Current Report Filing (8-k)

22 May 2019 - 8:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of

1934

Date of

Report (Date of earliest event reported):

May 21, 2019

|

AfterMaster, Inc.

|

|

(Exact

name of registrant as specified in its charter)

|

|

Delaware

|

|

001-10196

|

|

23-2517953

|

|

(State

or other jurisdictionof incorporation)

|

|

(Commission

FileNumber)

|

|

(IRS

Employer IdentificationNumber)

|

|

6671 Sunset Blvd., Suite 1520

Hollywood, California

|

|

90028

|

|

(Address

of principal executive offices)

|

|

(zip

code)

|

(310) 657-4886

(Registrant’s

telephone number, including area code)

(former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2.

below):

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this

chapter).

Emerging growth

company ☐

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

☐

Item

7.01 Regulation FD Disclosure.

On May

16, 20 and 21, 2019, Aftermaster Inc. (the “Company") entered

into forbearance agreements with all of the Company’s

convertible note holders who hold ratcheting convertible note debt,

that is currently eligible for conversion into common shares. The

forbearance agreements specifically include restrictions on (i)

debt conversions, (ii) the sale of Company common stock, and (iii)

the exercise of remedies under the convertible notes, for 120 days.

In exchange for the forbearance agreements, the Company will make

payments for the forbearance and principal and interest payments in

an aggregate amount of approximately 3% of the notes per month. The

120-day forbearance term can be extended for an additional 120 days

upon the Company’s payment of an additional 20% of the

outstanding note balances. The conversion of the Company’s

ratcheting convertible debt (colloquially known as toxic

convertible debt) into shares has resulted in substantial

shareholder dilution and adversely affected the Company’s

share price, which has reduced the Company’s ability to raise

capital on terms the Company views as attractive. The Company

believes that the forbearance agreements will provide much-needed

breathing room for the Company to execute on its operational

objectives and allow the Company’s share price to better

reflect its potential value, which is expected to assist in the

retirement of some or all of the notes.

The

information contained in this Item 7.01 is being furnished and

shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the

liabilities under Section 18 and shall not be deemed to be

incorporated by reference into the filings of the Company under the

Securities Act of 1933, as amended, or the Exchange

Act.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Dated:

May 21, 2019

|

AFTERMASTER, INC.

|

|

|

By:

|

|

/s/

Larry Ryckman

|

|

|

|

|

Name:

Larry Ryckman

|

|

|

|

|

Title:

President and Chief Executive Officer

|

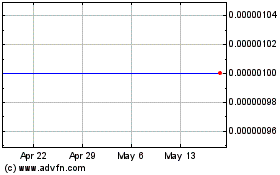

AfterMaster (CE) (USOTC:AFTM)

Historical Stock Chart

From Feb 2025 to Mar 2025

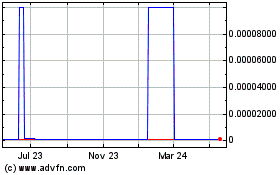

AfterMaster (CE) (USOTC:AFTM)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about AfterMaster Inc (CE) (OTCMarkets): 0 recent articles

More Aftermaster, Inc. News Articles