Securities Registration: Employee Benefit Plan (s-8)

30 May 2019 - 5:55AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Date of Report (Date of earliest event reported):

May 28, 2019

|

BARREL ENERGY, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

47-1963189

|

|

(State of Incorporation)

|

|

(I.R.S. Employer ID No.)

|

|

8275 S. Eastern Ave., Ste 200, Las Vegas, NV

|

|

89123

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

1-702-595-2247

Registrant’s telephone number, including area code

Calculation of Registration Fee

|

Title of Securities to be Registered

|

|

Amount to be Registered

|

|

|

Proposed Maximum Offering Price Per Share (1)

|

|

|

Proposed Aggregate Offering Price

|

|

|

Amount of Registration Fee

|

|

|

Common Stock

|

|

|

10,000,000

|

|

|

$

|

0.28

|

|

|

$

|

2,800,000

|

|

|

$

|

339.36

|

|

_______________

(1) The Offering Price is used solely for purposes of estimating the registration fee pursuant to Rules 457(c) and 457(h) promulgated pursuant to the Securities Act of 1933. The Offering Price is estimated as the trading price on April 25, 2019, which was $0.28.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information.

The Company is offering shares of its common stock to various employees and consultants for services performed on the Company's behalf. This issuance of shares is being made pursuant to the Company's Stock Plan adopted by the Board of Directors on April 26, 2019. The Board has equated this number of shares to the value of the services provided or to be provided by these individuals. The shares issued hereunder to eligible participants who are not affiliates of the Company as defined in Rule 405 of the Securities Act will not be subject to any resale restrictions. The Plan is not qualified under ERISA.

The services for which these shares are being issued are not in connection with any offer or sale of securities in a capital-raising transaction and does not directly or indirectly promote or maintain a market for the securities of the Company.

Item 2. Registrant Information and Employee Plan Annual Information.

The participants shall be provided a written statement notifying them that upon written or oral request they will be provided, without charge, (i) the documents incorporated by reference in Item 3 of Part II of the registration statement, and (ii) other documents required to be delivered pursuant to Rule 428(b). The statement will inform the participants that these documents are incorporated by reference in the Section 10(a) prospectus, and shall include the address (giving title or department) and telephone number to which the request is to be directed.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

Incorporated by reference into this Registration Statement are the contents of the Company's Registration Statement on Form S-8, and the Company's Annual Report on Form 10-K for the year ended September 30, 2018, the Company's Quarterly Reports on Form 10-Q for the periods ended March 31, 2018, June 30, 2018 and December 31, 2018. All documents filed by the Company with the Commission pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, after the date of this Registration Statement and prior to the termination of the offering shall be deemed to be incorporated by reference into this Registration Statement and to be a part hereof from the date of filing of such Registration Statement and to be a part hereof from the date of filing of such documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement. The Company will provide without charge to each person to whom a copy of this Registration Statement is delivered, on the written or oral request of such person, a copy of any or all of the documents referred to above which have been or may be incorporated by reference into this Registration Statement, other than certain exhibits to such documents. Requests for such copies shall be directed to the Secretary, Barrel Energy, Inc., 8275 S. Eastern Ave., Ste 200, Las Vegas, NV 89123; Telephone (702) 595-2247.

Item 4. Description of Securities.

Not Applicable.

Item 5. Interest of Named Experts and Counsel.

The legality of the shares of Common Stock offered hereby has been passed upon for the Company by Frederick C. Bauman, Esq. Mr. Bauman does not own any of the Company’s securities.

Item 6. Indemnification of Directors and Officers.

The Company and its affiliates may not be liable to its shareholders for errors in judgment or other acts or omissions not amounting to intentional misconduct, fraud, or a knowing violation of the law, since provisions have been made in the Articles of Incorporation and By-laws limiting such liability. The Articles of Incorporation and By-laws also provide for indemnification of the officers and directors of the Company in most cases for any liability suffered by them or arising from their activities as officers and directors of the Company if they were not engaged in intentional misconduct, fraud, or a knowing violation of the law. Therefore, purchasers of these securities may have a more limited right of action than they would have except for this limitation in the Articles of Incorporation and By-laws.

The officers and directors of the Company are accountable to the Company as fiduciaries, which means such officers and directors are required to exercise good faith and integrity in handling the Company's affairs. A shareholder may be able to institute legal action on behalf of himself and all others similarly stated shareholders to recover damages where the Company has failed or refused to observe the law.

Shareholders may, subject to applicable rules of civil procedure, be able to bring a class action or derivative suit to enforce their rights, including rights under certain federal and state securities laws and regulations. Shareholders who have suffered losses in connection with the purchase or sale of their interest in the Company in connection with such sale or purchase, including the misapplication by any such officer or director of the proceeds from the sale of these securities, may be able to recover such losses from the Company.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

___________

* Filed herewith.

Item 9. Undertakings.

The registrant makes the following undertakings.

|

a)

|

1)

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

|

|

i)

|

to include any prospectus required by Section 10(a)(3) of the Securities Act;

|

|

|

|

|

|

|

ii)

|

to reflect any facts or events which, individually or together, represent a fundamental change in the information in the registration statement;

|

|

|

|

|

|

|

iii)

|

to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

|

|

2)

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such post- effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

|

|

|

|

3)

|

To remove from registration by means of a post- effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

b)

|

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant's annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan's annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

|

|

c)

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed in the Act and is therefore, unenforceable. In the event that indemnification is permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of the expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities of such corporation it is the opinion of the SEC that any such indemnification is against public policy.

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, on May 28, 2019

|

|

BARREL ENERGY, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Craig S. Alford

|

|

|

|

|

Craig S. Alford

|

|

|

|

|

Principal Executive Officer

|

|

In accordance with the requirements of the Securities Act of 1933, this registration statement was signed by the following persons in the capacities and on the dates stated:

|

Name

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Craig S. Alford

|

|

Principal Executive Officer and a Director

|

|

May 28, 2019

|

|

|

|

|

|

|

|

/s/ Harpreet Sangha

|

|

Principal Financial Officer, Principal Accounting Officer and a Director

|

|

May 28, 2019

|

PART III

Index to Exhibits

____________

* Filed herewith.

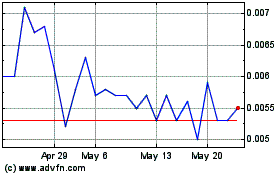

Barrel Energy (PK) (USOTC:BRLL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Barrel Energy (PK) (USOTC:BRLL)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Barrel Energy Inc (PK) (OTCMarkets): 0 recent articles

More Barrel Energy Inc. News Articles