TSX VENTURE COMPANIES

ALEXANDRIA MINERALS CORP. ("AZX")

BULLETIN TYPE: Property-Asset or Share Purchase Agreements

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation in connection

with the following agreements:

1. The Annamaque/Faraday Sale Agreement dated June 17, 2009 between the

Company and Teck Resources Limited whereby the Company has acquired a

98.29% interest in the Annamaque and Faraday properties located in the

Bourlamaque Township, Quebec. Consideration is 250,000 units where each

unit is comprised of one common share and one non-transferable share

purchase warrant. Each warrant is exercisable into a common share at $0.15

per share for a two year period. The property is subject to a 2% net

smelter returns royalty of which the Company may purchase half for

$800,000 at any time up to 90 days after the approval by the Company's

board of a production decision and is subject to further Exchange review

and acceptance.

2. The Valdora Sale Agreement dated June 17, 2009 between the Company and

Teck Resources Limited whereby the Company has acquired a 51% interest in

the Valdora property located in the Bourlamaque and Louvicourt Townships,

Quebec. Consideration is 75,000 units where each unit is comprised of one

common share and one non-transferable share purchase warrant. Each warrant

is exercisable into a common share at $0.15 per share for a two year

period. The property is subject to a 2% net smelter returns royalty of

which the Company may purchase half for $200,000 at any time up to 90 days

after the approval by the Company's board of a production decision and is

subject to further Exchange review and acceptance.

TSX-X

--------------------------------------------------------------------------

APPALACHES RESOURCES INC. ("APP")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation relating to

a property acquisition option agreement whereby the Company may acquire

100% of the outstanding common shares of Dufferin Resources Inc.

("Dufferin"), and certain mining properties held by the Vendor, dated

November 11, 2008 (the "Agreement"). The property owned by Dufferin ("the

Property") is located near Port Dufferin, in the province of Nova Scotia

and the purchase also includes ramp access to Dufferin Mine, a processing

plant, a mining lease and permits, and all related necessary

infrastructure.

Under the Agreement, the Company must pay $4,000,000 in cash in the

following instalments: $500,000 prior to April 11, 2009, $500,000 no later

than 180 days following the first payment, $1,500,000 no later than 365

days following the second payment, and $1,500,000 no later than 365 days

subsequent to the third payment. The Company has paid the first instalment

prior to the deadline.

Please refer to the Company's press releases dated December 2, 4 and 11,

2008 and that of June 16, 2009.

RESOURCES APPALACHES INC. ("APP")

TYPE DE BULLETIN : Convention d'achat de propriete, d'actif ou d'actions

DATE DU BULLETIN : Le 7 juillet 2009

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de documents en vertu d'une

convention d'option d'achat ou la societe a l'option d'acquerir 100 % des

actions en circulation de Dufferin Ressources inc. (" Dufferin ") et

certains actifs miniers detenus par le vendeur, en date du 11 novembre

2008 (la "convention"). La propriete detenue par Dufferin ("la Propriete")

est situee pres de la ville de Port Dufferin dans la province de la

Nouvelle-Ecosse. La convention d'achat inclut egalement l'acces a la rampe

de la Mine Dufferin, une usine de traitement, une baille miniere et toute

infrastructure requise.

Selon les termes de la Convention, la societe est oblige de payer 4 000

000 $ en especes en effectuant les versements suivants : 500 000 $ avant

le 11 avril 2009, 500 000 $ au plus tard 180 jours apres le premier

versement, 1 500 000 $ au plus tard 365 jours suivant le deuxieme

versement et 1 500 000 $ au plus tard 365 jours suivant le troisieme

versement. La societe a paye le premier versement avant sa date

d'echeance.

Veuillez-vous referer aux communiques de presse emis par la societe les 2,

4 et 11 decembre 2008, ainsi que celui date du 16 juin 2009.

TSX-X

--------------------------------------------------------------------------

ARCHANGEL DIAMOND CORPORATION ("AAD.H")

(formerly Archangel Diamond Corporation ("AAD"))

BULLETIN TYPE: Transfer and New Addition to NEX, Symbol Change

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

In accordance with TSX Venture Policy 2.5, the Company has not maintained

the requirements for a TSX Venture Tier 2 company. Therefore, effective

the opening Wednesday, July 8, 2009, the Company's listing will transfer

to NEX, the Company's Tier classification will change from Tier 2 to NEX,

and the Filing and Service Office will change from Vancouver to NEX.

