false

0001722731

0001722731

2025-01-21

2025-01-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report: January 21, 2025

(Date

of earliest event reported)

FDCTECH,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-56338 |

|

81-1265459 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS.

Employer

Identification

No.) |

200

Spectrum Center Drive, Suite 300

Irvine,

CA 92618

(Address

of principal executive offices, including zip code)

(877)

445-6047

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common |

|

FDCT |

|

OTC

Markets |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item

1.01 |

Entry

into a Material Definitive Agreement. |

January

27, 2025, FDCTech, Inc. (“FDC” or the “Company,” OTCQB: FDCT), a fintech-driven company specializing in acquiring

and integrating small—to mid-size legacy financial services firms, announced the signing of a Letter of Intent (LOI) to acquire

Alchemy Global Ltd. (“Alchemy Global”), a Seychelles-registered securities dealer authorized by the Financial Services Authority

(FSA) under license number SD136.

FDC

intends to purchase 100% of Alchemy Global’s shares, with the purchase price totaling $2,050,000, including Own Funds Capital of

$50,000 and a premium of $2,000,000.

The

foregoing description of the LOI with Alchemy Global does not purport to be complete. It is qualified in its entirety by

reference to the full text of the document, which is filed as an exhibit to this report and is incorporated herein by reference.

| Item

7.01 |

Regulation

FD Disclosure |

On

January 23, 2025, the Company issued a press release announcing the LOI with Alchemy Group. We have furnished a copy of the press

release as Exhibit 99.1 hereto, which is incorporated into Item 7.01 by reference.

The

information furnished pursuant to Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section, and is not deemed incorporated

by reference in any filing of Basic’s under the Securities Act of 1933, as amended unless specifically identified therein as being

incorporated therein by reference.

| ITEM

9.01 |

Financial

Statements and Exhibits |

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

|

FDCTECH,

INC. |

| |

|

|

|

| January

27, 2025 |

|

By: |

/s/

Imran Firoz |

| Date |

|

|

Imran

Firoz |

| |

|

|

Chief

Financial Officer |

| |

|

|

(Principal

Executive Officer) |

Exhibit

10.1

Article

I. NON-BINDING LETTER OF INTENT

This

Letter of Intent (hereinafter “LOI”) is set forth on 21st day of January 2025 by and between:

| |

1) |

SYNC

CAPITAL LIMITED a company incorporated in the UK, with registered company number 10519029, with its headquarter offices at Unit

1 74 Back Church Lane, London, England, E1 1LX (hereinafter the “Seller”); and |

| |

|

|

| |

2) |

FDCTech

INC, a company incorporated in the USA, with registered company number 81-1265459, with its headquarter offices at 200 Spectrum

Drive, Suit 300, Irvine, 92618, California, USA (hereinafter the “Buyer”) |

The

Seller and the Buyer shall be collectively referred to as the “Parties” and individually the “Party”.

Article

II. PREAMBLE:

| |

A. |

The

Seller is the existing shareholder of 100% of the share capital (hereinafter the “Shares”) of ALCHEMY GLOBAL LTD,

a company incorporated in Seychelles with registration number 8429852-1, duly authorized by the Financial Service Authority (hereinafter

the “FSA”) under license number SD136 to provide securities dealer services (hereinafter the “Company”). |

| |

|

|

| |

B. |

The

Buyer wishes to purchase the Shares of the Company from the Seller and the Seller wishes to sell the Shares to the Buyer. |

| |

|

|

| |

C. |

The

Parties agree to enter into this LOI in order to outline the principal terms and conditions whereby the Buyer would purchase the

Shares from the Sellers (hereinafter the “Transaction”). |

Article

III. IT IS HEREBY AGREED AS FOLLOWS:

| |

1. |

The

Buyer proposes to purchase the shares of the Company for a Purchase Price which consists of the following: |

| |

1.1. |

Own

Funds Capital, and |

| |

|

|

| |

1.2. |

$US2,000,000

minus the Own Funds Capital which will be the defined as the premium (the “Premium”). |

| |

2. |

Payment

Schedule: The payment for the Shares of the Company shall be made as following, the Buyer shall pay off in cash the Own Funds

