Rising prices dulled new-car demand as U.S. buyers looked for

deals at used-car lots.

By Nora Naughton

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 3, 2019).

Major auto makers saw U.S. new-vehicle sales drop in the first

half, a decline expected to extend for the remainder of the year as

the U.S. auto industry's historic sales run tapers off.

Rising car prices and higher interest rates dulled demand in the

year's first six months, with many buyers flocking to the used-car

lot looking for deals. A dramatic shift away from sedans and

compact cars helped dent sales volumes in the first part of the

year as General Motors Co. and other auto makers discontinued these

models.

U.S. new-vehicle sales this year are likely to fall short of the

17 million mark for the first time since 2014, analysts predict. A

protracted run of strong sales following the financial crisis has

satisfied pent-up demand, they say.

"We're just past the peak," said Michelle Krebs, an automotive

analyst at Cox Automotive. "Auto sales have been edging downward,

but it's nothing catastrophic."

The research firm J.D. Power estimates the annualized selling

pace in June to come in at 17.3 million, lower than a year

earlier.

The U.S. auto industry in the first half has posted six straight

months of weaker sales compared with the same period in 2018,

according to Cox Automotive.

GM's U.S. sales slid 4% through June, while Fiat Chrysler

Automobiles NV reported a 2% decline in the first six months.

Among the Japanese car companies, Toyota Motor Corp. was off 3%

in the first half, Nissan was down 8.2% and Honda Motor Co.'s U.S.

sales fell 1.4%.

Ford Motor Co. is the only major auto maker that will report

quarterly sales on Wednesday.

As the pace of sales slows, auto makers are wrestling with

keeping discounts in check, while also confronting rising inventory

levels and sticker prices that are stretching buyers' wallets.

The average new vehicle sold for about $33,350 in the first six

months, a record for the period and up nearly 4% from a year

earlier, according to an estimate from J.D. Power.

Prices are rising partly because U.S. buyers continue to

gravitate toward sport-utility vehicles and pickup trucks with

higher price tags.

The pace of sales remains historically strong, and analysts say

solid economic indicators and an expected influx of fresh models

into U.S. showrooms in coming years should keep sales from dropping

too steeply.

GM Chief Economist Elaine Buckberg said expected interest-rate

cuts should help new-vehicle demand in the second half of the year.

The Detroit auto maker said it commanded higher prices for its

models in the second quarter, with pricing up 4% to $37,126 per

vehicle.

"Auto demand was better than anticipated in the first half, and

we expect strong performance in the second half of the year," Ms.

Buckberg said in a statement.

Interest rates started to come down this spring after swelling

earlier in the year, with June's average hitting 6%, the lowest

this year, according to Edmunds.

"High interest rates have been the biggest story so far this

year, and for good reason," said Edmunds analyst Jessica Caldwell.

"The trickle-down effect has been significant for all areas of the

auto market."

The slowdown in the U.S. market comes as markets in Europe and

China are cooling. In a research note last week, Morgan Stanley

forecast global auto production to fall 4% this year, which will

pressure profits for suppliers and car companies.

Shoppers turned off by high sticker prices are finding

attractive used-car deals as a surge of newer SUVs coming off lease

wind up on used-vehicle lots. Used-car sales grew by around 9% in

the first half of the year, according to an estimate from J.D.

Power.

GM's U.S. sales decline in the first half was largely related to

weaker sedan sales and tighter inventories of its heavy-duty

trucks. Fiat Chrysler posted lower U.S. sales for five of its six

brands, including Jeep. Its profit-rich Ram truck division was the

one standout, with sales up 28% in the first six months.

Toyota, Honda and Nissan saw slowing sedan sales in the first

half as more buyers moved to models such as the RAV4 compact

crossover, Ridgeline pickup and the Pathfinder large SUV.

Subaru Corp. and Hyundai Motor Co. bucked the broader sales

slowdown in the first half with sales up 5.2% and 1.7%,

respectively, an increase bolstered by strong sales of their

sport-utility vehicles.

--Aisha Al-Muslim contributed to this article.

(END) Dow Jones Newswires

July 03, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

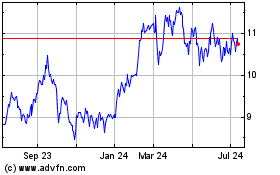

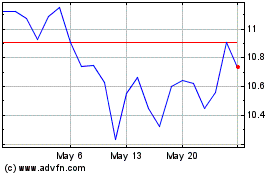

Subaru (PK) (USOTC:FUJHY)

Historical Stock Chart

From Feb 2025 to Mar 2025

Subaru (PK) (USOTC:FUJHY)

Historical Stock Chart

From Mar 2024 to Mar 2025