1st Colonial Bancorp, Inc. (OTCBB:FCOB), holding company of 1st

Colonial National Bank, today reported that its net income for the

three months ended March 31, 2011 was $170,000 ($0.05 per share),

compared to $111,000 ($0.03 per share) for the three months ended

March 31, 2010.

Gerry Banmiller, President and Chief Executive Officer,

commented, “As lowering interest expense is a key component of the

income statement, we continue to focus on the elimination of high

priced deposits. Critical, as well, to a successful year is

interest income derived from loans. We will be especially attentive

to these two elements of our performance for the remainder of the

year. Also, through our residential lending division and SBA

lending programs we are creating the core earnings to allow us to

continue to add to our loan loss reserve and absorb additional

expenses related to loans in foreclosure and still provide positive

earnings for our shareholders.”

At March 31, 2011, 1st Colonial also reported $276.1 million in

total assets and $240.6 million in deposits. These amounts reflect

a decrease of $3.7 million in assets from March 31, 2010, largely

due to the decrease in deposits of $5.0 million or 2.0% from March

31, 2010. Total loans were $177.8 million, an increase of $6.5

million or 3.8% from March 31, 2010. Investments were $83.3

million, a decrease of $5.8 million from March 31, 2010.

Net interest income of $2,153,000 for the three months ended

March 31, 2011 was $117,000, or 5.7%, higher than the net interest

income of $2,036,000 for the three months ended March 31, 2010.

This was due primarily to a 0.28% increase in net interest spread

to 3.21% for the three months ended March 31, 2011 compared to

2.93% for the three months ended March 31, 2010.

1st Colonial’s provision for loan losses for the three months

ended March 31, 2011 was $450,000 compared to the $640,000

provision for the three months ended March 31, 2010.

Non-interest income decreased $102,000 or 20.9% from the prior

year. Non-interest income for the three months ended March 31, 2010

included a gain on sale of investments of $212,000. Fees generated

by the origination and sale of residential mortgage loans increased

by $107,000.

Non-interest expense increased $193,000 or 11.1% from the

comparable period in 2010. Salaries and benefits accounted for

$136,000 of the increase due to increased expenses related to loan

volume in our residential lending department and general salary and

benefit increases. Expenses related to loans in foreclosure and

legal expenses inherent with enforcing loan contracts increased by

$63,000.

Highlights as of March 31, 2011 and March 31, 2010, and

comparing the three months ended March 31, 2011 and the three

months ended March 31, 2010, respectively (all unaudited), include

the following (dollars in thousands, except per share data):

at at $ increase/ % increase/

March 31,

2011

March 31,

2010

Decrease

decrease

Total assets $276,090 $279,779 ($3,689) -1.3% Total

loans 177,820 171,305 6,515 3.8% Investments 83,329 89,159

(5,830) -6.5% Total deposits 240,635 245,634 (4,999) -2.0%

Shareholders' equity 23,374 23,032 342 1.5%

For the three months

ended

$ increase/ % increase/

March 31,

2011

March 31,

2010

Decrease

decrease

Net interest income $2,153 $2,036 $117 5.7% Provision

for loan losses 450 640 (190) -29.7% Other income 387 489

(102) -20.9% Non interest expense 1,932 1,739 193 11.1%

Tax expense (benefit) (12) 35 (47) -134.3%

Net income

170 111 59 53.2% Earnings per share (diluted) $0.05 $0.03

$0.02 66.7%

1st Colonial National Bank, the subsidiary of 1st Colonial

Bancorp, provides a range of business and consumer financial

services, placing emphasis on customer service and access to

decision makers. Headquartered in Collingswood, New Jersey, the

Bank also has branches in the New Jersey communities of Westville

and Cinnaminson. To learn more, call (856) 858-8402 or visit

www.1stcolonial.com.

This Release contains forward-looking statements that are not

historical facts and include statements about management’s

strategies and expectations about our business. There are risks and

uncertainties that may cause our actual results and performance to

be materially different from results indicated by these

forward-looking statements. Factors that might cause a difference

include economic conditions; unanticipated loan losses, lack of

liquidity; changes in interest rates, changes in FDIC assessments,

deposit flows, loan demand, and real estate values; competition;

changes in accounting principles, policies or guidelines; changes

in laws or regulation; new technology and other factors affecting

our operations, pricing, products and services.

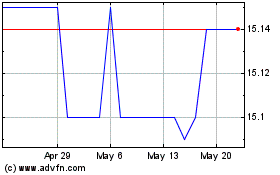

1st Colonial Bancorp (PK) (USOTC:FCOB)

Historical Stock Chart

From Oct 2024 to Nov 2024

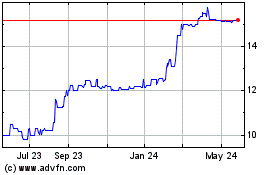

1st Colonial Bancorp (PK) (USOTC:FCOB)

Historical Stock Chart

From Nov 2023 to Nov 2024