New Zealand Energy Corp. ("NZEC" or the "Company") (TSX VENTURE:NZ)(OTCQX:NZERF)

has released the results of its first quarter ended March 31, 2013. Details of

the Company's financial results are described in the Unaudited Consolidated

Financial Statements and Management's Discussion and Analysis which, together

with further details on each of the Company's projects, will be available on the

Company's website at www.newzealandenergy.com and on SEDAR at www.sedar.com. All

amounts are in Canadian dollars unless otherwise stated.

HIGHLIGHTS

Quarterly results

-- 30,179 barrels of oil ("bbl") produced and 27,246 bbl sold in Q1-2013,

generating pre-tax oil sales of $3,061,064

-- Positive net cash flow from petroleum operations in Q1-2013 of

approximately $1.2 million

-- Average field netback of $45.29/bbl in Q1-2013, a 16% increase compared

to Q4-2012

-- Cash invested in resource properties, plant and equipment during Q1-2013

of $12,048,313

Cumulative results

-- 43,360 bbl produced and 43,634 bbl sold year to date (May 24, 2013),

generating pre-tax oil sales of approximately $4.7 million

-- Cumulative production of 251,581 bbl since commencement of production,

generating pre-tax oil sales (including sales from pre-production

testing) of approximately $26.8 million

Developments

-- Engaged independent reservoir management firm to analyse Copper Moki

wells and reservoir with the objective of optimizing oil recoveries

-- Completed 50-km 2D seismic survey on Wairoa permit in the East Coast

Basin

-- Initiated consent and permitting for two East Coast Basin exploration

wells

-- Extended the maturity date of the HSBC operating line of credit to

September 30, 2013

-- Progressed acquisition of assets from Origin: received Overseas

Investment Office approval related to Waihapa Production Station land,

working with Origin to finalize certain terms of the agreement

FINANCIAL SNAPSHOT

----------------------------------------------------------------------------

Current Preceding Comparative

quarter quarter quarter

ended ended ended

March 31, 2013 December 31, 2012 March 31, 2012

----------------------------------------------------------------------------

Production 30,179 bbl 29,516 bbl 39,852 bbl

Sales 27,246 bbl 29,901 bbl 34,659 bbl

----------------------------------------------------------------------------

Price 112.35 $/bbl 103.98 $/bbl 117.94 $/bbl

Production costs 62.08 $/bbl 59.63 $/bbl 22.25 $/bbl

Royalties 4.98 $/bbl 5.39 $/bbl 5.16 $/bbl

Field netback 45.29 $/bbl 38.96 $/bbl 90.53 $/bbl

----------------------------------------------------------------------------

Revenue 2,925,258 2,948,042 3,908,683

Pre-production

recoveries - 338,321 1,351,630

Total comprehensive

income (loss) 1,313,397 (1,333,805) 799,032

Net finance expense

(income) 17,887 (11,548) (18,311)

(Loss) earnings per

share - basic and

diluted (0.02) (0.02) 0.00

Current assets 48,199,638 49,137,637 76,167,931

Total assets 129,545,992 116,059,939 96,979,923

Total long-term

liabilities 3,273,617 2,598,840 250,559

Total liabilities 33,939,619 23,442,632 6,017,299

Shareholders' equity 95,606,373 92,617,307 90,962,624

----------------------------------------------------------------------------

Note: The abbreviation bbl means barrel or barrels of oil.

During the three-month period ended March 31, 2013, the Company produced 30,179

barrels of oil and sold 27,246 barrels for total oil sales of $3,061,064,

averaging $112.35 per barrel. Total recorded production revenue net of a 5%

royalty payable to the New Zealand Government (an average of $4.98 per barrel)

was $2,925,258. Production costs during the three-month period ended March 31,

2013 totalled $1,691,405, or an average of $62.08 per barrel, generating a field

netback on average of $45.29 per barrel during the first quarter. NZEC

calculates the netback as the oil sale price less fixed and variable operating

costs and a 5% royalty. While the field netback in Q1-2013 increased compared to

the last quarter as the result of a higher realized oil price, field netbacks

have declined compared to Q1-2012 as the result of decreased oil production

related to well declines coupled with higher fixed production costs as a result

of more wells coming into production during the prior year. Each new well site

brings additional production costs to the Company in the form of equipment

rentals and manpower.

