DEFIANCE EXTENDS HIGH-GRADE ZONES WITH DRILLING

AT VETA GRANDE

Vancouver,

British Columbia -- October 25, 2022 -- InvestorsHub NewsWire --

Defiance Silver Corp.

("Defiance"

or the "Company")

(TSXV:DEF OTCQX: DNCVF) (FSE: D4E)

is pleased to provide an update on the

Zacatecas district drill program, including high grade Ag-Zn-Pb-Au

mineralization in the heart of the Veta Grande vein system at the

Zacatecas silver project, further extending the limits of

mineralization below the 2014 resource area.

Highlight of Results

-

DDSA-22-52

– Intersected high-grade silver, base

metals, and gold over 0.9m (from 400.72m to 401.62m ) of

4.18 g/t Au, 868 g/t

Ag, 4.61% Pb and 17.05% Zn or 2172 g/t

AgEq, within a larger interval

of 3.38 metres of 1.96

g/t Au, 344.91 g/t Ag, 2.12% Pb and 8.01% Zn or 956 g/t

AgEq (from 400.22m to 403.60m),

representing one of the highest-grade intervals drilled to date in

the main San Acacio project area (see Fig. 2 and 3). The hole was

drilled approximately 50 metres below the reported high-grade

intervals of DDSA-21-37, which returned

3.0m

(from 270.45m to 273.45m) of

689.7 g/t

Ag and demonstrates the continuity

of this mineralized body at depth below the resource area (see Fig.

3).

-

DDSA-22-53

– Was drilled to test approximately

50m below hole DDSA-21-40 (4.55m @ 241g/t Ag from 314.4m to

318.95m). DDSA-22-53 deviated significantly from

the targeted pierce point towards the western limit of the

mineralized shoot. but still intercepted

2.0m of 0.51 g/t Au,

121 g/t Ag, 1.36% Pb and 4.85% Zn or 434 g/t

AgEq (from 301.17 to 303.17m).

Continued exploration in this zone

further demonstrates the expanding resource potential of important

structural intersections and their respective roles in resource

development (see Fig. 2).

Chris Wright, Chairman & CEO,

commented: "We continue to be encouraged by the expanding envelope

of mineralization well outside the limits of the current resource

area. The mineralized body encountered by high-grade drill holes

DDSA-21-36 & 37 and then further at depth with hole DDSA-22-52

clearly demonstrates the strength of the mineral system and the

exploration potential at depth outside of the current resource

area. We will continue to test these structures in order to

understand the limits of the mineral system for future resource

planning."

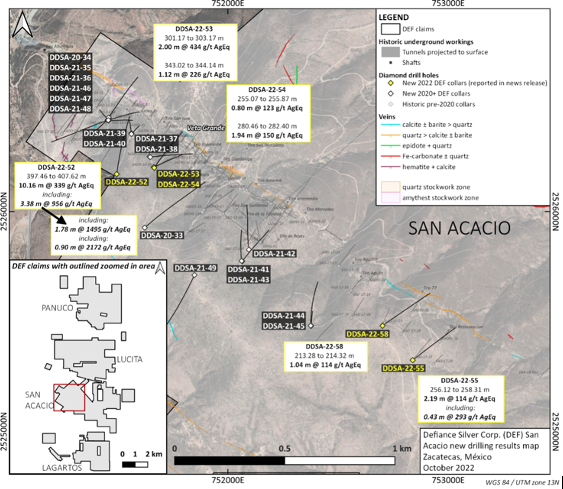

Overview Map of Drill Locations

Figure 1

– Plan map of

Defiance's San Acacio project area, including location of current

and past drill holes.

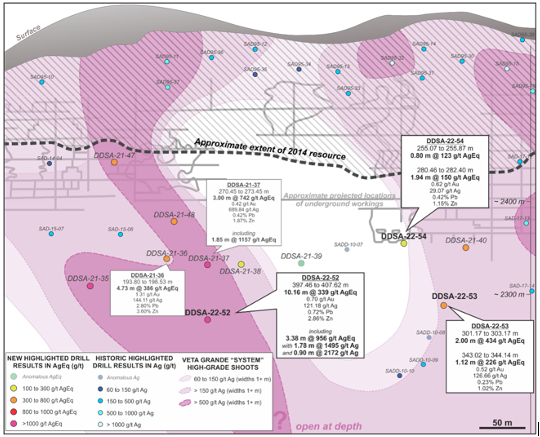

Long Section of Drilling

Figure 2 –

Schematic long section showing Veta Grande system drill results and

mineralized shoots, as well as approximate limits of 2014 resource

estimate and historic underground workings.

