Current Report Filing (8-k)

23 August 2019 - 6:30AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 22, 2019 (August 20, 2019)

GLASSBRIDGE

ENTERPRISES, INC.

(Exact

name of registrant as specified in charter)

|

Delaware

|

|

001-14310

|

|

41-1838504

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

510

Madison Avenue, 9th Floor, New York, NY 10022

(Address

of Principal Executive Offices) (Zip Code)

(651)

704-4000

(Registrant’s

Telephone Number, Including Area Code)

Not

Applicable

(Former

Name or Former Address, If Changed Since Last Report)

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

|

Trading

Symbol(s)

|

|

Name

of Each Exchange on Which Registered

|

|

None

|

|

None

|

|

None

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mart if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

3.03 Material Modification to Rights of Security Holders.

To

the extent required by Item 3.03 of Form 8-K, the information regarding the Reverse Stock Split (as defined below) and the Actions

by Written Consent Amendment (as defined below) contained in Item 5.03 of this Current Report on Form 8-K are incorporated by

reference herein.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Chain in Fiscal Year.

The

Reverse Stock Split

On

August 20, 2019, GlassBridge Enterprises, Inc. (the “Company” or “we”) filed an Amendment (the “Amendment”)

to the Restated Certificate of Incorporation, as amended, of the Company (the “Articles”) with the Secretary of State

of the State of Delaware to: (i) effect the previously announced reverse split of our common stock, par value $0.01 per share

at a ratio of 1:200 (the “Reverse Stock Split”) and (ii) effect an amendment allowing the stockholders of the Company

to act by written consent in lieu of meeting, subject to certain limitations (the “Written Consent Amendment”).

On

August 21, 2019 (the “Effective Date”), our common stock began trading on the Reverse Stock Split-adjusted basis on

the OTCQB at the opening of trading. In connection with the Reverse Stock Split, our common stock began trading with a new CUSIP

number at such time. There was no change to the Company’s stock symbol.

No

fractional shares of common stock will be issued in connection with the Reverse Stock Split. If, as a result of the Reverse Stock

Split, a stockholder would otherwise hold a fractional share, a stockholder will, in lieu of the issuance of such fractional share,

be entitled, upon surrender to the exchange agent of a certificate(s) representing its pre-split shares or upon conversion of

its shares held in book-entry, to receive a cash payment equal to the fraction to which the stockholder would otherwise be entitled,

multiplied by $106, which is the closing price per share (as adjusted to give effect to the Reverse Stock Split) on the OTCQB

on the closing date immediately prior to the Effective Date.

EQ

by Equiniti (“EQ”), the Company’s transfer agent, is acting as the exchange agent for the Reverse Stock Split,

and will provide instructions to stockholders of record regarding the process for exchanging shares. EQ will be issuing all of

the post-Reverse Stock Split shares through their paperless Direct Registration System (“DRS”), also known as “book

entry form.” Eligible book-entry or other electronic positions representing issued and outstanding shares of the Company’s

common stock will be automatically adjusted. Stockholders who hold certificated shares will be mailed a letter of transmittal

to be completed for the exchange of all of their shares. Those stockholders holding common stock in “street name”

will receive instructions from their brokers.

The

Written Consent Amendment

In

addition to the Reverse Stock Split, the Amendment had the effect of amending Article Twelve of the Articles of the Company. As

previously written, the Articles prevented stockholders of the Company from acting by written consent in lieu of a meeting. Such

a bar may have the effect of entrenching management, and limiting the shareholder franchise, as well as creating undue burden

to the Company where an action by written consent would be more expedient and cost effective. Article 12, as amended (the “Written

Consent Amendment”), now provides that any action to be taken at a meeting of stockholders may be taken without a meeting,

without prior notice and without a vote, if a consent in writing is executed by the holders of the Company’s common stock

having the minimum votes necessary to authorize such action if a meeting had taken place.

The

foregoing is merely a summary of the Amendment, the Reverse Stock Split and the Written Consent Amendment, and is qualified in

its entirety by reference to the Amendment, which is attached hereto as Exhibit 3.1.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Date:

August 22, 2019

|

|

GLASSBRIDGE ENTERPRISES, INC.

|

|

|

|

|

|

|

By:

|

/s/

Daniel Strauss

|

|

|

|

Daniel

Strauss

|

|

|

|

Chief

Executive Officer

|

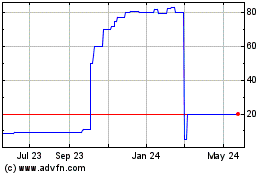

GlassBridge Enterprises (CE) (USOTC:GLAE)

Historical Stock Chart

From Jun 2024 to Jul 2024

GlassBridge Enterprises (CE) (USOTC:GLAE)

Historical Stock Chart

From Jul 2023 to Jul 2024