THIS DOCUMENT IS NOT INTENDED FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED

STATES.

Questor Technology Inc. ("Questor" or the "Company") (TSX VENTURE:QST) announced

today its financial and operating results for the three and nine month periods

ended September 30, 2013. The Company reported a profit of $817,840 ($0.033 per

basic share) for the three months ended September 30, 2013 compared to a profit

of $155,386 ($0.006 per basic share) for the same three-month period in the

prior year. Profit for the nine months ended September 30, 2013 was $1,869,101

($0.075 per basic share), 150 percent higher than profit of $742,264 ($0.030 per

basic share) for the nine months ended September 30, 2012.

FINANCIAL HIGHLIGHTS SUMMARY

(Stated in Canadian dollars except Shares outstanding)

Three months ended September 30

---------------------------------------------

Increase

For the 2013 2012 (decrease)

----------------------------------------------------------------------------

Revenue 2,989,767 1,112,976 1,876,791

Gross profit(1) 1,336,609 590,994 745,615

EBITDA(1) 1,036,215 299,225 736,990

Profit and total comprehensive

income 817,840 155,386 662,454

Cost of sales as a percent of

revenue(1) 55.3% 46.9% 8.4

Cash generated from operations

before movements in non-cash

working capital(1) 1,032,556 374,491 658,065

Shares outstanding(2)

Basic 25,119,327 24,857,370 261,957

Diluted 25,917,239 25,452,830 464,409

Earnings per share - Basic 0.033 0.006 0.027

Earnings per share - Diluted 0.032 0.006 0.026

----------------------------------------------------------------------------

Nine months ended September 30

---------------------------------------------

Increase

For the 2013 2012 (decrease)

----------------------------------------------------------------------------

Revenue 6,973,090 4,531,855 2,441,235

Gross profit(1) 3,404,490 2,093,292 1,311,198

EBITDA(1) 2,490,024 1,226,329 1,263,695

Profit and total comprehensive

income 1,869,101 742,264 1,126,837

Cost of sales as a percent of

revenue(1) 51.2% 53.8% (2.6)

Cash generated from operations

before movements in non-cash

working capital(1) 2,573,968 1,327,966 1,246,002

Shares outstanding(2)

Basic 25,068,175 24,857,370 210,805

Diluted 25,772,662 25,189,409 583,253

Earnings per share - Basic 0.075 0.030 0.045

Earnings per share - Diluted 0.073 0.029 0.044

----------------------------------------------------------------------------

As at September 30 Increase

2013 2012 (decrease)

----------------------------------------------------------------------------

Total assets 12,654,008 9,194,824 3,459,184

Non-current liabilities 250,902 234,829 16,073

----------------------------------------------------------------------------

(1) Non-IFRS financial measure. Please see discussion in the Non-IFRS

Financial Measures section of the Company's Management's Discussion and

Analysis for the three and nine month periods ended September 30, 2013.

(2) Weighted average.

Questor's Profit and total comprehensive income in the third quarter of 2013

improved by over 400 percent compared to the same period of the prior year. The

volume of incinerator sales drove the improved performance, offset in part by

lower utilization of the rental fleet and lower revenues from combustion

services and higher administration expense in the quarter. Higher income tax

expense on the Company's improved before tax earnings also negatively affected

the current quarter's results. Combustion services revenue depends in part on

timing of unit sales and the associated commissioning work as well as the level

of services required for customers renting units. Higher administration expenses

were due in part to the addition of personnel to the team to assist in managing

Questor's growth, in part to spending on improvements in the Company's

information processing infrastructure and equipment and in part to higher

business development expenditures incurred to increase the Company's profile in

those markets where management believes the short and long term success will be.

