Neptune Digital Assets Announces Bitcoin Mining Operations and Partnership With Link Global

04 March 2021 - 11:00PM

Neptune Digital Assets Corp. (TSX-V:NDA) (OTC:NPPTF) (FSE:1NW)

(“

Neptune” or the "

Company") is

excited to announce that it will begin Bitcoin mining operations in

the coming weeks. Neptune has entered into a partnership with Link

Global Technologies (CSE:LNK) (OTC:LGLOF) (FSE:LGT) (“Link”) that

will provide rack space, power, facilities and servicing of up to

1,500 ASIC mining machines. Neptune estimates that at the current

mining difficulty, 1,500 machines would produce roughly 0.7 BTC per

day. Further details will be announced in the weeks ahead regarding

Neptune’s initial ASIC miner deployment and scaling operations.

“The economics of Bitcoin mining have changed

drastically in the past months and as such we see this as another

accretive revenue stream for shareholders. The partnership with

Link enables us to rapidly move into Bitcoin mining with the

ability to scale as quickly as our resources allow. We intend to

operate a low cost and highly profitable mining operation using the

expertise and turnkey setup of Link along with Neptune’s ASIC

miners. As always, Neptune is committed to maintaining low overhead

while adding digital assets to our balance sheet. We are very

excited to scale this operation in order to add maximum value for

our shareholders,” stated Cale Moodie, Neptune’s CEO.

About Neptune Digital Assets

Corp.

The Company has a diversified cryptocurrency

portfolio with investments made in top market cap tokens,

proof-of-stake cryptocurrencies, decentralized finance and

associated blockchain technologies.

ON BEHALF OF THE BOARD

Cale Moodie, President and CEONeptune Digital

Assets Corp.1-800-545-0941www.neptunedigitalassets.com

Forward-Looking Statements

This release contains certain “forward looking

statements” and certain “forward-looking information” as defined

under applicable Canadian securities laws. Forward-looking

statements and information can generally be identified by the use

of forward-looking terminology such as “may”, “will”, “expect”,

“intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans”,

“proposes” or similar terminology. Forward-looking statements and

information include, but are not limited to, the completion of the

private placement; the Company’s future earnings and operating

costs; the Company’s future growth in total assets; the Company’s

strategy to purchase crypto currency and optimize its crypto

portfolio; the Company’s ability effectively dollar cost average

its purchases of crypto currency; and the future outlook of the

crypto currency market generally. Forward-looking statements and

information are based on forecasts of future results, estimates of

amounts not yet determinable and assumptions that, while believed

by management to be reasonable, are inherently subject to

significant business, economic and competitive uncertainties, and

contingencies. Forward-looking statements and information are

subject to various known and unknown risks and uncertainties, many

of which are beyond the ability of the Company to control or

predict, that may cause the Company’s actual results, performance

or achievements to be materially different from those expressed or

implied thereby, and are developed based on assumptions about such

risks, uncertainties and other factors set out herein, including

but not limited to: the inherent risks involved in the

cryptocurrency and general securities markets; the Company’s

ability to successfully mine digital currency; revenue of the

Company may not increase as currently anticipated, or at all; the

Company may not be able to profitably liquidate its current digital

currency inventory, or at all; a decline in digital currency prices

may have a significant negative impact on the Company’s operations;

the volatility of digital currency prices; uncertainties relating

to the availability and costs of financing needed in the future;

the inherent uncertainty of production and cost estimates and the

potential for unexpected costs and expenses, currency fluctuations;

regulatory restrictions, liability, competition, loss of key

employees and other related risks and uncertainties. The Company

does not undertake any obligation to update forward-looking

information except as required by applicable law. Such

forward-looking information represents management's best judgment

based on information currently available. No forward-looking

statement can be guaranteed and actual future results may vary

materially. Accordingly, readers are advised not to place undue

reliance on forward-looking statements or information.

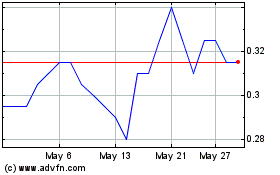

Neptune Digital Assets (TSXV:NDA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Neptune Digital Assets (TSXV:NDA)

Historical Stock Chart

From Nov 2023 to Nov 2024