As of July 8, 2009, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The trading symbol for the Company will change from AAD to AAD.H. There is

no change in the Company's name, no change in its CUSIP number and no

consolidation of capital. The symbol extension differentiates NEX symbols

from Tier 1 or Tier 2 symbols within the TSX Venture market.

TSX-X

--------------------------------------------------------------------------

ARTEVO CORPORATION ("AEV")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement of non-convertible debentures with

attached warrants announced April 16, June 4, and June 30, 2009:

Non-Convertible Debenture: $760,000

Maturity Dates: May 31, 2011, June 8, 2011

Interest Rate: 15% p.a.

Warrants: 253,333 share purchase warrants to

purchase 253,333 shares

Warrant Exercise Price: $0.10 expiring on May 31, 2010 and June

8, 2010

Number of Placees: 2 placees

No Insider / Pro Group Participation

Finder's Fee: $12,000 payable to Irene Besse

TSX-X

--------------------------------------------------------------------------

BENCHMARK ENERGY CORP. ("BEE")

BULLETIN TYPE: Warrant Term Extension

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

Private Placement:

# of Warrants: 762,500

Original Expiry Date of Warrants: July 9, 2009

New Expiry Date of Warrants: January 9, 2010

Exercise Price of Warrants: $0.65

These warrants were issued pursuant to a private placement of 1,525,000

shares with 762,500 share purchase warrants attached, which was accepted

for filing by the Exchange effective August 6, 2008.

TSX-X

--------------------------------------------------------------------------

CAPITAL PRO-EGAUX INC. ("CPE")

BULLETIN TYPE: Reinstated for Trading

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

Further to the TSX Venture Exchange Bulletin dated February 3, 2006, the

Exchange has been advised that the Cease Trade Orders issued by the

Autorite des marches financiers on February 3, 2006 and the British

Columbia Securities Commission on February 7, 2006 have been revoked.

Effective at the opening Wednesday, July 8, 2009, trading will be

reinstated in the securities of the Company.

TSX-X

--------------------------------------------------------------------------

CRESTON MOLY CORP. ("CMS")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: July 7, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 2,447,500 shares at deemed value of $0.10 per share to settle

outstanding debt for $244,750.

Number of Creditors: 4 Creditors

The Company shall issue a news release when the shares are issued and the

debt extinguished.

TSX-X

--------------------------------------------------------------------------

DIAMONDS NORTH RESOURCES LTD. ("DDN")

BULLETIN TYPE: Warrant Price Amendment and Warrant Term Extension

BULLETIN DATE: July 7, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has consented to the reduction in the exercise price

of the following warrants:

Private Placement:

# of Warrants: 2,524,800

Original Expiry Date of Warrants: July 7, 2009

New Expiry Date of Warrants: January 9, 2010

# of Warrants: 253,500

Original Expiry Date of Warrants: July 9, 2009

New Expiry Date of Warrants: January 9, 2010

Forced Exercise Provision: If the closing price for the Company's

shares is $0.40 or greater for a period

of 10 consecutive trading days, then the

warrant holders will have 30 days to

exercise their warrants; otherwise the

warrants will expire on the 31st day.

Original Exercise Price of

Warrants: $1.30

New Exercise Price of Warrants: $0.30

These warrants were issued pursuant to a private placement of 5,556,600

non flow-through shares with 2,778,300 share purchase warrants attached,

which was accepted for filing by the Exchange effective July 11, 2008.

TSX-X

--------------------------------------------------------------------------

DIANOR RESOURCES INC. ("DOR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing the documentation with

respect to a Non-Brokered Private Placement announced on May 29, 2009:

Number of Shares: 3,564,800 common shares

Purchase Price: $0.10 per common share

Warrants: 3,564,800 share purchase warrants to

purchase 3,564,800 shares

Warrant exercise price: $0.15 per share for the first year

following the closing and $0.20 during

the second year following the closing.

Finders' fee: Dundee Securities Corporation received

$13,798.40 in cash

The Company has confirmed the closing of the above-mentioned Private

Placement pursuant to the news release dated May 29, 2009.