The Company has also undertaken a number of reservoir and production tests in

recent months with the objective of optimizing oil production, and these tests

have added to production costs. During the three-month period ended March 31,

2013, fixed production costs represented approximately 89% of total production

costs. The Company is implementing measures to reduce production costs and

increase oil production. In order to reduce production costs associated with

manpower and equipment rentals, the Company installed permanent production

facilities at the Copper Moki site. Installation was completed in May and the

facilities are currently being commissioned. Permanent facilities are expected

to reduce production costs considerably in future quarters as the equipment is

owned by NZEC and operated and maintained by NZEC employees. In addition, the

Company has engaged an independent reservoir management company to review the

Copper Moki wells and identify opportunities to enhance recovery and optimize

oil production from the wells.

At May 22, 2013, the Company had an estimated $12.0 million in net working

capital. This includes US$35 million that has been placed on deposit to satisfy

the balance of the purchase price of the acquisition of assets from Origin, as

summarized below in Property Review, Origin Agreement. The Company has secured a

US$34.5 million operating line of credit against the US$35 million deposit and

to date has drawn down US$27.4 million. The Company is considering a number of

options to increase its financial capacity to carry out the acquisition of

assets and other anticipated activities.

PROPERTY REVIEW AND OUTLOOK

Taranaki Basin

The Taranaki Basin is situated on the west coast of the North Island and is

currently New Zealand's only oil and gas producing basin, with total production

of approximately 130,000 boe/d from 18 fields. Within the Taranaki Basin, NZEC

holds a 100% interest in the Eltham Permit; a 65% interest in the Alton Permit

in joint arrangement with L&M and a 60% interest in the Manaia Permit in joint

arrangement with New Zealand Oil & Gas ("NZOG"). The Eltham Permit covers

approximately 93,166 acres (377 km2) of which approximately 31,877 acres (129

km2) are offshore in shallow water. The Alton Permit covers approximately

119,204 onshore acres (482 km2). NZEC increased its interest in the Alton Permit

from 50% to 65% by completing the acquisition and processing of approximately 50

km2 of 3D seismic across the northern end of the permit. Transfer of the

additional 15% interest was approved by NZPAM on December 21, 2012. The Manaia

Permit covers approximately 27,426 onshore acres (111 km2) and was granted to

NZEC and NZOG in December 2012 as part of the annual New Zealand block offer for

exploration permits.

NZEC also expects to acquire four Petroleum Licenses and the Waihapa Production

Station upon completion of the acquisition of assets from Origin, as outlined

below under Origin Agreement.

Production

NZEC has drilled ten wells on its Eltham Permit and made six oil discoveries,

with results still pending from one well. At the date of this MD&A, four wells

have been advanced to commercial production. The wells are producing light oil

that is trucked to the Shell-operated Omata tank farm and sold at Brent pricing.

Cumulatively, as of the date of this report, the Company has produced

approximately 251,581 barrels of oil, with cumulative pre-tax oil sales of

approximately $26.8 million, including sales from oil produced during testing

(net results of operations are discussed under Results of Operations). Over 20

production days in May 2013, the wells have collectively produced oil at an

average rate of 225 bbl/day and generated gas at an average rate of 621 mcf/day.

Copper Moki-1 has been producing from the Mt. Messenger formation since December

10, 2011. Copper Moki-2 has been producing from the Mt. Messenger formation

since April 1, 2012. Copper Moki-3 has been producing from the Mt. Messenger

formation since July 2, 2012. The wells produce approx. 42 degrees API oil and

flowed from natural reservoir pressure until October 2012, when NZEC began

installing artificial lift (pump jacks) to stabilize production rates. All three

wells are now producing with artificial lift.

Waitapu-2 has been producing from the Mt. Messenger formation since December 20,

2012. The well produces approx. 40 degrees API oil and has continued to flow

from natural reservoir pressure, and will require artificial lift in the near

term. To assist with reservoir studies at the Copper Moki wells, NZEC has run

down-hole gauges into Waitapu-2 that will continually measure the bottom hole

temperature and pressure of the reservoir. Like the Copper Moki wells, Waitapu-2

is producing from the Mt. Messenger formation and the data will provide a good

analogue for the Copper Moki reservoir. Waitapu-2 will be shut in towards the

end of May for up to 90 days to gather valuable information for the planned

reservoir study, while the Company also evaluates artificial lift options for

the well.

