LONDON, Nov. 20, 2017 /CNW/ - Meridian Mining SE (TSX V:

MNO) ("Meridian " or the "Company") today provided an update on

reconnaissance exploration results from its Coice de Cobra Gold

program in the state of Rondônia, in NW

Brazil.

KEY POINTS

- Recent programs focussed on evaluation of a 281-hectare area,

within broader geochemical anomalies spanning 39 km2 in

the Coice de Cobra region and 8 km2 in the Gazetta area

to the west.

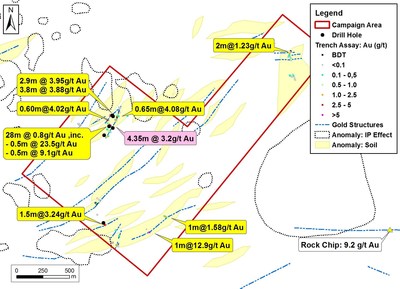

- The trenching program indicates potential for targets with a

broad footprint of mineralization, with results of 28m @ 0.8g/t Au,

including 0.5m @ 23.5g/t Au and 0.5m @ 9.1g/t Au in surface

saprolite below shallow soils.

- More discrete lode structures are observed in sub-surface

drilling. Peak intersections to date of 4.35m @ 3.2g/t Au in in

ductile shear zones with strong quartz-sulfidealteration.

- Preferred structural trends for mineralization mimic those

recognized more broadly in gold deposits of the Amazon Craton

(dominant E-W / NE trends). A review of the Company's geophysical

data in conjunction with recent exploration data has highlighted

additional target corridors to be prioritized for follow-up. The

Company has decided to pause the drilling and trenching program

whilst land access is arranged for these corridors.

"The results of the initial drilling and trenching campaign

support the presence of a bedrock gold system" said Anthony Julien, President and CEO of Meridian.

"All of the key geological elements are present that warrant a

sustained program to test for open pit targets where multiple

structures converge, and to test the opportunity for higher-grade

mineralization in discrete shear zones. With the number of targets

on the gold project expanding, the Company may seek strategic

partnerships. This will enable continued focus on development

studies for the Bom Futuro Tin Joint Venture, and expansion of the

Company's manganese business".

ESPIGÃO DO OESTE GOLD PROJECT

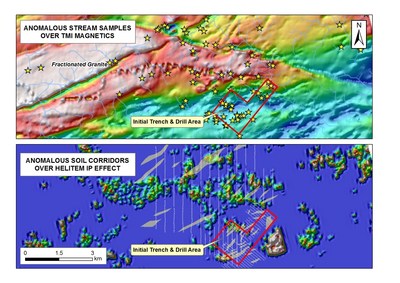

Meridian Mining first identified gold potential on licences

associated with its manganese operations during geochemical

programs in 2016. Stream and associated soil geochemical anomalies

were defined over 8 km2 in the Gazetta area to the west,

over 39 km2 in the Coice de Cobra areas to the east.

Reconnaissance trenching results support a local basement

structural source for the surface gold anomalies. This represents a

newly defined bedrock mineral system, being geographically

separated from the nearest gold districts (the Alto Guaporé Gold

Belt to the south and the Alta Floresta - Juruena Province to the

east in Mato Grosso; Fig 1). The

gold-bearing structures at Espigão do Oeste nevertheless share some

similar characteristics with other gold camps of the Amazon Craton,

with north-east and east-west structures favoured for

mineralization. These trends are similar to those seen in the

granite-hosted gold systems at Alta Floresta.

COICE DE COBRA EXPLORATION PROGRAM

The recent phase of bedrock exploration trenching and drilling

was prioritized in the Coice de Cobra area. The gold

anomalies here are located off the eastern flank of a fractionated

granite body, which is cut by prominent structures evident in the

aeromagnetic data (Fig 2). The Company has completed 45 trenches

and six diamond drill holes in the recent campaign, providing

valuable information on the targeting opportunity (Fig 3). Key

observations include:

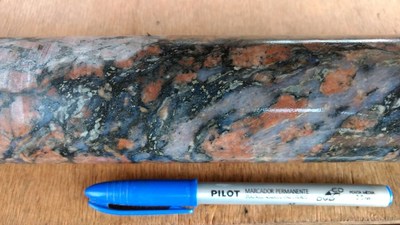

- High-strain shear zones are present in the basement sequence.

Altered mafic dykes have partitioned ductile stain, creating

competency contrasts with the adjacent granite. Boundinaged vein

sets and strong silica-sulfide alteration are developed in these

shear zones (Fig 4). Hole DDH_CC_003 returned 4.35 m @ 3.2 g/t Au

from 20.65m, including 0.6m @ 6.8g/t Au from 23.4m (down-hole

widths).

- In the hangingwall of the shear zones, the granite has

undergone broader brittle deformation, producing vein sets

associated with moderate degrees of silica-sulfide alteration (Fig

5). The granite package is also locally cut by gold-anomalous

veined porphyry dykes (Fig 6).

- Free gold could be readily panned from the up-dip projection of

some of these hangingwall positions (Fig. 7). Peak assays from

hangingwall veins included 0.5m @ 23.5g/t Au in TR_CC_031, within a

broader low-grade halo (28.0m @ 0.8g/t Au). Assays in the

unweathered bedrock in drill holes beneath this position were more

subdued. Further work required to evaluate if this is due to a

plunge control and/or supergene upgrade of saprolite

mineralization.