RESSOURCES DIANOR INC. ("DOR")

TYPE DE BULLETIN : Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN : Le 7 juillet 2009

Societe du groupe 1 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation

relativement a un placement prive sans l'entremise d'un courtier, tel

qu'annonce le 29 mai 2009 :

Nombre d'actions : 3 564 800 actions ordinaires

Prix : 0,10 $ par action ordinaire

Bons de souscription : 3 564 800 bons de souscription

permettant de souscrire a 3 564 800

actions

Prix d'exercice des bons : 0,15 $ par action durant la premiere

annee et 0,20 $ durant la deuxieme annee

Remuneration des intermediaires : Dundee Securities Corporation a recu 13

798,40 $ en especes

La societe a confirme la cloture du placement prive precite en vertu du

communique de presse du 29 mai 2009.

TSX-X

--------------------------------------------------------------------------

EVERGREEN GAMING CORPORATION ("TNA")

BULLETIN TYPE: Halt

BULLETIN DATE: July 7, 2009

TSX Venture Tier 1 Company

Effective at 6:01 a.m. PST, July 7, 2009, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

--------------------------------------------------------------------------

FALCON OIL & GAS LTD. ("FO")

BULLETIN TYPE: Prospectus-Debenture Offering, Prospectus-Share-Offering

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

Effective June 12, 2009, the Company's Prospectus dated June 11, 2009, was

filed with and accepted by TSX Venture Exchange, and filed with and

receipted by the British Columbia, Alberta, Saskatchewan, Manitoba,

Ontario, New Brunswick and Nova Scotia Securities Commissions, pursuant to

the provisions of the respective Securities Acts.

TSX Venture Exchange has been advised that closing occurred on June 30,

2009, for gross proceeds of $11,910,000.

Prospectus - Debenture and Share Offering:

Offering: $11,910,000, consisting of $10,719,000 in Debentures, and

2,977,500 common shares (each share issued at a price of $0.40)

Agent: Salman Partners Inc.

Agents' Commission: $744,375, plus 1,250,550 compensation

warrants payable to the Agent. Each

compensation warrant entitles the holder

to acquire one common share at a price

of $0.60 for a two year period.

Details of the Debentures:

Maturity Date: Four years from the date of their

issuance.

Redemption: The Debentures may be redeemed on a one-

time only basis, at the option of the

Company, in whole or in part, upon 30

day prior written notice, for a 5 day

period commencing on the date that is 10

days prior to one year following the

closing of the Offering. The redemption

price would be equal to 110% of the

principal amount of the Debentures, plus

accrued and unpaid interest.

Interest: 11% per annum payable semi-annually

Conversion: The Debentures are convertible into

common shares of the Company at $0.60

per share for a four year period.

For further information, please refer to the Company's Prospectus dated

June 11, 2009.

TSX-X

--------------------------------------------------------------------------

GOLDEN CHALICE RESOURCES INC. ("GCR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the first tranche of a Non-Brokered Private Placement announced June 22,

2009:

Number of Shares: 2,150,000 non flow-through shares

Purchase Price: $0.10 per share

Warrants: 2,150,000 share purchase warrants to

purchase 2,150,000 shares

Warrant Exercise Price: $0.15 for a one year period

$0.20 in the second year

Number of Placees: 3 placees

No Insider / Pro Group Participation

Finder's Fee: $15,200 payable to Redplug Capital

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. (Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.)

TSX-X

--------------------------------------------------------------------------

ISEE3D INC. ("ICT")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue shares to settle outstanding debt for $116,984.20.

Number of Creditors: 6 Creditors

Insider equals Y / Amount Deemed Price

Creditor Progroup equals P Owing per Share # of Shares

Dwight Romanica Y $46,868.70 $0.15 312,457

TNM Ventures Y $16,903 $0.15 112,687

(Tom Mitchell)

Alan G. Smith Y $35,000 $0.15 233,333

The Company shall issue a news release when the shares are issued and the

debt extinguished.