Production declines from the Copper Moki wells have been greater than expected

and have prompted the Company to initiate a reservoir review. These wells are

known to produce low pour point oil with associated wax. While a decline in

production is expected over time, it is possible that the higher decline rates

may be due not to reservoir conditions but rather to mechanical issues,

including wax build-up down-hole. Oil analysis shows that the wax appearance

temperature may be only slightly lower than the bottom-hole temperature,

allowing wax to build up around the pump, in the perforations and potentially in

the formation itself. The Company has conducted a number of tests to resolve

this issue and has found that flow from the wells improves following condensate

washes, which dissolve wax that has formed around the pump. The team is

analysing the results of condensate washes conducted to date in order to

identify the optimal interval between each wash. Information collected from the

Waitapu-2 gauges will provide additional insight into the formation temperature

and wax issues. Further work has been carried out by an independent firm to

develop a pour point depressant that could be used to treat wax deposition at

the pump and well bore. A trial is planned in the near term. In addition, the

Company has engaged an independent reservoir management company to investigate

the cause of and identify remedies to these issues in an effort to optimize oil

production. Such remedies may include stimulation of well flow with condensate

washes, modified pumping mechanisms or other forms of reservoir stimulation.

All four producing wells generate both oil and liquids-rich natural gas;

however, the Company is not yet generating cash flow from natural gas

production. The Company has completed a natural gas pipeline from the Copper

Moki site to the Waihapa Production Station and is considering a number of

options to tie-in the Waitapu site, including the possibility of building a

pipeline to deliver Waitapu's rich gas to the Copper Moki site and on to the

Waihapa Production Station through the existing Copper Moki pipeline. A pipeline

would minimise infrastructure at the Waitapu site, and ultimately reduce

production costs associated with the well. The Company will consider all options

as it evaluates the economics associated with artificial lift and infrastructure

at the Waitapu site.

Origin Agreement

In May 2012, the Company entered into the Origin Agreement with Origin to

acquire upstream and midstream assets (the "Acquisition"). These assets include

four Petroleum Licenses totalling 26,907 acres as well as the Waihapa Production

Station and associated gathering and sales infrastructure.

Under the terms of the Origin Agreement, and pursuant to an exclusive

arrangement, the Company has agreed to pay Origin consideration in the amount of

$42 million in cash, payable in the US$ equivalent at a fixed C$/US$ exchange

rate of 1.0349 (US$40.6 million), and such other adjustments as may be required

at closing. A $5 million deposit was paid with the remainder due on closing.

Closing of the Acquisition is conditional on the following:

----------------------------------------------------------------------------

Condition Status

----------------------------------------------------------------------------

1. NZPAM approval for transfer of the NZPAM has voiced support for

Petroleum Licenses the transaction

2. New Zealand's Overseas Investment Office Approval obtained

approval for acquisition of the land

upon which the Waihapa Production

Station is situated

3. Origin completing recommissioning of the Plant has been certified for

TAWN LPG plant operation

4. Origin and/or NZEC entering into an In process

agreement with Contact Energy regarding

the use and development of the Ahuroa

gas storage facility

5. TSX Venture Exchange conditional Approval obtained

approval

----------------------------------------------------------------------------

While certain delays have been experienced in completing the Acquisition and

related documentation, the Company has continued to engage with Origin in order

to finalize certain terms contained in the Origin Agreement. Management

continues to work diligently with the aim of concluding this transaction during

Q2-2013, subject to increasing the Company's financial capacity in order to meet

its commitments under the Origin Agreement.

Outlook - Taranaki Basin

On February 25, 2013, the Company announced the decision to delay the remaining

two wells in its Eltham/Alton drill program to focus on commercial opportunities

in the pending acquisition of assets from Origin. The Company's objective is to

increase near-term production and cash flow while reducing exploration expenses,

and the Company believes that opportunities exist on the Petroleum Licenses to

achieve this objective. While this decision in no way diminishes the Company's

view of the prospectivity of the Eltham and Alton permits, NZEC intends to focus

in the near-term on lower-cost opportunities that are close to infrastructure.

The acquisition from Origin includes Petroleum Licenses that are central to a

network of oil and gas gathering pipelines and the full-cycle Waihapa Production

Station.