- Hematite and sericite alteration is overserved to overprint the

granite. The hematite and sulfide alteration assemblages suggest

the presence of hydrothermal fluids with different redox conditions

(a favorable component of gold mineralizing processes).

- Various structural trends identified through the trenching

program are observed to strike towards geophysical anomalies

identified in the Company's HeliTEM survey data (IP Effect /

chargeability anomalies). These present an additional parameter for

targeting future drilling and trenching programs, given the sulfide

association observed with gold in the current program. The Company

is undertaking further reviews of it's geophysical data as part of

its gold targeting assessments. Geophysical exploration targets are

preliminary in nature and are not conclusive evidence of the

likelihood of a mineral deposit.

Next Steps

- The Company will continue liaison with landholders to expand

access agreements to regional properties identified as priority

targets from the geophysical review. These require additional soil

sampling as a prelude to trenching and drilling.

- Further processing of the aeromagnetic data will be undertaken

with an emphasis on gold targeting. This will include an assessment

for any plug-like bodies that might represent higher level

intrusive stocks or breccia complexes within the crystalline

basement.

- Options will be considered for strategic partnerships with

gold-focussed companies, given the current commitments of Meridian

Mining to development studies on its advanced tin project (under

the Bom Futuro Joint Venture), and on its manganese business.

On behalf of the Board of Directors of

Meridian Mining SE

"Anthony Julien"

Anthony Julien

President, CEO and Director

QUALIFIED PERSON

The technical information about the Company's exploration

activity has been has been prepared under the supervision of and

verified by Dr Adrian McArthur

(B.Sc. Hons, PhD. FAusIMM), the Chief Geologist of Meridian Mining,

who is a "qualified person" within the meaning of National

Instrument 43-101.

ABOUT MERIDIAN

Meridian Mining SE is focused on the acquisition, exploration,

development and mining activities in Brazil. The Company is currently focused on

exploring and developing the Espigão manganese project, the Bom

Futuro tin JV area, and adjacent areas in the state of Rondônia.

The Company employs a two-pronged strategy with the objective of

growing pilot production while advancing a parallel multi-commodity

regional exploration program. Meridian is currently producing high

grade manganese at its project located at Espigão do Oeste.

Further information can be found at www.meridianmining.co.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking

information or forward-looking statements for the purposes of

applicable securities laws. These statements include, among others,

statements with respect to the Company's plans for exploration and

development of its properties and potential mineralization. These

statements address future events and conditions and, as such,

involve known and unknown risks, uncertainties and other factors,

which may cause the actual results, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by the statements. Such risk

factors include, among others, failure to obtain regulatory

approvals, failure to complete anticipated transactions, the timing

and success of future exploration and development activities,

exploration and development risks, title matters, inability to

obtain any required third party consents, operating hazards, metal

prices, political and economic factors, competitive factors,

general economic conditions, relationships with strategic partners,

governmental regulation and supervision, seasonality, technological

change, industry practices and one-time events. In making the

forward-looking statements, the Company has applied several

material assumptions including, but not limited to, the assumptions

that: (1) the proposed exploration and development of mineral

projects will proceed as planned; (2) market fundamentals will

result in sustained metals and minerals prices and (3) any

additional financing needed will be available on reasonable terms.

The Company expressly disclaims any intention or obligation to

update or revise any forward-looking statements whether as a result

of new information, future events or otherwise except as otherwise

required by applicable securities legislation.

The Company cautions that it has not completed any feasibility

studies on any of its mineral properties, and no mineral reserve

estimate has been established. In particular, because the Company's

production decision relating to BMC's manganese project is not

based upon a feasibility study of mineral reserves, the economic

and technical viability of the Espigão manganese project has not

been established.

The TSX Venture Exchange has in no way passed upon the merits of

the proposed Arrangement and has neither approved nor disapproved

the contents of this news release. Neither TSX Venture

Exchange nor its Regulation Services Provider (as that term is

defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

NOTES

Surface geochemical evaluation involves an initial

pan-concentrate program with follow-up soil surveys. Positive

visual identifications of gold in field pan-concentrates are

cross-checked by mineralogical reports at SGS Laboratories in

Belo Horizonte. For drainage

sampling, this represents a 20 liter bucket of alluvium from the

lower level of a stream channel. The technique is an indicator of

minerals of exploration interest in the source area and are not

referenced to grade. Soil samples are collected by pitting or

hand-auger from "B-Horizon". Samples are sieved to 80# and

pulverized to 150#. Gold in soil samples is analysed by Fire Assay

of a 50g charge (method FAA505). Gold in rock samples and in drill

core is analysed by SGS method FAA323 (fire assay of 30g charge),

with samples containing visible gold analysed by screen fire assay

(SGS method FAASCR). Analytical quality is monitored by certified

references and blanks. Until dispatch, samples are stored in the

company's supervised stockpile yard or exploration office. The

samples are couriered to the assay laboratory using a commercial

contractor (Eucatur). Pulps and rejects are returned to the Company

and archived.

SOURCE Meridian Mining S.E.