TSX-X

--------------------------------------------------------------------------

KAMINAK GOLD CORPORATION ("KAM")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced June 22, 2009:

Number of Shares: 1,000,000 shares

Purchase Price: $0.50 per share

Warrants: 1,000,000 share purchase warrants to

purchase 1,000,000 shares

Warrant Exercise Price: $0.55 in the first year

$0.70 in the second year

Number of Placees: 2 placees

Finder's Fee: (i)70,000 units payable to Axemen

Resource Capital (Cal Everett & Dino

Minicucci)

(i)Finder's fee units are under the same

terms as those to be issued pursuant to

the private placement.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

--------------------------------------------------------------------------

LANDEN CAPITAL CORP. ("LAN.P")

BULLETIN TYPE: Miscellaneous

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

Further to the Exchange's Bulletin of November 3, 2008 and the Company's

press release of November 25, 2008, the Company which is a Capital Pool

Company ('CPC') is required to complete a Qualifying Transaction ('QT') by

August 7, 2009.

The records of the Exchange indicate that the Company has not yet

completed a QT. If the Company fails to complete a QT by August 7, 2009,

the Company's trading status may be changed to a halt or suspension

without further notice, in accordance with Exchange Policy 2.4 Section

14.6.

TSX-X

--------------------------------------------------------------------------

MAJESCOR RESOURCES INC. ("MJX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing the documentation with

respect to a Non-Brokered Private Placement, announced on May 26, 2009:

Number of Shares: 3,000,000 common shares

Purchase Price of Shares: $0.20 per common share

Warrants: 3,000,000 warrants to purchase 3,000,000

common shares

Warrants Exercise Price: $0.30 during the 12 months following the

closing of the Private Placement

Insider / Pro Group Participation:

Insider equals Y / Number

Name Pro Group equals P / of shares

Sheri Weichel (the shares are

controlled by Bernard Leroux) Y and P 450,000

Jill Lyall P 250,000

Robert Disbrow P 250,000

Trish Hodgson P 20,000

Aman Lidder P 10,000

Donny Cordick P 60,000

Jeff Willis P 100,000

Scott Hunter P 45,000

David Shepherd P 25,000

David Elliott P 62,500

Lisa Stefani P 50,000

Jean-Francois Perreault P 25,000

The Company has confirmed the closing of the above-mentioned Private-

Placement by way of a press release on June 18, 2009.

RESSOURCES MAJESCOR INC. ("MJX")

TYPE DE BULLETIN : Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN : Le 7 juillet 2009

Societe du groupe 1 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le 26

mai 2009 :

Nombre d'actions : 3 000 000 d'actions ordinaires

Prix par action : 0,20 $ par action ordinaire

Bons de souscription : 3 000 000 bons de souscription

permettant de souscrire a 3 000 000

d'actions ordinaires

Prix d'exercice des bons : 0,30 $ pendant les 12 mois suivant la

cloture du placement prive

Participation Initie / Groupe Pro :

Initie egale Y / Nombre

Nom Groupe Pro egale P / d'actions

Sheri Weichel (les actions sont

controlees par Bernard Leroux) Y et P 450 000

Jill Lyall P 250 000

Robert Disbrow P 250 000

Trish Hodgson P 20 000

Aman Lidder P 10 000

Donny Cordick P 60 000

Jeff Willis P 100 000

Scott Hunter P 45 000

David Shepherd P 25 000

David Elliott P 62 500

Lisa Stefani P 50 000

Jean-Francois Perreault P 25 000

La societe a confirme la cloture du placement prive precite par voie de

communique de presse le 18 juin 2009.

TSX-X

--------------------------------------------------------------------------

MEDMIRA INC. ("MIR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced June 18, 2009:

Number of Shares: 2,343,160 shares

Purchase Price: $0.064 per share

Number of Placees: 1 placee

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

--------------------------------------------------------------------------

MURGOR RESOURCES INC. ("MGR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted the filing of the documentation with

respect to a Non-Brokered Private Placement, announced on June 29, 2009:

Number of Shares: 4,442,222 common shares

Purchase Price: $0.09 per common share

Warrants: 4,442,222 share purchase warrants to

purchase 4,442,222 common shares.

Warrant Exercise Price: $0.11 per common share for the intial 12

months following the closing of the

Private Placement and $0.13 for the 12

months thereafter.

Number of Placees: 2 placees

The Company has confirmed the closing of the above-mentioned Private

Placement by way of a press release.

