Tornado Global Hydrovacs Reports Third Quarter 2021 Results

19 November 2021 - 12:00AM

Tornado Global Hydrovacs Ltd. (“Tornado” or the “Company”) (TGH:

TSX-V) today reported its unaudited condensed consolidated

financial results for the Three and Nine Months ended September 30,

2021. The unaudited condensed consolidated financial statements and

MD&A have been filed on SEDAR and can be reviewed at

www.sedar.com and on the Company’s web site www.tornadotrucks.com.

Financial and Operating Highlights (in

CAD $000’s except per share data)

|

|

Three months ended September 30 |

|

Nine Months ended September 30 |

|

|

|

2021 |

|

|

2020 |

|

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

| Revenue (1) |

$ |

8,355 |

|

$ |

7,404 |

|

|

$ |

23,404 |

|

$ |

25,647 |

|

| Cost of

sales (1) |

|

6,291 |

|

|

5,772 |

|

|

|

17,253 |

|

|

21,053 |

|

| Gross Profit |

|

2,064 |

|

|

1,632 |

|

|

|

6,151 |

|

|

4,594 |

|

| Gross Profit % |

|

24.7 |

% |

|

22.0 |

% |

|

|

26.3 |

% |

|

17.9 |

% |

| |

|

|

|

|

|

| Selling and general

administrative expenses |

|

1,463 |

|

|

832 |

|

|

|

3,773 |

|

|

2,882 |

|

| Depreciation and

amortization |

|

312 |

|

|

461 |

|

|

|

1,211 |

|

|

1,308 |

|

| Finance expense |

|

68 |

|

|

45 |

|

|

|

141 |

|

|

118 |

|

| Impairment write-down

(reversal) |

|

764 |

|

|

(174 |

) |

|

|

764 |

|

|

(174 |

) |

| Stock-based compensation |

|

131 |

|

|

- |

|

|

|

269 |

|

|

- |

|

| Loss on disposal of fixed

assets |

|

14 |

|

|

- |

|

|

|

77 |

|

|

- |

|

|

Accretion expense |

|

- |

|

|

50 |

|

|

|

75 |

|

|

50 |

|

| |

|

|

|

|

|

| Income (loss) before tax |

|

(688 |

) |

|

418 |

|

|

|

(159 |

) |

|

410 |

|

| Income

tax recovery (expense) |

|

37 |

|

|

(69 |

) |

|

|

(215 |

) |

|

(42 |

) |

| Net income (loss) |

$ |

(651 |

) |

$ |

349 |

|

|

$ |

(374 |

) |

$ |

368 |

|

| |

|

|

|

|

|

| Net income (loss) per share -

basic and diluted |

$ |

(0.005 |

) |

$ |

0.003 |

|

|

$ |

(0.003 |

) |

$ |

0.003 |

|

| |

|

|

|

|

|

| EBITDAS (2) |

$ |

601 |

|

$ |

800 |

|

|

$ |

2,378 |

|

$ |

1,712 |

|

| EBIT (2) |

$ |

(620 |

) |

$ |

513 |

|

|

$ |

1,585 |

|

$ |

230 |

|

| |

|

|

|

|

|

| Total assets |

$ |

28,158 |

|

$ |

28,747 |

|

|

$ |

28,158 |

|

$ |

28,747 |

|

|

Shareholders Equity |

$ |

15,020 |

|

$ |

15,805 |

|

|

$ |

15,020 |

|

$ |

15,805 |

|

| |

|

|

|

|

|

1 As described in the Financial Statements and

MDA for the three and nine months ended September 30, 2021, the

2020 comparative figures presented have been restated, with a

reduction to both revenue and cost of sales of $2.7 million and

$5.5 million respectively. There was no effect on basic or diluted

net income (loss) per share and did not have any effect on the

Company’s condensed consolidated statement of financial position or

condensed consolidated statement of cash flows.2 Earnings (loss)

before interest, tax, depreciation, amortization, impairment

write-down and stock-based compensation (“EBITDAS”) and earnings

(loss) before interest and tax (“EBIT”) are not defined by IFRS.

