Freedom Bank Announces $4 Million Common Stock Offering to Fuel Growth

04 November 2014 - 10:07AM

Business Wire

The Freedom Bank of Virginia (Bank) (OTCQX: FDVA) announces that

following the bank's record performance during the first half of

2014 in terms of assets, loans, and net income, the Board of

Directors of The Freedom Bank of Virginia approved a

$4 million stock offering. The offering

will open to the public on November 3, 2014 and will

close out at the earlier of being fully subscribed

or November 28, 2014. The offering may be increased to $4.8

million or extended at the discretion of the Board.

The shares of common stock will be priced at

$9.00 per share. The proceeds will be used for general corporate

purposes, which may include improving the regulatory capital

position and supporting future growth.

Purchasers of shares in this offering will be entitled to

participate in the previously announced Rights

Offering to shareholders, scheduled to begin on or about

December 8, 2014. The Rights Offering consists of units of our

common stock and warrants to purchase our common stock at an

exercise price of $9.00 per share.

CEO Craig S. Underhill said, “Freedom is raising additional

capital to take advantage of market conditions. This

public offering is an opportunity for local community

bank investors in recently acquired banks to reinvest in

a rapidly growing and profitable local bank."

For more information on the offering, please contact Craig S.

Underhill, President & CEO at (703) 667-4161 or email at

cunderhill@freedomabankva.com.

Freedom Bank is a community-oriented, locally-owned bank with

locations in Fairfax, Vienna and Reston, Virginia. For information

about Freedom Bank’s deposit and loan services, visit the Bank’s

website at www.freedombankva.com.

This release contains forward-looking statements, including our

expectations with respect to future events that are subject to

various risks and uncertainties. Factors that could cause actual

results to differ materially from management's projections,

forecasts, estimates and expectations include: fluctuation in

market rates of interest and loan and deposit pricing, adverse

changes in the overall national economy as well as adverse economic

conditions in our specific market areas, maintenance and

development of well-established and valued client relationships and

referral source relationships, and acquisition or loss of key

production personnel. Other risks that can affect the Bank are

detailed from time to time in our quarterly and annual reports

filed with the Federal Financial Institutions Examination Council.

We caution readers that the list of factors above is not exclusive.

The forward-looking statements are made as of the date of this

release, and we may not undertake steps to update the

forward-looking statements to reflect the impact of any

circumstances or events that arise after the date the

forward-looking statements are made. In addition, our past results

of operations are not necessarily indicative of future

performance.

The Freedom Bank of VirginiaCraig S. Underhill, President &

CEO703-242-5300

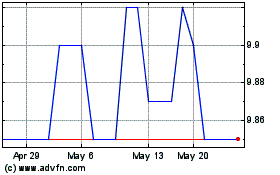

Freedom Financial (QX) (USOTC:FDVA)

Historical Stock Chart

From May 2024 to Jun 2024

Freedom Financial (QX) (USOTC:FDVA)

Historical Stock Chart

From Jun 2023 to Jun 2024