The Company exceeds FY 2024 guidance

30% increase in FY 2024 Adjusted EBITDA to

$16.7 million

Targets 20%+ revenue growth in FY

2025

Conference call and webcast tomorrow,

October 10, at 11 a.m. PT/ 2 p.m. ET

Thunderbird Entertainment Group Inc. (TSXV: TBRD, OTCQX:

THBRF) (“Thunderbird” or the “Company”) today announced its

financial results for its fourth quarter and fiscal 2024, which

ended June 30, 2024, and provided a corporate update.

Financial Summary

- Revenue for the fourth quarter increased 37% year-over-year

from $37.7 million to $51.8 million. Revenue declined by 1%

year-over-year, from $166.7 million to $165.3 million, for the

fiscal year ended June 30, 2024.

- Fourth quarter AEBITDA1 increased to $7.0 million, compared to

$0.7 million in the same period last year. Annual AEBITDA1 rose by

30% year-over-year, from $12.8 million to $16.7 million, for the

fiscal year ended June 30, 2024.

- Fourth quarter AEBITDA margin1 increased to 13.4%, up from 1.8%

in the same period last year. Annual AEBITDA margin1 improved by

240 basis points, rising to 10.1% from 7.7% in the previous fiscal

year.

1 AEBITDA, and AEBITDA margin are Non-IFRS Measures, see

“Non-IFRS Measures” section below for their definitions, detailed

calculation, and detailed reconciliation to IFRS measures. The most

directly comparable financial measure of the Company is net income,

as reported below.

Financial Outlook

Despite facing industry-wide headwinds, the Company is

forecasting a return to top-line growth in fiscal 2025, with a

target for 20% revenue growth and over 10% AEBITDA1 growth. The

variance between revenue and AEBITDA1 growth reflects the

anticipated gross margin1 difference associated with the types of

projects being forecasted in FY 2025 compared to FY 2024. These

targets are supported by a strong content pipeline, strategic

investments, and signs of a stabilizing market environment.

In fiscal 2024, Thunderbird introduced comprehensive cost-saving

measures that delivered savings exceeding $3 million and resulted

in an ongoing reduction to the Company’s fixed cost base. The

Company continues to maintain a disciplined approach to managing

costs and will seek out additional ways to increase efficiencies

and realize savings throughout fiscal 2025 without sacrificing the

quality that the Company is known for.

Thunderbird’s balance sheet remains robust, with no corporate

debt, providing the financial flexibility needed to pursue growth

opportunities. This strength supports the Company’s plans to invest

in new content production, a key driver of future growth. By

aligning its content strategy with disciplined financial oversight,

Thunderbird is committed to delivering increased value to

shareholders.

The Company’s fiscal 2025 outlook is based on the Company’s

latest internal projections, though certain risks remain, as

detailed in the “Risk and Uncertainty” section of the Company’s

June 30, 2024, MD&A. With a clear focus on executing its

strategic priorities, Thunderbird is well positioned to succeed in

a competitive and evolving market landscape.

“Our strong Q4 results and overall fiscal 2024 performance

demonstrate how Thunderbird is a healthy, successful business even

in today’s challenging market,” said Jennifer Twiner McCarron, CEO

and Chair of Thunderbird. “Looking ahead, as the entertainment

industry continues to recover from setbacks experienced in 2023,

Thunderbird will be exceptionally well-positioned to build

significant value for our shareholders. Supported by our robust

content pipeline, strong industry relationships and disciplined

cost management, we are optimistic about the future as Thunderbird

is ready to seize the opportunities ahead.”

Strategic Review Process Update

A special committee (the “Special Committee”) of the board of

directors of Thunderbird (the “Board”) comprised of three directors

of Thunderbird (including two independent directors and a Voss

Capital-nominee) was created to assess Thunderbird’s capital

allocation strategy and strategic alternatives and opportunities to

maximize shareholder value. After conducting a thorough review

process, and obtaining financial and legal advice, the Special

Committee recommended to the Board that the formal strategic review

process be concluded, and the Company focus on the execution of its

strategic business plan. The Board, following the recommendation of

the Special Committee determined that it was in the best interests

of the Company’s stakeholders to terminate the formal strategic

review process and have the Company’s management focus on executing

the Company’s current business plan, which includes the pursuit of

strategic growth opportunities.