Revenue for the first nine months of 2013 was 54% higher than the same period in

2012 driven by Questor's sales success in the second and third quarters of the

current year. The 150 percent increase to profitability in the first nine months

of 2013 over 2012 was due not only to continued improvements in margins, but

also to the fact that revenue has grown significantly with only modest growth in

G&A

"The economic and operational benefits of our technology are leading to greater

market penetration for our products and services. With larger fabrication

facilities, a network of fabricators who do excellent work for us and a strong

balance sheet, we are well positioned to take the next steps in our growth

strategy." said Audrey Mascarenhas, President and Chief Executive Officer. "Our

revenue in the first nine months of 2013 was $2.4 million higher than the same

period last year. On a comparative basis, gross profit improved by 63 percent

and earnings per basic share grew from $0.033 to $0.075, 150 percent higher than

it was in the corresponding period of last year. We currently have confirmed

incinerator sales orders for $9.6 million of which $5.8 million has been

recognized in the first nine months of the year. Third quarter revenue and

EBITDA growth over the 2nd quarter was 32% and 30%, respectively.

Clients who elect to utilize our technology are making statements to their

affected publics that they wish to employ a best available technology. In doing

so they are also enjoying economic benefits through reduced operating expenses

which Questor strives to make a significant part of every project.

In addition, challenging new emission standards in the United States and Europe

are creating additional demand for Questor's clean air solutions and we are

pursuing expansion of the Company's presence in those markets.

Canadian sales have also experienced growth as we continue to support our

customers in their quests for social licenses to operate." concluded Ms.

Mascarenhas.

In relation to the Company's market awareness and brand recognition initiatives,

Ms. Mascarenhas was invited to attend the SelectUSA Investment Summit in

Washington, DC on October 31, 2013. She also presented the Questor story at a

number of investor relations sessions in Toronto, Ontario during the third

quarter and into the current quarter. Ms. Mascarenhas was the keynote speaker at

the Society of Petroleum Engineers ("SPE") luncheon on the 21st of November in

Oklahoma City. She has been invited to travel to Mexico at the end of November

to present at the Pemex Technology Exchange Forum.

Questor's unaudited condensed financial statements and notes thereto and

management's discussion and analysis for the three and nine month periods ended

September 30, 2013 will be available shortly on the Company's website at

www.questortech.com and through SEDAR at www.sedar.com.

ABOUT QUESTOR TECHNOLOGY INC.

Questor is an international environmental oilfield service company founded in

late 1994 and headquartered in Calgary, Alberta, Canada with a field office

located in Grande Prairie, Alberta. The Company is focused on clean air

technologies with activities in Canada, the United States, Europe and Asia.

Questor designs and manufactures high efficiency waste gas incinerators for sale

or for use on a rental basis and also provides combustion-related oilfield

services. The Company's proprietary incinerator technology destroys noxious or

toxic hydrocarbon gases at 99.99% efficiency which ensures regulatory

compliance, environmental protection, public confidence and reduced operating

costs for customers. The technology creates an opportunity to utilize the heat

generated from efficient combustion. Questor is recognized for its particular

expertise in the combustion of sour gas (H2S). While the Company's current

customer base is primarily in the oil and gas industry, this technology is

applicable to other industries such as landfills, water and sewage treatment,

tire recycling and agriculture.

Questor trades on the TSX Venture Exchange under the symbol "QST".

Certain information in this news release constitutes forward-looking statements.

When used in this news release, the words "may", "would", "could", "will",

"intend", "plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company, are intended

to identify forward-looking statements. In particular, this news release

contains forward-looking statements with respect to, among other things,

business objectives, expected growth, results of operations, performance,

business projects and opportunities and financial results. These statements

involve known and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those anticipated in such

forward-looking statements. Such statements reflect the Company's current views

with respect to future events based on certain material factors and assumptions

and are subject to certain risks and uncertainties, including without

limitation, changes in market, competition, governmental or regulatory

developments, general economic conditions and other factors set out in the

Company's public disclosure documents. Many factors could cause the Company's

actual results, performance or achievements to vary from those described in this

news release, including without limitation those listed above. These factors

should not be construed as exhaustive. Should one or more of these risks or

uncertainties materialize, or should assumptions underlying forward-looking

statements prove incorrect, actual results may vary materially from those

described in this news release and such forward-looking statements included in,

or incorporated by reference in this news release, should not be unduly relied

upon. Such statements speak only as of the date of this news release. The

Company does not intend, and does not assume any obligation, to update these

forward-looking statements. The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENTS OF FINANCIAL POSITION

