Current Report Filing (8-k)

07 August 2019 - 8:03PM

Edgar (US Regulatory)

CURRENT REPORT FOR ISSUERS SUBJECT TO THE

1934 ACT REPORTING REQUIREMENTS

FORM 8-K

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act

July 31, 2019

Date of Report

(Date of Earliest Event Reported)

DYNARESOURCE, INC.

(Exact name of registrant as specified in its

charter)

|

Delaware

|

|

000-30371

|

|

94-1589426

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

222 W Las Colinas Blvd., Suite 1910 North Tower,

Irving, Texas 75039

(Address of principal executive offices (zip

code))

(972) 868-9066

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

[ ]

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

4.02 Non-Reliance on Previously

Issued Financial Statements or a Related Audit Report or Completed Interim Review.

On July 31, 2019, the Board of

Directors of DynaResource, Inc. (the “Company”), after discussion with management of the Company and Whitley Penn LLP,

the Company’s independent registered public accounting firm, concluded that the Company’s previously issued consolidated

financial statements as of and for the years ended December 31, 2018 and 2017 should be restated and no longer be relied upon.

The principal effects of the restatement are:

|

|

o

|

Certain expenditures

for mining site improvements and equipment that were previously capitalized as fixed assets by the Company during fiscal years

2017 and 2018 will be expensed in the consolidated statements of operations for such periods, resulting in a decrease net of adjustment

for depreciation in the Company’s earnings

in the amount of $1,109,324 and $755,209

for such periods; and

|

|

|

o

|

The Company will make

appropriate adjustments to remove certain expenditures for mining site improvements and equipment that were previously capitalized

as fixed assets in the amounts of $1,260,873 and $1,039,391 on the consolidated balance sheets for the fiscal years ended December

31, 2018 and 2017, respectively.

|

|

|

o

|

The Company will also

make the appropriate adjustment to the opening January 1, 2017 equity balance to reflect the cumulative effect of prior periods

to remove certain expenditures for mining site improvements and equipment that were previously capitalized as fixed assets in the

net amount of $569,022.

|

The restatement does not:

|

|

o

|

Impact the Company’s

net cash generated or used in the consolidated statements of cash flows in any period; or

|

|

|

o

|

Reflect changes in the

Company’s business or operations.

|

The Company is working to prepare

restated financial statements for the fiscal years ended December 31, 2018 and 2017, which the Company anticipates filing with

the SEC on Form 10-K/A for the year ended December 31, 2018 as soon as practicable. The Company is also working to prepare restated

financial statements for the fiscal quarters ended March 31, 2019 and March 31, 2018, June 30, 2018 and September 30, 2018, which

the Company anticipates filing with the SEC on Form 10-Q/A for the quarter ended March 31, 2019 as soon as practicable. The Company

does not intend to file amendments to any of its other previously filed Annual Reports on Form 10-K or to any of its previously

filed Quarterly Reports on Form 10-Q.

The Company has identified a material

weakness in its internal control over financial reporting relating to its interpretation and application of GAAP for the changes

in the accounting treatment for certain expenditures for mining site improvements and equipment that were previously capitalized

as fixed assets discussed above. The Company has developed a plan to remediate this material weakness, which is discussed in its

Form 10-K/A and Form 10-Q/A.

Background Underlying the

Board’s Conclusion

The Company has historically capitalized

certain expenditures for mining site improvements and equipment as fixed assets. As a result of a comment letter the Company received

from the United States Securities and Exchange Commission (“SEC”), the Company has been engaged in discussions with

the staff of the SEC (the “

Staff

”) concerning the Company’s accounting for certain expenditures for mining

site improvements and equipment that were previously capitalized as fixed assets recorded in its consolidated financial statements

for the fiscal years ended December 31, 2018 and 2017. The Company reevaluated and determined it had not properly expensed certain

expenditures for mining site improvements and equipment during such periods described above in accordance with generally accepted

accounting principles (“GAAP”).

As soon as practicable, the Company

will file its amended Form 10-K and Form 10-Q described above, to record certain expenditures for mining site improvements and

equipment that were previously recorded as fixed assets on the Company’s balance sheet as expenses in the Company’s

consolidated statements of operations during the periods such expenditures were made.

8.01 Other Information

The Company will file its Form

10-Q for the period ended June 30, 2019 as soon as practicable after the amended Form 10-K and Form 10-Q described above are filed.

Discussion with Independent Accountant

The Board of Directors has discussed

the matters disclosed in this Current Report on Form 8-K with Whitley Penn LLP, the Company’s independent registered public

accounting firm.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

DYNARESOURCE, INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

|

/s/ K.W.

Diepholz

|

|

|

|

|

Name:

|

|

K.W. Diepholz

|

|

|

|

|

Title:

|

|

Chairman and CEO

|

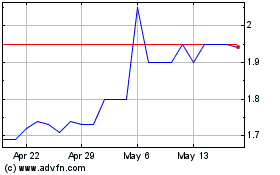

Dynaresource (QX) (USOTC:DYNR)

Historical Stock Chart

From Jun 2024 to Jul 2024

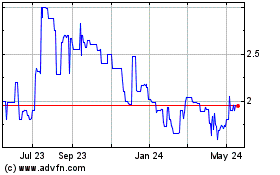

Dynaresource (QX) (USOTC:DYNR)

Historical Stock Chart

From Jul 2023 to Jul 2024