Amen Properties Reports Results for First Quarter of 2014 and Announces Quarterly Dividend

12 June 2014 - 4:15AM

Business Wire

Amen Properties, Inc. (Pink Sheets: AMEN) today announced

financial results for its fiscal quarter ended March 31, 2014. The

Company posted quarterly revenue of $734 thousand and a net profit

of $545 thousand, or $10.61 per diluted share. These results

compare to revenue of $680 thousand and net income of $494

thousand, or $9.61 per diluted share, for the same quarter last

year. The increase in profitability from last year was caused

primarily by changes in commodity prices for oil and gas.

Amen also announced that the Company’s Board of Directors has

approved the payment of a quarterly dividend of $15 per share to

the Company’s common shareholders. The dividend will be paid on

June 30, 2014 to shareholders of record as of June 23, 2014.

Finally, Amen reiterated that its Board has approved a plan

whereby the Company will no longer hedge the revenue stream

associated with its oil and gas royalties. “Shareholders of Amen

need to understand that they hold an un-hedged long oil and gas

position and should pursue their own hedging strategy if they are

uncomfortable with that risk,” said Kris Oliver, Amen’s Chief

Executive Officer.

The Company’s 2014 first quarter report is available for viewing

or download from the company’s web site –

www.amenproperties.com.

About Amen Properties:

Amen Properties owns a diverse portfolio of cash-producing

properties including real estate and oil and gas interests.

Cautionary Statement:

This document contains forward-looking statements, which involve

a number of risks and uncertainties that could cause our actual

results to differ materially from those reflected in the

forward-looking statements. Forward-looking statements can be

identified by use of the words "expect," "project," "may," "might,"

potential," and similar terms. AMEN Properties, Inc. ("Amen", "we"

or the "Company") cautions readers that any forward-looking

information is not a guarantee of future performance and that

actual results could differ materially from those contained in the

forward-looking information. Forward-looking statements involve a

number of risks, uncertainties or other factors beyond Amen's

control. These factors include, but are not limited to, our ability

to implement our strategic initiatives, economic, political and

market conditions and price fluctuations, government and industry

regulation, U.S. and global competition and other factors. We

undertake no obligation to update any forward-looking statement,

whether as a result of new information, future events or

otherwise.

Amen Properties, Inc.Kris Oliver, 972-999-0494

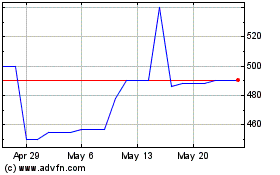

AMEN Properties (PK) (USOTC:AMEN)

Historical Stock Chart

From Jan 2025 to Feb 2025

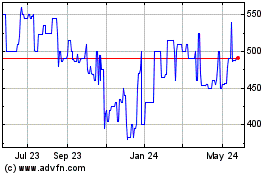

AMEN Properties (PK) (USOTC:AMEN)

Historical Stock Chart

From Feb 2024 to Feb 2025