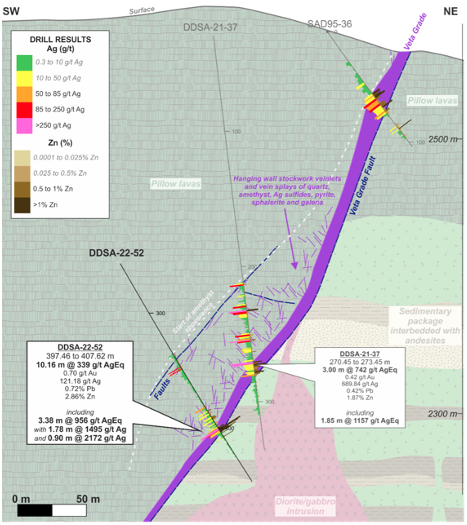

Cross Section

Figure 3

– Cross Section of

drill hole DDSA-22-52, showing Ag g/t (left) and Zn % (right) on

drill-string trace and outline of main Veta Grande vein.

Discussion of Results

Hole DDSA-22-52 was designed to test

approximately 50m below hole DDSA-21-37 and has demonstrated that

the recently-discovered mineralized zone extends deeper (see Fig.

3). This mineralized shoot remains open at depth and also contains

the recently-reported intercepts, including: 1.57m @ 2.27g/t Au,

1090 g/t Ag from 248.7m in DDSA-21-35 and 3m @ 0.42g/t Au and 689

g/t Ag from 270.45m in DDSA-21-37 (See

News Release dated April

28th, 2021).

Holes DDSA-22-53 and DDSA-22-54 were

designed to test another mineralized shoot east of

DDSA-22-52. DDSA-22-53 was drilled to test

approximately 50m below hole DDSA-21-40 (4.55m @ 241g/t Ag from

314.4m, (See

News Release dated August

4th, 2021).

DDSA-22-53 deviated significantly from

the targeted pierce point towards the western limit of the

mineralized shoot but still intercepted the mineralized zone (see

Fig. 2). DDSA-22-54 was designed to test at the

same level and approximately 70m west of DDSA-21-40.

Hole DDSA-22-54 intercepted some grade

but appears to be very close to the western limit of the

mineralized zone (see Fig. 2).

Holes DDSA-22-55 & DDSA-22-58 were

designed to gain further structural information east of the Veta

Grande resource area as well as to confirm historic results drilled

by Silver Standard in 1995. Structural complexity in this area has

led to a poor understanding of the mineralization in this zone. The

company is encouraged that drilling returned appreciable Ag grades

and is in the process of further modelling this zone in

anticipation of future drilling.

Holes DDSA-22-56 & DDSA-22-57 are

pending analytical laboratory checks and will be released when data

is finalized.

The highest-grade silver

mineralization at the San Acacio project is typically associated

with honey-coloured sphalerite, argentiferous galena, variable

silver sulfides and sulfosalts, and spatially correlated with

amethyst. The highest-grade gold mineralization

is typically associated with pyrite, brown to red-coloured

sphalerite, and occasionally with hematite. The hanging wall

mineralization tends to express as a more conventional vein to

veinlet array morphology while the Veta Grande often occurs as a

large breccia-vein with typical intermediate to low-sulfidation

epithermal textures and gangue minerals.

San Acacio hosts a current inferred

mineral resource estimate containing 16.97M oz silver (17.76M oz

AgEq) grading 181.94 g/t silver (192.5 g/t AgEq) with a 100 g/t

AgEq cut off (see the Technical report titled: Technical Report and

Resource Estimate, San Acacio Silver Deposit, Zacatecas State,

Mexico by Giroux and Cuttle dated September 26, 2014, which is

available on Sedar and the company's website

here).