The Company's technical and engineering teams, working with independent experts,

continue to investigate options to enhance recovery and performance from the

Copper Moki and Waitapu wells. In addition, a review is underway to evaluate

NZEC's drilling and completion operations to date, in parallel with reprocessing

and interpretation of the Company's extensive 3D seismic data, with the goal of

recommencing drilling operations early in the third quarter of 2013. The Company

has one remaining commitment well on its Alton permit and expects to commence

drilling a Mt. Messenger target well in Q3-2013. The Company is responsible for

expenditures and is entitled to profits for its respective interest (65% NZEC /

35% L&M).

Upon closing of the acquisition of assets from Origin, NZEC plans to reactivate

six wells in the Tikorangi formation using an established gas lift system.

Reactivation of these wells is pending the completion and commissioning of

Contact Energy's new 18" pipeline, which is expected to provide the gas source

to lift these wells. NZEC has also determined that six previously drilled wells

on the Petroleum Licenses have uphole completion potential. Recompletion of

these wells would be significantly less expensive and faster than drilling new

wells, and economic discoveries could be quickly tied in to the Waihapa

Production Station using existing oil and gas gathering pipelines. Both the

reactivations and uphole completions could bring near-term, low-cost production

and cash flow to the Company.

NZEC's technical team has also identified five high-priority Mt. Messenger

targets in the southwest corner of the Petroleum Licenses. NZEC has completed

permitting for a new site called Waipapa (Oru Rd) and expects that drill pad

construction will be complete by mid Q3-2013, allowing the Company to access

these targets shortly after the acquisition has closed.

Longer-term exploration plans on the Petroleum Licenses include accessing Mt.

Messenger targets from existing drill pads, many of which have gathering

pipelines in place, that offer lower-cost exploration potential and can be

tied-in to the Waihapa Production Station on an expedited basis. NZEC is

advancing a number of new commercial opportunities to use the Waihapa Production

Station to its full potential and in order to maximize facility revenues, while

ensuring that NZEC's gas and associated natural gas liquids production can be

efficiently delivered to market.

Commercial oil discoveries on NZEC's properties and those of its peers have

confirmed the prospectivity of the Mt. Messenger formation, which remains NZEC's

primary exploration target in the near term. Mt. Messenger leads continue to be

refined as the Company interprets its propriety database of 3D seismic. NZEC's

technical team has also identified a number of leads in the deeper Moki,

Tikorangi and Kapuni formations on both the Petroleum Licenses and the Eltham

and Alton permits. Discoveries by other companies have demonstrated significant

flow rates and long-term production from reservoirs in these deeper formations.

NZEC will continue to advance these leads to drillable prospects and will move

these targets higher on the Company's priority list as warranted.

East Coast Basin

The East Coast Basin of New Zealand's North Island hosts two prospective oil

shale formations, the Waipawa and Whangai, which are the source of more than 300

oil and gas seeps. Within the East Coast Basin, NZEC holds a 100% interest in

the Castlepoint Permit, which covers approximately 551,042 onshore acres (2,230

km2), and a 100% interest in the Ranui Permit, which covers approximately

223,087 onshore acres (903 km2) and is adjacent to the Castlepoint Permit. On

September 3, 2010, NZEC applied to the Minister of Energy to obtain a 100%

interest in the East Cape Permit. The application is uncontested and the Company

expects the East Cape Permit to be granted to NZEC upon completion of NZPAM's

review of the application. The East Cape Permit covers approximately 1,067,495

onshore acres (4,320 km2) on the northeast tip of the North Island.

In addition, NZEC has entered into a binding agreement with Westech to acquire

80% ownership and become operator of the Wairoa Permit, which covers

approximately 267,862 onshore acres (1,084 km2) south of the East Cape Permit.

Preliminary approval of transfer of ownership was obtained from NZPAM on

December 20, 2012 and formation of a joint arrangement with Westech is subject

to completion of a joint operating agreement and final NZPAM approval. The

Wairoa Permit has been actively explored for many years, with extensive 2D

seismic data across the permit and log data from more than 15 wells drilled on

the property. Historical exploration focused on the conventional Miocene sands.

NZEC's technical team has identified conventional opportunities as well as

potential in the unconventional oil shales that underlie the property. NZEC's

team knows the property well and provided extensive consulting services (through

the consulting company Ian R Brown Associates) to previous permit holders,

assisting with seismic acquisition and interpretation, wellsite geology and

regional prospectivity evaluation. In addition, NZEC's team assisted with

permitting and land access agreements and worked extensively with local district

council, local service providers, land owners and iwi groups, allowing the team

to establish an excellent relationship with local communities.