“After a thorough strategic review process led by the Special

Committee, the Board determined that remaining a standalone public

company and executing on our strategic business plan is in the best

interests of our stakeholders. We anticipate that executing on our

targeted growth in the coming years, along with exploring strategic

capital markets and other opportunities, such as a potential

opportunity to uplist to the Toronto Stock Exchange (“TSX”) to

increase visibility and liquidity, will prove to be a path to

enhancing value for our shareholders,” said Ms. Twiner

McCarron.

Taylor Henderson, Company Director and Investment Analyst at

Voss Capital added, “The Board of Directors is aligned in the

decision to maintain Thunderbird as an independent, publicly traded

company after considering all available strategic options. We

believe remaining a standalone public company will lead to the best

opportunity for significant mid- to long-term value creation. We

believe that Thunderbird is significantly undervalued and the work

to close this valuation gap will continue through a combination of

ongoing operational execution and strategic actions to increase

visibility and liquidity for the stock, such as the potential

uplisting to the TSX. Thunderbird has navigated challenging

industry dynamics better than most. We believe the troughs for

earnings and margins are behind us and we have a line of sight to

accelerate revenue growth and margin expansion. The management team

and Board are confident in Thunderbird’s ability to execute on its

targets.”

Normal Course Issuer Bid

Thunderbird implemented a normal course issuer bid (the “NCIB”)

which is detailed in the Company’s December 1, 2023 news release,

pursuant to which it may repurchase its own common shares for

cancellation through the facilities of the TSXV in an amount not to

exceed 10% of its public float, as may be permitted by the TSXV and

applicable securities laws.

To June 30, 2024, the Company has repurchased for cancellation

591,400 common shares, representing 17.3% of its allotted share

repurchase under its NCIB in effect for a total consideration of

$1.2 million, representing an average price of $2.08 per common

share. Purchases under the NCIB may continue for up to one year

from the commencement day of December 7, 2023.

1 AEBITDA, and gross margin are Non-IFRS Measures, see “Non-IFRS

Measures” section below for their definitions, detailed

calculation, and detailed reconciliation to IFRS measures. The most

directly comparable financial measure of the Company are net income

and gross profit, respectively, as reported below.

Thunderbird’s Fiscal 2024 Corporate Highlights

- At June 30, 2024, the Company had 24 programs in various stages

of production and was working with 17 clients. Of the 24 programs

in production, six were Thunderbird’s intellectual property (“IP”),

and 18 were service productions.

- Thunderbird Kids & Family, producing under Atomic Cartoons

(“Atomic”), was in production on several animated series throughout

fiscal 2024 including: Princess Power (Seasons 2 and 3) for

Netflix, CoComelon Lane for Moonbug for Netflix, Marvel's Spidey

and His Amazing Friends (Seasons 2, 3 and 4) for Disney Junior, My

Little Pony: Make Your Mark (Chapter 6) for eOne/Hasbro, The

Mindful Adventures of Unicorn Island for Headspace, Zombies: The

Re-Animated Series for Disney TVA, LEGO Jurassic Park: The

Unofficial Retelling for NBCUniversal, and Molly of Denali (Season

4) for PBS KIDS, among others, as well as Atomic originals Super

Team Canada (Crave), Rocket Saves the Day (PBS KIDS), and

Mermicorno: Starfall (Warner Bros. Discovery).

- In fiscal 2024, Thunderbird introduced its first adult animated

original series, Super Team Canada. Produced alongside Will

Arnett’s Electric Avenue and co-created by Canadian comedy writers

Robert Cohen and Joel H. Cohen. Super Team Canada also represents

Crave’s first commission of an original animated series for adults.

The series is set to debut in early 2025.