RESSOURCES MURGOR INC. ("MGR")

TYPE DE BULLETIN : Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN : Le 7 juillet 2009

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le 29

juin 2009 :

Nombre d'actions : 4 442 222 actions ordinaires

Prix : 0,09 $ par action ordinaire

Bons de souscription : 4 442 222 bons de souscription

permettant de souscrire a 4 442 222

actions ordinaires.

Prix d'exercice des bons : 0,11 $ par action ordinaire pour une

periode initale de 12 mois suivant la

cloture du placement prive et 0,13 $

pour la periode de 12 mois subsequente.

Nombre de souscripteurs : 2 souscripteurs

La societe a emis un communique de presse confirmant la cloture du

placement prive precite.

TSX-X

--------------------------------------------------------------------------

NORTHERN FREEGOLD RESOURCES LTD. ("NFR")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced May 28, 2009:

Number of Shares: 16,000,000 common shares

Purchase Price: $0.50 per Unit

Warrants: 8,000,000 warrants to purchase 8,000,000

common shares

Exercise Price: $0.75 per share for a period of two

years

Number of Placees: 17 placees

No Insider / Pro Group Participation

Agent: Canaccord Capital Corporation

Dundee Securities Corporation

Haywood Securities Inc.

Agents' Fee's: Canaccord Capital Corporation - $325,000

cash, 100,000 Units and 455,000 Broker

Warrants

Dundee Securities Corporation - 130,000

Broker Warrants

Haywood Securities Inc. - 65,000 Broker

Warrants

Finders: Northern Conference Institute Inc.

USC Ltd.

Global Resource Investments Inc.

Finder's Fees: Northern Conference Institute Inc. -

110,500 Units

USC Ltd. - 211,380 Units

Global Resource Investments Inc. -

$24,950 cash

Each Unit has the same terms as above

Each Broker Warrant is exercisable at a price of $0.75 per share for a

period of two years

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s).

TSX-X

--------------------------------------------------------------------------

NORTHROCK RESOURCES INC. ("NRK")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced May 29, 2009:

Number of Shares: 4,275,300 flow-through shares and

10,587,000 non flow-through shares

Purchase Price: $0.075 per flow-through share and $0.05

per non flow-through share

Warrants: 14,862,300 share purchase warrants to

purchase 14,862,300 shares

Warrant Exercise Price: $0.10 for an eighteen month period

(10,587,000 warrants)

$0.15 for an eighteen month period

(4,275,300 warrants)

Number of Placees: 71 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Karl Kottmeier Y 33,333 FT

Lily Fey P 50,000 FT

Gordon Medland P 133,300 FT

David Garnett P 100,000 NFT

Renee D. Garnett P 100,000 NFT

Chris T. Morgan P 75,000 NFT

Russell Morrison P 100,000 NFT

David Hamilton-Smith P 100,000 NFT

Lorne Warner ITF Brittany Warner Y 200,000 NFT

Lorne Warner ITF Julianne Warner Y 200,000 NFT

Jill Anglin P 200,000 NFT

Richard Carter P 100,000 NFT

Finder's Fee: $24,876.32 cash payable to Canaccord

Capital Corporation

$10,904.08 cash payable to Leede

Financial Markets Inc.

$2,159.50 cash payable to Bolder

Investment Partners, Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

--------------------------------------------------------------------------

NX PHASE CAPITAL INC. ("NXP.RT")

BULLETIN TYPE: Rights Expiry-Delist

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

Effective at the opening Wednesday, July 8, 2009, the Rights of the

Company will trade for cash. The Rights expire July 13, 2009 and will

therefore be delisted at the close of business July 13, 2009.

TRADE DATES

July 8, 2009 - TO SETTLE - July 9, 2009

July 9, 2009 - TO SETTLE - July 10, 2009

July 10, 2009 - TO SETTLE - July 13, 2009

July 13, 2009 - TO SETTLE - July 13, 2009

The above is in compliance with Trading Rule C.2.18 - Expiry Date:

Trading in the rights shall be for cash for the three trading days

preceding the expiry date and also on expiry date. On the expiry date,

trading shall cease at 12 o'clock noon E.T. and no transactions shall take

place thereafter except with permission of the Exchange.

