Conference call and webcast today, May 23,

at 11 a.m. PT/ 2 p.m. ET

Thunderbird Entertainment Group Inc. (TSXV: TBRD, OTCQX:

THBRF) (“Thunderbird” or the “Company”) today announced its Q3

2024 financial results, which ended March 31, 2024, and provided a

corporate update.

Financial Summary

- Free Cash Flow1 increased from ($15.8) million to $13.4 million

and ($3.7) million to $11.4 million for the three and nine months

ended March 31, 2024, as compared to the comparative periods,

variances of $29.2 million (185%) and $15.1 million (408%). The

increase for the current quarter is primarily due to receipt of

accounts receivables and tax credits.

- Net income for the three months ended March 31, 2024, was $0.01

million compared to a net loss of $2.3 million for the comparative

period in the previous year, an improvement of $2.3 million

(100%).

- Net loss for the nine months ended March 31, 2024, was $0.1

million compared to $2.4 million for the comparative period in the

previous year, an improvement of $2.3 million (96%).

- AEBITDA1 decreased from $3.7 million to $3.3 million and from

$12.1 million to $9.7 million for the three and nine months ended

March 31, 2024, as compared to the comparative periods, variances

of $0.4 million (11%) and $2.4 million (20%). The decrease is

attributable to the reduction in intellectual property (“IP”)

deliveries over the comparative periods.

- Revenue decreased from $37.3 million to $35.4 million and from

$129.0 million to $113.5 million for the three and nine months

ended March 31, 2024, as compared to the comparative periods in the

prior year, variances of $1.9 million (5%) and $15.5 million

(12%).

1 Free Cash Flow and AEBITDA are Non-IFRS Measures, see

“Non-IFRS Measures” section below for their respective definitions,

detailed calculations, and reconciliations.

Financial Outlook

Throughout the ongoing fiscal year, the Company, alongside the

rest of the media industry, has encountered a

slower-than-anticipated recovery in the content creation market,

largely influenced by major buyers' adoption of cost-cutting

measures and reduced greenlighting activities. In response to this,

during the earlier part of the year, strategic cost reduction

measures were implemented to navigate market uncertainties and pave

the way for investment in future growth prospects, which are

expected to yield cumulative savings exceeding $3 million for

fiscal 2024. Management recalibrated its fiscal expectations

accordingly.

For the quarter ended March 31, 2024, the Company reported its

second consecutive profitable quarter and continues to expect the

final quarter of the year to be its most robust. The Company

remains proactive in optimizing operational efficiencies and

exploring further avenues for cost reduction where possible while

focusing on executing against its strategic initiatives. The

Company remains steadfast in its commitment to maintaining a

resilient balance sheet and exercising prudent management decisions

to navigate evolving market dynamics while diligently pursuing

sustainable growth.

At the end of the current quarter, the business continued to

operate in line with expectations and has witnessed healthy levels

of activity with our customers. One notable development was the

expansion of one ongoing animation production in the current

quarter, which will result in approximately 30% additional revenue

over the term of this project. This expansion represents additional

secured revenue for the Company for fiscals 2025 and 2026 and will

positively impact results for both years respectively.

The short-term financial impact from this expansion is a slight

reduction in expected revenue from that production during the

fourth quarter. This is because the Company is required to

recognize revenue based on the percentage of the project completed

within the period.

While there are several compensating factors with other

productions to counter this change, we now expect Thunderbird's

total revenue to be approximately 3% less than the prior year. In

spite of this, the Company anticipates AEBITDA1 growth for fiscal

2024 to be above 20%. This projection is based on the completion of

an additional 16 hours of IP delivery in the fourth quarter of the

fiscal year, which would bring the total IP delivery for the year

to 53 hours.

"We are delighted to inform our shareholders that Thunderbird

has not only achieved profitability for the second consecutive

quarter but is also on track to fulfill our AEBITDA1 targets of

more than 20% growth year over year for fiscal year 2024," said

Jennifer Twiner McCarron, CEO and Chair of Thunderbird. "Facing

industry headwinds and market volatility, we have concentrated on

reducing costs to steer back towards robust growth, and we remain

dedicated to continuing to enhance our operational efficiencies.