Capital of the Company and the Premium within 3 months as of the Change of Control, for the removal of any doubt, the Buyer has the

sole right to substate the whole cash payment or any part of it, with the shares of the Buyer and which will amount to the same value. |

| |

3. |

Expenses

and Maintenance Fees: The Buyer shall be responsible for all the expenses and/ or related costs for the ordinary running of the

business and maintenance of the license of the Company in the amount of $US40,000 or less as applicable for the period commencing

from 3 months after the execution date of the relevant SPA (hereinafter each being the “Closing Date”) until the

respective approvals (or rejections) of FSA for the acquisition of the 100% of the Shares of the Company by the Buyer (hereinafter

each being the “Interim Period”). |

| |

|

|

| |

4. |

Normal

Operations of the Business: During the Transitional Period, the Parties will operate the business in the ordinary course. |

| |

|

|

| |

5. |

Assignment:

The Parties hereby agree that neither of the Parties shall have the right to assign or otherwise transfer its rights of this

LOI without the prior written consent of the other Party which will not be unreasonable withheld |

| |

|

|

| |

6. |

NON-Binding:

This LOI is a good faith expression of the mutual intent of the Parties to consummate the proposed Transaction herein but is

not binding on either Party. The Parties agree to a mutual execution of a definitive SPA which will adopt the terms contemplated

in this LOI in full and in more detailed description, within 45 (forty-five) days from the date of execution of this LOI by both

Parties, provided that all the provisions of this LOI are affected and the results of the due diligence are accepted by the Buyer. |

| |

|

|

| |

7. |

Exclusivity

(No Shop) and Confidentiality Agreement: The Sellers agree not to offer the Company to any other potential buyer for a period

of 45 (forty-five) days from the date of execution of this LOI by both Parties, during which period the Buyer will perform a due

diligence on the Company and then will examine the results of the said and therefore, eventually a final SPA will be signed between

the Parties. |

The

Parties agree that within 45 (forty-five) days from the date of this LOI, provided that all the provisions of this LOI are affected and

the results of the due diligence are accepted by the Buyer, the Parties will be bound and will proceed with the Transaction with no undue

delay. Both Parties agree to refrain from providing any information concerning the Transaction contemplated herein to any third party

and to keep any information concerning the Transaction strictly confidential. Notwithstanding anything to the contrary, the Parties agree

to only provide information to other parties on a “need to know” basis, in order to facilitate a timely closing of the Transaction.

The provisions of this section are legally binding on both Parties to this letter.

| |

8. |

Representations,

Warranties and Indemnities: The Parties represent and warrant that they have or have received the necessary authority to enter

into this LOI and that if the provisions of this LOI are met, a definitive SPA will be signed by the Parties. |

| |

|

|

| |

9. |

Governing

Law and Jurisdiction: This LOI and any dispute or claim (including non- contractual disputes or claims) arising out of or in

connection with it or its subject matter or formation shall be governed by and construed in accordance with the laws of Seychelles.

Each Party irrevocably agrees that the courts of Seychelles, shall have exclusive jurisdiction to settle any dispute or claim (including

non-contractual disputes or claims) arising out of or in connection with this LOI or its subject matter or formation. |

| |

|

|

| |

10. |

Counterparts:

This LOI may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall

constitute one and the same instrument. |

| |

|

|

| |

11. |

Variation/

Assignment: No variation and/or assignment of this LOI shall be valid unless it is in writing and signed by or on behalf of each

of the Parties to it. The expression “variation” shall include any variation, supplement, deletion or replacement however

effected. |

Article

IV. THE SELLER

| (Sign.) |

|

|

| Name: |

Gope Kundnani For and on behalf of |

|

| |

|

|

| |

SYNC CAPITAL LIMITED |

|

| |

Date: January 21, 2025 |

|

Article

V. THE BUYER

| (Sign.) |

|

|

| Name: |

Mitchell Eaglestein For and on behalf of FDCTech INC |

|

Date:

January 21, 2025

Exhibit

99.1

FDCTech,

Inc. Announces Acquisition of Alchemy Global to Expand Market Presence in the Middle East and Asia

The

Company is strengthening its balance sheet, achieving profitable growth, and establishing a global footprint with strategic market expansion.