- Thunderbird Unscripted, producing under Great Pacific Media

(“GPM”), was in production on several series in fiscal 2024,

including: Deadman’s Curse (Seasons 2 and 3) for History Channel,

Styled (Season 2) for HGTV Canada/Hulu, Wild Rose Vets (Season 1),

a spinoff of Dr. Savannah: Wild Rose Vet, for APTN and Cottage Life

TV; Timber Titans (Seasons 1 and 2) for Discovery, Highway Thru

Hell (Seasons 12 and 13) for Discovery, and Rocky Mountain Wreckers

(Season 1) for The Weather Channel (US) and Discovery in

Canada.

- In fiscal 2024, GPM unveiled the all-new original docuseries

Rocky Mountain Wreckers, which follows the adventures of four

family-owned heavy wrecking businesses across Colorado, Utah and

Wyoming. The series has been commissioned by The Weather Channel in

the US, with Bell Media serving as the Canadian broadcast partner

and owning the rights to the show for Discovery Canada. Season 1 is

set to premiere in early 2025.

- In fiscal 2024, GPM’s Deadman’s Curse marked several exciting

milestones. Following the success of Season 1, the team was in

production on both Seasons 2 and 3, with Season 3 scheduled to

premiere in 2025 on The History Channel. In addition, companion

podcast Deadman’s Curse: Slumach’s Gold hit #4 on Apple’s History

charts, won three 2023 Signal Awards, and was named one of the Best

Podcasts of the Year by Amazon Music. Season 2 of the podcast,

titled Deadman’s Curse: Volcanic Gold, premiered in June on Apple

Podcasts, Spotify, and Amazon Music.

- GPM was also in production on two scripted projects in fiscal

2024, including Sidelined: The QB and Me, a new Tubi Original movie

based on the Wattpad novel. Blue Fox Entertainment is managing

international distribution, announcing sales to partners in Europe,

Latin America, South Africa, and more. In addition, Blue Fox

Entertainment acquired international distribution rights, outside

Canada and the US, for GPM and Wattpad Studios’ YA film Boot Camp,

based on the popular Wattpad story by Gina Musa.

- The Company currently has 12 scripted projects in active

development, and three projects in active network development.

- Thunderbird Distribution and Brands continued to expand in

fiscal 2024. Season 1 of Mittens & Pants was sold to buyers in

more than 34 territories, and the acquired preschool series has

also been adopted by several US streaming platforms, including

NBCU’s Peacock, Roku, Tubi, and children’s free ad-supported

streamers HappyKids, Kidoodle.TV and Sensical. Thunderbird also

announced the acquisition of media and consumer products rights to

the mixed-media series BooSnoo!, which began rolling out on

international platforms, including Peacock, in July 2024.

- In fiscal 2024, the Company further built brand momentum around

Mermicorno: Starfall by announcing new territory distribution deals

in the US (Max), UK (POP), Canada (Corus Entertainment for

Treehouse, STACKTV and TELETOON+), LATAM (Max and Cartoon Network)

and Southeast Asia (Cartoon Network). Thunderbird Brands and

partner tokidoki also appointed renowned toymaker Jazwares as

global master toy licensee for Mermicorno: Starfall for several

retail distribution channels, including mass-market, e-commerce and

direct-to-consumer platforms.

- Thunderbird also expanded its presence on FAST (Free

advertising-supported streaming television) channels, with Banijay

Rights launching a dedicated Highway Thru Hell-branded FAST channel

that features the first 10 seasons of the long-running hit

docuseries. The channel, which also features Heavy Rescue: 401,

launched in March in the UK, and in Australia in April. Bell Media

also launched the CTV Gridlock FAST channel, which features classic

episodes of Highway Thru Hell and the entire series of Heavy

Rescue: 401.

- Company recognitions in fiscal 2024 included Atomic placing

third on the annual Kidscreen Hot50 list of top production

companies, GPM series receiving five 2023 Leo Awards, Reginald the

Vampire being awarded an Environmental Media Association Gold Seal

for its dedication to sustainability, Colin Beadle (VP of Human

Resources at Thunderbird) being named one of the Top HR Leaders in

Canadian Tech by ScaleHR, Pinecone & Pony receiving a Canadian

Screen Award (Best Picture Editing, Animation category) for the

episode “The Sturdy Stone”, and Thunderbird ranking #12 on

Playback’s Indie List 2024.