This strategic adjustment positions us for significantly improved

financial outcomes in the latter half of 2024, with Q4 anticipated

to be our strongest quarter this fiscal. The momentum we've built

provides clear insight into 2025 and 2026, setting the stage for

sustained growth and a return to our historical profitability

levels."

Normal Course Issuer Bid

Thunderbird implemented a normal course issuer bid (the “NCIB”)

which is detailed in the Company’s December 1, 2023 news release,

pursuant to which it may repurchase its own common shares for

cancellation through the facilities of the TSXV in an amount not to

exceed 10% of its public float, as may be permitted by the TSXV and

applicable securities laws. During the nine months ended March 31,

2024, the Company repurchased for cancellation 591,400 common

shares under its NCIB for total consideration of $1.2 million,

representing an average price of $2.08 per common share. Purchases

under the NCIB may continue for up to one year from the

commencement day of December 7, 2023.

Thunderbird’s Q3 2024 Corporate Highlights

- In Q3 2024, the Company had 22 programs in various stages of

production, and one podcast and was working with 18 clients. Of the

22 programs in production, seven were Thunderbird IP, and 15 were

service productions.

- Thunderbird Kids & Family, producing under Atomic Cartoons,

was in production on 16 programs, and working for 11 clients,

including: CoComelon Lane for Moonbug for Netflix, Marvel's Spidey

and His Amazing Friends (Seasons 3 and 4) for Disney Junior,

Zombies: The Re-Animated Series for Disney TVA, among others, and

Atomic original Mermicorno: Starfall (Warner Bros. Discovery).

- In Q3, Atomic announced that new series Super Team Canada,

which is being produced alongside Will Arnett’s Electric Avenue and

co-created by Canadian comedy writers Robert Cohen and Joel H.

Cohen, was commissioned by Crave. Super Team Canada represents

Atomic’s first adult animated original series, and Crave’s first

commission of an original animated series.

- In Q3, Thunderbird Unscripted, producing under Great Pacific

Media (“GPM”), was in production on five unscripted programs, one

scripted and one podcast, and was working for seven clients.

Unscripted productions include: Deadman’s Curse (Season 3) for

History Channel, Wild Rose Vets (Season 1), a spinoff of Dr.

Savannah: Wild Rose Vet, for APTN, Timber Titans (Season 1) for

Discovery Canada, Rocky Mountain Wreckers (Season 1) for The

Weather Channel (US) and Discovery Canada, Deadman's Curse:

Slumach's Gold podcast (Season 2) and Highway Thru Hell (Season 13)

for Discovery Canada.

- In Q3, GPM was also working on Reginald the Vampire (Season 2),

a scripted series for SYFY, which debuted in May.

- In Q3, GPM announced that its latest original adventure

docuseries, Rocky Mountain Wreckers, was commissioned by The

Weather Channel in the US, with Bell Media serving as the Canadian

production partner.

- GPM’s Highway Thru Hell also broadened its distribution in Q3

with a dedicated FAST (free ad-supported streaming TV) channel from

partner Banijay Rights. The channel, which also features Heavy

Rescue: 401, launched in March in the UK, and in Australia in

April. Bell Media also launched the CTV Gridlock FAST channel,

which also features classic episodes of Highway Thru Hell and the

entire series of Heavy Rescue: 401.

- GPM also announced that preliminary filming for Prizefighter

(working title), a series being produced in partnership with the

World Boxing Council, is underway in Las Vegas.

- In Q3, GPM announced that two of its projects were acquired for

distribution: Blue Fox Entertainment acquired international rights

to GPM’s YA film Boot Camp, based on the popular Wattpad story by

Gina Musa, and Blue Ant Media acquired Wild Rose Vets, a spin-off

of docuseries Dr. Savannah: Wild Rose Vet, for Cottage Life

Television. Wild Rose Vets is a Wapanatahk Media production and is

being co-commissioned with APTN.

- The Company currently has 12 scripted projects in active

development, as well as three projects in active network

development.