Irvine,

CA: January 23, 2025, FDCTech, Inc. (“FDC” or the “Company,” OTCQB: FDCT), a fintech-driven company specializing

in acquiring and integrating small—to mid-size legacy financial services firms, announced the signing of a Letter of Intent (LOI)

to acquire Alchemy Global Ltd. (“Alchemy Global”), a Seychelles-registered securities dealer authorized by the Financial

Services Authority (FSA) under license number SD136. The acquisition is a strategic move aimed at establishing a significant presence

in the Middle Eastern and Asian markets, with the deal expected to close by the third quarter of 2025, subject to customary closing conditions

and regulatory approvals.

Transaction

Highlights:

| |

● |

Acquisition

Structure: FDC intends to purchase 100% of Alchemy Global’s shares, with the purchase price comprising Own Funds Capital

and a premium of $2,000,000 minus the Own Funds Capital. |

| |

|

|

| |

● |

Strong

Financials: For the nine months ending September 30, 2024, Alchemy Global reported revenues exceeding $4.00 million, a net income

of $2.2 million, net assets of $3.88 million, client funds of over $6.7 million, and a working capital surplus of $3.80 million. |

| |

|

|

| |

● |

Strategic

Value Addition: Post-acquisition, FDC plans to integrate its proprietary trading platform and advanced risk management systems

into Alchemy Global, enhancing client offerings and operational efficiency. |

Rationale

for the Acquisition:

The

acquisition of Alchemy Global is strategically aligned with FDC’s objective to expand its market footprint in emerging economies

with high growth potential. The Middle East and Asia represent untapped opportunities in the financial trading and brokerage sectors,

driven by increasing demand for innovative trading solutions. Alchemy Global’s established presence and regulatory credentials

in Seychelles provide a credible platform for FDC to enter these markets seamlessly.

Seychelles:

A Premier Jurisdiction for FX Brokers

Seychelles

has emerged as a reputable jurisdiction for financial and securities dealers, offering a robust regulatory framework under the oversight

of the Financial Services Authority. Major global brokers, including Plus500, XTB, and eToro, conduct business in Seychelles,

leveraging its business-friendly policies and strategic location. This makes Seychelles a highly attractive base for Alchemy Global’s

continued growth and FDC’s expansion strategy.

Please

visit our SEC filings or the Company’s website for more information on the full results and management’s

plan.

About

Alchemy Global Ltd.

Incorporated

in November 2022, Alchemy Global has quickly established itself as a competitive player in the securities trading industry. The company’s

financial stability, operational efficiency, and commitment to client satisfaction make it an ideal partner for FDC’s ambitious

growth plans.

FDCTech,

Inc.

FDCTech,

Inc. (“FDC”) is a regulatory-grade financial technology infrastructure developer designed to serve the future financial

markets. Our clients include regulated and OTC brokerages and prop and algo trading firms of all sizes in forex, stocks, CFDs, commodities,

indices, ETFs, precious metals, and other asset classes. Our growth strategy involves acquiring and integrating small to mid-size legacy

financial services companies, leveraging our proprietary trading technology and liquidity solutions to deliver exceptional value to our

clients.

Press

Release Disclaimer

This

press release’s statements may be forward-looking statements or future expectations based on currently available information. Such

statements are naturally subject to risks and uncertainties. Factors such as the development of general economic conditions, future market

conditions, unusual catastrophic loss events, changes in the capital markets, and other circumstances may cause the actual events or

results to be materially different from those anticipated by such statements. The Company does not make any representation or warranty,

express or implied, regarding the accuracy, completeness, or updated status of such forward-looking statements or information provided

by the third party. Therefore, in no case will the Company and its affiliate companies be liable to anyone for any decision made or action

taken in conjunction with the information and/or statements in this press release or any related damages.

Contact

Media Relations

FDCTech,

Inc.

info@fdctech.com

www.fdctech.com

+1

877-445-6047

200

Spectrum Center Drive, Suite 300,

Irvine,

CA, 92618

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

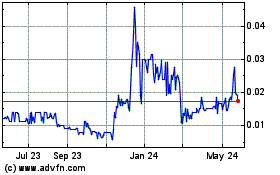

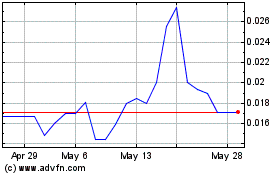

FDCTech (PK) (USOTC:FDCT)

Historical Stock Chart

From Dec 2024 to Jan 2025

FDCTech (PK) (USOTC:FDCT)

Historical Stock Chart

From Jan 2024 to Jan 2025