Exploration and Outlook

NZEC has cored two test holes on the Castlepoint Permit. The Orui (125 metres

total depth) and Te Mai (195 metres total depth) collected core data across the

Waipawa and Whangai shales. NZEC also completed a test hole on the Ranui Permit.

Ranui-2 was drilled to 1,440 metres, coring the Whangai shale across several

intervals. In Q2-2012, NZEC completed 70 line km of 2D seismic data across the

Castlepoint and Ranui permits.

A review of the geochemical and physical properties of the two shale packages,

coupled with information from seismic data, has focused NZEC's exploration

strategy for the East Coast Basin. NZEC plans to drill one exploration well on

both the Ranui and Castlepoint permits in Q4-2013. The Company has met regularly

with local communities to discuss its exploration plans, and has initiated the

permitting and consent process for the drill locations.

The Company recently completed and is processing a 50-km 2D seismic program on

the Wairoa Permit that will help to identify exploration targets on the

property, and will finalize its exploration plans for the permit after reviewing

all of the seismic and well log data.

The Company's application for the East Cape Permit is uncontested and NZEC

expects the permit to be granted upon completion of NZPAM's review of the

application.

SUMMARY OF QUARTERLY RESULTS

----------------------------------------------------------------------------

2013 2012 2012 2012

Q1 Q4 Q3 Q2

$ $ $ $

----------------------------------------------------------------------------

Total assets 129,545,992 116,059,939 98,882,087 98,814,102

Exploration and

evaluation assets 49,610,922 37,379,726 26,377,188 25,373,718

Property, plant and

equipment 25,793,089 23,867,758 16,293,123 8,674,152

Working capital 17,533,636 28,293,845 45,204,695 53,844,035

Revenues 2,925,258 2,948,041 3,708,254 5,910,993

Accumulated deficit (22,386,089) (19,992,243) (17,804,045) (15,613,594)

Total comprehensive

income (loss) 1,313,397 (1,333,805) (2,018,634) 1,317,915

Basic (loss) earnings

per share (0.02) (0.02) (0.02) 0.01

Diluted (loss) earnings

per share (0.02) (0.02) (0.02) 0.01

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2012 2011 2011 2011

Q1 Q4 Q3 Q2

$ $ $ $

----------------------------------------------------------------------------

Total assets 96,979,923 31,152,804 33,566,611 10,683,239

Exploration and

evaluation assets 12,103,712 6,052,699 9,509,095 4,641,525

Property, plant and

equipment 8,150,802 5,509,511 63,421 68,366

Working capital 70,401,191 18,030,398 18,699,022 5,333,999

Revenues 3,908,683 974,517 - -

Accumulated deficit (16,548,180) (16,911,070) (17,057,134) (13,258,649)

Total comprehensive

income (loss) 799,032 (1,258,314) (4,279,538) (773,524)

Basic (loss) earnings

per share 0.00 0.01 (0.04) (0.01)

Diluted (loss) earnings

per share 0.00 0.01 (0.04) (0.01)

----------------------------------------------------------------------------

On behalf of the Board of Directors

John Proust, Chief Executive Officer & Director

About New Zealand Energy Corp.

NZEC is an oil and natural gas company engaged in the production, development

and exploration of petroleum and natural gas assets in New Zealand. NZEC's

property portfolio collectively covers approximately 2.25 million acres

(including pending permits) of conventional and unconventional prospects in the

Taranaki Basin and East Coast Basin of New Zealand's North Island. The Company's

management team has extensive experience exploring and developing oil and

natural gas fields in New Zealand and Canada. NZEC plans to add shareholder

value by executing a technically disciplined exploration and development program

focused on the onshore and offshore oil and natural gas resources in the

politically and fiscally stable country of New Zealand. NZEC is listed on the

TSX Venture Exchange under the symbol "NZ" and on the OTCQX International under

the symbol "NZERF". More information is available at www.newzealandenergy.com or

by emailing info@newzealandenergy.com.