The definition of EBITDAS does not consider gains and losses on the

disposal of assets, fair value changes in foreign currency forward

contracts and non-cash components of stock-based compensation.

While not an IFRS measure, EBITDAS is used by management,

creditors, analysts, investors and other financial stakeholders to

assess the Company’s performance and management from a financial

and operational perspective.

Third Quarter 2021 Overview and Recent

Developments

All amounts are in thousands ($000’s CAD)

- On July 14, 2021, the Company entered into a $4,875 term loan

and a $3,000 revolving operating line of credit (together the

“Credit Facility”). The term loan was used to repay the balance of

the non-interest bearing vendor take-back mortgage secured against

the Company’s Red Deer Facility and the balance of the Credit

Facility will be used for general working capital purposes.

- The $1.2 USD trillion infrastructure bill (the “Infrastructure

Bill”), previously ratified by US Congress and passed by US Senate,

was signed by the US President on November 15, 2021, is expected to

create a significant number of jobs in the US to improve broadband,

water suppliers and other public works and to increase the demand

for hydrovac trucks in US.

- The market environment continued to improve during the third

quarter. The Company’s North American Operations continued to be

affected by COVID-19 in Q3/2021, although to a lesser extent than

during the past year. All key operating financial metrics improved

compared to a year ago. Sales increased compared to Q2/21, however

the Company’s supply chain was impacted by a shortage of chassis

driven by chip issues and other components at the manufacturer

level.

- Revenue of $8,355 increased 12.8% compared to $7,404 in Q3/2020

as customer demand continued to recover.

- Gross Profit of $2,064 increased by $432 compared to $1,632 in

Q3/2020 due to increased revenue and production efficiencies,

including labour utilization, at the Company’s Red Deer Facility,

and recoveries from the Canada Emergency Wage Subsidy (the “wage

subsidy”). Gross Profit was also positively impacted by the

increased benefits from cost savings on parts sourced from China

during the quarter.

- General and administrative expense of $1,463 increased by $631

compared to $832 in Q3/2020. Included in Q3/21 were one-time

employee costs of $52. Other increases were due to general

increased employee costs in North America to handle present and

anticipated growth. The wage subsidy was less in Q3/21 compared to

Q3/20. Also in Q3/2020 the Company had temporarily laid off 40% of

its employees and senior management and head office employees had

taken significant salary reductions.

- EBITDAS of $601 decreased by $199 compared to $800 in Q3/2020,

due to the factors discussed above.

- In Q3/2021 the Company recorded an impairment write-down of

$764 related to certain non-core hydrovac equipment in North

America which was disposed of in November 2021.

- The Company incurred a net loss of $651 in Q3/2021, which

represents an income decrease of $1,000 compared to net income of

$349 in Q3/2020. This was due to the factors discussed above, plus

stock based compensation expense of $131.

Segmented information (in CAD $000’s)