- In Q3, Thunderbird Distribution had several programs in active

media distribution, including company-owned comedies Strays and

Kim’s Convenience, as well as owned kids series Mermicorno:

Starfall and Rocket Saves the Day, and acquisitions Mittens &

Pants and BooSnoo!. There was also an additional range of TV movies

and series from the Thunderbird catalog in active media

distribution.

- In Q3, Thunderbird Distribution had several company-owned IPs

in active consumer products licensing. These include Mermicorno:

Starfall from Kids and Family, and acquisitions Mittens &

Pants, and BooSnoo!.

Results of Operations

For the three months

ended

For the nine months

ended

Mar 31, 2024

Mar 31, 2023

Mar 31, 2024

Mar 31, 2023

($000’s, except per share data)

$

$

$

$

Revenue

35,371

37,281

113,510

128,985

Expenses

35,366

39,531

113,614

131,428

Net income (loss) for the

period

5

(2,250)

(104)

(2,443)

AEBITDA1

3,347

3,674

9,740

12,073

AEBITDA Margin1

9.5%

9.9%

8.6%

9.4%

Free Cash Flow1

13,389

(15,814)

11,392

(3,653)

Basic and diluted income (loss) per

share

-

(0.045)

(0.002)

(0.049)

1 AEBITDA, AEBITDA Margin, and Free Cash Flow are Non-IFRS

Measures, see “Non-IFRS Measures” section below for their

respective definitions, detailed calculations, and

reconciliations.

For more information, please see the financial statements and

the management’s discussion and analysis (MD&A) for Q3 fiscal

2024, which ended March 31, 2024, available on SEDAR+ and the

Company’s website.

Thunderbird’s Q3 2024 Conference Call & Webcast

Information

Conference Call & Webcast Information Date: May 23,

2024 Time: 11 a.m. PT/ 2 p.m. ET

Pre-Registration:

To pre-register for this call, please go to the following link

and you will receive access details via email:

https://www.netroadshow.com/events/login?show=8ae70692&confId=63912

If you are unable to pre-register, please see the information

for joining by webcast or telephone:

Webcast: https://events.q4inc.com/attendee/770484356

Canada Toll Free: +1 833 950 0062 United States

(Toll-Free): +1 833 470 1428 All other locations: +1 929

526 1599 Access Code: 882255 Press *1 to ask a question, *2

to withdraw your question, or *0 for operator assistance.

Participants joining by phone are requested to call the

conference line 10 minutes early to avoid wait times while

connecting to the call. The conference call will be webcast live

and available for replay via the “Investors” section of the

Thunderbird website.

For information on Thunderbird and to subscribe to the Company’s

investor list for news updates, go to www.thunderbird.tv.

ABOUT THUNDERBIRD ENTERTAINMENT GROUP

Thunderbird Entertainment Group is a global award-winning,

full-service multiplatform production, distribution and rights

management company, headquartered in Vancouver, with additional

offices in Los Angeles and Ottawa. Thunderbird creates

award-winning scripted, unscripted, and animated programming for

the world’s leading digital platforms, as well as Canadian and

international broadcasters. The Company develops, produces, and

distributes animated, factual, and scripted content through its

various content arms, including Thunderbird Kids and Family (Atomic

Cartoons), Thunderbird Unscripted (Great Pacific Media) and

Thunderbird Scripted. Productions under the Thunderbird umbrella

include The Last Kids on Earth, Molly of Denali, Highway Thru Hell,

Kim’s Convenience, Reginald the Vampire and Boot Camp. Thunderbird

Distribution and Thunderbird Brands manage global media and

consumer products rights, respectively, for the Company and select

third parties. Thunderbird is on Facebook, Twitter, and Instagram

at @tbirdent. For more information, visit: www.thunderbird.tv.

Neither the TSX-V nor its Regulation Services Provider (as that

term is defined in the policies of the TSX-V) accepts

responsibility for the adequacy or accuracy of this release, which

has been prepared by management.

