UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): March 8, 2015

A1 Group, Inc.

(Exact name of registrant

as specified in its charter)

| Nevada |

000-54009 |

20-5982715 |

(State or other

jurisdiction of incorporation) |

(Commission File

Number) |

(IRS employer

Identification Number) |

| 7040 Avenida Encinas, Suite 104-159, Carlsbad, CA |

92011 |

| (Address of principal executive offices) |

(Zip Code) |

| |

|

|

|

| |

Registrant’s telephone number, including area code: |

(760) 487-7772 |

|

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o |

Written communications pursuant to Rule 425 under the Securities Act |

| |

|

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| |

|

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

|

| o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Item

1.01 Entry into a Material Definitive Agreement.

On or about March 8, 2015 the Company entered

into an Letter of Intent with A1A Sod to purchase the business known as A1A Sod, Sand and Soil. The Company will acquire all of

the assets, tangible and intangible, owned by Seller that are used in, or necessary for the administration and operation of its

current Construction, Wholesale, Retail and Growing business, including, but not limited to: (i) cash, inventory, accounts receivable,

fixed assets, software, customer lists, prepaids, and security deposits. (ii) certain liabilities will be assumed as of the date

of Closing. The purchase price is $1,500,000. In addition the Company will would enter into an employment agreement with A1A Sod

current employees during the Transition, which shall not go beyond 6 months, under terms and conditions that would be negotiated

and agreed upon by both parties, including provisions regarding term of contract, base and incentive compensation and benefits

package. All of the terms and conditions of the transaction would be stated in the Asset Purchase Agreement, to be negotiated,

agreed and executed by the Buyer and Seller by or before June 1, 2015, and complete the transaction as soon as possible thereafter.

Item

9.01 Financial Statements and Exhibits

(d) Exhibits

| Exhibit No. |

Description |

| |

|

| 99.1 |

Letter of Intent |

| |

|

SIGNATURES

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the Registrant has duly cause this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

A1 Group, Inc. |

| |

|

| |

By: |

/s/ Bruce Storrs |

| |

|

Bruce Storrs

President, CEO |

Dated

April 15, 2015

EXHIBIT INDEX

| Exhibit No. |

Description |

| |

|

| 99.1 |

Letter of Intent |

| |

|

Exhibit 99.1

A1

Group, Inc.

7040 Avenida Encinas,

Suite 104-159, Carlsbad, CA 92011

LETTER OF INTENT

For Purchase of

Business and Assets

A1 Group, Inc (“Buyer”)

hereby express their intention to enter into an agreement in the future pursuant to which Buyer intends to purchase from A1A Sod

(“Seller”) the business known as A1A Sod, Sand and Soil (“the Business”), located at: 28400

S Dixie Hwy, Homestead, FL 33033 upon the following terms and conditions:

Terms

and Conditions

| · | Purchase

price in the total sum of $1.500.000.00 (“the Purchase Price”) shall be payable

as follows |

| · | At

Closing, A1 Group, Inc. will pay to A1A Sod shareholders: $1.5 million via Cash-Wire

transfer. |

| · | Buyer

would enter into an employment agreement with A1A Sod current employees during the Transition,

which shall not go beyond 6 months, under terms and conditions that would be negotiated

and agreed upon by both parties, including provisions regarding term of contract, base

and incentive compensation and benefits package. |

| · | Business

to be Acquired; Liabilities to be Assumed. Buyer would acquire all of the assets,

tangible and intangible, owned by Seller that are used in, or necessary for the administration

and operation of its current Construction, Wholesale, Retail and Growing business, including,

but not limited to: (i) cash, inventory, accounts receivable, fixed assets, software,

customer lists, prepaids, and security deposits. (ii) certain liabilities will be assumed

as of the date of Closing. |

| · | Definitive

Asset Purchase Agreement. All of the terms and conditions of the transaction would

be stated in the Asset Purchase Agreement, to be negotiated, agreed and executed by the

Buyer and Seller by or before June 1, 2015, and complete the transaction as soon as possible

thereafter. |

Expiration

1. This offer shall expire unless a

copy hereof the Seller’s written acceptance is delivered to Purchaser or to his Agent on or before April 10th, 2015

at 6pm. Seller warrants the accuracy of the information by dating and signing this document.