Table of Results

|

Hole

|

From

|

To

|

Interval

(m)

|

Au g/t

|

Ag g/t

|

Pb %

|

Zn %

|

AgEq g/t

|

|

DDSA-22-52

|

397.46

|

407.62

|

10.16

|

0.70

|

121.18

|

0.72

|

2.86

|

339

|

|

Including

|

400.22

|

403.60

|

3.38

|

1.96

|

344.91

|

2.12

|

8.01

|

956

|

|

Including

|

400.22

|

402.00

|

1.78

|

2.79

|

616.02

|

3.35

|

11.38

|

1495

|

|

Including

|

400.72

|

401.62

|

0.90

|

4.18

|

868.00

|

4.61

|

17.05

|

2172

|

|

DDSA-22-53

|

301.17

|

303.17

|

2.00

|

0.51

|

121.00

|

1.36

|

4.85

|

434

|

|

DDSA-22-53

|

343.02

|

344.14

|

1.12

|

0.52

|

126.66

|

0.23

|

1.02

|

226

|

|

DDSA-22-54

|

255.07

|

255.87

|

0.80

|

0.11

|

100.37

|

0.04

|

0.24

|

123

|

|

DDSA-22-54

|

280.46

|

282.40

|

1.94

|

0.62

|

29.07

|

0.42

|

1.15

|

150

|

|

DDSA-22-55

|

256.12

|

258.31

|

2.19

|

0.29

|

78.72

|

0.06

|

0.17

|

114

|

|

Including

|

257.88

|

258.31

|

0.43

|

0.70

|

204.00

|

0.17

|

0.50

|

293

|

|

DDSA-22-58

|

213.28

|

214.32

|

1.04

|

0.07

|

96.14

|

0.02

|

0.25

|

114

|

Table 1 – Silver

equivalent is calculated using the following formula:

Silver-Equivalent (AgEq) = [(Au_ppm x 53.05)+(Ag_ppm x

0.61)+(Pb_ppm x .0018)+(Zn_ppm x 0.0028)]/ 0.61. Metal price

assumptions are Au:$1650, Ag:$19, Pb: $0.85, Zn:$1.3. 100% recovery

has been assumed for all metals.

At this stage of

the project, no metallurgy has been completed, and the reader is

cautioned that 100% recoveries are never achieved. True thickness

is assumed to be 50%-80% of downhole width.

Drill Hole Information

|

Hole

Number

|

Total

Depth

|

Azimuth

|

Dip

|

Easting

|

Northing

|

Elevation

(m)

|

|

DDSA-22-52

|

489

|

10

|

-57

|

751495

|

2526170

|

2626

|

|

DDSA-22-53

|

400

|

67

|

-70

|

751663

|

2526202

|

2603

|

|

DDSA-22-54

|

441

|

36

|

-65

|

751666

|

2526199

|

2602

|

|

DDSA-22-55

|

342

|

52

|

-45

|

752839

|

2525326

|

2590

|

|

DDSA-22-58

|

365

|

54

|

-43

|

752702

|

2525481

|

2607

|

Table

2 – Drill collar details. All coordinates in WGS84 UTM Zone

13N.

Next Steps

-

Drilling program at Veta Grande with planned start date in

November. Follow-up drilling will be focused on expanding the

resource footprint at Veta Grande by building on the success of the

past drill campaigns. Additional follow-up targets

include:

-

Newly-discovered deep historic

workings east of the previously known limit of mining.

-

Footwall vein north of the main Veta

Grande Structure.

-

Recently-identified cross structures

and vein splays with the potential to host significant

mineralization.

-

Metallurgical drilling for planned

resource estimate.

-

Continued regional exploration to design a follow-up drill program

at Lucita.

-

Confirmation drill program to determine cut-off date for resource

estimate preparation.

Discussion of QAQC and Analytical Procedure

Samples were selected based on the

lithology, alteration, and mineralization characteristics; sample

size ranges from 0.25 – 2m in width. All altered and mineralized intervals

were sent for assay. One blank, one standard, and one duplicate

were included within every 20 samples. Standard materials are certified

reference materials [CRMs] from OREAS and contain a range of Ag,

Au, Cu, Pb, and Zn values. Blanks, standards, and duplicates did

not detect any issues with the analytical results.

Samples were analyzed by ALS Chemex

Laboratories. Sample preparation was performed at

the Zacatecas, Mexico, prep facility, and analyses were performed

at the Vancouver, Canada, analytical facility.

All elements except Au and Hg were

analyzed by a multi-element geochemistry method utilizing a

four-acid digestion followed by ICP-MS detection [ME-MS61m];

mercury was analyzed after a separate aqua regia digest by ICP-MS.