| |

|

|

|

|

|

Three months ended September 30, 2021 |

North America |

China |

Corporate |

Total |

|

Revenue |

$ |

8,355 |

$ |

- |

|

$ |

- |

|

$ |

8,355 |

|

Cost of sales |

|

6,291 |

|

- |

|

|

- |

|

|

6,291 |

|

Selling and general administrative |

|

1,125 |

|

78 |

|

|

260 |

|

|

1,463 |

|

EBITDAS |

$ |

939 |

$ |

(78 |

) |

$ |

(260 |

) |

$ |

601 |

| |

|

|

|

|

| |

|

|

|

|

|

Three months ended September 30, 2020 |

North America |

China |

Corporate |

Total |

|

Revenue |

$ |

7,230 |

$ |

174 |

|

$ |

- |

|

$ |

7,404 |

|

Cost of sales |

|

5,598 |

|

174 |

|

|

- |

|

|

5,772 |

| Selling

and general administrative |

|

655 |

|

97 |

|

|

80 |

|

|

832 |

|

EBITDAS |

$ |

977 |

$ |

(97 |

) |

$ |

(80 |

) |

$ |

800 |

| |

|

|

|

|

| |

|

|

|

|

|

Nine months ended September 30, 2021 |

North America |

China |

Corporate |

Total |

|

Revenue |

$ |

23,404 |

$ |

- |

|

$ |

- |

|

$ |

23,404 |

|

Cost of sales |

|

17,253 |

|

- |

|

|

- |

|

|

17,253 |

|

Selling and general administrative |

|

2,840 |

|

208 |

|

|

724 |

|

|

3,773 |

|

EBITDAS |

$ |

3,311 |

$ |

(208 |

) |

$ |

(724 |

) |

$ |

2,378 |

| |

|

|

|

|

| |

|

|

|

|

|

Nine months ended September 30, 2020 |

North America |

China |

Corporate |

Total |

|

Revenue |

$ |

25,473 |

$ |

174 |

|

$ |

- |

|

$ |

25,647 |

|

Cost of sales |

|

20,879 |

|

174 |

|

|

- |

|

|

21,053 |

| Selling

and general administrative |

|

2,199 |

|

335 |

|

|

348 |

|

|

2,882 |

|

EBITDAS |

$ |

2,395 |

$ |

(335 |

) |

$ |

(348 |

) |

$ |

1,712 |

|

|

|

|

|

|

Outlook

The Company implemented two strategic actions

during the second quarter of 2021:

- In June 2021, the Company moved all

production into the Red Deer Facility, effectively tripling its

monthly production capacity.

- To capitalize on the expected

massive increase in infrastructure spending in North America and

the impact that this will have on construction in general and

hydrovac excavation in particular, the Company strengthened its

executive management team with the appointment of Brett Newton as

President and Chief Operating Officer.

The approval the Infrastructure Bill in the US

is expected to validate the steps made by Tornado to triple its

manufacturing capacity with the purchase of a state of the art,

57,000 square foot facility on 17 acres of land in Alberta, Canada

in 2020. The investment by Tornado in additional manufacturing

capacity is expected to assist Tornado in capitalizing on the

increasing demand for hydrovac trucks, parts and services by our

U.S. dealer and customers. The Company anticipates that the outlook

for hydrovac demand throughout North America will remain strong

over the next year.

The improving market environment experienced

during the third quarter is expected to continue through the

remainder of 2021 as customer confidence and spending levels

continue to recover.

With the possibility of an adverse impact

arising from the spread of COVID-19 variants in all relevant

jurisdictions to the Company’s supply chain and customer base and

the impact of the roll out of vaccinations in the US and Canada,

management recognizes that the situation continues to evolve. The

Company continues to evaluate its business operations with a focus

on health and safety of its employees, current company operations,

business continuity and managing liquidity.

To manage such adverse impacts of COVID-19, the

Company has access to its unused line of credit and may have access

to other forms of government support available to businesses

impacted by the pandemic. As the Company’s production and revenue

increase, the Company will add staff as needed. As a result of an

increase in production and a corresponding increase in revenue, the

Company expects that the Company’s access to government support

currently available will be reduced or eliminated. The previous

Canadian federal wage subsidy program ended on October 23, 2021 and

although a replacement program may be introduced, details have not

yet been announced.

Limiting factors on the Company’s ability to

meet increased demand include the possibility of chassis supply

chain interruption due to chip shortages at the chassis

manufacturer level and other supply chain issues related to other

key components.

Overall, management believes the underlying

fundamentals of the Company’s business remain strong and expects

its production and sales of hydrovac trucks in North America to

recover and return to, and eventually exceed, the record pre-COVID

levels achieved in 2019 over the long term for the following

reasons:

- Expanded capacity and manufacturing

and production efficiencies from the Red Deer Facility, which is

fully operational.

- A strengthened senior executive

management team.

- Expected increased spending on

infrastructure in North America, particularly in the US as a result

of the Infrastructure Bill.

- The Company’s commitment to

continuous improvement of its hydrovac truck design which in the

Company’s view has compelling advantages over hydrovac trucks

currently offered in the market.

- The continued expansion of parts

and services business in the Red Deer Facility.

About Tornado Global Hydrovacs

Ltd.

