Ventripoint Announces Closing of First Tranche of Private Placement and Shares for Debt

23 June 2014 - 9:00PM

Marketwired Canada

NOT TO BE RELEASED IN THE UNITED STATES OF AMERICA

Ventripoint Diagnostics Ltd. ("Ventripoint" or the "Corporation") (TSX

VENTURE:VPT) is pleased to announce that it has completed the first tranche of

its previously announced private placement ("Private Placement") of 24,951,426

Units ("Units") for gross proceeds of $1,996,114. Each Unit is comprised of one

common share ("Common Share") and one half of one Common Share purchase warrant

("Warrant"). Each full Warrant is exercisable into one additional Common Share

at an exercise price of $0.12 until June 20, 2016. The Private Placement was

approximately 33% non-brokered and 67% brokered, with D&D Securities Inc.

("D&D") acting as the agent of the Corporation in the brokered portion of the

Private Placement.

The Corporation will use the proceeds of the Private Placement for sales and

marketing and general working capital purposes.

Three of the subscribers in the Private Placement accepted Units as payment in

full of outstanding secured debentures previously issued by the Corporation as a

shares-for-debt transaction (the "Shares for Debt"). As a result of the Shares

for Debt, the Corporation's net debt has been reduced by $773,626.

The Corporation has paid D&D a cash commission of $63,808, plus 841,600 warrants

(the "Agent's Warrants") each exercisable to purchase one Unit of the

Corporation. The Agent's Warrants will expire 18 months from the closing date of

the Private Placement.

The Common Shares, Warrants and Agent's Warrants acquired by the subscribers are

subject to a hold period of four months plus one day and may not be traded until

October 21, 2014 except as permitted by applicable securities legislation and

the rules of the TSX Venture Exchange. The Private Placement is subject to

receipt of final acceptance from the TSX Venture Exchange.

Forward Looking Statement:

This news release contains forward-looking statements and forward-looking

information within the meaning of applicable securities laws. The use of any of

the words "expect", "anticipate", "continue", "estimate", "objective",

"ongoing", "may", "will", "project", "should", "believe", "plans", "intends" and

similar expressions are intended to identify forward-looking information or

statements. In particular, this news release contains forward-looking

information relating to the Offering and the use of the proceeds therefrom. The

forward-looking statements and information are based on certain key expectations

and assumptions made by the Corporation, including expectations and assumptions

concerning the completion of the Offering and the use of net proceeds of the

Offering. Although the Corporation believes that the expectations and

assumptions on which such forward-looking statements and information are based

are reasonable, undue reliance should not be placed on the forward looking

statements and information because the Corporation can give no assurance that

they will prove to be correct.

Since forward-looking statements and information address future events and

conditions, by their very nature they involve inherent risks and uncertainties.

Actual results could differ materially from those currently anticipated due to a

number of factors and risks. Such factors may include the failure to

successfully market the Units and failure to satisfy certain conditions in

connection with the issuance of the Units. Other factors which could materially

affect such forward-looking information are described in the risk factors in the

Corporation's most recent annual management's discussion and analysis that is

available on the Corporation's profile on SEDAR at www.sedar.com. Readers are

cautioned that the foregoing list of factors is not exhaustive. The

forward-looking statements included in this news release are expressly qualified

by this cautionary statement. The forward-looking statements and information

contained in this news release are made as of the date hereof and the

Corporation undertakes no obligation to update publicly or revise any

forward-looking statements or information, whether as a result of new

information, future events or otherwise, unless so required by applicable

securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

George Adams, President and CEO

T: (206) 910-9125

E: gadams@ventripoint.com

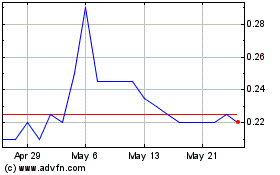

Ventripoint Diagnostics (TSXV:VPT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ventripoint Diagnostics (TSXV:VPT)

Historical Stock Chart

From Nov 2023 to Nov 2024