TSX-X

--------------------------------------------------------------------------

ORACLE ENERGY CORP. ("OCL")

BULLETIN TYPE: Warrant Term Extension, Warrant Price Amendment

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has consented to the extension in the expiry date of

the following warrants:

Private Placement:

# of Warrants: 2,800,000

Original Expiry Date of Warrants: 2,755,000 - July 8, 2009

45,000 - July 17, 2009

New Expiry Date of Warrants: 2,755,000 - July 8, 2011

45,000 - July 17, 2011

Original Exercise Price of

Warrants: $0.40

New Exercise Price of Warrants: $0.27

These warrants were issued pursuant to a private placement of 2,800,000

shares with 2,800,000 share purchase warrants attached, which was accepted

for filing by the Exchange effective July 5, 2007.

TSX-X

--------------------------------------------------------------------------

ORO GOLD RESOURCES LTD. ("OGR")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced June 16, 2009 and June 17, 2009:

Number of Shares: 17,200,000 shares

Purchase Price: $0.70 per share

Warrants: 8,600,000 share purchase warrants to

purchase 8,600,000 shares

Warrant Exercise Price: $1.00 for an 18-month period

Number of Placees: 94 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Macquarie Bank Limited P 1,428,572

Prussian Capital Corporation P 125,000

Canaccord Capital Corporation P 500,000

Matthew Cicci P 50,000

Andrew Williams P 25,000

David Elliott P 100,000

Graham Saunders P 27,000

Peter Brown P 140,000

Matthew Gaasenbeek P 13,500

Todd Degelman P 72,000

Nirvan Meharchand P 14,000

Thomas Clapp P 58,000

Brian Clouse P 29,000

Keith Gilday P 5,000

William Washington P 14,000

Agent's Fee: Wellington West Capital Markets Inc. -

$772,799.97 and 739,680 Broker Warrants

that are exercisable into common shares

at $0.70 per share for an 18 month

period.

Canaccord Capital Corporation - 309,120

Broker Warrants that are exercisable

into common shares at $0.70 per share

for an 18 month period.

Blackmont Capital Inc. - 55,200 Broker

Warrants that are exercisable into

common shares at $0.70 per share for an

18 month period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

--------------------------------------------------------------------------

PANTHERA EXPLORATION INC. ("PNX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced June 19, 2009 and amended on

June 22, 2009:

Number of Shares: 4,612,000 shares

Purchase Price: $0.0825 per share

Warrants: 4,612,000 share purchase warrants to

purchase 4,612,000 shares

Warrant Exercise Price: $0.11 for a two year period

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

David Terry Y 100,000

Gerald Carlson Y 100,000

Jerry Minni Y 320,000

Nikolaos Cacos Y 730,000

Finder's Fee: $14,256 payable to GD Financial Group

S.A.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. (Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.)

TSX-X

--------------------------------------------------------------------------

QHR TECHNOLOGIES INC. ("QHR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced June 10, 2009:

Number of Shares: 2,000,000 shares

Purchase Price: $0.50 per share

Warrants: 2,000,000 share purchase warrants to

purchase 2,000,000 shares

Warrant Exercise Price: $0.60 for a one year period

$0.70 in the second year

Number of Placees: 34 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Thomas J. Kinahan Y 100,000

Brent Todd P 50,000

Johnny Markovina P 30,000

Finder's Fee: 5% of the proceeds raised payable in

cash to Canaccord Capital Corp.

($14,875).

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

--------------------------------------------------------------------------

SAHA PETROLEUM LTD. ("SPZ")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 5,680,000 shares to settle outstanding debt for $284,000.

Number of Creditors: 1 Creditor

Insider / Pro Group Participation:

Insider equals Y / Amount Deemed Price

Creditor Progroup equals P Owing per Share # of Shares

Brahma Resources Ltd. Y $284,000 $0.05 5,680,000

The Company shall issue a news release when the shares are issued and the

debt extinguished.

TSX-X

--------------------------------------------------------------------------

SEPROTECH SYSTEMS INCORPORATED ("SET")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

Effective at the opening, July 7, 2009, shares of the Company resumed

trading, an announcement having been made over Market News Publishing.