FORWARD-LOOKING INFORMATION

This document contains certain forward-looking information and forward-looking

statements within the meaning of applicable securities legislation (collectively

"forward-looking statements"). The use of any of the words "objective",

"implementing", "in order to", "expected to", "review", "identify", "enhance",

"optimize", "is considering", "increase", "carry out", "expects to", "upon

completion", "will require", " will", "pending", "will provide", "will be",

"analyzing", "planned", "investigate", "may include", "would", "will consider",

"evaluate", "may be required", "conditional on", "goal of", "recommencing",

"entitled to", "plans to", "potential", "could", "expects", "can be", "will

continue", "to acquire", "subject to", "initiated", "will help", and similar

expressions are intended to identify forward-looking statements. These

statements involve known and unknown risks, uncertainties and other factors that

may cause actual results or events to differ materially from those anticipated

in such forward-looking statements. The Company believes the expectations

reflected in those forward-looking statements are reasonable, but no assurance

can be given that these expectations will prove to be correct. Such

forward-looking statements included in the document should not be unduly relied

upon. These statements speak only as of the date of the document. This document

contains forward-looking statements and assumptions pertaining to the following:

business strategy, strength and focus; the granting of regulatory approvals; the

timing for receipt of regulatory approvals; geological and engineering estimates

relating to the resource potential of the Properties; the Company's future

production levels; the estimated quantity and quality of the Company's oil and

natural gas resources; supply and demand for oil and natural gas and the

Company's ability to market crude oil, natural gas and natural gas liquids

production; and expectations regarding the ability to raise capital and to

continually add to resources through acquisitions and development; future

commodity prices; the Company's ability to obtain qualified staff and equipment

in a timely and cost-efficient manner; the ability of the Company to progress

through the conditions precedent to conclude the acquisition of assets from

Origin on schedule, or at all; the ability of the Company's subsidiaries to

obtain mining permits and access rights in respect of land and resource and

environmental consents; the recoverability of the Company's crude oil, natural

gas and natural gas liquids resources; future capital expenditures to be made by

the Company; and future cash flows from production meeting the expectations

stated herein.

Actual results could differ materially from those anticipated in these

forward-looking statements as a result of the risk factors set forth below and

elsewhere in the presentation, such as the speculative nature of exploration,

appraisal and development of oil and natural gas properties; uncertainties

associated with estimating oil and natural gas resources; changes in the cost of

operations, including costs of extracting and delivering oil and natural gas to

market, that affect potential profitability of oil and natural gas exploration;

operating hazards and risks inherent in oil and natural gas operations;

volatility in market prices for oil and natural gas; market conditions that

prevent the Company from raising the funds necessary for exploration and

development on acceptable terms or at all; global financial market events that

cause significant volatility in commodity prices; unexpected costs or

liabilities for environmental matters; competition for, among other things,

capital, acquisitions of resources, skilled personnel, and access to equipment

and services required for exploration, development and production; changes in

exchange rates, laws of New Zealand or laws of Canada affecting foreign trade,

taxation and investment; failure to realize the anticipated benefits of

acquisitions; and other factors. Readers are cautioned that the foregoing list

of factors is not exhaustive. Statements relating to "resources" are deemed to

be forward-looking statements, as they involve the implied assessment, based on

certain estimates and assumptions, that the resources described can be

profitably produced in the future. The forward-looking statements contained in

the document are expressly qualified by this cautionary statement. These

statements speak only as of the date of this document and the Company does not

undertake to update any forward-looking statements that are contained in this

document, except in accordance with applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

New Zealand Energy Corp.

John Proust

Chief Executive Officer & Director

North American toll-free: 1-855-630-8997

New Zealand Energy Corp.

Bruce McIntyre

Executive Director

North American toll-free: 1-855-630-8997

New Zealand Energy Corp.

Rhylin Bailie

Vice President Communications & Investor Relations

North American toll-free: 1-855-630-8997

New Zealand Energy Corp.

Chris Bush

New Zealand Country Manager

New Zealand: 64-6-757-4470

info@newzealandenergy.com

www.newzealandenergy.com

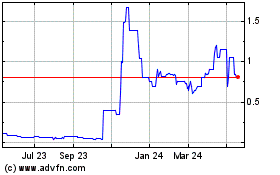

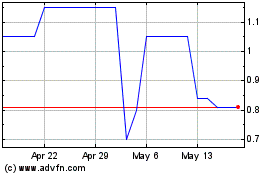

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Jul 2023 to Jul 2024