Salona Global Extends Biodex Acquisition Debt Duration to July 2025

08 August 2023 - 9:30PM

Salona Global Medical Device Corporation (the

“

Company”) (TSXV:SGMD) today announced it has

executed an agreement (the “

Agreement”) to extend

the payment terms of the debt incurred in connection with its

acquisition of Biodex Medical Systems, Inc.

(“

Biodex”).

On April 3, 2023, the Company acquired all of

the outstanding equity of Biodex in consideration for, among other

things, the Company’s future obligation to pay an aggregate of

approximately US$10 million, which included (i) approximately

US$1.5 million payable under a loan for nuclear medicine

medical device inventory and parts which was due May 15, 2023; (ii)

approximately US$1.5 million payable under a working capital loan

which was due on June 15, 2023 (the “WC Loan”);

and (iii) approximately US$7 million in three payments: US$2

million payable on June 30, 2023, US$3 million payable September

30, 2023 and US$2 million payable December 31, 2023 (the

“Acquisition Debt”). The Company’s obligation to

pay both the Acquisition Debt and the WC Loan are secured by a

pledge of all of the outstanding shares of Biodex.

As of July 25, 2023, the remaining amounts to be

paid according to the closing statement by the Company under the

Agreement are (i) the Acquisition Debt is total US$6,756,525.45

plus interest; and (ii) the WC Loan total of US$1,502,765.63, for a

total of US$8,259.291.08

The Company entered into an agreement dated

August 4, 2023 (the “Debt Extension Agreement”)

which extends the maturity date for amounts payable under (i) the

WC Loan to October 31, 2023; and (ii) the Acquisition Debt to July

31, 2025.

The Company is working towards finalizing a US$2

million asset-based lending (ABL) facility on the Biodex assets

with its current lender. As of June 30, 2023, these unencumbered

assets totaled in excess of US$2.5 million in accounts receivable

and inventory. Subject to successfully closing on the ABL facility,

SGMD intends to use a portion of this facility to pay down the WC

Loan.

Pursuant to this Debt Extension Agreement, all

cash in excess of US$2.5 million held by the Company is required to

be paid to reduce the Acquisition Debt until payments are current.

The Debt Extension Agreement also requires the Company to increase

its ABL facility to 80% of working capital to provide further case

to reduce amounts owing under the Acquisition Debt. The Company has

the right to prepay the Acquisition Debt at any time without cost

or penalty.

“These agreements should give us the ability to

generate additional cash flow and focus on growth,” said Mike

Seckler, CEO. “As I mentioned recently, I plan to conduct a

strategic review with an aim to put us back on a path to revenue

growth and achieve a market multiple consistent with our peers

thereby increasing our share price.”

For more information please contact:

Mike SecklerChief Executive OfficerTel: 1 (800)

760-6826Email: Info@Salonaglobal.com

Additional Information

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

There can be no assurance that a new ABL

facility on the Biodex assets will be completed or the timing of

any agreement. Completion of any transaction will be subject to,

amongst other things, negotiation and execution of definitive

agreements, applicable director, shareholder and regulatory

approvals.

Certain statements contained in this press

release constitute "forward-looking information" within the

meaning of the Private Securities Litigation Reform Act of 1995

and applicable Canadian securities laws. These statements can be

identified by the use of forward-looking terminology such as

“expects” “believes”, “estimates”, "may", "would", "could",

"should", "potential", "will", "seek", "intend", "plan",

and "anticipate", and similar expressions as they relate to

the Company, including: the Company obtaining a new ABL facility on

the Biodex assets; the Company using cash flow generated as well as

leverage against assets to reduce the principal and interest of the

Acquisition Debt over the next 24 months; the Company being able to

successfully increase its ABL facility to 80% of working capital;

the Company believing it can operate profitably for the quarter

ending September 30, 2023; and the Company increasing its share

price.

All statements other than statements of

historical fact may be forward-looking information. Such

statements reflect the Company's current views and intentions with

respect to future events, and current information available to

the Company, and are subject to certain risks, uncertainties and

assumptions. Salona cautions that the forward-looking statements

contained herein are qualified by important factors that could

cause actual results to differ materially from those reflected by

such statements. Such factors include but are not limited to the

general business and economic conditions in the regions in

which Salona operates; the ability of Salona to execute on key

priorities, including the successful completion of acquisitions,

business retention, and strategic plans and to attract,

develop and retain key executives; difficulty integrating newly

acquired businesses; ongoing or new disruptions in the supply

chain, the extent and scope of such supply chain disruptions, and

the timing or extent of the resolution or improvement of such

disruptions; the ability to implement business strategies

and pursue business opportunities; disruptions in or attacks

(including cyber-attacks) on Salona ’ s information

technology, internet, network access or other voice or data

communications systems or services; the evolution of various

types of fraud or other criminal behavior to which Salona

is exposed; the failure of third parties to comply with their

obligations to Salona or its affiliates; the impact of new

and changes to, or application of, current laws and regulations;

granting of permits and licenses in a highly regulated business;

the overall difficult litigation environment, including in

the United States; increased competition; changes in foreign

currency rates; increased funding costs and market

volatility due to market illiquidity and competition for funding;

the availability of funds and resources to pursue

operations; critical accounting estimates and changes to

accounting standards, policies, and methods used by Salona;

the occurrence of natural and unnatural catastrophic events

and claims resulting from such events; www.sec.gov, and with

the securities regulatory authorities in certain provinces of

Canada and available at www.sedar.com. Should any factor affect

Salona in an unexpected manner, or should assumptions

underlying the forward-looking information prove incorrect, the

actual results or events may differ materially from the

results or events predicted. Any such forward-looking information

is expressly qualified in its entirety by this

cautionary statement. Moreover, Salona does not assume

responsibility for the accuracy or completeness of such

forward-looking information. The forward-looking information

included in this press release is made as of the date of

this press release and the Company undertakes no obligation to

publicly update or revise any forward-looking information,

other than as required by applicable law.

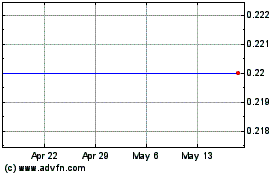

Salona Global Medical De... (TSXV:SGMD)

Historical Stock Chart

From Feb 2025 to Mar 2025

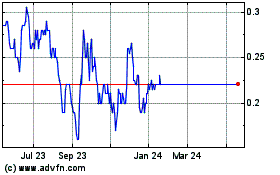

Salona Global Medical De... (TSXV:SGMD)

Historical Stock Chart

From Mar 2024 to Mar 2025