TSX-X

--------------------------------------------------------------------------

SLATER MINING CORPORATION ("SLM.P")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement:

Number of Shares: 2,000,000 shares

Purchase Price: $0.10 per share

Number of Placees: 2 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Jeffrey Mason Y 500,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

--------------------------------------------------------------------------

SMARTCOOL SYSTEMS INC. ("SSC")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced June 12, 2009:

Number of Shares: 3,138,750 shares

Purchase Price: $0.16 per share

Warrants: 1,569,375 share purchase warrants to

purchase 1,569,375 shares

Warrant Exercise Price: $0.30 for a one year period

Number of Placees: 28 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Robert Disbrow P 165,000

Thomas W Seltzer P 50,000

James Rogers P 100,000

Bob Kerr P 25,000

Nick Zuccaro P 200,000

Robert Griffiths P 30,000

Leann Paulger P 30,000

John Griffiths P 60,000

Dawn Griffiths P 30,000

Finder's Fee: Haywood Securities $19,560 in cash and

163,000 warrants where each warrant has

the same terms as those in the above

private placement

Blackmont Capital $960 cash

Odlum Brown $240 cash

Raymond James $3,840 cash

Jones Gable $1,440 cash

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

--------------------------------------------------------------------------

TRIGON URANIUM CORP. ("TEL")

BULLETIN TYPE: Regional Office Change

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

Pursuant to Policy 1.2, TSX Venture Exchange has been advised of, and

accepted the change of the Filing and Regional Office from Vancouver to

Toronto.

TSX-X

--------------------------------------------------------------------------

UNITED REEF LIMITED ("URP")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced June 22, 2009:

Number of Shares: 8,049,000 shares

Purchase Price: $0.02 per share

Warrants: 8,049,000 share purchase warrants to

purchase 8,049,000 shares

Warrant Exercise Price: $0.05 for a one year period

$0.10 in the second year

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Michael Coulter Y 250,000

Marilyn Turner Y 250,000

William Ollerhead Y 300,000

For further details, please refer to the Company's news release dated July

6, 2009.

TSX-X

--------------------------------------------------------------------------

ZZZ CAPITAL CORP. ("ZAP.P")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 7, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced May 11, 2009:

Number of Shares: 655,000 shares

Purchase Price: $0.10 per share

Number of Placees: 15 placees

Finder's Fee: $6,550 payable to Doctors Investment

Group Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

--------------------------------------------------------------------------

NEX COMPANIES

GARNEAU INC. ("GAR.H")

BULLETIN TYPE: New Listing-Shares, Transfer and New Addition to NEX

BULLETIN DATE: July 7, 2009

NEX Company

Effective at the opening Wednesday, July 8, 2009, the shares of the

Company will commence trading on NEX.

The Company will be delisted from trading on Toronto Stock Exchange

effective at the close of business on July 7, 2009. The Company no longer

meets Toronto Stock Exchange minimum listing requirements and also does

not meet the requirements of a TSX Venture Tier 2 company.

As of July 8, 2009, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The symbol extension differentiates NEX symbols from Tier 1 or Tier 2

symbols within the TSX Venture market.

Corporate Jurisdiction: Business Corporations Act (Alberta)

Capitalization: Unlimited common shares with no par

value of which 12,118,527 common shares

are issued and outstanding

Escrowed Shares: N/A

Transfer Agent: Olympia Trust Company (Calgary)

Trading Symbol: GAR.H

CUSIP Number: 365900 10 9

Agent's Warrants: N/A

Company Contact: Glen Garneau, President, CEO & Director

Company Address: Suite 2003, 5th Street

Nisku, Alberta, T9E 7X4

Company Phone Number: (780) 955-2398

Company Fax Number: (780) 955-7715

Company Email Address: gleng@garneau-inc.com

TSX-X

--------------------------------------------------------------------------

NEWSTRIKE CAPITAL INC. ("NES.H")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: July 7, 2009

NEX Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced July 3, 2009:

Number of Shares: 1,000,000 shares

Purchase Price: $0.10 per share

Number of Placees: 1 placee

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Robert Sali P 1,000,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

--------------------------------------------------------------------------

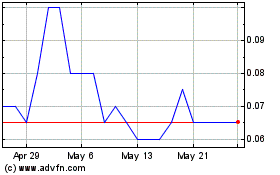

SuperBuzz (TSXV:SPZ)

Historical Stock Chart

From Apr 2024 to May 2024

SuperBuzz (TSXV:SPZ)

Historical Stock Chart

From May 2023 to May 2024