The Company designs and manufactures hydrovac

trucks as well as provides heavy duty truck maintenance operations

in central Alberta. It sells hydrovac trucks to excavation service

providers in the infrastructure and industrial construction and oil

and gas markets. Hydrovac trucks use high pressure water and vacuum

to safely penetrate and cut soil to expose critical infrastructure

for repair and installation without damage. Hydrovac excavation

methods are quickly becoming a standard in the North America to

safely excavate in urban areas and around critical infrastructure

greatly reducing infrastructure damage and related fatalities. In

China, the Company’s subsidiary is used principally to source

certain parts to the Company’s North America operations.

For more information about Tornado Global

Hydrovacs Ltd., visit www.tornadotrucks.com or contact:

|

Bill Rollins |

Brett Newton |

|

Chief Executive Officer |

President & Chief Operating Officer |

|

Phone: (403) 204-6333 |

Phone: (416) 522-6390 |

|

Email: brollins@tghl.ca |

Email: bnewton@tghl.ca |

Advisory

Certain statements contained in this news

release constitute forward-looking statements. These statements

relate to future events. All statements other than statements of

historical fact are forward-looking statements. The use of the

words “anticipates”, “should”, ‘‘may”, “expected”, “expects”,

“believes” and other words of a similar nature are intended to

identify forward-looking statements. These statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements. Although Tornado

believes these statements to be reasonable, no assurance can be

given that these expectations will prove to be correct and such

forward-looking statements included in this news release should not

be unduly relied upon. Such statements include those with respect

to: (i) the expectation that the Infrastructure Bill will lead to

an increase in infrastructure spending and result in job creations

and increased demand for hydrovac trucks; (ii) the Company’s

outlook for the 2021 fiscal year; (iii) the expectation that the

improving market environment is expected to continue through the

remainder of 2021; (iv) the anticipation that the outlook for

hydrovac demand throughout North America will remain bullish for

years to come; (v) the expectation that the Company’s access to

government support currently available will be reduced or

eliminated as the Company’s production and revenue increases; (vi)

the Company’s ability to meet increased demand may be limited by

factors including chassis supply chain interruption due to chip

shortages at the chassis manufacturer level and other supply chain

issues related to other key components; (vii) management’s belief

that the underlying fundamentals of the Company’s business will

remain strong over the long term; (viii) the expectation that long

term production and sales of hydrovac in North America will recover

and eventually exceed the record pre-COVID levels achieved in 2019;

(ix) the expectation that spending on infrastructure in North

America will increase; (x) management’s belief that the Company’s

commitment to continuous improvement of its hydrovac truck design

will continue to provide compelling advantages over hydrovac trucks

currently offered in the market; (xi) the anticipated manufacturing

and production efficiencies from the Red Deer Facility; and (xii)

management’s anticipation of continued expansion of parts and

services business in the Red Deer Facility. These statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements. Actual

results could differ materially from those anticipated in these

forward-looking statements as a result of prevailing economic

conditions, and other factors, many of which are beyond the control

of Tornado. Although Tornado believes these statements to be

reasonable, no assurance can be given that these expectations will

prove to be correct and such forward-looking statements included in

this news release should not be unduly relied upon. The

forward-looking statements contained in this news release represent

Tornado’s expectations as of the date hereof and are subject to

change after such date. Tornado disclaims any intention or

obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise,

except as may be required by applicable securities regulations.

Neither the Exchange nor its Regulation

Service Provider (as that term is defined in policies of the

Exchange) accepts responsibility for the adequacy or accuracy of

this news release.

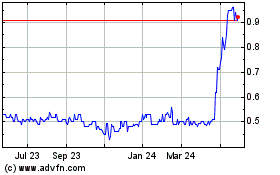

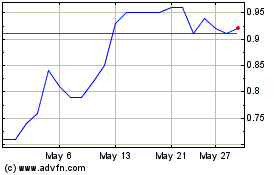

Tornado Infrastructure E... (TSXV:TGH)

Historical Stock Chart

From Dec 2024 to Dec 2024

Tornado Infrastructure E... (TSXV:TGH)

Historical Stock Chart

From Dec 2023 to Dec 2024