Cairn Energy, Cheiron Buy Shell's Western Desert Assets in Egypt for $646 Million

09 March 2021 - 6:59PM

Dow Jones News

By Jaime Llinares Taboada

Cairn Energy PLC on Tuesday said its consortium with Cheiron

Petroleum Co. has acquired Shell's Western Desert assets in Egypt

for $646 million.

The FTSE 250 energy said Western Desert will expand and

diversify its producing asset base, as the deal is expected to add

33,000-39,000 barrels of oil equivalent a day in 2021--of which 66%

is gas. Cairn will acquire 50% of the assets and pay 50% of the

price.

In addition, the company said it has agreed on the sale of its

interest in the U.K. Catcher and Kraken fields for $460 million

plus contingencies to Waldorf Production Ltd.

Cairn said it hasn't yet received a $1.2 billion damages award

from India's government. The company said it is taking all

necessary steps to ensure access to the award.

The company reported a net loss of $394 million for 2020,

swinging from a $94 million net profit a year earlier. Lower

production and energy prices hurt its performance during the year,

it said.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

March 09, 2021 02:44 ET (07:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

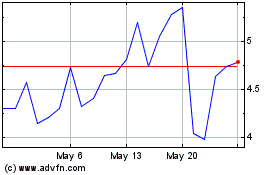

Capricorn Energy (PK) (USOTC:CRNCY)

Historical Stock Chart

From May 2024 to Jun 2024

Capricorn Energy (PK) (USOTC:CRNCY)

Historical Stock Chart

From Jun 2023 to Jun 2024

Real-Time news about Capricorn Energy PLC (PK) (OTCMarkets): 0 recent articles

More Cairn Energy PLC (PK) News Articles