1st Colonial Bancorp, Inc. (OTCQB:FCOB), holding company of 1st

Colonial Community Bank, today reported that its net income for the

three months ended June 30, 2013 was $251,000 ($0.06 per share)

compared to $239,000 ($0.06 per share) for the three months ended

June 30, 2012. Net interest income decreased $116,000 resulting

from a decrease in its net interest spread to 2.95% for the three

months ended June 30, 2013 compared to 3.49% for the three months

ended June 30, 2012. However, non-interest income increased by

$284,000, as fees generated by the origination and sale of SBA

loans and residential mortgage loans increased $186,000 and

$110,000, respectively.

Non-interest expense increased by $236,000, primarily due to an

increase in costs associated with problem loans by $115,000 and an

increase in salaries and benefits by $98,000. The latter increase

was due to increases in staff and higher commissions in residential

and SBA lending as a result of increased loan volume. In addition,

our provision for loan losses decreased by $100,000 for the quarter

ended June 30, 2013 from the quarter ended June 30, 2012.

Net income for the six months ended June 30, 2013 was $464,000

($0.13 per share), compared to $622,000 ($0.18 per share) for the

six months ended June 30, 2012.

Gerry Banmiller, President and Chief Executive Officer,

commented, “We are pleased with the growth in our non-interest

income. We continue to make inroads in this area. Unfortunately,

the continued pressure downward on net interest margins is the

primary reason for our net interest income decline from 2012 to

2013. We continue to make adjustments on deposit rates but cannot

control many of the early payoffs on higher yielding assets. We

will continue to monitor controllable expenses, such as payroll,

and make adjustments when necessary.”

At June 30, 2013, 1st Colonial also reported $302.4 million in

total assets, $265.5 million in deposits and $181.4 million in

loans. These amounts reflect increases of $28.9 million in assets

and $22.4 million in deposits from June 30, 2012. Also increasing

were investment securities by $23.3 million, loans by $3.0 million

and other borrowings by $6.4 million.

Net interest income of $4,458,000 for the six months ended June

30, 2013 was $266,000, or 5.6%, lower than the net interest income

of $4,724,000 for the six months ended June 30, 2012. This was due

primarily to a decrease of 0.53% in net interest spread to 2.95%

for the six months ended June 30, 2013 compared to 3.48% for the

six months ended June 30, 2012.

1st Colonial’s provision for loan losses was $600,000 for the

six months ended June 30, 2013 compared to a provision for loan

losses of $850,000 for the six months ended June 30, 2012.

Non-interest income of $1,292,000 for the six months ended June

30, 2013 was $390,000, or 43.2%, higher than non-interest income

for the six months ended June 30, 2012. Fees generated by the

origination and sale of residential mortgage loans and SBA loans

increased by $238,000 and $185,000 respectively. There were no

gains or losses on investment securities sold for the six months

ended June 30, 2013 compared to $19,000 in gains from the sale of

investments during the six months ended June 30, 2012.

Non-interest expense for the six months ended June 30, 2013

increased $555,000 or 14.1% from the comparable period in 2012.

Salaries and benefits increased by $209,000 due to increases in

staff in the compliance, residential lending and SBA departments,

as well as higher commissions in residential lending and SBA as a

result of increased loan volume. Also increasing were costs

associated with problem loans by $214,000 and data processing

expenses by $43,000 due to increased customer volume.

The company also reported that its shareholders equity and book

value per share decreased since June 30, 2012 due to a shift from

an unrealized gain to an unrealized loss in the investment

portfolio, as interest rates moved higher during the past

quarter.

Highlights as of June 30, 2013 and June 30, 2012, and comparing

the three and six months ended June 30, 2013 and the three and six

months ended June 30, 2012, respectively, include the following

(dollars in thousands, except per share data):

At At $

increase/ % increase/

June 30,

2013

June 30,

2012

(decrease)

(decrease)

Total assets $ 302,450 $ 273,577 $ 28,873 10.6 %

Total loans 181,413 178,418 2,995 1.7 % Investments 104,404

81,091 23,313 28.7 % Total deposits 265,511 243,157 22,354

9.2 %

Shareholders' equity

24,626 24,954 (328 ) -1.3 %

Book value per share (1)

7.36 7.46 (0.10 ) -1.3 %

For the six months ended $ increase/ % increase/

June 30,

2013

June 30,

2012

(decrease)

(decrease)

Net interest income $ 4,458 $ 4,724 $ (266 ) -5.6 %

Provision for loan losses 600 850 (250 ) -29.4 % Other

income 1,292 902 390 43.2 % Non-interest expense 4,503 3,948

555 14.1 % Tax expense 183 206 (23 ) -11.2 % Net

income 464 622 (158 ) -25.4 % Earnings per share, diluted

(1) $ 0.13 $ 0.18 $ (0.05 ) -27.8 % For the three months

ended $ increase/ % increase/

June 30,

2013

June 30,

2012

(decrease)

(decrease)

Net interest income $ 2,231 $ 2,347 $ (116 ) -4.9 %

Provision for loan losses 300 400 (100 ) -25.0 % Other

income 787 503 284 56.5 % Non-interest expense 2,369 2,133

236 11.1 % Tax expense 98 78 20 25.6 % Net income 251

239 12 5.0 % Earnings per share, diluted (1) $ 0.06 $ 0.06 $

0.00 0.0 %

(1) Adjusted to give effect to the 5% stock dividend distributed

to shareholders on April 15, 2013.

1st Colonial Community Bank, the subsidiary of 1st Colonial

Bancorp, provides a range of business and consumer financial

services, placing emphasis on customer service and access to

decision makers. Headquartered in Collingswood, New Jersey, the

Bank also has branches in the New Jersey communities of Westville

and Cinnaminson. To learn more, call (856) 858-8402 or visit

www.1stcolonial.com.

This Release contains forward-looking statements that are not

historical facts and include statements about management’s

strategies and expectations about our business. There are risks and

uncertainties that may cause our actual results and performance to

be materially different from results indicated by these

forward-looking statements. Factors that might cause a difference

include economic conditions; unanticipated loan losses, lack of

liquidity; varying and unanticipated costs of collection with

respect to nonperforming loans; changes in interest rates, changes

in FDIC assessments, deposit flows, loan demand, and real estate

values; changes in relationships with major customers; operational

risks, including the risk of fraud by employees, customers or

outsiders; competition; changes in accounting principles, policies

or guidelines; changes in laws or regulations and in the manner in

which the regulators enforce same; new technology and other factors

affecting our operations, pricing, products and services.

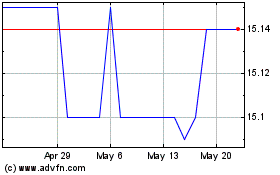

1st Colonial Bancorp (PK) (USOTC:FCOB)

Historical Stock Chart

From May 2024 to Jun 2024

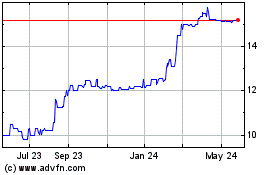

1st Colonial Bancorp (PK) (USOTC:FCOB)

Historical Stock Chart

From Jun 2023 to Jun 2024