Current Report Filing (8-k)

29 November 2017 - 8:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 21, 2017

Equitable Financial Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

Maryland

|

32-0467709

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification Number)

|

|

|

|

|

113 North Locust Street

|

|

|

Grand Island, NE

|

68801

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(308) 382-3136

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 5.07

Submission of Matters to a Vote of Security Holders.

On November 21, 2017, Equitable Financial Corp. (the “Company”) held its Annual Meeting of Stockholders. The matters listed below were submitted to a vote of the stockholders through the solicitation proxies, and the proposals are described in detail in the Company’s Proxy Statement filed with the Securities and Exchange Commission on October 19, 2017. The final results of the stockholder vote are as follows:

|

|

1.

|

|

The stockholders elected each director nominated to serve for a three-year term as follows:

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Withheld

|

|

Broker Non-Votes

|

|

Thomas E. Gdowski

|

|

1,081,681

|

|

973,239

|

|

950,810

|

|

|

|

|

|

|

|

|

|

Vincent J. Dugan

|

|

1,081,056

|

|

973,864

|

|

950,810

|

|

|

|

|

|

|

|

|

|

William B. Westering

|

|

1,081,433

|

|

973,487

|

|

950,810

|

|

|

2.

|

|

The stockholders approved the ratification of the appointment of BKD, LLP as the Company’s independent registered public accounting firm for the year ending June 30, 20187 as follows:

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non‑Votes

|

|

2,968,369

|

|

14,775

|

|

22,586

|

|

0

|

Item 8.01

Other Events.

On November 21, 2017, the Board of Directors of the Company authorized a stock repurchase program pursuant to which the Company intends to repurchase up to 168,446 shares, or 5% of the Company’s issued and outstanding common stock.

The repurchase program permits shares to be repurchased in open market or private transactions, through block trades and pursuant to any trading plan that may be adopted in accordance with Rule 10b5-1 promulgated by the Securities Exchange Commission (“SEC”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Repurchases will be made at management’s discretion at prices management considers to be attractive and in the best interests of both the Company and its shareholders, subject to the availability of stock, general market conditions, the trading price of the stock, alternative uses for capital and the Company’s financial performance. Open market purchases will be conducted in accordance with the limitations set forth in Rule 10b-18 promulgated by the SEC under the Exchange Act and other applicable legal requirements.

The repurchase program may be suspended, terminated or modified at any time for any reason, including market conditions, the cost of repurchasing shares, the availability of alternative investment opportunities, liquidity and other factors deemed appropriate. These factors also may affect the timing and amount of share repurchases. The repurchase program does not obligate the Company to purchase any particular number of shares.

Certain statements contained herein constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may be identified by words such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” and similar expressions. These statements are based upon the current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties. Actual results may differ materially from those set forth in the forward-looking statements as a result of numerous factors. Factors that could cause such differences to exist include, but are not limited to, general economic conditions, changes in interest rates, regulatory considerations and competition. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Current Report on Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

EQUITABLE FINANCIAL CORP.

|

|

|

|

|

|

Dated: November 28, 2017

|

By:

|

/s/ Thomas E. Gdowski

|

|

|

|

Thomas E. Gdowski

|

|

|

|

President and CEO

|

|

|

|

|

|

Dated: November 28, 2017

|

By:

|

/s/ Darcy M. Ray

|

|

|

|

Darcy M. Ray

|

|

|

|

Chief Financial Officer

|

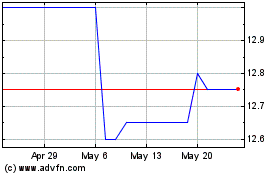

Equitable Financial (PK) (USOTC:EQFN)

Historical Stock Chart

From Nov 2024 to Dec 2024

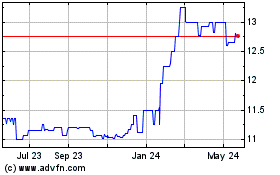

Equitable Financial (PK) (USOTC:EQFN)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Equitable Financial Corporation (PK) (OTCMarkets): 0 recent articles

More Equitable Financial Corp. News Articles