Cautionary Statement Regarding Forward-Looking

Information

Thunderbird’s public communications may include written, or oral

“forward-looking statements” and “forward-looking information” as

defined under applicable Canadian securities legislation. To the

extent any forward-looking information in this news release

constitutes “financial outlooks” or “future-oriented financial

information” within the meaning of applicable Canadian securities

laws, the reader is cautioned not to place undue reliance on such

information. All such statements may not be based on historical

facts that relate to the Company’s current expectations and views

of future events and are made pursuant to the “safe harbour”

provisions of applicable securities laws.

Forward-looking statements or information may be identified by

words such as “anticipate”, “continue”, “estimate”, “expect”,

“forecast”, “may”, “will”, “plan”, “project”, “should”, “believe”,

“intend”, or similar expressions concerning matters that are not

historical facts. Forward-looking statements in this document

include, but are not limited to, statements with respect to

expectations regarding strategic cost reduction measures yielding

savings for fiscal 2024; exploring further avenues for cost

reduction; expectations regarding the final quarter of the year

being the most robust; projections and forecasted growth in

AEBITDA1; expectations for total revenue to be approximately 3%

less than the prior year; the Company's continued financial

strength; the expansion of one ongoing animation production in the

current quarter resulting in approximately 30% additional revenue

over the term of the project and securing additional revenue for

the Company for fiscals 2025 and 2026; expectations for IP

delivery; maintaining a resilient balance sheet and exercising

prudent management decisions to navigate evolving market dynamics

while diligently pursuing sustainable growth; significantly

improved financial outcomes in the latter half of 2024; and

expectations for sustained growth and a return to the Company’s

historical profitability levels.

Financial outlook and future-oriented financial information, as

with forward-looking information generally, are, without

limitation, based on the assumptions and subject to various risks.

The targets included herein, and the related assumptions, involve

known and unknown risks and uncertainties that may cause actual

results to differ materially. The purpose of the information is to

provide readers with a more complete perspective on the Company’s

anticipated future operations and business activities. Readers are

cautioned that the information may not be appropriate for other

purposes. While management of Thunderbird believes there is a

reasonable basis for these targets, such targets may not be met.

The Company’s actual financial position and results of operations

may differ materially from management’s current expectations and,

as a result, the Company’s future revenue and AEBITDA1 may differ

materially from the financial outlooks and future-oriented

information provided in this news release. Accordingly, investors

are cautioned not to place undue reliance on the foregoing

information.

Forward looking statements are necessarily based on a number of

estimates and assumptions that, while considered reasonable, are

subject to known and unknown risks, uncertainties and other factors

which may cause actual results and future events to differ

materially from those expressed or implied by such forward-looking

statements. Such factors include, but are not limited to: general

business, economic and social uncertainties; market segment

conditions; litigation, legislative, environmental and other

judicial, regulatory, political and competitive developments;

product capability and acceptance; international risk and currency

exchange rates; and technology changes. An assessment of these

risks that could cause actual results to materially differ from

current expectations is contained in the “Risks and Uncertainty”

section of June 30, 2023 MD&A. The foregoing is not an

exhaustive list. Additional risks and uncertainties not presently

known to Thunderbird or that management believes to be less

significant may also adversely affect the Company. Although the

Company believes that the assumptions and factors used in preparing

the forward-looking statements or information contained in this

document are reasonable, undue reliance should not be placed on

these statements which represent our views as of the date hereof

and as such information should not be relied upon as representing

our views as of any date subsequent to the date of this document.

The Company undertakes no obligation to update publicly or revise

any forward-looking statements or information, whether as a result

of new information, future events or otherwise, unless so required

by applicable securities laws. Accordingly, readers are cautioned

not to place undue reliance on forward-looking statements or

information.