Stated in Canadian dollars

Unaudited

September 30 December 31

As at Notes 2013 2012

----------------------------------------------------------------------------

ASSETS

Current assets

Cash and cash equivalents 3 $ 7,177,085 $ 4,405,624

Trade and other receivables 2,453,430 2,304,478

Inventories 4 1,460,366 670,959

Prepaid expenses and deposits 176,269 88,378

Current tax assets 51,853 25,158

----------------------------------------------------------------------------

Total current assets 11,319,003 7,494,597

----------------------------------------------------------------------------

Non-current assets

Property and equipment 5,9 1,327,596 2,295,529

Intangible assets 7,409 8,323

----------------------------------------------------------------------------

Total non-current assets 1,335,005 2,303,852

----------------------------------------------------------------------------

Total assets $ 12,654,008 $ 9,798,449

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LIABILITIES AND EQUITY

Current liabilities

Trade payables, accrued liabilities

and provisions $ 1,385,602 $ 894,206

Deferred revenue and deposits 52,276 2,205

Current tax liabilities 516,318 171,907

----------------------------------------------------------------------------

Total current liabilities 1,954,196 1,068,318

----------------------------------------------------------------------------

Non-current liabilities

Deferred tax liabilities 64,947 97,319

Lease inducement 185,955 152,746

----------------------------------------------------------------------------

Total non-current liabilities 250,902 250,065

----------------------------------------------------------------------------

Total liabilities 2,205,098 1,318,383

----------------------------------------------------------------------------

Capital and reserves

Issued capital 6 5,596,842 5,521,001

Reserves 700,736 676,834

Retained earnings 4,151,332 2,282,231

----------------------------------------------------------------------------

Total equity 10,448,910 8,480,066

----------------------------------------------------------------------------

Total liabilities and equity $ 12,654,008 $ 9,798,449

----------------------------------------------------------------------------

----------------------------------------------------------------------------

See accompanying notes to the unaudited condensed financial statements.

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENTS OF COMPREHENSIVE INCOME

Stated in Canadian dollars except per share data

Unaudited

For the three months For the nine months

ended ended

September 30 September 30

----------------------------------------------------------------------------

Notes 2013 2012 2013 2012

----------------------------------------------------------------------------

Revenue 7,9 $ 2,989,767 $ 1,112,976 $ 6,973,090 $ 4,531,855

Cost of sales (1,653,158) (521,982) (3,568,600) (2,438,563)

----------------------------------------------------------------------------

Gross profit 1,336,609 590,994 3,404,490 2,093,292

Administration

expenses (349,741) (328,410) (1,200,948) (1,046,071)

Net foreign exchange

gains (16,167) (21,568) 76,267 (4,232)

Depreciation of

property and

equipment 5 (10,459) (10,340) (30,998) (31,125)

Amortization of

intangible assets (305) (305) (914) (914)

Loss on disposal of

property and

equipment 5 - (18,871) (347) (27,865)

Other income 898 9,377 7,870 21,290

----------------------------------------------------------------------------

Profit before tax 960,835 220,877 2,255,420 1,004,375

Income tax (expense)

income

Current (164,458) (47,705) (418,691) (252,051)

Deferred 21,463 (17,786) 32,372 (10,060)

----------------------------------------------------------------------------

Profit and

comprehensive income $ 817,840 $ 155,386 $ 1,869,101 $ 742,264

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Earnings per share

Basic $ 0.033 $ 0.006 $ 0.075 $ 0.030

Diluted $ 0.032 $ 0.006 $ 0.073 $ 0.029

----------------------------------------------------------------------------

See accompanying notes to the unaudited condensed financial statements.