Results of Operations

For the three months

ended

For the year ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

($000’s, except per share data)

$

$

$

$

Revenue

51,814

37,745

165,323

166,730

Expenses

49,334

40,314

162,945

171,741

Net income (loss) for the

period

2,480

(2,569)

2,378

(5,011)

AEBITDA1

6,954

687

16,693

12,761

AEBITDA Margin1

13.4%

1.8%

10.1%

7.7%

Free Cash Flow1

(4,771)

7,984

6,623

4,331

Basic income (loss) per share

0.050

(0.051)

0.048

(0.101)

Diluted income (loss) per share

0.047

(0.051)

0.046

(0.101)

1 AEBITDA, AEBITDA margin, and Free Cash Flow are Non-IFRS

Measures, see “Non-IFRS Measures” section below for their

definitions, detailed calculations, and detailed reconciliations to

IFRS measures. The most directly comparable financial measure of

the Company are net income and cash flows from Operations,

respectively, as reported below.

For more information, please see the financial statements and

the management’s discussion and analysis (MD&A) for the year

end results for fiscal 2024, which ended June 30, 2024, available

on SEDAR+ and the Company’s website.

Thunderbird’s Fiscal 2024 Conference Call & Webcast

Information

Conference Call & Webcast Information Date: October

10, 2024 Time: 11 a.m. PT/ 2 p.m. ET

Pre-Registration: To pre-register for this call, please go to the

following link and you will receive access details via email:

https://registrations.events/direct/Q4I984380

If you are unable to pre-register, please see the information

for joining by webcast or telephone:

Webcast: https://events.q4inc.com/attendee/854845440

Canada Toll Free: +1 (800) 715-9871 United States

(Toll-Free): +1 (800) 715-9871 All other locations: +1

(646) 307-1963 Access Code: 98438 Press *1 to ask a

question, *1 to withdraw your question, or *0 for operator

assistance.

Participants joining by phone are requested to call the

conference line 10 minutes early to avoid wait times while

connecting to the call. The conference call will be webcast live

and available for replay via the “Investors” section of the

Thunderbird website.

For information on Thunderbird and to subscribe to the Company’s

investor list for news updates, go to www.thunderbird.tv.

ABOUT THUNDERBIRD ENTERTAINMENT GROUP

Thunderbird Entertainment Group is a global award-winning,

full-service multiplatform production, distribution and rights

management company, headquartered in Vancouver, with additional

offices in Los Angeles and Ottawa. Thunderbird creates

award-winning scripted, unscripted, and animated programming for

the world’s leading digital platforms, as well as Canadian and

international broadcasters. The Company develops, produces, and

distributes animated, factual, and scripted content through its

various content arms, including Thunderbird Kids and Family (Atomic

Cartoons), Thunderbird Unscripted (Great Pacific Media) and

Thunderbird Scripted. Productions under the Thunderbird umbrella

include Mermicorno: Starfall, Super Team Canada, Molly of Denali,

Highway Thru Hell, Kim’s Convenience, Boot Camp, and Sidelined: The

QB and Me. Thunderbird Distribution and Thunderbird Brands manage

global media and consumer products rights, respectively, for the

Company and select third parties. Thunderbird is on Facebook,

Twitter, and Instagram at @tbirdent. For more information, visit:

www.thunderbird.tv.

Neither the TSX-V nor its Regulation Services Provider (as that

term is defined in the policies of the TSX-V) accepts

responsibility for the adequacy or accuracy of this release, which

has been prepared by management.

Cautionary Statement Regarding Forward-Looking

Information

Certain statements in this press release contain

“forward-looking information” for purposes of applicable securities

laws (“forward-looking statements”). Forward-looking statements or

information may be identified by words such as “anticipate”,

“continue”, “estimate”, “expect”, “forecast”, “may”, “will”,

“plan”, “project”, “should”, “believe”, “intend”, or similar

expressions concerning matters that are not historical facts.