NON-IFRS MEASURES

In addition to the results reported in accordance with IFRS, the

Company uses various non-IFRS financial measures which are not

recognized under IFRS, and therefore do not have standardized

meanings prescribed by IFRS, as supplemental indicators of our

operating performance and financial position. The Company’s method

of calculating such financial measures may differ from the methods

used by other issuers and, accordingly, our definition of these

non-IFRS financial measures may not be comparable to similar

measures presented by other issuers. These non-IFRS financial

measures are provided to enhance the user’s understanding of our

historical and current financial performance and our prospects for

the future. Management believes that these measures provide useful

information in that they exclude amounts that are not indicative of

our core operating results and ongoing operations and provide a

more consistent basis for comparison between periods. The following

discussion explains the Company’s use of AEBITDA, Free Cash Flow,

and AEBITDA Margins.

“AEBITDA” is calculated based on EBITDA before share-based

compensation, unrealized foreign exchange gain/loss and items of an

unusual or one-time nature that do not reflect our ongoing

operations. AEBITDA is commonly reported and widely used by

investors and lenders as an indicator of a company’s operating

performance and ability to incur and service debt, and as a

valuation metric. The most directly comparable measure under IFRS

is net income.

“Free Cash Flow” is calculated based on cash flows from

operations, purchase of property and equipment and net interim

production financing. Free Cash Flow represents the cash a company

generates after accounting for cash outflows to support operations

and maintain its capital assets. The most directly comparable

measure under IFRS is cash flows from operations.

“AEBITDA Margins” is calculated as a ratio of AEBITDA over total

revenues. Margin is a non-IFRS ratio when applied to non-IFRS

financial measures.

Non-IFRS Measures Reconciliations

The following table presents the reconciliation from net income

(loss) to AEBITDA, for the three and nine months ended March 31,

2024 and 2023.

For the three months

ended

For the nine months

ended

Mar 31, 2024

Mar 31, 2023

Mar 31, 2024

Mar 31, 2023

($000’s)

$

$

$

$

Net income (loss) for the

period

5

(2,250)

(104)

(2,443)

Income tax expense (recovery)

569

(183)

344

401

Deferred income tax expense (recovery)

(563)

(198)

91

(1,130)

Finance costs

Interest

358

618

990

1,547

Dividends on redeemable preferred

shares

7

7

22

22

Amortization

Property and equipment

390

550

1,376

1,699

Right-of-use assets

1,731

3,198

5,418

8,566

Intangible assets

67

68

203

203

2,559

4,060

8,444

11,308

EBITDA

2,564

1,810

8,340

8,865

Share-based compensation

193

233

622

574

Unrealized foreign exchange loss

(gain)

(46)

14

6

534

Loss (gain) on disposal of property and

equipment

1

-

7

(1)

Loss on termination of leases

65

-

40

-

Restructuring and other costs

570

-

725

-

Proxy contest

-

1,617

-

2,101

783

1,864

1,400

3,208

AEBITDA

3,347

3,674

9,740

12,073

The following table presents the reconciliation from cash flows

from operations to Free Cash Flow, for the three and nine months

ended March 31, 2024 and 2023.

Summary of Cash Flows

For the three months

ended

For the nine months

ended

Mar 31, 2024

Mar 31, 2023

Mar 31, 2024

Mar 31, 2023

($000’s)

$

$

$

$

Cash inflows (outflows) from

operations

14,219

(13,125)

34,439

23,999

Purchase of property and equipment

(52)

(139)

(273)

(1,902)

Net repayment of interim production

financing

(778)

(2,550)

(22,774)

(25,750)

Free Cash Flow

13,389

(15,814)

11,392

(3,653)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240523989197/en/

Investor Relations Contacts: Glen Akselrod, Bristol

Capital Phone: + 1 905 326 1888 ext 1 Email: glen@bristolir.com

Media Relations Contact: Lana Castleman, Director, Marketing

& Communications Phone: 416-219-3769 Email:

lcastleman@thunderbird.tv Corporate Communications

Julia Smith, Finch Media Email: Julia@finchmedia.net

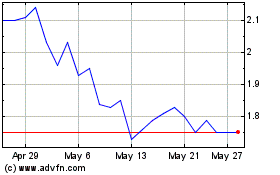

Thunderbird Entertainment (TSXV:TBRD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Thunderbird Entertainment (TSXV:TBRD)

Historical Stock Chart

From Dec 2023 to Dec 2024