicknesses

compared to the 2011 RC drill program.

Drilling at the Kaniago West gold target focused on defining controls to gold

mineralization adjacent to the thick zone of gold mineralization intercepted in

previously released drill hole KNRC-11-041 (27 meters grading 2.97 g/t gold -

please see press release dated February 6, 2012). Drill holes KNDD-12-004 and

KNDD-12-005 totaling 606.7 meters confirmed the presence at depth and on strike

of gold mineralization above 0.5 g/t gold with a best composite of 7.0 meters

grading 1.75 g/t gold at a drill depth of 165.5 meters in KNDD-12-005. The

drilling provided the expected structural control but as at Mmooho it did not

enhance grades or thicknesses compared to the 2011 RC drill program.

A recent reinterpretation of soil geochemical results has further enhanced the

gold anomalous trends. The NNE trending Esaase-Kaniago West soil geochemical

trend extends NNE to the Keegan Resources' Esaase gold deposit (measured and

indicated resources of 98.7 million tonnes at an average grade of 1.1 g/t for

3.64 million ounces gold) and PMI Gold Corporation's Abore gold deposit

(measured and indicated resources of 6.03 million tonnes at an average grade of

1.6 g/t for 0.31 million ounces gold) on the adjacent concessions. The Kaniago

West and Mmooho prospects are located on this trend.

Parallel to this trend, two further trends are known to extend on adjacent

companies' concessions and host significant gold deposits:

-- the Besease-Adubiaso NNE trend hosts PMI Gold Corporation's Adubiaso

gold deposit (measured and indicated resources of 4.17 million tonnes at

an average grade of 2.59 g/t for 0.35 million ounces gold) immediately

south of the Kaniago concession; and,

-- the Kampese-Nkran-Asuadai NNE trend hosts PMI Gold Corporation's Nkran

gold deposit (measured and indicated resources of 32.15 million tonnes

at an average grade of 2.28 g/t for 2.35 million ounces gold) and

Asuadai gold deposit (measured and indicated resources of 2.44 million

tonnes at an average grade of 1.28 g/t for 0.1 million ounces gold).

Midlands' next phase of work on the Kaniago concession will focus on expanding

the potential for large shallow, potentially bulk-mineable gold deposits

associated with NNE shear zones along the soil geochemical trends by testing

them with systematic fences of air core drilling spaced 500 meters to 800 meters

across the trends. Air core holes will be drilled at -50 degrees to refusal,

usually the limit of fresh rock. The collar of the following hole on the fence

will be located vertically above the last sample of the last drilled hole in

order to cover all the target area with drill information.

Additionally, the Company announced that it has granted stock options to acquire

an aggregate of 1,500,000 common shares to the Vice President, Exploration of

the Company under Midlands Minerals' stock option plan. Each option granted to

the officer is exercisable for a five year period to acquire one common share at

a price of $0.10 per share and vest on an annual schedule over a period of 3

years.

About Midlands Minerals:

Midlands Minerals is focused on developing a portfolio of high quality gold

exploration projects in Ghana and Tanzania, countries with exceptional histories

of gold production and home to some of the most profitable gold mines in Africa.

Midland's flagship gold property is the 65% owned Sian project, site of a past

producing open pit gold mine located in the Ashanti gold belt. Sian has NI

43-101 compliant Indicated gold resources of 2.6 million tonnes grading 2.33 g/t

gold (192,400 ounces) and Inferred gold resources of 2.7 million tonnes grading

2.35 g/t gold (203,350 ounces). Extensions to these resources are open along

strike and at depth, highlighting the potential to grow the gold resource at

Sian. Midlands' Kaniago gold project is located in Ghana's Asankrangwa gold belt

and is contiguous to two past open pit gold producers: Abore to the north and

Obotan to the south. Recent drilling and exploration has produced encouraging

results, demonstrating the gold resource potential of the project.

Midlands also holds licences for gold and diamonds in two regions in Tanzania.

The first is found in the Lake Victoria Goldfields region and includes its

advanced Itilima Gold Project, which lies within the Geita-Bulyanhulu-Sekenke

Trend, which hosts over 40 million ounces in gold reserves. The second region

lies within the Kilindi-Handeni Trend and includes the New Kilindi-Handeni

prospecting licences.

Dr Dominique Fournier, EurGeol, a "qualified person" as defined by National

Instrument 43-101, has reviewed and approved the technical information and data

included in this press release. Additional information on Midlands can be viewed

under the Company's profile at www.sedar.com or on Midlands' website:

www.midlandsminerals.com.

This news release includes certain forward-looking statements or information.

All statements other than statements of historical fact included in this

release, including, without limitation, statements relating to the potential

mineralization and geological merits of the company's projects and other future

plans, objectives or expectations of the Company are forward-looking statements

that involve various risks and uncertainties. There can be no assurance that

such statements will prove to be accurate and actual results and future events

could differ materially from those anticipated in such statements. Important

factors that could cause actual results to differ materially from the Company's

plans or expectations include risks relating to the actual results of current

exploration activities, fluctuating gold prices, possibility of equipment

breakdowns and delays, exploration cost overruns, availability of capital and

financing, general economic, market or business conditions, regulatory changes,

timeliness of government or regulatory approvals and other risks detailed herein

and from time to time in the filings made by the Company with securities

regulators. The Company expressly disclaims any intention or obligation to

update or revise any forward-looking statements whether as a result of new

information, future events or otherwise except as otherwise required by

applicable securities legislation.

To view the figures associated with this press release, please visit the

following link: http://media3.marketwire.com/docs/MEX528figs.pdf

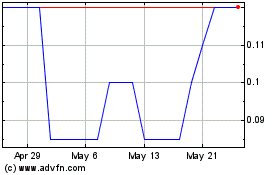

Mexican Gold Mining (TSXV:MEX)

Historical Stock Chart

From Jun 2024 to Jul 2024

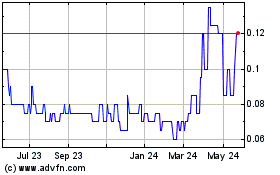

Mexican Gold Mining (TSXV:MEX)

Historical Stock Chart

From Jul 2023 to Jul 2024