Examples of forward-looking statements in this press release

include, but are not limited to, forecasting a return to top-line

growth in fiscal 2025, forecasted 2025 growth in revenue and

AEBITDA1; anticipated gross margin1 differences; expectations

regarding comprehensive cost-saving measures yielding ongoing

reduction to the Company’s fixed cost base; being successful in

increasing efficiencies and realizing additional savings throughout

fiscal 2025; successfully investing in new content production;

abilities to execute strategic priorities; potential opportunity to

uplist to the TSX to increase visibility and liquidity; the ability

of the Company to enhance and maximize shareholder value or execute

on its strategic business plan.

Financial outlook and future-oriented financial information, as

with forward-looking information generally, are, without

limitation, based on the assumptions and estimates and subject to

various risks. The targets, forecasts and projections included

herein, and the related assumptions, involve known and unknown

risks and uncertainties that may cause actual results to differ

materially. While management of Thunderbird believes there is a

reasonable basis for these targets, forecasts and projections, such

targets, forecasts, or projections may not be achieved. The

Company’s actual financial position and results of operations may

differ materially from management’s current expectations and, as a

result, among other things, the Company’s future revenue and

AEBITDA1 may differ materially from the financial outlooks and

future-oriented information provided in this news release.

Accordingly, investors are cautioned not to place undue reliance on

the foregoing information.

Forward looking statements are necessarily based on a number of

estimates and assumptions that, while considered reasonable, are

subject to known and unknown risks, uncertainties and other factors

which may cause actual results and future events to differ

materially from those expressed or implied by such forward-looking

statements. Such factors include, but are not limited to: general

business, economic and social uncertainties; the ability to satisfy

the criteria of the TSX to be able to uplist on the TSX and the

timing related thereto; market segment conditions; litigation,

legislative, environmental and other judicial, regulatory,

political and competitive developments; product capability and

acceptance; international risk and currency exchange rates; and

technology changes. An assessment of these risks that could cause

actual results to materially differ from current expectations is

contained in the “Risks and Uncertainty” section of the Company’s

June 30, 2024, MD&A. The foregoing is not an exhaustive list.

Additional risks and uncertainties not presently known to

Thunderbird or that management believes to be less significant may

also adversely affect the Company. Although the Company believes

that the assumptions and factors used in preparing the

forward-looking statements contained in this document (including

statements containing future-oriented financial information) are

reasonable, undue reliance should not be placed on these statements

which represent the Company’s views as of the date hereof and as

such information should not be relied upon as representing the

Company’s views as of any date subsequent to the date of this press

release. The Company undertakes no obligation to update publicly or

revise any forward-looking statements, whether because of new

information, future events or otherwise, unless so required by

applicable securities laws. Accordingly, readers are cautioned not

to place undue reliance on forward-looking statements.

1 AEBITDA and gross margin are Non-IFRS Measures, see “Non-IFRS

Measures” section below for their definitions, detailed

calculations, and detailed reconciliations to IFRS measures. The

most directly comparable financial measure of the Company are net

income and gross profit, respectively, as reported below.

NON-IFRS MEASURES

In addition to the results reported in accordance with IFRS, the

Company uses various non-IFRS financial measures which are not

recognized under IFRS, and therefore do not have standardized

meanings prescribed by IFRS, as supplemental indicators of our

operating performance and financial position. The Company’s method

of calculating such financial measures may differ from the methods

used by other issuers and, accordingly, our definition of these

non-IFRS financial measures may not be comparable to similar

measures presented by other issuers. These non-IFRS financial

measures are provided to enhance the user’s understanding of our

historical and current financial performance and our prospects for

the future. Management believes that these measures provide useful

information in that they exclude amounts that are not indicative of

our core operating results and ongoing operations and provide a

more consistent basis for comparison between periods. The following

discussion explains the Company’s use of AEBITDA, Free Cash Flow,

AEBITDA Margins and Gross Margin.