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENTS OF CHANGES IN EQUITY

Stated in Canadian dollars

Unaudited

Issued Retained

capital Reserves earnings Total equity

----------------------------------------------------------------------------

Balance at January 1, 2013 $ 5,521,001 $ 676,834 $ 2,282,231 $ 8,480,066

Profit and total

comprehensive income - - 1,869,101 1,869,101

Recognition of share-based

payments - 54,993 - 54,993

Issue of ordinary shares

under employee share

option plan 75,841 (31,091) - 44,750

----------------------------------------------------------------------------

Balance at September 30,

2013 $ 5,596,842 $ 700,736 $ 4,151,332 $ 10,448,910

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Balance at January 1, 2012 $ 5,458,215 $ 622,226 $ 1,241,875 $ 7,322,316

Profit and total

comprehensive income - - 742,264 742,264

Recognition of share-based

payments - 56,244 - 56,244

Issue of ordinary shares

under employee share

option plan - - - -

----------------------------------------------------------------------------

Balance at September 30,

2012 $ 5,458,215 $ 678,470 $ 1,984,139 $ 8,120,824

----------------------------------------------------------------------------

----------------------------------------------------------------------------

See accompanying notes to the unaudited condensed financial statements.

QUESTOR TECHNOLOGY INC.

CONDENSED STATEMENTS OF CASH FLOWS

Stated in Canadian dollars

Unaudited

For the nine months ended

September 30 Notes 2013 2012

----------------------------------------------------------------------------

Cash flows provided by operating

activities

Profit and total comprehensive

income $ 1,869,101 $ 742,264

Adjustments for:

Income tax expense 386,319 262,111

Loss on disposal of property

and equipment 5 347 27,865

Depreciation of property and

equipment 5 233,690 221,040

Amortization of intangible

assets 914 914

Net unrealized foreign

exchange losses 28,604 16,307

Expense recognized in respect

of equity-settled share-based

payments 6 54,993 56,244

Write-downs of inventories to

net realizable value 4 - 1,221

----------------------------------------------------------------------------

2,573,968 1,327,966

Movements in non-cash working

capital 10 329,058 2,411,569

----------------------------------------------------------------------------

Cash provided by operations 2,903,026 3,739,535

Income taxes paid (26,639) (383,793)

----------------------------------------------------------------------------

Net cash provided by operating

activities 2,876,387 3,355,742

----------------------------------------------------------------------------

Cash flows (used in) provided by

investing activities

Payments for property and

equipment 5 (120,067) (750,510)

Proceeds from disposal of

property and equipment 5,000 -

----------------------------------------------------------------------------

Net cash used in investing

activities (115,067) (750,510)

----------------------------------------------------------------------------

Cash flows provided by financing

activities

Proceeds from issue of ordinary

shares under employee share

option plan 6 44,750 -

----------------------------------------------------------------------------

Net cash provided by financing

activities 44,750 -

----------------------------------------------------------------------------

Net increase in cash 2,806,070 2,605,232

Cash and cash equivalents at

beginning of the period 4,405,624 2,166,301

Effects of exchange rate changes

on the balance of cash held in

foreign currencies (34,609) (10,631)

----------------------------------------------------------------------------

Cash and cash equivalents at end

of the period $ 7,177,085 $ 4,760,902

----------------------------------------------------------------------------

----------------------------------------------------------------------------

See accompanying notes to the unaudited condensed financial statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Questor Technology Inc.

Audrey Mascarenhas

President and Chief Executive Officer

(403) 571-1530

(403) 571-1539 (FAX)

amascarenhas@questortech.com

www.questortech.com

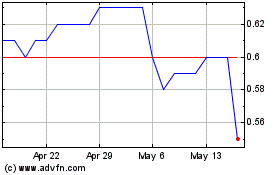

Questor Technology (TSXV:QST)

Historical Stock Chart

From Apr 2024 to May 2024

Questor Technology (TSXV:QST)

Historical Stock Chart

From May 2023 to May 2024