Overlimit assays for Ag, Pb, and Zn were conducted using the OG62

method (multi-acid digest with ICP-AES/AAS finish). Gold was

measured by fire-assay with an ICP-AES finish [50g sample,

Au-ICP22].

'San Acacio History

Zacatecas State continues to be the

top producer of silver in Mexico and is one of the reasons Mexico

remains the world's largest silver-producing region. The

Zacatecas-Fresnillo Silver Belt is one of the most prolific silver

producing areas in the world. Production at the San Acacio mine

dates to at least 1548 when Spanish colonialists mined mainly

bonanza oxide ores, typically grading in excess of 1kg/tonne

Silver. The various veins were mined

intermittently until the mid-1800s when an English company drove

the ~2km Purisima tunnel to allow for deeper underground access and

drainage. From the late 1800s until the Mexican

Revolution in 1920, mining consisted of intermittent production

from bonanza grade ores. During the Mexican Revolution, heavy

fighting in the Zacatecas region led to the halt of most mining

endeavors. In the mid 1920's, a cyanide plant

targeting silica rich ores and a floatation plant for complex Pb-Zn

ores were built with varying success until the transition from

oxide to sulphide rich ores made for recovery complexities.

In the mid 1930s the first tonnage

estimate was created on the property, although the project sat

mostly idle save for some stope and adit rehabilitation at Purisima

and Refugio. Production was largely dormant except

for some small processing done by CIA Fresnillo in the late 1930s

to early 1940s. In the mid- 1990s Silver Standard

Resources Inc. began a systematic exploration and evaluation

program targeting an open pit silver mine consisting of backfill,

remaining stopes and silica-rich hanging wall and footwall

mineralization of the Veta Grande structure. This entry by a

publicly-listed company kicked off nearly 3 decades of exploration,

development, and bulk-scale processing.

Defiance Silver has been exploring the

project since 2011 and has focused primarily on identifying mineral

resources. Drilling by previous operators as well

as Defiance Silver from 2009 to early 2017 confirmed the presence

of significant mineralizing events that provide evidence for a

long-lived mineralizing system. Drilling in late 2017 and early 2019

outlined complexities in the structural geology of the area and

identified significant "down dropped" and rotated structural blocks

as the company tested the Veta Grande at similar elevations where

it was encountered by earlier mining and drilling.

Shares for Debt

Defiance also

reports that

it intends to settle $70,975 of

debt through the issuance of up to 366,538 common shares of the

Company (the "Shares").

About Defiance Silver Corp.

Defiance Silver Corp. (DEF | TSX

Venture Exchange; DNCVF | OTCQX; D4E | Frankfurt) is an exploration

company advancing the district-scale San Acacio Deposit, located in

the historic Zacatecas Silver District and the Tepal Gold/Copper

Project in Michoacán state, Mexico. Defiance is managed by a team of

proven mine developers with a track record of exploring, advancing

and developing several operating mines and advanced resource

projects Defiance's corporate mandate is to expand the San Acacio

and Tepal projects to become premier Mexican silver and gold

deposits.

Mr. George Cavey, P.Geo, V.P

Exploration for Defiance Silver is a Qualified Person within the

meaning of National Instrument 43-101 and has approved the

technical information concerning the Company's material mineral

properties contained in this press release.

On behalf of Defiance Silver

Corp.

"Chris Wright"

Chairman of the Board

For more information,

please contact: Investor Relations at +1 (604) 343-4677 or via

email at

info@defiancesilver.com.

www.defiancesilver.com

Suite 2900-550 Burrard

Street

Vancouver, BC V6C 0A3

Canada

Neither TSX Venture

Exchange nor its Regulation Services Provider (as that term is

defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this

release.

This news release

may contain forward-looking statements including but not limited to

comments regarding timing and content of upcoming work programs,

geological interpretations, receipt of property titles, potential

mineral recovery processes, etc. Forward-looking statements address

future events and conditions and therefore involve inherent risks

and uncertainties. Actual results may differ materially from those

currently anticipated in such statements. Defiance Silver Corp.

relies upon litigation protection for forward-looking

statements.

Defiance Silver (QX) (USOTC:DNCVF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Defiance Silver (QX) (USOTC:DNCVF)

Historical Stock Chart

From Dec 2023 to Dec 2024