Closing

2. At time of closing both parties shall

deposit with an authorized escrow holder, selected by mutually agreement of parties involved, all funds and instruments necessary

to complete the sale in accordance with the terms hereof including the purchase price for the benefit of the seller, a valid bill

of sale of said business together with any lease assignment thereof of the premises on which the business is located.

Due Diligence

Period To Be Included in Purchase Contract

3. Seller’s and Seller’s

representatives’ at sellers expense and within 15 days of effective date (“Due Diligence Period” ) will

provide for review all of Seller’s books and records regarding the Business including, without limitation, financial records;

bank records; tax returns; production records; vendor records; customer records; employee records; material legal documents and

contracts; records of pending or past litigation, administrative actions or notices of any kind from any governmental agency involving

or affecting the Business.

4. It is understood “Buyer”

is currently a reporting Public Company, and that a condition of closing is the audibility of the selling Company, which audit

for the previous 2 years will have to be delivered during the “Due Diligence Period. To include financial records; bank

records; tax returns; production records; vendor records; customer records; employee records; material legal documents and contracts;

inspection and approval of the physical condition of Seller’s fixtures, equipment and inventory used in the Business. Records

of pending or past litigation, administrative actions or notices of any kind from any governmental agency involving or affecting

the Business

5. Buyer’s and Buyer’s representatives’

physical inspection and approval of any real property and improvements thereon owned or occupied by the Business including the

environmental condition thereof and any existing environmental or other reports concerning the condition of same• Buyer’s

and Buyer’s representatives’ review of Seller’s lease for the premises occupied by the Business, if any, and

obtaining of Seller’s lessor’s approval of the transfer thereof, if required,

5.1 • Approval by appropriate

governing agencies of the transfer of any licenses, permits or interests in property required to operate the Business

Applicable

Conditions

6 • Preparation of agreement to

final documents of sale and approval thereof by the agreed upon closing attorney and other representatives, agents and auditors

including, without limitation, documentation of any covenant not to compete, consulting agreement or other covenant or condition

related to the sale of the Business.

7 • Closing costs: Any tax on the

transfer, attorney fees, shall be paid by Seller and Buyer 50/50, at the time of Closing.

8 • Proration’s: rents, personal

property tax, employee salaries, security deposits shall be reconciled at closing.

The undersigned SELLER hereby

acknowledges receipt of the accepted agreement

Seller: A1A Sod, Sand and Soil. INC

Seller’s Address: 28400 S Dixie

Hwy, Homestead, FL 33033

| By: Andy

Diaz |

Date: March

8th, 2015 |

Andy Diaz, President

|

|

The undersigned PURCHASER

hereby acknowledges receipt of the accepted agreement.

Purchaser: A1 Group, Inc.

Purchaser’s Address: 7040 Avenida

Encinas, Suite 104-159.

Carlsbad, CA 92011

| By: /s/

Bruce Storrs |

Date: March

8th, 2015 |

| Bruce Storrs,

Chief Executive Officer |

|

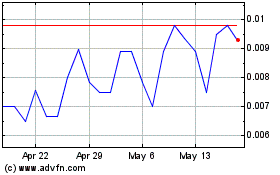

A 1 (PK) (USOTC:AWON)

Historical Stock Chart

From Oct 2024 to Dec 2024

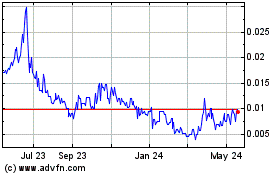

A 1 (PK) (USOTC:AWON)

Historical Stock Chart

From Dec 2023 to Dec 2024