“AEBITDA” is calculated based on EBITDA before share-based

compensation, unrealized foreign exchange gain/loss and items of an

unusual or one-time nature that do not reflect our ongoing

operations. AEBITDA is commonly reported and widely used by

investors and lenders as an indicator of a company’s operating

performance and ability to incur and service debt, and as a

valuation metric. The most directly comparable measure under IFRS

is net income.

“Free Cash Flow” is calculated based on cash flows from

operations, purchase of property and equipment and net interim

production financing. Free Cash Flow represents the cash a company

generates after accounting for cash outflows to support operations

and maintain its capital assets. The most directly comparable

measure under IFRS is cash flows from operations.

“AEBITDA Margins” is calculated as a ratio of AEBITDA over total

revenues. Margin is a non-IFRS ratio when applied to non-IFRS

financial measures.

"Gross Margin" is calculated as a ratio of revenue that exceeds

direct operating costs. Management considers Gross Margin a useful

indicator of profitability before operating and other expenses,

aiding in the assessment of the Company's ability to generate net

earnings and cash flow. The most directly comparable measure under

IFRS is gross profit.

Non-IFRS Measures Reconciliations

The following table presents the reconciliation from net income

(loss) to AEBITDA, for the three and twelve months ended June 30,

2024 and 2023.

For the three months

ended

For the year ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

($000’s)

$

$

$

$

Net income (loss) for the

period

2,480

(2,569)

2,378

(5,011)

Income tax expense (recovery)

584

(374)

930

27

Deferred income tax expense (recovery)

343

(685)

431

(1,815)

Finance costs

Interest

472

793

1,461

2,340

Dividends on redeemable preferred

shares

7

7

29

29

Amortization

Property and equipment

359

348

1,734

2,047

Right-of-use assets

1,661

2,372

7,079

10,938

Intangible assets

67

67

270

270

3,493

2,528

11,934

13,836

EBITDA

5,973

(41)

14,312

8,825

Share-based compensation

117

260

739

834

Unrealized foreign exchange loss

(gain)

22

(171)

28

363

Gain on disposal of property and

equipment

(37)

-

(29)

-

Loss on termination of leases

-

-

40

-

Restructuring and other costs

879

639

1,603

638

Proxy contest

-

-

-

2,101

981

728

2,381

3,936

AEBITDA

6,954

687

16,693

12,761

The following table presents the reconciliation from Gross

Profit to Gross Margin, for the three and twelve months ended June

30, 2024 and 2023.

Summary of Gross Profit

For the three months

ended

For the year ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

($000’s)

$

$

$

$

Revenue

51,814

37,745

165,323

166,730

Direct Operating

40,303

29,919

127,795

129,792

Gross Profit

11,511

7,826

37,528

36,938

Gross Margin

22.2%

20.7%

22.7%

22.2%

The following table presents the reconciliation from cash flows

from operations to Free Cash Flow, for the three and twelve months

ended June 30, 2024 and 2023.

Summary of Cash Flows

For the three months

ended

For the year ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

($000’s)

$

$

$

$

Cash inflows (outflows) from

operations

3,232

(10,816)

37,673

13,182

Disposal (purchase) of property and

equipment

(184)

92

(456)

(1,810)

Net advances (repayment) of interim

production financing

(7,819)

18,708

(30,594)

(7,041)

Free Cash Flow

(4,771)

7,984

6,623

4,331

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241009644741/en/

Investor Relations Contacts: Glen Akselrod, Bristol

Capital Phone: + 1 905 326 1888 ext 1 Email: glen@bristolir.com

Media Relations Contact: Lana Castleman, Director,

Marketing & Communications Phone: 416-219-3769 Email:

lcastleman@thunderbird.tv

Corporate Communications Julia Smith, Finch Media Email:

Julia@finchmedia.net

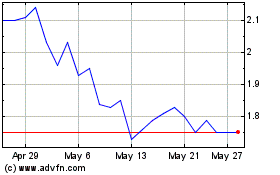

Thunderbird Entertainment (TSXV:TBRD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Thunderbird Entertainment (TSXV:TBRD)

Historical Stock Chart

From Dec 2023 to Dec 2024